The rise of digital technology has transformed the way we handle our finances, making money management apps indispensable tools in today’s fast-paced world. These applications not only simplify the process of tracking spending and budgeting but also empower users to take control of their financial futures. By leveraging intuitive features and real-time analytics, individuals can gain insights that were once reserved for financial advisors.

This newfound accessibility to personal finance tools has made managing money more efficient and effective.

In a landscape where traditional budgeting methods often fall short, money management apps present a modern solution. They enable users to set financial goals, monitor their spending habits, and receive personalized advice tailored to their unique financial situations. As a result, many users report improved financial health, illustrating that these apps are more than just digital tools; they are catalysts for positive change.

Understanding the Importance of Money Management Apps

In today’s fast-paced digital world, money management apps have emerged as indispensable tools for personal finance. With the ability to track expenses, create budgets, and monitor investments, these apps simplify the often daunting task of managing finances. They empower users to take control of their financial lives with just a few taps on their smartphones. As financial literacy becomes increasingly important, leveraging technology to manage money effectively is more crucial than ever.

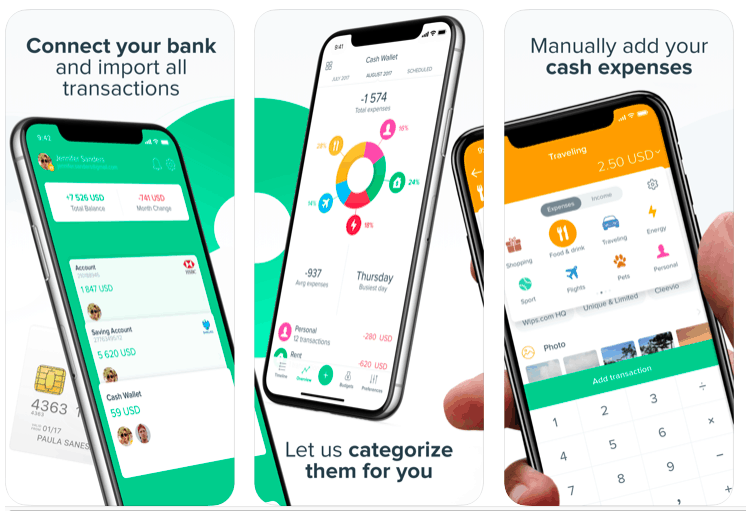

The benefits of using money management apps over traditional budgeting methods are significant. Unlike paper-based methods or spreadsheets, these apps provide instant access to financial information, enabling users to make informed decisions on the go. They often come equipped with features like automated categorization of expenses, alerts for bills, and goal-setting functionalities, which can lead to more disciplined spending and saving habits.

Advantages Leading to Enhanced Financial Outcomes

To understand how money management apps can contribute to better financial outcomes, consider the following key advantages:

- Real-Time Tracking: Users can track their spending in real time, allowing for immediate adjustments to budgets and spending habits. This immediate feedback loop fosters better financial decision-making.

- Automated Budgeting: Many apps allow users to set up budgets automatically based on their spending patterns, ensuring they stay within limits without constant manual tracking.

- Goal Setting: Apps help users set specific financial goals, such as saving for a vacation or paying off debt, and track progress towards these goals. The visualization of progress can motivate users to continue their saving efforts.

- Expense Categorization: With automatic categorization, users can easily see where their money goes each month, allowing for more strategic budget adjustments and identification of unnecessary expenses.

- Enhanced Financial Insights: Analytics and reports provided by these apps can highlight spending trends, enabling users to make informed decisions about their financial futures.

For instance, a user who sets up a budget through an app may find they spend significantly more on dining out than anticipated. Recognizing this trend allows them to adjust their spending and allocate more funds toward savings or debt repayment. Furthermore, a study conducted by the National Endowment for Financial Education found that individuals who actively use budgeting apps reported a greater sense of control over their finances, which translated into higher savings rates and lower debt levels.By embracing these modern tools, individuals can navigate their financial journeys with increased confidence and efficacy.

Key Features to Look for in a Money Management App

In today’s fast-paced financial landscape, effective money management is crucial for achieving personal financial goals. A well-designed money management app can be a game changer, providing users with the tools they need to track spending, budget effectively, and ultimately, gain control over their finances. Understanding the key features of these apps is essential for selecting the right one that meets individual needs and preferences.A good money management app should include several essential features that enhance user experience and enable efficient financial tracking.

