Money management app is revolutionizing the way individuals handle their finances, making budgeting and expense tracking more accessible than ever. With an array of features tailored to diverse user needs, these apps empower users to take control of their financial future.

From monitoring spending habits to setting achievable financial goals, a money management app can transform your approach to money. By integrating banking accounts and offering personalized insights, they not only assist in keeping your budget on track but also enhance your overall financial literacy.

Understanding the Basics of a Money Management App

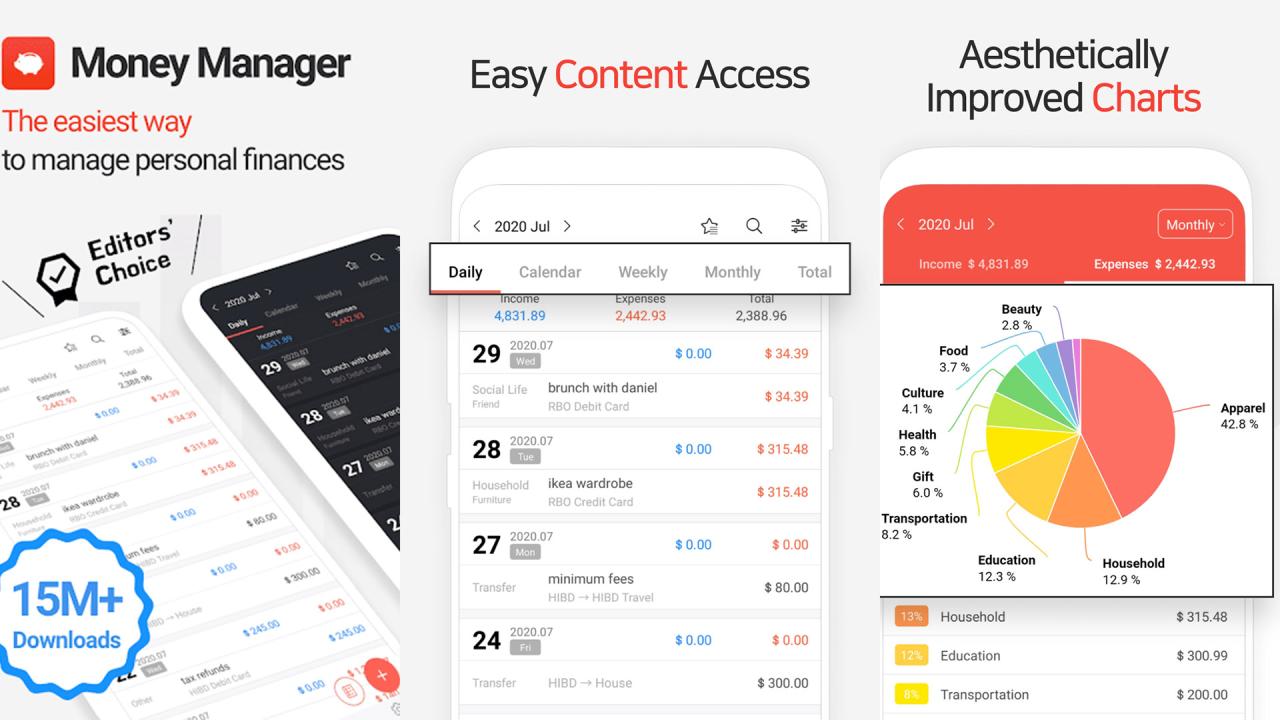

Money management apps are designed to help individuals and households track their finances, budgeting, and spending habits in an efficient and user-friendly manner. These applications have gained significant popularity due to their ability to simplify financial management tasks, making them accessible even to those who may not have a background in finance. The fundamental features of a money management app include budget tracking, expense categorization, financial goal setting, and reporting tools.

These features cater to diverse user needs by providing customizable options that align with various financial objectives. For instance, some users may prioritize tracking daily expenses, while others focus on saving for specific goals like vacations or retirement.

