Budgeting tips serve as essential tools in navigating the complexities of personal finance, empowering individuals to take charge of their financial destinies. Understanding the importance of budgeting is paramount, as it lays the foundation for sound financial management and guides you towards achieving your financial aspirations. From promoting discipline in spending to fostering a sense of security, the benefits of maintaining a budget extend beyond mere numbers, enhancing both your financial literacy and confidence.

By exploring various budgeting methods tailored to diverse lifestyles, alongside examining common pitfalls and effective strategies for adherence, this guide aims to provide you with a comprehensive understanding of how to craft and maintain a budget that aligns with your goals. Embracing technology in budgeting and teaching these principles to younger generations further enriches this discussion, making the journey toward financial well-being both accessible and engaging.

Understanding the Importance of Budgeting in Personal Finance: Budgeting Tips

Budgeting is a fundamental aspect of managing personal finances, providing individuals with a structured approach to tracking income, expenses, and financial goals. It serves as a roadmap for financial decision-making, enabling individuals to allocate their resources efficiently. With the increasing complexity of financial obligations, establishing a budget has become essential for achieving long-term financial stability and success.The role of budgeting extends beyond mere number-crunching; it fosters a deep understanding of one’s financial situation.

By meticulously tracking income and expenditures, individuals can identify spending patterns, prioritize necessities over luxuries, and make informed decisions regarding savings and investments. This proactive approach allows for greater control over financial outcomes and minimizes the risk of falling into debt. Furthermore, budgeting creates a clear pathway toward achieving specific financial goals, whether it be saving for a home, planning for retirement, or funding education.

Achievement of Financial Goals

Effective budgeting is instrumental in reaching financial aspirations. By setting clear, measurable goals and allocating funds accordingly, individuals can systematically work towards their objectives. The importance of this process can be summarized in a few key points:

- Goal Clarity: Establishing a budget allows individuals to define their financial goals precisely, making it easier to focus efforts on achieving these aspirations.

- Progress Tracking: Regularly reviewing a budget enables individuals to monitor their progress, providing motivation and accountability in their financial journey.

- Prioritization of Savings: Budgeting assists in distinguishing between essential and discretionary spending, ensuring that sufficient funds are allocated toward savings and investments.

- Emergency Preparedness: A well-structured budget includes provisions for unexpected expenses, which can safeguard against financial setbacks.

The psychological benefits of maintaining a budget are equally significant. Individuals who actively engage in budgeting often experience reduced financial stress and anxiety. This is largely due to the sense of control and organization that comes from understanding one’s financial landscape. Adopting a budgeting mindset can lead to increased confidence in making financial decisions, as individuals become more attuned to their spending habits and financial patterns.

A well-planned budget not only provides insight into current financial status but also contributes to a more secure and stress-free future.

Different Budgeting Methods Suitable for Various Lifestyles

Budgeting is an essential aspect of financial management that helps individuals and families allocate their resources effectively. Different budgeting methods cater to varying lifestyles and preferences, enabling people to choose a system that aligns with their specific needs. This section explores the envelope budgeting method, the zero-based budgeting approach, and compares traditional budgeting with digital budgeting tools, providing insights into their practical applications and effectiveness.

Envelope Budgeting Method

The envelope budgeting method is a tactile and highly visual approach to managing finances. This technique involves dividing cash into designated envelopes, each representing a specific spending category such as groceries, transportation, entertainment, and savings. By allocating a fixed amount of cash to each envelope at the beginning of the month, individuals can monitor their spending in real-time and avoid overspending.

This method is particularly beneficial for those who may struggle with impulse purchases or need a clearer understanding of their financial limits.

To implement the envelope budgeting system, one can follow these straightforward steps:

- Determine monthly income and essential expenses.

- Identify spending categories and assign a budget for each.

- Withdraw cash and distribute it into labeled envelopes according to the budget.

- Once the cash in an envelope is depleted, no further spending can occur in that category until the next budget period.

This method encourages disciplined spending and can lead to significant savings over time, as it promotes mindfulness about where money goes.

