Financial due diligence serves as a cornerstone for investors, ensuring a comprehensive understanding of potential risks and rewards associated with target companies. This meticulous process examines various aspects of a company’s financial health, enabling informed decision-making and protecting investors from unforeseen pitfalls. By delving into financial statements, cash flow analysis, and other critical evaluations, stakeholders can gain insights that shape their strategies and enhance their investment outcomes.

As the financial landscape grows increasingly complex, the need for rigorous financial due diligence becomes more pronounced. Investors must navigate a web of financial data, compliance issues, and market conditions to assess a company’s true value. Whether it’s evaluating debt structures or analyzing tax implications, each element plays a vital role in understanding the overall financial viability of a target investment.

Financial due diligence is crucial for investors in assessing the potential risks and rewards of a target company.

Financial due diligence serves as a critical component in the investment decision-making process. It provides investors with a comprehensive understanding of a target company’s financial health and operational performance. By meticulously examining financial records, investors can identify potential red flags, assess future profitability, and evaluate the overall viability of the investment. This thorough investigation helps investors mitigate risks associated with financial misstatements, fraud, or other hidden liabilities that could adversely impact their investment.The significance of financial due diligence cannot be overstated.

It acts as a safety net for investors, ensuring they are well-informed before committing capital. This process typically involves a detailed analysis of the target company’s financial statements, cash flow projections, and market positioning. Such scrutiny allows investors to make educated decisions based on concrete data rather than assumptions. In a world where financial landscapes can be unpredictable, robust due diligence can mean the difference between a successful investment and a costly mistake.

