Finance ppc keywords – Finance PPC s take center stage as they become essential for promoting financial services in the digital landscape. In an era where consumers increasingly turn to online channels for financial solutions, harnessing the power of pay-per-click advertising is crucial for businesses looking to engage and convert potential clients. Effective financial marketing strategies not only stimulate consumer interest but also shape their decision-making processes, ultimately driving growth and brand loyalty.

This overview delves into the pivotal role of financial advertising, exploring the different types of financial services that benefit from PPC campaigns, as well as the unique challenges each category faces. By understanding these dynamics, businesses can design effective campaigns that resonate with their target audiences, leading to measurable success in the competitive financial sector.

Understanding the Importance of Financial Advertising

In the dynamic world of finance, advertising plays a pivotal role in shaping consumer perceptions and driving engagement. Financial advertising encompasses a wide array of services, including banking, investment, insurance, and personal finance. The primary purpose of financial advertising is to inform potential customers about products and services while building trust and credibility in an industry often perceived as complex and intimidating.Effective financial marketing strategies directly influence consumer behavior by providing information that guides decision-making.

Consumers are often faced with numerous choices when it comes to financial products. A well-crafted advertisement can highlight the unique benefits of a financial service, making it easier for consumers to evaluate their options. For instance, a bank may promote its low-interest rates on loans through targeted advertising, which can attract borrowers who are looking to save money. Furthermore, emotional appeal in financial advertising can foster a connection with consumers, leading to enhanced brand loyalty and trust over time.

Significance of PPC in Promoting Financial Services

Pay-per-click (PPC) advertising has emerged as a crucial component of financial marketing strategies. The real-time nature of PPC allows financial institutions to respond quickly to market trends and consumer needs. By bidding on relevant s, financial brands can ensure their services are visible at critical moments in the consumer’s journey.PPC campaigns also offer measurable results, enabling financial marketers to track the return on investment (ROI) effectively.

This data-driven approach allows for continuous optimization of ad campaigns, ensuring that advertising budgets are utilized efficiently. Some key factors highlighting the significance of PPC in financial advertising include:

- Targeted Reach: PPC enables financial brands to target specific demographics based on interests, location, and behaviors, allowing for precise alignment with potential customer needs.

- Cost-Effectiveness: With PPC, financial services only pay when a user clicks on their ad, making it a cost-effective option compared to traditional advertising.

- Immediate Traffic: Well-optimized PPC campaigns can drive immediate traffic to a financial service’s website, facilitating faster lead generation.

In conclusion, the role of advertising in the finance sector cannot be overstated. It is essential for informing consumers, building trust, and driving engagement. The integration of PPC into financial advertising strategies maximizes visibility and effectiveness, ultimately leading to increased customer acquisition and retention.

Exploring the Different Types of Financial Services for PPC

In the rapidly evolving world of finance, Pay-Per-Click (PPC) advertising has emerged as a crucial strategy for businesses aiming to attract new customers and enhance their online visibility. Financial services, a diverse sector encompassing a range of offerings, have found unique ways to leverage PPC campaigns to meet their specific advertising needs. This content delves into three distinct types of financial services that commonly utilize PPC advertising, highlighting how each can benefit from targeted advertising campaigns.

Banking Services, Finance ppc keywords

Banking services, including retail banks, credit unions, and online banks, represent a significant segment of the financial services sector. These institutions use PPC advertising to reach individuals seeking various financial products, such as checking accounts, savings accounts, loans, and mortgages.Utilizing targeted advertising campaigns allows banks to:

- Enhance visibility for specific financial products, ensuring they reach potential customers actively searching for these services.

- Promote limited-time offers, such as reduced interest rates on loans, which can drive immediate customer action.

- Segment audiences based on demographics or financial behaviors, allowing for personalized ad messaging that resonates with specific groups.

The unique advertising needs of banking services often revolve around compliance and trust-building. Ads must convey reliability while also adhering to strict regulatory standards, ensuring that the messaging is both compelling and compliant with financial regulations.

Investment Services

Investment services, including brokerage firms and wealth management companies, heavily rely on PPC advertising to attract clients seeking to grow their wealth. These services need to communicate the value of their offerings effectively, whether it’s stock trading, mutual funds, or retirement planning.Targeted advertising campaigns for investment services can:

- Highlight the expertise of advisors, showcasing their qualifications and successful track records to build trust with potential investors.