Zero-Based Budgeting Approach

Zero-based budgeting (ZBB) is a financial strategy where every dollar is assigned a specific purpose, ensuring that income minus expenses equals zero at the end of a budgeting period. This approach requires individuals to evaluate their expenses from scratch each budgeting cycle rather than basing it on previous spending habits. This method empowers individuals to prioritize their spending and eliminate unnecessary expenses.

The importance of zero-based budgeting can be highlighted through the following key aspects:

- All income is accounted for: Every dollar earned is designated for expenses, savings, or debt repayment.

- Promotes accountability: Individuals can track where their money goes, ensuring that funds are used wisely.

- Encourages strategic thinking: Evaluating expenses from a fresh perspective allows individuals to identify and eliminate non-essential costs.

For example, a household earning $3,000 a month may allocate funds as follows: $1,200 for housing, $800 for food, $500 for savings, $300 for transportation, and $200 for discretionary spending. By the end of the month, the budget balances to zero, ensuring no money is left unallocated.

Comparison of Traditional Budgeting and Digital Budgeting Tools, Budgeting tips

Traditional budgeting often involves pen-and-paper methods or simple spreadsheets, while digital budgeting tools offer more sophisticated features such as real-time tracking, automated expense categorization, and integration with bank accounts. Both methods have their merits and limitations.

Traditional budgeting methods can be beneficial for individuals who prefer a hands-on approach or those who may not have access to technology. However, they can be time-consuming and may lack the capability to provide real-time insights into spending patterns. Conversely, digital tools simplify the budgeting process by allowing users to easily visualize their finances, set goals, and monitor progress through user-friendly interfaces and mobile applications.

The effectiveness of each method can depend on personal preferences and lifestyle choices. Digital budgeting tools often provide updates and notifications, enhancing user engagement and prompting timely financial decisions. In contrast, traditional methods may foster a more personal connection to money management, allowing individuals to physically handle and set aside cash for different purposes. Each budgeting style can be effective; the best choice depends on individual preferences and financial goals.

Common Mistakes People Make When Budgeting

Budgeting is an essential tool for financial management; however, many individuals encounter pitfalls that hinder their budgeting success. Recognizing these common mistakes can pave the way for achieving better financial stability and making informed decisions. Understanding the underlying issues will help individuals develop effective strategies to navigate the budgeting process more successfully.One frequent pitfall is setting unrealistic expectations when creating a budget.

Many people tend to overestimate their income and underestimate their expenses, leading to a budget that is not reflective of reality. This can create a false sense of security and result in overspending. It is crucial to base your budget on realistic income projections and to account for variable expenses, including emergency funds for unexpected costs. Regularly reviewing and adjusting your budget can help align it with actual financial circumstances.

Impact of Unrealistic Expectations on Budget Adherence

Unrealistic expectations can have a detrimental effect on one’s ability to adhere to a budget. When individuals perceive their financial goals as unattainable, they may feel disheartened and abandon their budgeting efforts altogether. The following points highlight the consequences of setting unattainable financial goals:

- Increased Stress: Constantly feeling far from financial goals can lead to anxiety and stress, affecting overall well-being.

- Lack of Motivation: When budgets are overly restrictive or ambitious, individuals may become less motivated to follow them, often leading to poor financial decisions.

- Cycle of Debt: Failing to adhere to a budget due to unrealistic expectations can result in falling back into debt, undermining financial progress.

Incorporating realistic and achievable goals is essential for maintaining motivation and ensuring that budgeting remains a positive endeavor rather than a source of frustration.

Consequences of Neglecting to Review and Adjust Budgets Regularly

Neglecting to regularly review and adjust a budget can lead to significant financial setbacks. The dynamic nature of personal finances requires ongoing attention and flexibility to adapt to changing circumstances. Consider the following implications of not adjusting your budget:

- Inaccurate Financial Picture: Without regular updates, individuals may rely on outdated information, leading to poor financial decisions.

- Missed Savings Opportunities: Regular reviews can reveal areas where expenses can be cut, allowing for increased savings that might otherwise be overlooked.

- Failure to Meet Financial Goals: As life situations change, so should your budget. Not adjusting can hinder progress toward important goals, such as saving for a home or retirement.