Here are five key features that can significantly impact how users interact with their finances and make informed decisions.

Essential Features for Money Management Apps

The following features are critical in ensuring that a money management app serves its purpose effectively. Each feature contributes to an overall better user experience and enhances financial tracking.

- User-Friendly Interface: A straightforward and intuitive interface is essential for users of all ages. A clutter-free design and easy navigation help users quickly access and manage their finances without feeling overwhelmed.

- Budgeting Tools: These tools allow users to set spending limits for various categories, such as groceries, entertainment, and bills. By visually tracking spending against budgeted amounts, users can make informed adjustments to their financial habits.

- Expense Tracking: Automatic categorization of transactions and detailed expense reports enable users to see where their money is going. This feature helps identify spending patterns and areas where they can cut back.

- Goal Setting and Savings Features: Users can set financial goals, such as saving for a vacation or a new car, and track their progress. Visual representations of savings can motivate users to stick to their plans.

- Secure Data Management: Ensuring that personal financial data is secure is paramount. Features like two-factor authentication and encryption provide users with peace of mind that their information is safe.

These features collectively enhance user experience by making money management accessible, transparent, and secure. Users can feel empowered to take control of their finances with the right tools at their fingertips.

Comparison of Popular Money Management Apps

A side-by-side comparison of popular money management apps can help potential users make informed choices. The following table highlights key features of several leading apps in the market.

| App Name | User-Friendly Interface | Budgeting Tools | Expense Tracking | Goal Setting | Security Features |

|---|---|---|---|---|---|

| Mint | Yes | Yes | Automatic | Yes | Two-Factor Authentication |

| YNAB (You Need A Budget) | Yes | Advanced | Manual | Yes | Encryption |

| PocketGuard | Yes | Basic | Automatic | No | Two-Factor Authentication |

| Personal Capital | Yes | Yes | Automatic | Yes | Encryption |

This comparison illustrates how different apps can cater to various user needs, from budgeting and expense tracking to security. By evaluating these features, users can select the app that aligns best with their financial management goals.

How Money Management Apps Enhance Budgeting Skills

Money management apps have transformed the way individuals approach personal finance, particularly in the realm of budgeting. These digital tools offer intuitive interfaces and powerful features that help users develop robust budgeting skills, allowing them to manage their finances more effectively. By providing immediate insights into spending habits and financial goals, these apps empower users to take control of their financial destiny.One of the key ways money management apps enhance budgeting skills is through real-time tracking of income and expenses.

Users can link their bank accounts and credit cards to the app, which automatically categorizes transactions. This helps individuals recognize spending patterns, identify areas for improvement, and make informed decisions. For instance, when users see that dining out expenses exceed their budget, they can adjust their behavior accordingly.

Budgeting Strategies Implemented Through Apps

Money management apps provide various budgeting strategies that users can easily implement. These strategies not only encourage mindful spending but also promote savings. Here are several effective approaches:

1. Zero-Based Budgeting

This method encourages users to allocate every dollar of their income to specific expenses, savings, or debt repayment. The app allows users to create a budget that ensures no money goes unallocated, fostering accountability in spending.

2. 50/30/20 Rule

This popular strategy divides income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Money management apps can help users set up these categories and monitor their adherence to this rule.

3. Envelope Budgeting

Originally a physical method, this strategy involves creating ‘envelopes’ for different spending categories. Apps facilitate digital envelopes, allowing users to allocate funds to various categories and see how much is left to spend.

4. Goal-Oriented Budgeting

Users can set specific financial goals, such as saving for a vacation or paying off debt. The app tracks progress towards these goals, motivating users to stick to their budgets.Statistics show that individuals who utilize money management apps are significantly more likely to stick to their budgets. According to a study by the National Endowment for Financial Education, 70% of app users reported improved budgeting effectiveness.

Moreover, users of budgeting apps save, on average, 20% more than those who manage their finances without such tools. Incorporating these budgeting strategies through money management apps not only enhances users’ skills but also fosters a healthier relationship with money. As people become more engaged in their financial planning, they often experience reduced stress and greater financial security.

