Finance seo keywords – Finance s takes center stage as we delve into the significance of digital strategies in enhancing financial growth. In today’s fast-paced financial landscape, leveraging the right s can be a game-changer for companies aiming to boost their online presence and attract potential clients. With the financial sector becoming increasingly competitive, understanding how to utilize effectively can set businesses apart, leading to increased visibility and engagement.

This exploration will not only cover the essential role of content quality and optimization techniques but also highlight how transparency and audience understanding can fortify trust and drive financial success. From the impact of social media to the intersection of technology and financial services, we will navigate through the various strategies that can elevate a company’s financial communication.

Understanding the Role of Digital Strategies in Financial Growth

The integration of digital strategies into the financial sector has revolutionized how businesses approach growth. With the rapid advancement of technology, financial institutions are no longer confined to traditional methods of operation. Instead, they leverage digital tools to enhance efficiency, broaden their reach, and ultimately drive financial success. The key to thriving in today’s market lies in understanding and effectively implementing these digital strategies.Digital strategies enhance financial growth by optimizing operations, improving customer engagement, and providing valuable insights through data analytics.

Financial institutions can streamline processes, reduce costs, and enhance the customer experience, which is essential in a competitive landscape. The use of digital platforms enables businesses to reach a wider audience and cater to customer needs in real-time. Moreover, data analytics offers insights that help in decision-making, enabling businesses to anticipate market trends and adjust strategies accordingly.

Key Digital Strategies Impacting Financial Success

To illustrate the importance of digital strategies, here are three significant approaches that directly contribute to financial success:

1. Social Media Marketing

Financial companies harness social media platforms to connect with customers and promote their services. This form of digital marketing allows for targeted advertising, which can yield higher conversion rates. For example, companies like Charles Schwab utilize platforms such as Twitter and Facebook to engage with clients, answer questions, and provide valuable financial advice. Their proactive presence on these channels not only builds brand loyalty but also enhances customer trust.

2. Mobile Banking Solutions

The rise of mobile banking has transformed how consumers manage their finances. Institutions like JPMorgan Chase have invested heavily in mobile app development, providing customers with the ability to conduct transactions, monitor accounts, and access financial advice from their smartphones. This convenience not only appeals to tech-savvy customers but also attracts a younger demographic, driving growth in account openings and customer retention.

3. Data Analytics and Personalization

By utilizing advanced data analytics, financial organizations can offer personalized services that significantly improve customer satisfaction. Companies like Capital One employ data-driven strategies to analyze customer behavior and preferences, allowing them to tailor offerings and recommendations. This approach not only enhances user experience but also increases cross-selling opportunities, leading to greater revenue generation.In summary, the application of digital strategies in the financial sector is essential for growth.

The examples of successful companies demonstrate how an effective digital approach can lead to enhanced customer engagement, operational efficiency, and ultimately, financial success.

The Importance of Content Quality in Financial Communication

In the financial sector, the quality of content plays a crucial role in shaping perceptions, building trust, and driving engagement. Financial institutions and professionals must convey complex information clearly and accurately, as this directly impacts decision-making processes for both individuals and businesses. High-quality content not only informs but also empowers audiences to make sound financial decisions, ultimately influencing their financial health and success.Effective financial communication hinges on clarity, accuracy, and relevance.

High-quality content distinguishes itself through several key attributes that resonate strongly with financial audiences. These attributes not only enhance the readability of the content but also foster trust and credibility among readers. Understanding these attributes can help financial professionals create impactful communications that resonate with their target audiences.

Key Attributes of High-Quality Financial Content

High-quality financial content possesses several defining characteristics that elevate its effectiveness. The following points Artikel these attributes, illustrating their importance in financial communication:

- Clarity: Content must be straightforward, avoiding jargon unless it’s commonly understood by the target audience. Clear language helps demystify complex financial concepts.

- Accuracy: Financial information must be precise and backed by reliable data sources. Misinformation can lead to poor financial decisions and loss of credibility.