Core Features of Money Management Apps

The effectiveness of money management apps lies in their core functionalities, which include:

- Budget Tracking: Users can create and monitor budgets tailored to their income and spending habits, ensuring they stay within their financial limits.

- Expense Categorization: Transactions can be automatically categorized into predefined groups such as groceries, entertainment, and utilities, making it easier to understand spending patterns.

- Financial Goal Setting: Many apps allow users to set short-term and long-term financial goals, providing motivation and a clear target to aim for.

- Reporting Tools: Users receive visual reports and summaries of their financial activities, enabling them to identify trends and areas for improvement.

These features not only assist users in managing their day-to-day finances but also provide insights that can lead to informed financial decisions.

Popular Money Management Apps and Their Unique Offerings

Several money management apps have emerged, each with unique features designed to cater to various user preferences. Here are a few noteworthy examples:

- Mint: Known for its user-friendly interface, Mint aggregates all financial accounts in one place, providing a comprehensive overview of personal finances. It offers budgeting tools and alerts for unusual spending.

- YNAB (You Need A Budget): This app emphasizes proactive budgeting, enabling users to allocate every dollar they earn towards specific categories, thus promoting a disciplined approach to spending.

- Personal Capital: Focusing on investment tracking, Personal Capital provides tools for retirement planning and portfolio analysis, making it ideal for users interested in growing their wealth.

- Clarity Money: This app utilizes AI to analyze spending habits, helping users to cancel unwanted subscriptions and save money, ultimately fostering better financial behaviors.

These applications exemplify how money management tools can adapt to individual needs, enhancing financial literacy and empowering users to achieve their financial goals.

The Importance of Budgeting and Tracking Expenses

Budgeting is a cornerstone of effective personal finance management. By creating a budget, individuals can gain insight into their income and expenditures, allowing them to make informed financial decisions. Money management apps enhance this process, offering tools that simplify budgeting and tracking expenses, leading to improved financial health and accountability.Budgeting is essential as it provides a clear picture of one’s financial situation.

It helps prioritize spending, set savings goals, and avoid unnecessary debt. Money management apps streamline this process by allowing users to categorize expenses, set limits, and visualize spending trends over time. With real-time updates and alerts, these apps empower users to stay on track and adjust their budgets as needed.

Setting Up a Budget Using a Money Management App

Establishing a budget through a money management app not only makes the process simpler but also more engaging. Here’s a straightforward guide to getting started:

1. Choose the Right App

Select an app that fits your needs. Look for features like expense tracking, budgeting tools, and user-friendly interfaces.

2. Link Your Accounts

Connect your bank accounts and credit cards to the app. This enables automatic tracking of your transactions, making it easier to categorize expenses.

3. Define Your Income

Input all sources of income, including salaries, side hustles, and any passive income. This gives you a clear starting point for your budget.

4. Categorize Expenses

Break down your expenses into categories like housing, food, entertainment, and savings. Most apps allow you to customize these categories to suit your lifestyle.

5. Set Spending Limits

Allocate a certain amount for each category based on your income and financial goals. This helps in controlling overspending in any area.

6. Monitor and Adjust

Regularly review your budget within the app. Most apps provide insights and graphs that help visualize your spending habits, allowing you to adjust as necessary.

“Budgeting is not about limiting yourself, it’s about making the things that excite you possible.”

Examples of Tracking Expenses Leading to Better Financial Decisions

Tracking expenses provides invaluable data that can lead to smarter financial choices. Here are compelling examples illustrating the benefits of diligent expense tracking:

Identifying Unnecessary Subscriptions

Regularly reviewing expenditures may reveal dormant subscriptions—like streaming services or gym memberships—that can be canceled, freeing up funds for more meaningful use.

Spotting Spending Patterns

By analyzing where money is spent regularly, individuals can identify trends, such as frequent dining out. This insight can prompt a switch to meal prepping at home, saving money without sacrificing nutrition.