- Utilize educational content that positions the firm as a thought leader in investment strategies, thereby attracting more knowledgeable clients.

- Promote specific investment products that align with trending market opportunities, driving interest among active investors.

Investment services face unique challenges in their advertising efforts, particularly in differentiating themselves in a crowded marketplace and addressing the varying risk tolerances of potential clients.

Insurance Services

Insurance services, covering a wide array of products such as health, auto, and life insurance, also benefit significantly from PPC advertising. These campaigns are vital for engaging consumers who are in urgent need of coverage or looking to compare policies.Through targeted PPC campaigns, insurance services can:

- Drive traffic to quote comparison tools, allowing potential clients to easily evaluate their options and make informed decisions.

- Focus on local markets through geo-targeting, ensuring ads reach consumers in specific regions where services are offered.

- Promote tailored insurance solutions that address unique customer needs, such as bundling home and auto insurance for additional savings.

The advertising needs for insurance services often center on transparency and clarity, as potential clients seek to understand complex policy details. Visual elements, such as calculators and infographics, can enhance ad effectiveness by simplifying information.

Designing Effective Campaigns for Financial Services

Creating a successful PPC campaign for financial services requires a strategic approach that takes into account the unique nature of financial products. With the competitive landscape of the finance industry, it is essential to develop campaigns that not only attract clicks but also convert leads into customers. This involves a careful consideration of the target audience, the messaging, and the overall campaign structure.

Step-by-Step Guide to Creating a PPC Campaign for Financial Products

A well-structured PPC campaign involves several key steps, each contributing to the overall success of the campaign. Here’s a comprehensive guide to facilitate the creation of effective PPC campaigns tailored for financial services:

1. Define Campaign Goals

Establish clear objectives, whether it’s lead generation, brand awareness, or customer retention. This clarity will guide your campaign structure.

2. Identify Your Target Audience

Understand who your ideal customers are. Analyze demographics, interests, and online behaviors to segment your audience effectively.