- Relevance: Content should address the specific interests and needs of the audience, providing valuable insights that cater to their unique financial situations.

- Engagement: High-quality content uses engaging formats, such as infographics or interactive elements, to hold readers’ attention and make complex data more digestible.

- Trustworthiness: Citing reputable sources and providing transparency in data sourcing builds trust. Readers are more likely to engage with content from sources they deem credible.

Assessing the quality of financial content requires a systematic approach that evaluates various aspects of the material. Financial professionals and marketers can employ several methods to gauge content quality effectively.

Methods for Assessing the Quality of Financial Content

The assessment of financial content quality is vital for ensuring that it meets the expectations and needs of the audience. Several practical methods can be utilized to perform this evaluation:

- Peer Review: Having content reviewed by industry experts can provide valuable feedback on accuracy and relevance, ensuring that information aligns with current practices and regulatory standards.

- Audience Analytics: Utilizing tools to analyze audience engagement metrics helps gauge the effectiveness of the content. High engagement rates (likes, shares, comments) indicate relevance and quality.

- Readability Tests: Employing readability formulas can help ensure that content is accessible to a broader audience. Content that scores well on readability tests is more likely to be understood by lay audiences.

- Feedback Mechanisms: Implementing feedback forms or surveys can help gather insights directly from the audience, allowing for continuous improvement in content quality.

High-quality financial content not only informs but also enhances the overall reputation of the financial organization. By prioritizing these attributes and assessment methods, financial communicators can create effective, trustworthy, and engaging content that resonates with their audiences.

Techniques for Optimizing Financial Topics for Online Visibility

In the dynamic world of finance, standing out online is essential for driving traffic and engaging audiences. The financial sector is saturated with information, so leveraging effective optimization techniques can enhance visibility and authority. By understanding and implementing both traditional and modern strategies, financial content can reach a wider audience and fulfill its intended purpose.The landscape of has evolved significantly, leading to the adoption of various techniques tailored specifically for financial topics.

Traditional optimization methods often focused on density, title tags, and meta descriptions, while modern techniques emphasize user experience, semantic search, and content relevance. The emphasis has shifted towards creating high-quality, informative content that resonates with users and aligns with their search intent.

Practical Steps for Improving Online Visibility in Finance

To successfully optimize financial topics for online visibility, it’s crucial to adopt a strategic approach. Here are practical steps to enhance your financial content’s visibility:

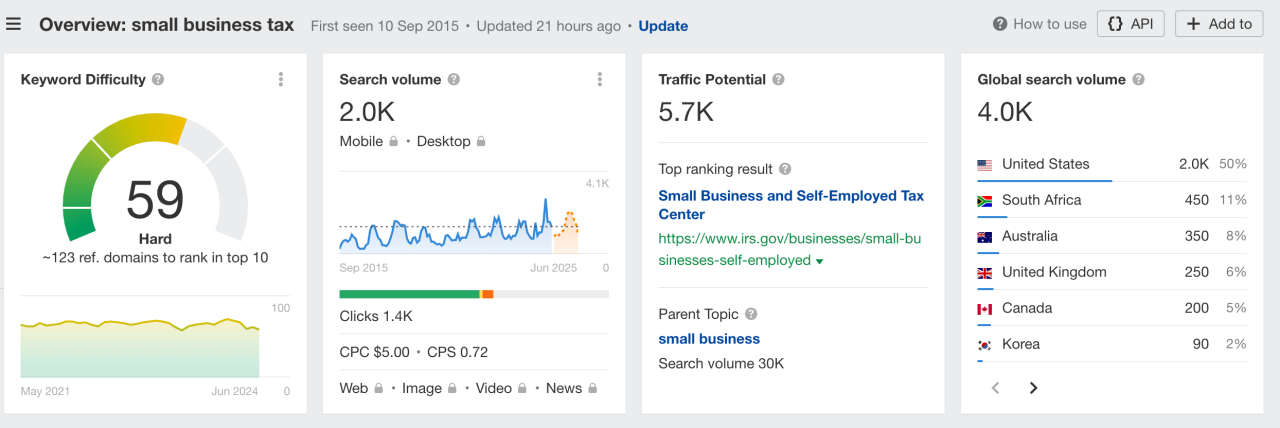

- Research: Use tools like Google Planner and SEMrush to identify relevant s with high search volume and low competition. Focus on long-tail s that reflect specific financial queries.