Establishing Emergency Funds

Tracking expenses can highlight areas where savings can be allocated. For example, if an individual identifies a consistent surplus in their budget each month, this amount can be redirected to build an emergency fund for unforeseen expenses.

Informed Investment Decisions

By maintaining a detailed account of expenses, individuals can allocate surplus funds towards investments. Understanding discretionary spending helps in deciding how much to invest without jeopardizing essential expenses.By leveraging budgeting and expense tracking through money management apps, users can cultivate a more proactive approach to their finances, ultimately leading to better financial stability and growth.

Integrating Banking and Financial Accounts with Money Management Apps

Linking your bank accounts to money management apps can dramatically simplify your financial life. It allows for a consolidated view of your finances, helping you track spending, manage budgets, and ultimately make more informed financial decisions. With just a few taps, you can monitor your transactions, assess your savings, and plan for future expenses.

The integration of financial accounts with money management apps provides numerous benefits. By connecting your bank accounts, users gain instant access to a comprehensive overview of their financial health. This real-time data enables better budgeting and spending habits, as users can identify trends and adjust their financial strategies accordingly. Furthermore, automatic transaction categorization saves time and reduces manual entry, allowing individuals to focus on more critical financial goals.

Benefits of Linking Bank Accounts

Linking bank accounts to money management apps offers various advantages that enhance financial tracking and management. Here are some key benefits to consider:

- Comprehensive Overview: A unified view of income, expenses, and savings allows users to assess their overall financial status at a glance.

- Budgeting Ease: Automatic tracking and categorization of expenses streamline budgeting processes, helping users stay within their limits.

- Real-Time Insights: Users receive instant notifications about spending patterns, enabling timely adjustments to their financial strategies.

- Goal Monitoring: Linking accounts facilitates tracking towards savings goals, making it easier to stay motivated and on target.

Ensuring Security and Privacy

While the benefits of integration are significant, security and privacy remain paramount concerns when linking financial accounts to apps. It’s essential to take proper measures to safeguard sensitive information. Here are some guidelines to ensure safety:

- Choose Reputable Apps: Only use well-known and widely reviewed apps that prioritize user data protection.

- Enable Two-Factor Authentication: This adds an extra layer of security by requiring a second form of verification during logins.

- Monitor Account Activity: Regularly check your linked accounts for any unauthorized transactions to catch any issues early.

- Understand Data Policies: Familiarize yourself with the app’s privacy policy to know how your data will be used and protected.

Challenges and Solutions

Users may encounter several challenges when integrating their bank accounts with money management apps. Addressing these challenges effectively can enhance the user experience. Here are common obstacles and their solutions:

- Technical Glitches: Occasionally, apps may experience syncing issues. Restarting the app or re-linking accounts often resolves these problems.

- Data Entry Errors: Users may notice mistaken categorization of transactions. Regularly reviewing transactions allows for quick corrections.

- Limited Bank Compatibility: Not all banks are supported by every app. Researching app capabilities before signing up can prevent disappointment.

- Privacy Concerns: Users may worry about sharing financial data. Opting for apps with strong encryption and clear policies helps mitigate these fears.

Linking your bank accounts to money management apps not only provides convenience but also empowers you to take control of your financial future.

Customization and Personalization Features in Money Management Apps

Customization and personalization features play a crucial role in enhancing the user experience within money management apps. As financial management can often feel overwhelming, having a tailored interface allows users to interact with the app in a way that aligns with their unique preferences and financial goals. This not only boosts usability but also fosters a sense of ownership over one’s financial journey.Understanding how these features can be utilized effectively can significantly improve a user’s engagement with their finances.

Personalization in money management apps can take many forms, from customized dashboards that present financial data in an easily digestible manner to personalized notifications that keep users informed about their spending habits.