Adjusting budgets to reflect current realities and future aspirations is vital for successful financial planning. By actively engaging in the budgeting process and avoiding common mistakes, individuals can foster better financial habits and enhance their overall fiscal health.

Effective Strategies for Sticking to Your Budget

Staying committed to a budget can be a challenging endeavor, but with the right strategies in place, it becomes significantly more manageable. Effective budgeting is not merely a numerical exercise; it requires discipline, awareness, and motivation. By implementing actionable tips, individuals can develop habits that reinforce their budgetary commitments and ultimately improve their financial well-being.One critical aspect of successful budgeting is the consistent tracking of expenses.

Understanding where your money goes is vital for making informed financial decisions. When individuals take the time to log every transaction, they gain insights into their spending patterns, which helps identify areas for improvement. This practice not only fosters accountability but also provides the necessary data to adjust budgets realistically based on spending habits.

Importance of Tracking Expenses

Tracking expenses is a cornerstone of effective budgeting, as it allows individuals to remain informed about their financial standing. Here are key advantages of keeping a detailed record of expenditures:

- Awareness of Spending Patterns: Familiarity with daily, weekly, or monthly spending habits enables individuals to detect unnecessary expenses and allocate funds more wisely.

- Enhanced Budget Adjustments: Regularly reviewing expenses allows for timely adjustments to budgets in response to lifestyle changes, unexpected costs, or improved financial circumstances.

- Goal Achievement: Monitoring expenses serves as a motivational tool, as tracking progress towards financial goals can make the process more tangible and rewarding.

- Accountability: Maintaining a spending log creates a sense of responsibility, encouraging individuals to adhere to their budget plans.

This emphasis on tracking expenses helps build a comprehensive picture of financial health, fostering better decision-making and commitment to budgetary goals.

Techniques for Rewarding Milestones

Rewarding oneself upon achieving budgeting milestones can significantly enhance motivation and adherence to financial goals. Celebrating accomplishments, no matter how small, reinforces positive behavior and creates a sense of achievement. Below are effective techniques for rewarding budgeting milestones:

- Set Clear Milestones: Define specific, measurable objectives within your budget, such as saving a certain amount or reducing discretionary spending by a defined percentage.

- Choose Meaningful Rewards: Select rewards that resonate with personal interests or desires, such as a spa day, a small luxury item, or a special meal.

- Incorporate Time-Based Rewards: Plan rewards to coincide with milestones, such as monthly savings goals, to create a sense of anticipation and excitement.

- Share Achievements: Sharing milestones with friends or family can encourage accountability and create a supportive environment for financial success.

Utilizing these techniques not only enhances the budgeting experience but also fosters a positive relationship with money management, encouraging sustained commitment to financial goals.

How to Create a Budget That Fits Your Financial Goals

Creating a budget that aligns with your financial goals is essential for achieving long-term financial stability and success. A well-structured budget serves not only as a roadmap for your spending but also as a tool to help you prioritize your financial aspirations. In this segment, we will explore the steps necessary for designing a personalized budget that effectively supports your financial objectives, including the importance of incorporating savings and investments, as well as methods for adjusting your budget over time.

Steps for Designing a Personalized Budget

To create a budget that reflects your individual financial aspirations, follow these structured steps:

1. Assess Your Current Financial Situation

Begin by gathering all financial statements, including income sources, expenses, debts, and assets. This comprehensive overview will provide clarity on your current financial standing.

2. Define Financial Goals

Clearly Artikel your short-term and long-term financial goals. Short-term goals may include saving for a vacation or paying off a credit card, while long-term goals could focus on retirement savings or purchasing a home.

3. Categorize Expenses

Divide your expenses into fixed and variable categories. Fixed expenses include rent or mortgage payments, while variable expenses cover groceries, entertainment, and discretionary spending. This categorization simplifies tracking your spending habits.

4. Create the Budget Framework

Utilizing your income and categorized expenses, establish a monthly budget. Allocate funds to necessary expenses first, then designate amounts for savings and discretionary spending.