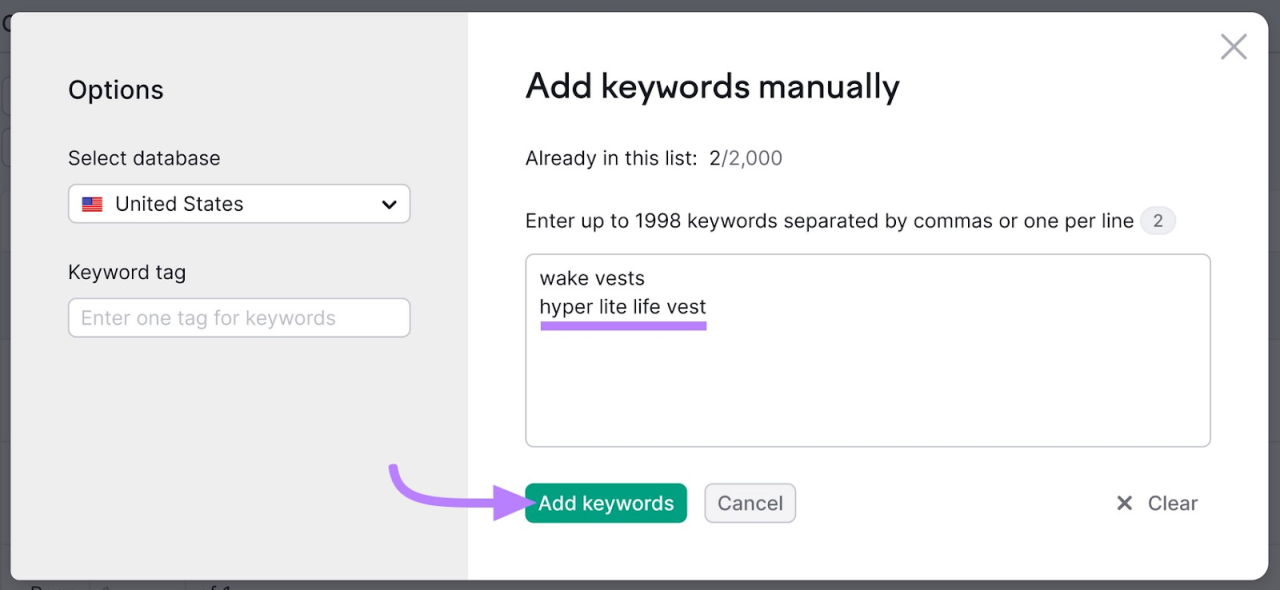

3. Research

Utilize tools like Google Planner to identify relevant s with solid search volumes and manageable competition. Focus on long-tail s that reflect specific financial services.

4. Craft Compelling Ad Copy

Write clear, concise, and persuasive ad copy that highlights the benefits of your financial products. Use strong calls-to-action (CTAs) to encourage clicks.

5. Design Landing Pages

Ensure your landing pages are optimized to convert. They should be relevant to the ad copy, easy to navigate, and contain clear CTAs.

6. Set Your Budget and Bids

Determine your budget based on your goals and analyze the cost-per-click (CPC) for your selected s. Set bid strategies accordingly.

7. Launch and Monitor the Campaign

Once everything is set, launch your campaign but continue to monitor performance metrics regularly to identify areas for improvement.

8. Optimize Based on Data

Use A/B testing to compare different elements of your ads and landing pages. Analyze click-through rates (CTR), conversion rates, and adjust strategies based on performance data.

9. Evaluate Success

After a set period, review your campaign against the defined goals to measure success and identify lessons learned for future campaigns.

Importance of Audience Targeting in Financial PPC Campaigns

Audience targeting is critical in financial PPC campaigns as it ensures that your ads are shown to the most relevant potential customers. Effective targeting can enhance engagement and drive higher conversion rates. Here are key aspects to consider:

Demographic Targeting

Tailor your campaigns to specific demographics such as age, gender, income level, and education, which can significantly impact financial product needs.

Geographic Targeting

Focus on specific locations where your services are offered. For example, if you provide mortgage services, target areas with high real estate activity.

Behavioral Targeting

Analyze user behavior to reach individuals who have previously shown interest in financial products. Retargeting campaigns can be particularly effective here.

Interest-Based Targeting

Use interest categories to reach users based on their hobbies or interests, which can align with the financial services they may seek.By honing in on these targeting methods, financial services can maximize their ad spend efficiency and enhance the overall effectiveness of their PPC campaigns.

Methods for Measuring the Success of Financial PPC Campaigns

Measuring the success of your PPC campaigns is essential to understand their effectiveness and to make informed decisions for future strategies. Consider the following metrics for evaluation:

Click-Through Rate (CTR)

This metric indicates the effectiveness of your ad copy. A higher CTR suggests that your ad is relevant to your audience.

Conversion Rate

This measures how many clicks resulted in actual conversions, such as sign-ups or purchases. High conversion rates indicate that your landing page and messaging are on point.

Quality Score

Google assigns a Quality Score based on your ad relevance, CTR, and landing page experience. A higher score can lead to lower CPC and better ad placements.

Cost Per Acquisition (CPA)

This metric evaluates how much you are spending to acquire a customer. Keeping CPA within acceptable limits is crucial for profitability.

Return on Ad Spend (ROAS)

This measures the revenue generated for every dollar spent on advertising. A higher ROAS indicates a successful campaign.By continually monitoring these metrics, financial services can make data-driven decisions to refine their campaigns, ensuring ongoing improvement and higher returns on investment.

Analyzing the Competitive Landscape in Financial PPC

Understanding the competitive landscape is crucial for formulating effective PPC strategies in the financial sector. By analyzing your competitors, you can uncover valuable insights that help refine your campaigns, ensuring they stand out in a crowded marketplace. This process not only enhances your ad performance but also maximizes your return on investment.Researching competitors in the financial advertising space involves a systematic approach.

Start by identifying key players in your niche. Utilize tools like SEMrush, Ahrefs, or SpyFu to gather data on their PPC strategies, including s, ad copy, and landing pages. This initial analysis will provide a foundation for deeper insights into their approach.