Methods for Leveraging Personalization Options

Personalization features in money management apps can be leveraged through various methods, which enhance the overall experience and effectiveness of financial tracking. Below are some common approaches users can adopt:

- Customizable Dashboards: Users can rearrange widgets to prioritize information that matters most, such as recent transactions, upcoming bills, or savings goals. This allows for quick access to key financial metrics at a glance.

- Personalized Notifications: Users can set alerts based on their spending habits or savings milestones, ensuring they stay on track with their financial goals without feeling overwhelmed by unnecessary updates.

- Spending Categories: Many apps allow users to create their own spending categories that reflect their lifestyle, making it easier to track where money is going and identify areas for improvement.

- Goal Setting: Users can customize savings goals by setting specific targets and timelines, which helps in visualizing progress and maintaining motivation along the way.

Personalization can lead to better money management practices through the following examples:

“When users engage with personalized features, they are more likely to develop sustainable financial habits.”

For instance, if a user customizes their dashboard to focus on monthly spending limits, they may become more aware of their purchasing patterns and adjust their behavior accordingly. Similarly, by receiving tailored notifications about upcoming bills, users can avoid late fees and manage their cash flow more effectively. This proactive approach to managing finances can lead to enhanced savings and a greater sense of financial security over time.

The Role of Analytics and Insights in Financial Planning

Money management apps have revolutionized how individuals approach their finances by harnessing the power of analytics. By providing detailed insights into spending habits, these apps enable users to make informed decisions that significantly enhance their financial health. The integration of analytics not only simplifies the process of understanding one’s finances but also highlights areas that require attention.Money management apps utilize analytics to track and categorize spending patterns.

By aggregating transaction data, these apps generate reports that reveal where money is going each month. This data-driven approach allows users to visualize their financial behavior, identify trends, and spot potential issues before they escalate. The insights gained from these analytics can empower users to modify their spending habits, establish budgets, and ultimately achieve their financial goals.

Interpreting Insights for Improved Financial Health

Understanding the analytics provided by a money management app is crucial for users looking to enhance their financial situation. The insights often come in the form of charts, graphs, and summaries that depict spending categories, trends over time, and budget adherence. For effective interpretation, users can focus on the following aspects:

- Spending Categories: Users can view their expenditures broken down into categories such as groceries, entertainment, and utilities. This breakdown helps identify areas where overspending occurs.

- Trends Over Time: Monitoring spending trends over weeks or months can reveal patterns such as seasonal fluctuations in expenses, allowing users to plan accordingly.

- Budget Adherence: Analyzing budget compliance offers insights into how well users are sticking to their financial plans, highlighting the need for adjustments if overspending is observed.

By applying these insights, users can make proactive changes to their financial behaviors. For instance, if a user notices that a significant amount is spent on dining out, they might choose to cook at home more often, redirecting those funds towards savings or debt repayment.

Case Studies of Financial Transformation

Real-life examples underscore the transformative potential of analytics in money management. Consider the case of Sarah, a young professional who used a money management app to track her spending. Initially, Sarah was unaware that she was spending nearly 30% of her income on non-essential items. After reviewing her spending analytics, she decided to implement a strict budget, focusing on necessities and savings.

In six months, she managed to save enough for a substantial vacation, illustrating the positive impact of financial awareness.Another example is John, a freelance graphic designer who struggled with inconsistent income. By utilizing the forecasting features of his money management app, he gained insights into upcoming expenses and adjusted his spending during lean months. Through careful planning and adherence to the insights provided by the app, John built an emergency fund that now provides a safety net for his fluctuating income.

“Data is a valuable asset in the journey towards financial stability—analytics empower informed decisions.”

These case studies exemplify how understanding analytics can lead to significant financial improvements, illustrating the importance of utilizing insights for smarter financial planning.

Comparing Free and Paid Money Management Apps

Many users are often torn between choosing free or premium money management apps, each offering distinct advantages. Free apps typically provide basic functionalities sufficient for everyday budgeting and expense tracking, while paid apps often include advanced features that enhance the user experience and offer deeper financial insights. Understanding the differences can help users make informed decisions that best suit their financial management needs.When considering which type of money management app to use, it’s essential to weigh the pros and cons of both free and paid options.