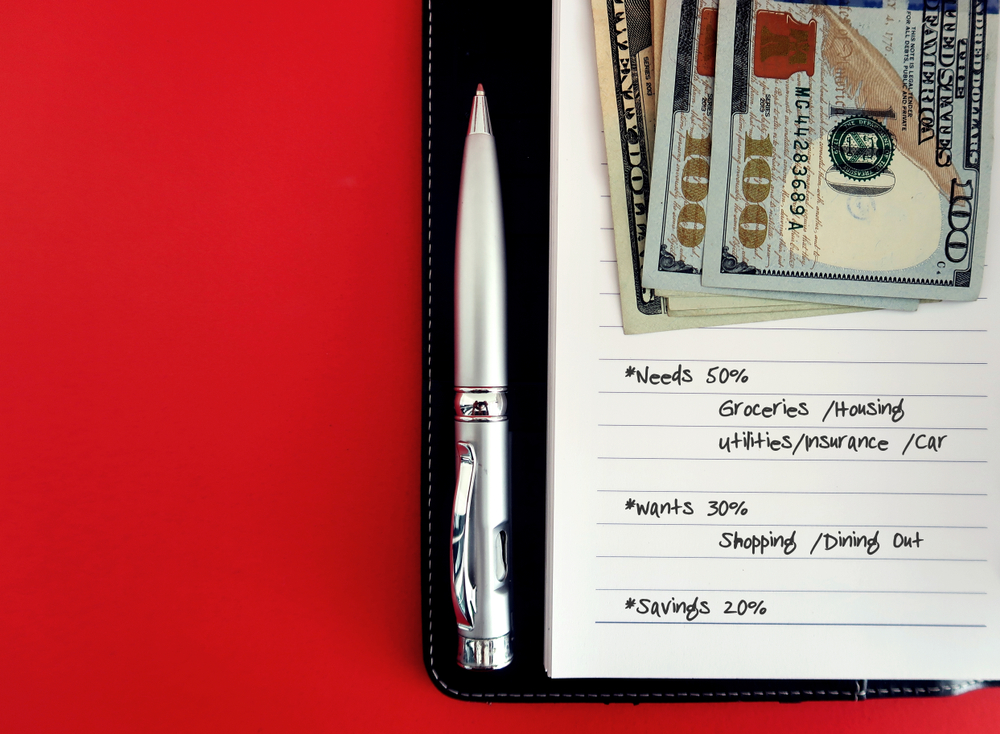

5. Incorporate Savings and Investments

It is imperative to integrate savings and investments into your budget. Aim to save a minimum of 20% of your income, setting aside funds for emergencies, retirement, and future expenditures.

“A budget is not just a listing of expenses; it is a plan for achieving your financial dreams.”

6. Monitor and Adjust

Regularly review your budget to ensure adherence and effectiveness. Analyze any discrepancies between projected and actual spending. Adjust your budget as necessary to accommodate changes in income, expenses, or financial goals.

Significance of Including Savings and Investments in Your Budget

Incorporating savings and investments into your budget framework is critical for building a secure financial future. Savings act as a safety net, providing resources for unexpected expenses or emergencies. Investments, on the other hand, allow your money to grow over time, helping you to achieve financial goals such as retirement.Benefits of including savings and investments in your budget include:

- Emergency Preparedness: Savings allow you to manage unforeseen circumstances without derailing your financial plans.

- Wealth Accumulation: Investments create opportunities for wealth growth through compound interest and market returns.

- Financial Independence: Consistent savings and investments lead to greater financial independence and security.

Methods for Adjusting Your Budget as Financial Situations Evolve

As financial circumstances change, it is vital to remain adaptable by adjusting your budget accordingly. Common scenarios warranting budget adjustments include a change in income, unexpected expenses, or shifts in financial goals. Effective methods for adapting your budget include:

- Regular Reviews: Schedule monthly reviews of your budget to assess financial performance and make necessary adjustments.

- Track Progress: Utilize budgeting apps or spreadsheets to monitor your expenditures and savings over time.

- Reassess Goals: As life circumstances evolve, revisit and update your financial goals to ensure alignment with your current situation.