Identifying Gaps in Competitors’ PPC Strategies

Recognizing gaps in your competitors’ PPC strategies is essential for developing a unique value proposition. To uncover these opportunities, consider the following techniques:

1. Analysis

Examine the s your competitors are targeting. Identify high-volume s that they may have overlooked. Tools like Google Planner can help you discover relevant terms that align with your services but are not prominently featured in their campaigns.

2. Ad Copy Review

Analyze the messaging in your competitors’ ads. Look for themes or angles that are underutilized. If competitors are focusing heavily on price, consider emphasizing customer service or unique features in your ads.

3. Landing Page Evaluation

Review the landing pages your competitors are directing traffic to. Assess their design, user experience, and call-to-action strategies. Identify elements that could be improved upon or features that are absent, which you can incorporate into your own landing pages.

4. Campaign Structure Examination

Investigate how competitors organize their campaigns and ad groups. A well-structured campaign can lead to better Quality Scores and lower CPC. Look for inconsistencies or areas where your competitors may not be effectively segmenting their audience.

5. Ad Extensions and Features

Check the ad extensions used by your competitors. This includes site links, callouts, and structured snippets. If they are not utilizing certain features, exploiting these can give you an edge in visibility and click-through rates.Understanding your competitors allows you to craft better financial PPC campaigns. By leveraging insights gained from their strategies, you can position your ads more effectively.

This not only helps in capturing attention but also in resonating with your target audience, ultimately driving conversions and achieving your financial goals.

Creating Engaging Ad Copy for Financial Products

Crafting compelling ad copy for financial products is essential for attracting potential customers and converting leads into loyal clients. In a saturated market, the way you convey your message can make all the difference. Effective ad copy not only highlights the benefits of your offerings but also builds trust and resonates with the unique needs of potential customers.To resonate with your audience, your ad copy should be concise, clear, and compelling.

It’s important to tap into the emotional and rational aspects of decision-making. Emphasizing security, growth, and the potential for financial success can influence customer engagement. Moreover, aligning your messaging with compliance regulations ensures that you maintain credibility and avoid legal pitfalls.

Effective Headlines and Descriptions for Financial Services

A well-crafted headline grabs attention and encourages the reader to delve deeper. Following that, concise and informative descriptions provide the necessary details that highlight the unique selling propositions of your financial services. Here are examples of effective headlines and descriptions that illustrate this concept:

- Headline: “Unlock Your Financial Future Today!”

Description: “Explore our range of investment options that can help you secure your financial independence. Join thousands of satisfied clients who have taken control of their financial destiny.” - Headline: “Your Path to Smart Savings Starts Here”

Description: “Discover tailored savings plans that grow with you. Our expert advisors are here to guide you every step of the way.” - Headline: “Experience Hassle-Free Loans with Low Rates”

Description: “Get approved quickly with our straightforward application process. Enjoy competitive rates and flexible repayment options tailored to your needs.”

The importance of these headlines and descriptions lies in their ability to convey value while addressing the target audience’s pain points. Remember to focus on clarity and impact, as consumers are often inundated with information.

“Effective ad copy is not just about selling; it’s about solving problems.”

Compliance with advertising regulations in financial promotions is crucial to maintain trust and integrity. Financial institutions must adhere to guidelines set by regulatory bodies, ensuring that all claims are accurate and substantiated. Misleading information can lead to not only legal repercussions but also a damaged reputation. By crafting messages that are not only engaging but also compliant, advertisers can effectively promote financial products while safeguarding their brand’s credibility and fostering long-term customer relationships.

Budgeting for Financial Advertising Campaigns: Finance Ppc Keywords

Budgeting effectively for a pay-per-click (PPC) campaign targeting financial services is crucial for maximizing your advertising spend. With the competitive nature of the financial sector, understanding how to allocate your budget wisely can lead to improved returns and business growth. A well-defined budget plan not only optimizes your ad performance but also ensures that you can measure the effectiveness of your investment in financial advertising.The importance of return on investment (ROI) in financial PPC advertising cannot be overstated.

ROI serves as a key metric to assess the effectiveness of your advertising efforts, helping to gauge whether your campaigns are yielding profitable results. By analyzing ROI, businesses can refine their strategies, adjust budgets, and focus on high-performing s that generate the best returns.