Free apps attract users with zero upfront costs but may include ads, limited features, and minimal customer support. Premium apps, on the other hand, generally feature a subscription fee, which can translate into a more comprehensive service, including advanced analytics, personalized financial advice, and enhanced security features.

Differences and Features

To help users better understand the offerings in both categories, here’s a comparison of features and costs for some top-rated money management apps. The table below Artikels key features and pricing, providing clarity on what each app brings to the table.

| App Name | Type | Key Features | Cost |

|---|---|---|---|

| Mint | Free | Budgeting tools, Expense tracking, Bill reminders, Credit score monitoring | Free (with ads) |

| YNAB (You Need A Budget) | Paid | Real-time budgeting, Goal tracking, Financial education resources, Priority support | $14.99/month or $98.99/year |

| Personal Capital | Free | Investment tracking, Retirement planning tools, Net worth calculator | Free (with optional advisory services) |

| EveryDollar | Paid | Zero-based budgeting, Expense tracking, Customizable budget categories | $12/month or $120/year |

The selection of an app should align with the user’s specific financial circumstances. For individuals seeking basic budgeting tools without any costs, free apps like Mint or Personal Capital can offer substantial value. Conversely, users who prioritize advanced features and personalized support may find paid apps like YNAB or EveryDollar worth the investment.

“Choosing the right money management app can lead you towards achieving your financial goals more efficiently.”

Ultimately, the decision between free and paid money management apps depends on individual preferences, financial habits, and specific needs. Users should evaluate what features are essential for their financial journey and choose accordingly.

Overcoming Common Challenges When Using Money Management Apps

Many users encounter various challenges when utilizing money management apps, often leading to frustration and abandonment of the tool. Understanding these common obstacles and implementing effective strategies can enhance the overall experience and promote better financial habits. This guide aims to shed light on those challenges and offer practical solutions to ensure users get the most out of their money management apps.

Typical Obstacles Users Encounter

Money management apps present a host of challenges that can hinder users from effectively tracking their finances. Common issues include:

- Complex user interfaces that may be overwhelming for beginners, causing them to disengage.

- Inaccurate data synchronization with bank accounts, leading to discrepancies in financial tracking.

- Difficulty in categorizing expenses, which can result in unclear insights into spending habits.

- Technical glitches that cause frustration and downtime, disrupting regular financial monitoring.

- Lack of motivation to consistently input data, as users might find it tedious or time-consuming.

Recognizing these obstacles is the first step towards overcoming them.

Strategies for Maintaining Consistency

Staying consistent with tracking finances using an app is crucial for achieving financial goals. Implementing the following strategies can significantly enhance user engagement and commitment:

- Set specific financial goals within the app. This can foster a sense of purpose and motivation to engage regularly.

- Establish a routine for checking and updating the app, such as a weekly review on Sunday evenings, which can help build a habit.

- Utilize app notifications to remind users to log expenses or review financial summaries, making it easier to stay on track.

- Limit the time spent on the app by planning specific tasks, which can help users feel less overwhelmed and more focused.

- Engage with community features, if available, to share experiences and tips, which can create a support system and boost motivation.

These strategies encourage a consistent approach to finance management, ensuring users leverage the full potential of their apps.

Resources for App-Related Challenges

Users seeking assistance with app-related challenges can access a variety of resources to enhance their experience. These include:

- Help centers within the app, which typically contain FAQs, troubleshooting tips, and user guides tailored to common issues.

- Online forums or community groups where users can exchange advice, share experiences, and find solutions to specific problems.

- Social media platforms where app developers often provide updates, tips, and direct support channels for users facing challenges.

- YouTube tutorials that offer visual guidance on how to navigate app features and troubleshoot common problems.

- Podcasts focused on personal finance management, often discussing app usage and offering tips for effective budgeting.