By following these steps for designing a personalized budget and understanding the importance of savings and investments, individuals can lay a strong foundation for reaching their financial aspirations while maintaining flexibility to adapt to changing circumstances.

The Role of Technology in Modern Budgeting Practices

In today’s fast-paced financial landscape, technology plays a pivotal role in simplifying the budgeting process. The introduction of various apps and software has transformed how individuals and businesses manage their finances. No longer are spreadsheets and manual calculations the sole method for tracking expenses and income; technological tools provide a streamlined, user-friendly experience that enhances financial management.Modern budgeting applications and software simplify the budgeting process by automating tasks that were once tedious and time-consuming.

These tools allow users to input their income and expenses, categorize transactions, and even set financial goals with ease. Advanced software can connect to bank accounts, automatically importing transactions and reducing the likelihood of human error. With features such as real-time tracking, users can monitor their spending habits and quickly identify areas for improvement. Financial management tools not only provide visibility into current financial standing but also offer insights and analytics that can guide users in making informed decisions.

Benefits of Financial Management Tools for Tracking and Analyzing Expenses

Utilizing financial management tools enables users to track and analyze their expenses effectively. The ability to visualize spending patterns and trends is invaluable for budgeting. These applications offer various features that contribute to smarter financial decision-making:

- Automated Expense Tracking: Many budgeting apps automate the process of tracking expenses by linking to bank accounts, credit cards, and investment accounts. This feature ensures that all transactions are recorded accurately without manual entry.

- Customizable Categories: Users can create personalized categories for their expenses, allowing for better organization and insight into spending behavior. For example, one might categorize expenses into food, transportation, entertainment, and savings.

- Real-Time Notifications: Notifications alert users when they are approaching their budget limits or when a significant expense occurs, helping them stay on track and avoid overspending.

- Financial Goal Setting: Many tools enable users to set financial goals, such as saving for a vacation or paying off debt. This functionality motivates users to adhere to their budgets and track their progress.

- Comprehensive Reports: Users can generate reports that provide a detailed analysis of their financial health, illustrating income versus expenses over time, which assists in strategic planning.

Several popular budgeting apps exemplify the advancements in budgeting technology. For instance, Mint offers robust features such as budgeting, tracking investments, and providing credit score monitoring, all in one platform. YNAB (You Need A Budget) emphasizes proactive budgeting and offers educational resources to help users build better financial habits. Another noteworthy app is PocketGuard, which simplifies budgeting by displaying how much disposable income is available after accounting for bills, goals, and necessities.The integration of technology into budgeting practices is essential for individuals and businesses seeking to manage their finances more effectively.

By leveraging these innovative tools, users can gain greater control over their financial futures and make well-informed decisions.

Teaching Budgeting Skills to Kids and Teens

Instilling budgeting skills in children and teenagers is crucial for their financial literacy and long-term financial health. By teaching them the fundamentals of budgeting early on, parents can equip their children with the tools needed to make informed financial decisions in adulthood. This educational process can be engaging and fun, making the often-dry topic of finance accessible to younger minds.Financial literacy is an essential life skill that empowers young individuals to understand the value of money, saving, and spending wisely.

Engaging children in budgeting can foster a sense of responsibility and independence. Effective techniques for teaching budgeting skills include interactive activities that resonate with their interests and developmental stages.

Engaging Budgeting Activities for Youth

Practical activities play a vital role in cultivating budgeting skills among kids and teens. By integrating lessons with real-life experiences, parents can create memorable learning moments. The following activities are designed to be enjoyable while imparting essential budgeting knowledge:

1. Allowance Management

Providing a weekly or monthly allowance allows children to manage their money. Encourage them to allocate funds towards saving, spending, and sharing (charity). This teaches them the importance of budgeting as they decide how to distribute their allowance.

2. Savings Goals

Help children set specific savings goals, such as buying a toy or a game console. By tracking their progress towards these goals, they learn to prioritize their spending and appreciate the value of saving.

3. Grocery Shopping Activity

Involve kids in grocery shopping by giving them a budget to work within. Allow them to select items while ensuring they stay within the allocated amount. This activity demonstrates real-life budgeting and helps develop decision-making skills.