- Quality Content Creation: Develop well-researched, informative articles that provide value to readers. Incorporate data, case studies, and real-life examples to enhance credibility.

- On-Page Techniques: Optimize title tags, meta descriptions, and headers with targeted s. Ensure that your content flows logically and is easy to read.

- User Engagement: Encourage interaction through comments, shares, and social media engagement. Address questions and feedback promptly to build a community around your content.

- Visual Elements: Incorporate infographics, charts, and videos to illustrate complex financial concepts. Visuals can increase engagement and help explain difficult topics more clearly.

- Mobile Optimization: Ensure your website is mobile-friendly, as a significant portion of users access financial information via smartphones. Google prioritizes mobile-optimized sites in its rankings.

- Link Building: Establish relationships with other financial websites for guest blogging or collaboration, which can lead to valuable backlinks that enhance your site’s authority.

- Local Strategies: If applicable, utilize local techniques by optimizing your content for local searches and creating a Google My Business profile to improve local visibility.

By implementing these techniques thoughtfully, financial content creators can progressively improve their online visibility, engage with a broader audience, and establish their authority in the finance sector.

Building Trust Through Transparency in Financial Communications

In the realm of finance, establishing trust is paramount. Clients and investors alike seek assurance that their financial institutions operate with integrity and openness. Transparency in financial communications forms the bedrock of this trust, as it fosters an environment where stakeholders feel informed and empowered to make decisions. When institutions communicate transparently, they not only meet regulatory requirements but also cultivate strong relationships with their clients.Transparency encompasses sharing relevant information, addressing potential risks, and being candid about financial performance.

It is essential for financial institutions to present data clearly, ensuring that clients understand their financial options and the implications of their choices. For instance, firms that clearly Artikel their fees, charges, and potential risks associated with various financial products demonstrate a commitment to honesty, which in turn enhances client confidence.

Examples of Financial Institutions Excelling in Transparency, Finance seo keywords

Several financial institutions have set benchmarks in transparency, earning commendations from both clients and industry experts. For example, Vanguard, one of the largest investment management companies, is widely recognized for its transparent fee structure. Vanguard clearly communicates its expense ratios and how they impact investment returns, allowing investors to understand what they pay and what they receive in return. This level of clarity is pivotal in building trust among investors who are wary of hidden fees.Another exemplary institution is Charles Schwab, which provides extensive resources and tools to help clients navigate their finance and investment options.

Schwab’s commitment to transparency is evident in its educational materials that break down complex financial concepts, empowering clients to make well-informed decisions. By prioritizing straightforward communication, Schwab reinforces its reputation as a trustworthy financial partner.The commitment to transparency not only enhances credibility but also has numerous benefits for financial institutions. Below is a table presenting the key benefits of transparency in the finance sector:

| Benefit | Description |

|---|---|

| Increased Client Trust | Transparent communication fosters a higher level of trust between clients and financial institutions, leading to stronger client relationships. |

| Improved Client Retention | When clients feel informed and valued, they are more likely to remain loyal to their financial institutions, reducing turnover rates. |

| Enhanced Reputation | Institutions known for their transparency often enjoy a stronger reputation in the industry, which can attract new clients and partnerships. |

| Regulatory Compliance | Transparent practices ensure adherence to regulatory standards, reducing the risk of legal issues and penalties. |

| Better Decision-Making | Clients equipped with comprehensive information are empowered to make informed financial decisions, leading to better outcomes. |

In summary, the financial industry’s commitment to transparency is essential for building trust with clients. By sharing vital information and fostering open communication, financial institutions can enhance their reputations, improve client relationships, and ensure compliance with regulations. Ultimately, transparency not only benefits clients but also contributes to the long-term success of financial institutions in a competitive landscape.