Creating a PPC Budget Plan for Financial Services

Establishing a solid budget plan for a PPC campaign involves several critical steps. Here are key considerations to effectively allocate your advertising budget:

- Identify Your Goals: Clearly define what you want to achieve with your PPC campaign. This might include increasing brand awareness, generating leads, or driving sales.

- Research s: Conduct thorough research to determine which terms are relevant to your financial services. Focus on high-intent s that potential clients are likely to use.

- Allocate Budget by Platform: Different platforms, such as Google Ads or Bing Ads, may perform differently for your specific target audience. Allocating your budget based on past performance can optimize results.

- Monitor and Adjust: Regularly review your campaign’s performance data. Adjust your budget allocations based on which ads and s are generating the highest ROI.

Understanding ROI in Financial PPC Advertising

ROI is a vital metric that enables businesses to measure the success of their PPC campaigns. A strong understanding of ROI can lead to informed decision-making regarding budget allocation and campaign adjustments.

ROI = (Net Profit / Cost of Investment) x 100

A high ROI indicates that the financial investment in PPC advertising is paying off, while a low ROI may signal a need for reevaluation. Regularly analyzing the ROI of each campaign can help identify which strategies work best, allowing for more effective budget management.

Effective Budget Allocation Across Different Platforms

Allocating your budget across various platforms requires a strategic approach. Each platform has unique characteristics and audience behaviors that should be considered. Here are some tips for effective budget allocation:

- Analyze Historical Data: Look at past campaign data to determine which platforms have delivered the best results in terms of conversions and ROI.

- Test and Optimize: Start with smaller budgets on new platforms to test performance before committing larger amounts. Use A/B testing to see which ads perform better.

- Consider Audience Demographics: Allocate more budget to platforms where your target audience is most active. For example, younger demographics may respond better to social media ads, while professionals may engage more on search engines.

- Adjust for Seasonality: Financial services often experience seasonal trends. Adjust your budget allocation based on high-demand periods, such as tax season, when consumer interest in financial services peaks.

Utilizing Data Analytics to Optimize Financial PPC Campaigns

In the fast-paced world of finance, utilizing data analytics in pay-per-click (PPC) campaigns can significantly enhance performance and lead to better return on investment (ROI). By analyzing data, financial services can better understand their audience, optimize campaign strategies, and make informed decisions that align with their business goals. Data analytics empowers marketers to dissect their PPC performance by examining user behavior, identifying trends, and uncovering insights that might otherwise go unnoticed.

This approach enables financial services to adjust their campaigns in real-time, ensuring they are targeting the right audience with the right message at the right time.

Key Metrics for Evaluating Campaign Effectiveness

To assess the effectiveness of PPC campaigns in the financial sector, several metrics are crucial. Understanding these metrics helps in making data-driven decisions and continually improving campaign performance. Here are some of the most important metrics to monitor:

- Click-Through Rate (CTR): This metric measures the ratio of users who click on the ad to the number of total impressions. A high CTR indicates that the ad is relevant and engaging, while a low CTR suggests the need for adjustments.

- Cost Per Acquisition (CPA): This measures the cost incurred to acquire a new customer through the PPC campaign. Monitoring CPA helps in assessing the financial efficiency of the campaign.

- Conversion Rate: This metric indicates the percentage of users who complete a desired action after clicking on the ad, such as signing up for a service or making a purchase. A higher conversion rate signifies effective targeting and messaging.

- Quality Score: A score assigned by search engines based on the relevance of the ad and landing page content. A higher Quality Score can lead to lower costs and better ad placements.

- Return on Ad Spend (ROAS): This metric calculates the revenue generated for every dollar spent on advertising. A higher ROAS indicates that the campaign is profitable.

Analyzing these metrics allows financial services to gain insights into campaign performance and audience engagement. By leveraging these insights, marketers can adjust their PPC campaigns to improve targeting, optimize ad creative, and allocate budgets more effectively. For instance, if data shows a particular demographic has a higher conversion rate, financial marketers can increase bids for that audience segment.

“Data-driven decision-making in PPC campaigns can lead to significant improvements in both engagement and ROI.”