4. Budgeting Apps for Teens

Introduce teens to personal finance apps designed for budgeting, like Mint or YNAB (You Need A Budget). These platforms can help them manage their money digitally, showcasing the importance of tracking expenses and setting limits.

5. Create a Budgeting Game

Design a board game that simulates financial decisions, such as earning income, paying bills, and saving for goals. Incorporate challenges and rewards, making the learning process interactive and competitive.

6. Discuss Real-Life Financial Scenarios

Use family discussions to introduce real financial situations. For example, talk about how to budget for a family vacation or manage expenses for a pet. This contextualizes budgeting and highlights its relevance in everyday life.By implementing these activities, parents can foster a deeper understanding of budgeting principles among their children. Engaging with them in discussions about money can demystify finance and promote a positive attitude towards financial responsibility.

“Teaching kids about money is not just about saving; it’s about making informed choices that will serve them throughout their lives.”

Adapting Your Budget in Times of Financial Hardship

Facing unexpected financial challenges can be daunting, but with a well-structured approach to budgeting, it is possible to navigate these tough times effectively. Adapting your budget during periods of financial strain requires a keen understanding of your essential needs versus discretionary spending. This adjustment is crucial to maintain financial stability and ensure that necessary expenses are covered while alleviating stress.When confronted with financial hardship, it is vital to prioritize essential expenses.

Essential expenses typically include housing, utilities, food, healthcare, and transportation. To effectively manage your budget, consider the following strategies:

Prioritization of Essential Expenses

In times of financial difficulty, distinguishing between needs and wants is essential. Focus on maintaining your basic living standards while reducing non-essential spending. Here are some steps to consider when prioritizing expenses:

- Assess Necessities: Start by listing all your monthly expenses. Identify which are essential for your survival and well-being, such as rent, groceries, and healthcare.

- Cut Non-Essential Spending: Review your discretionary spending such as dining out, subscriptions, and entertainment. Temporarily eliminate or significantly reduce these expenses.

- Negotiate Bills: Contact service providers to negotiate lower rates or inquire about assistance programs that may be available to help you manage bills during tough times.

- Explore Community Resources: Utilize local food banks, community services, and government assistance programs to relieve some financial burdens.

Resourcefulness plays a critical role in reducing expenses without compromising your quality of life. Here are several practical ways to achieve this:

Resourcefulness in Expense Reduction

Finding creative and resourceful ways to manage your finances can make a significant difference in your overall budget. Consider the following approaches:

- DIY Solutions: Take on do-it-yourself projects for home repairs or personal care when possible, which can save money compared to hiring professionals.

- Meal Planning: Plan meals ahead of time to minimize food waste and optimize grocery spending. Shopping with a list can help you avoid impulse purchases.

- Public Services: Engage with library services for free access to books, movies, and workshops instead of spending on entertainment.

- Utilize Discounts: Always be on the lookout for discounts, coupons, or loyalty programs that can reduce costs on necessary purchases.

“Taking a proactive approach to managing your financial situation can empower you to overcome challenges while maintaining your quality of life.”

Closing Summary

In conclusion, the journey through budgeting tips reveals a multifaceted approach to personal finance that is both achievable and rewarding. By recognizing the importance of budgeting, employing the right methods, avoiding common mistakes, and leveraging technology, you can cultivate a healthy financial environment. As you adapt your budget to changing circumstances, remember that the skills you develop today not only benefit you but also lay the groundwork for future generations to thrive in their financial endeavors.

Commonly Asked Questions

What are the benefits of budgeting?

Budgeting helps individuals manage their finances, achieve financial goals, and reduces stress associated with money management.

How often should I review my budget?

It is recommended to review your budget monthly to ensure it reflects your current financial situation and goals.

What is the best budgeting method for beginners?

The envelope budgeting method is often recommended for beginners due to its simplicity and practical approach to managing expenses.

Can budgeting apps really help?

Yes, budgeting apps can simplify tracking expenses, provide insights into spending habits, and help maintain adherence to your budget.

How can I stay motivated to stick to my budget?

Setting specific financial goals, tracking progress, and rewarding yourself for achieving milestones can help maintain motivation.