The Impact of Social Media on Financial Engagement

Social media has transformed the landscape of communication, profoundly affecting engagement within the financial industry. As financial institutions increasingly adopt social media platforms to connect with clients and stakeholders, understanding this impact becomes essential. With the rise of platforms such as Twitter, LinkedIn, and Instagram, financial entities now face both opportunities and challenges in how they share information, interact with clients, and build their brands.The influence of social media on financial engagement is significant.

It enhances transparency, promotes real-time communication, and allows for broader outreach. Users can easily access intricate financial details, investment strategies, and market trends through a simple scroll on their devices. This democratization of financial knowledge fosters a more engaged and informed public, enabling individuals to make better financial decisions. Moreover, financial companies can leverage social media for personalized communication, allowing for tailored messages that resonate more with their audience.

Key Social Media Platforms for Financial Engagement

Different social media platforms exhibit distinct advantages for financial engagement. Identifying the most effective platforms is crucial for successful communication strategies. The following platforms play pivotal roles in the financial sector:

- Twitter: Known for its real-time updates, Twitter is ideal for sharing instant market news, financial tips, and engaging in discussions. It has become a platform for thought leadership, allowing financial experts to share insights quickly.

- LinkedIn: As a professional networking site, LinkedIn is particularly effective for B2B communication. Financial institutions can use it to establish credibility, share industry reports, and connect with other professionals.

- Instagram: With its visual focus, Instagram is effective for creating engaging content that simplifies complex financial concepts. It is ideal for campaigns aimed at younger demographics who prefer visual learning.

- Facebook: Facebook’s vast user base allows financial entities to reach a larger audience. It also enables interactive content sharing, such as live Q&A sessions or webinars, fostering community engagement.

Implementing a strategic approach to social media engagement is essential for financial institutions seeking to enhance their communication efforts. A comprehensive strategy includes the following components:

- Content Creation: Develop informative and engaging content tailored to the target audience. This includes infographics, articles, and videos that simplify financial information.

- Engagement Tactics: Encourage interaction through polls, quizzes, and live sessions where followers can ask questions. This fosters a two-way communication channel.

- Analytics Monitoring: Utilize social media analytics tools to track engagement metrics and understand audience preferences. This data can inform future content strategies.

- Building Community: Create groups or forums where clients can discuss financial topics. This not only enhances engagement but also establishes the institution as a thought leader.

Through effective use of social media, financial institutions can enhance their customer engagement, improve brand awareness, and ultimately drive better financial outcomes for their clients.

Understanding Your Audience in Financial Services

A key element in the success of financial services marketing lies in comprehending the audience. By understanding who your clients are, financial institutions can tailor their services and communication strategies effectively. This understanding helps in building trust, enhancing customer satisfaction, and ultimately driving revenue growth. With the complexity of financial products, recognizing the unique needs and preferences of various customer segments allows businesses to create targeted marketing strategies that resonate with their audience.Demographics play a crucial role in shaping financial service marketing strategies.

Factors such as age, income, occupation, education level, and geographic location are instrumental in determining how financial products are perceived and utilized. For instance, millennials may prioritize mobile banking and investment apps, while older generations might lean towards traditional banking methods. Understanding these demographic nuances enables financial service providers to segment their markets and deliver personalized experiences.

Demographic Factors Influencing Financial Service Marketing

The following demographic factors significantly influence how financial services are marketed:

- Age: Different age groups have varying financial needs. For example, younger clients may seek student loans or credit cards, while older individuals may look for retirement planning and wealth management services.