Implementing changes based on analytical insights involves a systematic approach. Marketers can conduct A/B testing on various ad creatives to identify which performs best, analyze performance to refine targeting, and adjust bidding strategies based on time-of-day performance trends. By continuously iterating and optimizing based on data, financial services can achieve a more effective PPC campaign that aligns with their strategic objectives.

The Role of Landing Pages in Financial PPC Success

In the highly competitive world of financial services, a well-designed landing page can make or break the success of a PPC campaign. Landing pages serve as the final destination for potential clients after clicking on an advertisement, and their design and content significantly impact conversion rates. An effective landing page not only captures attention but also guides users toward taking action, whether that’s signing up for a newsletter, requesting a quote, or applying for a financial product.

Designing the ideal landing page for a financial service advertisement requires a strategic approach. First and foremost, it should have a clean and professional aesthetic that aligns with the brand’s identity. The layout should be intuitive, allowing visitors to navigate without confusion. Key elements include a compelling headline that communicates the value proposition, concise yet informative content, and prominent calls-to-action (CTAs).

Additionally, incorporating trust signals, such as testimonials or certifications, can enhance credibility and reassure visitors about the legitimacy of the service.

Elements Contributing to High Conversion Rates on Landing Pages

To optimize conversion rates, various elements must be thoughtfully integrated into the landing page design. The following factors play a critical role:

- Clear Value Proposition: The headline and subheading should immediately convey the benefits of the financial service, addressing the needs of the target audience.

- Engaging Visuals: Use high-quality images, infographics, or videos that complement the text and help convey the message more effectively.

- Strategic CTAs: Calls-to-action must be visible and compelling, using action-oriented language that encourages visitors to act immediately, such as “Get Your Free Quote” or “Start Saving Today.”

- Mobile Responsiveness: With a significant number of users accessing financial services via mobile devices, the landing page must be optimized for mobile use to ensure a seamless experience.

- Trust Elements: Incorporate testimonials, reviews, or industry awards to build trust and credibility with potential clients.

- Easy Navigation: Minimize distractions by limiting navigation options and focusing on the primary goal of the landing page.

Aligning landing page content with PPC ad messaging is crucial for ensuring a cohesive experience for users. When visitors click on an ad, they expect to find relevant information that reflects what was promised in the advertisement. This alignment can be achieved through the following strategies:

- Consistent Messaging: Ensure that the language, tone, and key phrases used in the ad are mirrored in the landing page content. This consistency reinforces trust and helps maintain user engagement.

- Targeted s: Use the same s that triggered the PPC ads within the landing page to enhance relevancy and improve quality scores.

- Specific Offers: If the ad promotes a particular financial product or benefit, the landing page should prominently feature this element to meet user expectations.

- Clear Path to Conversion: The landing page should guide users towards the desired action in a straightforward manner that echoes the ad’s promise.

By thoughtfully crafting landing pages that resonate with PPC ad messaging, financial services can significantly enhance their chances of converting traffic into loyal customers.

Final Wrap-Up

In summary, embracing finance PPC s as part of a well-structured marketing strategy can significantly enhance a financial service’s visibility and engagement. By carefully crafting campaigns, analyzing competitors, and utilizing data analytics, businesses can optimize their advertising efforts for maximum impact. As the financial landscape continues to evolve, staying ahead with innovative PPC strategies will be key to achieving sustainable growth and establishing a strong online presence.

Quick FAQs

What are finance PPC s?

Finance PPC s are specific search terms related to financial services that advertisers use to target potential customers through pay-per-click advertising.

How do I choose the right finance PPC s?

Selecting the right finance PPC s involves researching industry-specific terms, analyzing competitors, and understanding your target audience’s search behavior.

What metrics should I track for finance PPC campaigns?

Key metrics include click-through rate (CTR), conversion rate, cost per acquisition (CPA), and return on investment (ROI).

How can I improve my finance PPC ad copy?

Improving your finance PPC ad copy involves using compelling language, clear calls-to-action, and addressing customer pain points while adhering to compliance regulations.

What is the typical budget for finance PPC campaigns?

The budget for finance PPC campaigns varies widely, depending on factors like competition, targeted s, and advertising platforms, but it’s essential to allocate funds thoughtfully for optimal results.