Overcoming Common Challenges in Personal Finance with Apps

Managing personal finances can be daunting, with many individuals facing obstacles such as budgeting, saving, and tracking expenses. Money management apps have emerged as effective tools to address these challenges by providing users with innovative solutions and features that simplify financial management. By leveraging technology, users can take control of their finances and work towards their financial goals with greater ease.Common financial challenges include overspending, lack of budgeting, and difficulty in tracking savings goals.

Money management apps are designed to tackle these issues by offering functionalities that promote better financial habits. They can help users set and adhere to budgets, monitor spending patterns, and automate savings. Additionally, many apps provide insights and analytics, enabling users to make informed decisions about their finances.

Identifying Financial Challenges and Solutions

Recognizing the specific financial challenges users face is crucial for effective management. Various obstacles can hinder financial success, and understanding how apps can help is essential. Here are some common challenges and the solutions that money management apps offer:

- Overspending: Many users struggle to control their spending habits. Money management apps often feature budget trackers that categorize expenses and alert users when they approach their limits.

- Lack of Budgeting: Creating and sticking to a budget can be overwhelming. Apps simplify this process with customizable budget templates and automatic updates based on user transactions.

- Tracking Savings Goals: Setting savings goals is easy, but tracking progress can be challenging. Apps provide visual progress indicators and reminders to keep users motivated and accountable.

- Debt Management: Managing debt can feel insurmountable. Many apps offer debt repayment calculators, helping users strategize repayment plans effectively.

To maximize the benefits of these apps, users can follow practical tips that enhance their experience and foster better financial habits. Regularly reviewing spending habits and updating budgets to reflect changes in income or expenses is essential. Furthermore, users should take advantage of features like notifications for bill payments, which help avoid late fees and maintain good credit.

Flowchart for Using an App to Tackle Financial Challenges

Creating a flowchart can effectively illustrate the process of using an app to address personal finance challenges. The flowchart Artikels the following steps:

- Identify Financial Challenge (e.g., overspending, lack of savings).

- Download and Set Up Money Management App (choose one that meets your needs).

- Input Financial Information (link bank accounts, enter income, and expenses).

- Set Up Budget or Savings Goals (customize categories and limits).

- Track Daily Spending (log expenses in real-time).

- Review Monthly Reports (analyze spending patterns and identify areas for improvement).

- Adjust Budget or Goals Accordingly (make necessary changes based on insights).

- Repeat Process (continuously monitor and refine financial strategies).

Implementing this flowchart helps users visualize their journey toward better financial management through the use of money management apps, ensuring they remain proactive rather than reactive in their financial lives.

“The journey to financial stability begins with understanding your challenges and utilizing the right tools.”

The Future of Money Management Apps and Financial Technology

The landscape of money management apps is evolving rapidly, influenced by advancements in financial technology (fintech). As users become more tech-savvy and demand seamless integration of services, these apps are transforming to offer smarter, personalized experiences. The future holds exciting possibilities, with various trends set to shape the functionalities and capabilities of money management solutions.Emerging trends in fintech are creating a new paradigm for money management apps, enabling features that were once thought to be confined to traditional finance.

Artificial intelligence (AI) and machine learning (ML) are at the forefront, allowing for improved predictive analytics and tailored recommendations. Blockchain technology is also gaining traction, offering enhanced security and transparency in transactions.

Technological Advancements Influencing Future Money Management Apps

The evolution of money management apps will heavily rely on specific advancements in technology. Here are several key developments expected to enhance app functionality over the coming years:

1. Integration of AI and Personalization

As AI algorithms advance, apps will increasingly offer personalized financial advice based on user behavior and spending patterns. For example, users may receive notifications suggesting budget adjustments or investment opportunities tailored to their unique financial situations.

2. Blockchain Technology

Utilizing blockchain can facilitate secure, real-time transactions, reducing the risks associated with fraud and enhancing trust. Apps may leverage smart contracts for automating agreements and transactions, streamlining financial processes.

3. Open Banking

The shift towards open banking encourages third-party developers to create applications that can access user financial data (with permission). This fosters innovation and leads to new features such as aggregating multiple accounts into a single dashboard for better financial oversight.

4. Enhanced User Experience (UX)

Future apps will focus on creating an intuitive and engaging user experience, incorporating voice commands and chatbots to facilitate interaction. This will simplify navigation and make financial management more accessible to a broader audience.