- Income Level: High-income individuals often prefer investment opportunities and wealth management, while lower-income groups may need budgeting tools or savings accounts.

- Occupation: Professionals in high-stress jobs might require financial planning for work-related expenses, whereas those in more stable roles may be interested in basic savings and insurance products.

- Geographic Location: Urban residents typically have access to diverse financial products compared to those in rural areas, influencing product offerings and marketing strategies.

- Education Level: Individuals with higher education may seek more complex financial products, while others may require more straightforward financial solutions.

Effective audience segmentation in finance can be illustrated through successful case studies. For instance, a bank that developed a tailored product specifically for college students, complete with no-fee checking and budgeting tools, successfully attracted this demographic. Another example includes firms focusing on retirees, offering specialized investment portfolios and financial planning services that address their unique needs. These targeted approaches not only improve customer satisfaction but also enhance brand loyalty and market share.

The Intersection of Technology and Financial Services

The financial services sector is undergoing a remarkable transformation as technology continues to reshape how we manage, invest, and spend money. With advancements in artificial intelligence (AI), blockchain, and big data analytics, businesses in this industry are not only streamlining operations but also enhancing customer experiences and security. This evolution reflects a broader trend where technology becomes a key driver of innovation in finance, leading to more efficient and accessible financial solutions.Emerging technologies are revolutionizing financial services by introducing novel approaches to traditional practices.

For instance, blockchain technology is providing unprecedented levels of security and transparency in transactions, which is vital in an era marked by increasing cyber threats. Similarly, AI and machine learning are enabling financial institutions to analyze vast amounts of data, improve risk management, and personalize customer service.

Impact of Artificial Intelligence and Automation

Artificial intelligence is at the forefront of this technological revolution, with significant implications for financial services. AI-driven tools enhance decision-making processes, facilitate faster loan approvals, and improve fraud detection. Financial companies are increasingly leveraging automated systems to offer tailored financial advice, which allows them to cater to unique customer needs on a large scale.The integration of AI leads to the following advantages:

-

Improved Efficiency:

Automation of routine tasks reduces operational costs and frees up human resources for more complex responsibilities.

-

Enhanced Customer Experience:

AI algorithms analyze user behavior and preferences, allowing businesses to offer customized products and support.

-

Risk Mitigation:

Predictive analytics ensures that companies can anticipate and mitigate potential risks associated with lending and investment.

Blockchain Technology in Financial Services

Blockchain technology is fundamentally altering the way financial transactions are conducted. Its decentralized nature enhances security, reduces the likelihood of fraud, and increases transaction speed. As more firms adopt blockchain, they are not only improving their operational efficiency but also responding to the growing demand for transparency and trust in financial dealings.Key benefits of blockchain adoption include:

-

Transparency and Traceability:

Each transaction is recorded on a public ledger, providing a clear audit trail for regulatory compliance and trust-building.

-

Cost Reduction:

By eliminating intermediaries, blockchain can significantly lower transaction costs.

-

Faster Transactions:

Cross-border payments can be settled in a fraction of the time compared to traditional methods.

Adaptation Strategies for Financial Companies

To successfully navigate these technological changes, financial institutions must adopt proactive strategies. Embracing a culture of innovation and continuous learning is essential for organizations that wish to remain competitive. Furthermore, investing in talent development ensures that staff are equipped with the necessary skills to leverage new technologies.Recommended adaptation strategies include:

-

Investment in Technology:

Allocating resources towards the latest tech tools can enhance operational capabilities and customer satisfaction.

-

Partnerships with Fintech Firms:

Collaborating with technology startups can accelerate innovation and provide access to cutting-edge solutions.

-

Focus on Cybersecurity:

As technology advances, so do cyber threats; thus, prioritizing robust security measures is crucial for protecting sensitive data.

Trends in Financial Communication and Their Implications

Financial communication is rapidly evolving, driven by advancements in technology, changes in consumer behavior, and increasing regulatory demands. As financial organizations adapt to these shifts, understanding current trends becomes essential for effective stakeholder engagement, transparency, and compliance. This discussion focuses on three key trends shaping the future of financial communication and explores their potential implications for the industry.