Leveraging these resources can empower users to overcome obstacles and maximize the benefits of their money management apps.

Future Trends in Money Management Applications

The landscape of money management applications is evolving rapidly, driven by technological advancements and changing user expectations. As we look ahead, it is essential to understand how these changes may shape the features and functionalities of budgeting tools and financial trackers. This analysis reveals the anticipated developments that will redefine user experiences and enhance financial literacy.

Technological Integration in Money Management

The integration of cutting-edge technologies will play a pivotal role in the evolution of money management applications. Users can expect to see a significant rise in the use of artificial intelligence (AI) and machine learning to personalize financial advice. These technologies will analyze user spending habits and provide tailored recommendations, making budgeting more intuitive and effective. Moreover, blockchain technology may offer enhanced security and transparency in financial transactions, building trust between users and their financial data.As we explore the potential features driven by these technological advancements, it is important to consider the following:

- Enhanced Data Analytics: Users will benefit from sophisticated data analytics tools that provide insights into spending patterns and investment opportunities. For example, apps may offer predictive analytics to forecast future expenses based on historical data.

- Real-Time Financial Monitoring: Integration with banking APIs will allow users to monitor their accounts in real-time, giving them immediate visibility into their financial health and enabling swift responses to spending anomalies.

- Voice-Activated Budgeting: With the rise of smart home devices, voice-activated budgeting will become commonplace, allowing users to manage their finances hands-free while multitasking.

Evolving User Needs and App Features

As users become increasingly aware of their financial needs, they demand more from money management applications. This evolving landscape reflects a shift towards holistic financial wellness, incorporating mental health, investment, and savings goals alongside traditional budgeting.In response to these changing needs, money management apps will likely include features that cater to various aspects of financial well-being. The following functionalities are expected to become integral:

- Gamification of Saving: Techniques that turn saving into a game will resonate with users, encouraging them to reach their financial goals through interactive challenges and rewards.

- Social Features: Users may seek community-driven support, leading to the development of social features that allow sharing achievements, tips, or even pooled savings for group goals.

- Comprehensive Financial Education: Many applications will integrate educational resources directly into the app, offering tips, webinars, and courses on financial literacy to empower users.

Anticipated User Experience in Five Years

Looking ahead, users can expect a more seamless and user-friendly experience with money management applications over the next five years. With enhanced personalization powered by AI, users will receive suggestions that are not only tailored to their preferences but also aligned with their life goals. Innovations such as augmented reality (AR) could revolutionize how users visualize their financial data, creating interactive experiences that make understanding finances engaging.For instance, users might find themselves using AR to visualize their savings growth over time, projecting future financial scenarios in an immersive manner.

Additionally, biometrics will enhance security, allowing users to access their accounts with facial recognition or fingerprint scans securely.In summary, the future of money management applications holds great promise, with technology integration and evolving user needs driving the development of more sophisticated features. As these trends unfold, users will be better equipped to manage their finances, ultimately leading to improved financial well-being.

Wrap-Up

In conclusion, embracing a money management app can significantly elevate your financial management skills and help pave the way toward achieving your financial aspirations. As technology continues to innovate, these apps will undoubtedly evolve, offering even more robust features to cater to the ever-changing needs of users.

FAQ Resource

What is a money management app?

A money management app is a digital tool designed to help users track their finances, manage budgets, and monitor spending.

Are money management apps secure?

Most reputable money management apps use strong encryption and security measures to protect user data, but it’s essential to choose well-reviewed apps.

Do I need to link my bank account to use these apps?

No, linking your bank account is optional; you can also manually input transactions and expenses if preferred.

Can I use a money management app if I have multiple bank accounts?

Yes, many apps allow you to link multiple bank accounts, enabling you to view all your finances in one place.

How do money management apps help with budgeting?

They assist users in creating budgets, tracking expenses, and providing insights into spending habits to facilitate better financial decisions.