5. Sustainability and Ethical Investing

With growing awareness around sustainability, apps are likely to incorporate features that allow users to track the environmental impact of their investments, helping them make informed decisions aligned with their values.To illustrate current applications versus future predictions, the following table compares typical features found in today’s money management apps with anticipated advancements:

| Current Features | Predicted Future Features |

|---|---|

| Basic budgeting tools | AI-driven personalized budgeting and financial advice |

| Account aggregation for manual tracking | Seamless integration with third-party services via open banking |

| Static reports on spending | Real-time analytics and trends powered by machine learning |

| Limited investment tracking | Blockchain-enabled tracking of investments with dynamic risk assessment |

| Standard customer support | AI-powered virtual assistants for 24/7 personalized support |

The future of money management apps promises to be significantly more advanced, user-friendly, and secure, paving the way for a new era of financial management that caters to the needs of modern users.

Evaluating Security Features in Money Management Apps

In the digital age, money management apps have become essential tools for budgeting, tracking expenses, and managing finances. However, the convenience they offer can come with significant security risks. It’s crucial for users to understand the importance of security features in these apps and what to look for to ensure their financial data remains protected. By prioritizing security, users can confidently manage their finances without compromising personal information.The security of money management apps is paramount, as these applications often handle sensitive financial information such as bank account details, credit card numbers, and transaction history.

Users should be vigilant about the security measures in place, including encryption technologies, multi-factor authentication, and secure server practices. Encryption ensures that data is scrambled and unreadable to unauthorized users, making it a fundamental element of app security. Multi-factor authentication adds an additional layer of protection, requiring users to verify their identity through multiple methods before accessing their accounts.

Data Privacy Maintenance and User Protection Steps

Data privacy is a critical aspect of using money management apps. Companies must implement robust privacy policies and adhere to regulations to safeguard user information. Users can play an active role in protecting their data by following best practices while using these apps. Understanding the app’s privacy policy is essential in determining how user data is collected, stored, and shared.

Transparency in these policies helps users assess the risks associated with using the app. Additionally, users should be aware of the permissions they grant to the app, limiting access to only what is necessary for the app’s functionality.To reinforce security while using money management apps, consider the following best practices:

- Regularly update the app to the latest version, which often includes security patches and improvements.

- Enable biometric authentication, such as fingerprint or facial recognition, for easier and safer access.

- Use unique, strong passwords that combine letters, numbers, and special characters.

- Monitor account activity frequently to detect any unauthorized transactions promptly.

- Be cautious about public Wi-Fi networks; use a VPN when accessing sensitive information on unsecured networks.

- Log out after each session, especially when using shared or public devices.

“Prioritizing security features in money management apps is essential to protect personal financial data and maintain privacy.”

By following these steps and being aware of the security features available, users can enhance their safety while managing their finances with these apps. With the right precautions, users can enjoy the benefits of technology without compromising their financial security.

User Experience and Design Principles in Money Management Apps

The user experience (UX) in money management apps is critical to their effectiveness and adoption. A well-designed app enhances user engagement, promotes better financial habits, and facilitates informed decision-making. By prioritizing user needs and expectations, developers can create applications that not only serve their purpose but also provide satisfaction and ease of use.User experience directly impacts how users interact with money management apps.

A positive UX can lead to increased usage, while a poor experience can result in frustration and abandonment. Good design principles are essential in ensuring that users can easily navigate through features, understand functionalities, and derive value from the app. Key design principles that enhance usability include simplicity, consistency, feedback, and accessibility.

Essential Design Principles for Money Management Apps

Implementing effective design principles is vital in creating a user-friendly money management app. Below are some core principles that enhance usability and satisfaction among users:

- Simplicity: The interface should be clean and uncluttered, allowing users to find what they need quickly without unnecessary distractions.

- Consistency: Visual elements and terminology should remain consistent throughout the app to minimize confusion and enhance learning.

- Feedback: Users should receive immediate and clear feedback on their actions, such as confirmation of transactions or notifications of budget alerts, ensuring they feel in control of their financial activities.

- Accessibility: Design should accommodate users with various needs, ensuring features are usable for individuals with disabilities, including screen readers and high-contrast modes.

- Visual Hierarchy: Important information, like account balances and spending trends, should be prominently displayed to grab users’ attention at a glance.