Digital Transformation in Financial Communication

Digital transformation is a defining trend in financial communication, significantly impacting how organizations interact with their stakeholders. With the rise of digital platforms, companies can now disseminate information more rapidly and broadly than ever before. This shift presents both opportunities and challenges.

Enhanced Speed and Accessibility

Information can be shared in real-time through various digital channels, including social media, websites, and mobile apps. This immediacy allows organizations to keep stakeholders informed about critical developments, such as earnings reports or market changes.

Increased Focus on Multimedia Content

Financial firms are increasingly leveraging video content, infographics, and podcasts to convey complex information more engagingly. For example, a financial institution might use animated videos to explain investment strategies, making the content more accessible to a broader audience.

Greater Transparency and Accountability

Digital platforms enable organizations to provide more detailed disclosures and updates, fostering a culture of transparency. For instance, companies can implement live Q&A sessions during earnings calls, allowing stakeholders to engage directly with executives.This digital landscape allows financial organizations to enhance their communication strategies, ultimately improving stakeholder trust and engagement.

Personalization and Targeted Communication

The trend toward personalization in financial communication reflects a broader shift in consumer expectations. As clients demand tailored experiences, financial organizations must adapt their communication strategies to meet these needs.

Data-Driven Insights

Organizations can analyze customer data to segment their audiences and tailor messages accordingly. For instance, a bank may send personalized investment advice based on a client’s financial history and goals, increasing the likelihood of engagement.

Customized Messaging

Through targeted communication, firms can enhance client satisfaction. For example, sending timely market updates to specific investor segments can help clients make informed decisions and feel valued.

Building Stronger Relationships

Personalization fosters deeper connections with clients. Financial organizations can use communication platforms to send personalized greetings on milestones, such as anniversaries of account openings, thereby reinforcing client loyalty.By leveraging personalization, financial institutions can create more meaningful interactions, resulting in enhanced client retention and satisfaction.

Regulatory Compliance and Ethical Communication

Increasing regulatory scrutiny is reshaping financial communication practices, necessitating a focus on compliance and ethical standards.

Adherence to Regulations

Financial organizations must navigate complex regulations, such as the SEC’s rules on disclosure and communication. Ensuring compliance with these regulations requires robust communication strategies that prioritize transparency and accuracy.

Ethical Communication Practices

Upholding ethical standards is paramount. Organizations must commit to honest communication, avoiding misleading information that could harm stakeholders. For example, during crises, clear and truthful updates are crucial to maintaining trust.

Risk Management

Effective communication can mitigate reputational risks. By proactively addressing potential issues through transparent messaging, organizations can safeguard their reputations and maintain stakeholder confidence.By emphasizing regulatory compliance and ethical communication, financial organizations can foster trust and credibility, essential for long-term success in a competitive marketplace.

Outcome Summary

In conclusion, the journey through finance s reveals the vital components that can significantly impact financial communication and growth. By embracing digital strategies, maintaining high content quality, and fostering transparency, financial institutions can build trust and engage effectively with their audiences. As we look ahead, adapting to technological advancements and current trends will be essential to thriving in the ever-evolving financial landscape.

FAQ: Finance Seo Keywords

What are finance s?

Finance s are specific phrases and terms related to finance that help improve a website’s visibility on search engines.

How can I find the best finance s for my business?

Utilize research tools like Google Planner or SEMrush to identify relevant and high-traffic finance s.

Do finance s change over time?

Yes, finance s can evolve based on market trends, consumer behavior, and industry developments.

How often should I update my finance s?

It’s advisable to review and update your finance s regularly, ideally every few months, to stay current with trends.

Why is content quality important for finance ?

High-quality content enhances user experience, builds trust, and improves search engine rankings, making it crucial for successful finance .