User feedback plays a significant role in illustrating the importance of design principles in money management apps. Here are some examples that highlight user sentiments regarding design:

- “I love how easy it is to track my expenses; the layout is so intuitive!”

- “The app crashes sometimes, but when it works, the alerts really help me stay on budget.”

- “I appreciate the consistent layout across different sections; it makes navigating super easy.”

- “The color scheme is pleasant, and I can read everything clearly, which is a huge plus for me.”

- “I dislike apps that are complicated; I want to get to my information quickly. This one nails it!”

Incorporating these design principles based on user feedback can significantly enhance the overall experience, leading to increased trust and engagement with money management apps.

Case Studies of Successful Money Management App Users

In today’s fast-paced financial landscape, money management apps have become essential tools for individuals seeking to take control of their finances. Real-life success stories highlight the transformative impact these apps have had on users’ financial lives, showcasing how strategic use of specific features can lead to remarkable outcomes. Here, we explore the journeys of several users who found their financial footing through dedicated use of money management apps.

Transformative Journey of Emily: From Overspending to Savings

Emily, a recent college graduate, struggled with managing her finances after starting her first job. She often found herself living paycheck to paycheck, with little to no savings. After downloading a popular money management app, she discovered features that changed her approach to budgeting and saving.The app’s budgeting tool allowed Emily to categorize her expenses, giving her a clear overview of where her money was going.

She set up alerts for overspending in categories like dining out and entertainment. This feature served as a wake-up call; she realized how much she was spending on meals and decided to cut back. In addition, the app’s goal-setting feature enabled her to create a savings plan for her future travels. By setting specific savings targets, Emily became motivated to prioritize her spending more consciously.

After six months of using the app, she successfully saved enough to book a trip to Europe, marking a significant financial milestone for her.

“Budgeting isn’t just about restricting spending; it’s about making informed choices that align with your goals.” – Emily

James’ Journey: Debt Repayment and Financial Freedom

James had accumulated a significant amount of debt from student loans and credit cards. Feeling overwhelmed, he turned to a money management app that offered personalized debt repayment strategies. This app not only tracked his debt but also provided a roadmap for repayment based on his income and expenses.One key feature that helped James was the debt snowball calculator. By prioritizing his smallest debts first, he gained quick wins that motivated him to stay on track.

The app also sent reminders for due dates, helping him avoid late fees and additional interest. Over the course of two years, James consistently followed the app’s recommendations, making extra payments whenever he could. He experienced a remarkable transformation, paying off nearly $30,000 in debt. Today, he enjoys financial freedom and is even saving for a down payment on his first home.

“The app turned my financial chaos into clarity; it was like having a personal finance coach.” – James

Sarah’s Success: Building Wealth Through Investment

Sarah, a young professional with a keen interest in investing, utilized a money management app that offered investment tracking alongside budgeting. This dual functionality helped her understand how her spending habits impacted her investment potential.The app featured educational resources that demystified investing. Sarah learned about different asset classes and the importance of diversification. By setting a monthly budget for investments, she was able to consistently contribute to her portfolio while managing her everyday expenses.

Within three years of using the app, Sarah watched her investments grow significantly due to her disciplined approach. She attributes her financial literacy and growing wealth to the insights and tools provided by the app.

“Investing became less intimidating when I had the tools to understand it better; the app made it accessible.” – Sarah

Final Summary

In conclusion, money management apps have revolutionized personal finance by providing accessible, user-friendly tools that encourage better budgeting and financial awareness. As we continue to navigate the complexities of managing money in a digital age, these apps not only provide solutions to current challenges but also pave the way for future innovations in financial technology. Embracing these tools can lead to a more secure financial future, making it essential for anyone looking to enhance their financial literacy and well-being.

General Inquiries

What is a money management app?

A money management app is a digital tool designed to help users track their finances, create budgets, and manage expenses effectively.

Are money management apps safe to use?

Most reputable money management apps incorporate strong security features, but users should always ensure they choose apps with robust data protection measures.

Can I use a money management app for multiple accounts?

Yes, many money management apps allow users to link multiple bank accounts and credit cards for a comprehensive view of their financial situation.

Do money management apps cost money?

While some apps are free, others may charge a subscription fee for premium features. Always check the pricing model before committing.

How do I choose the right money management app?

Consider your specific financial needs, the features offered, user reviews, and whether the app aligns with your budgeting style.