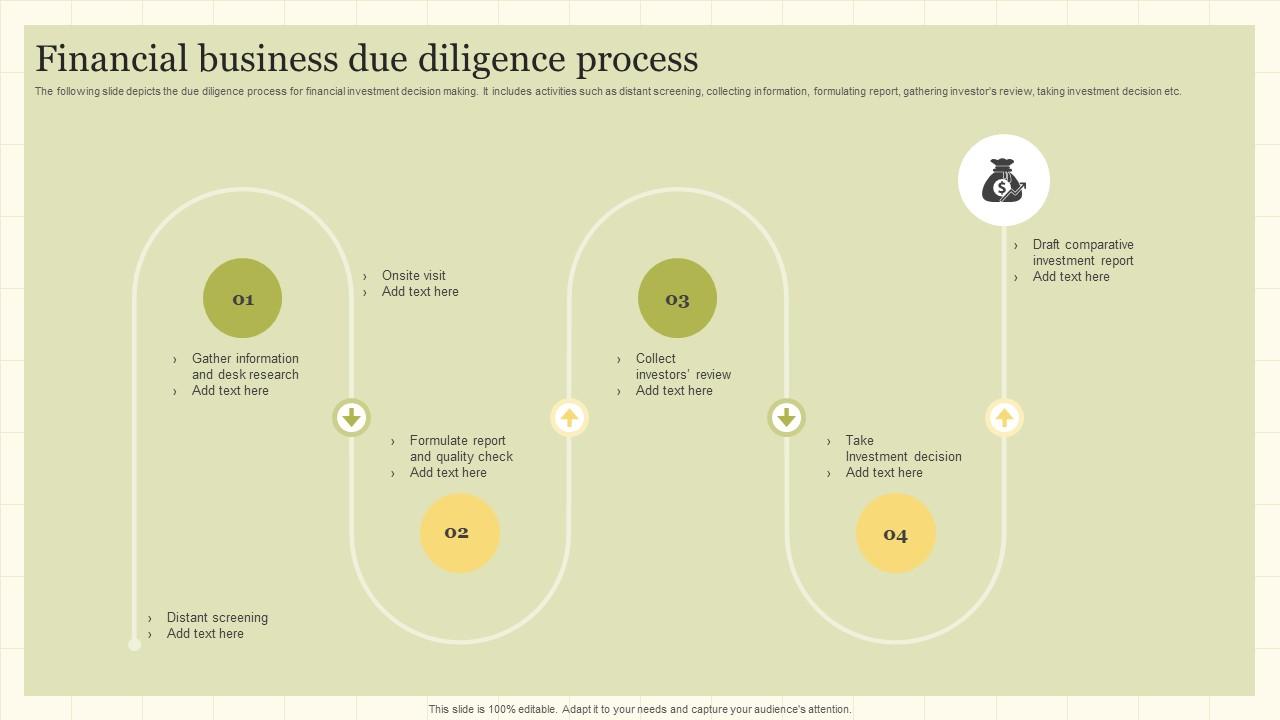

Steps involved in conducting financial due diligence for an acquisition

The process of financial due diligence is systematic and involves several key steps. Understanding these steps is essential for investors aiming to conduct a thorough assessment.

1. Planning the Due Diligence Process

Establishing the scope, objectives, and timeline for the due diligence investigation. This initial planning phase sets the foundation for the entire process.

2. Gathering Financial Information

Collecting pertinent financial documents, including balance sheets, income statements, tax returns, and cash flow statements for the past three to five years. This data is crucial for a comprehensive analysis.

3. Analyzing Financial Statements

Evaluating the accuracy and integrity of the financial statements. This involves checking for consistency, identifying trends, and ensuring compliance with accounting standards.

4. Assessing Cash Flow and Working Capital

Analyzing cash flow statements to determine liquidity and working capital needs, which can indicate the company’s operational efficiency and financial stability.

5. Identifying Risks and Liabilities

Reviewing contingent liabilities, debts, and any potential legal issues that might affect the company’s financial standing. This step is essential in identifying potential pitfalls.

6. Evaluating Financial Projections

Scrutinizing the target company’s financial forecasts and assumptions. This can reveal whether projected growth is realistic and attainable.

7. Reporting Findings

Compiling all findings into a comprehensive report that Artikels potential risks, financial health, and overall investment viability. This report will guide the final investment decision.Real-world scenarios highlight the importance of financial due diligence. For example, in 2013, Dell’s acquisition of EMC, valued at $67 billion, involved extensive due diligence that uncovered complexities in EMC’s financial structure, which ultimately influenced the final terms of the deal.

Similarly, the failure of the 2019 merger between T-Mobile and Sprint was partly attributed to inadequate financial assessment and market analysis, showcasing how due diligence could have mitigated substantial risks. Thus, financial due diligence remains a vital practice for prudent investment strategies, ensuring that potential risks are thoroughly understood and managed.

Identifying the key components of financial statements during due diligence can reveal underlying financial health.

During financial due diligence, the examination of specific financial statements is crucial in understanding a company’s overall financial health. This process involves analyzing the income statement, balance sheet, and cash flow statement. Each of these documents provides essential information that can reveal potential red flags or confirm the viability of an investment. By identifying these components, investors can make informed decisions that significantly impact their portfolio.The income statement portrays a company’s profitability over a specific period, detailing revenues, expenses, and net income.

It is essential for assessing operational performance and profitability trends. The balance sheet, on the other hand, provides a snapshot of a company’s assets, liabilities, and equity at a given moment in time. This document is vital for understanding a company’s financial leverage and liquidity position. Finally, the cash flow statement tracks the inflow and outflow of cash, revealing how well the company manages its cash position to fund operations and support growth initiatives.

Implications of Discrepancies in Financial Statements

Discrepancies in financial statements can severely impact investment decisions. These inconsistencies can range from minor accounting errors to significant misrepresentations that may indicate financial distress or fraud. Investors rely heavily on the accuracy and reliability of these statements to evaluate the risk and potential return of their investments.For instance, a significant deviation in reported revenue can suggest that a company is inflating its earnings to attract investors or secure financing.

If an investor discovers that a company has exaggerated its revenues, it can lead to a loss of trust and an immediate reassessment of the investment’s value. Moreover, inaccurate expense reporting can conceal the true operational costs, misleading investors about the company’s profitability. In addition to affecting trust, discrepancies can have legal implications. Regulatory bodies like the Securities and Exchange Commission (SEC) impose strict penalties for misleading financial reporting.

Investors may face risks of litigation or financial losses if they invest based on inaccurate financial data. Thus, it becomes imperative for investors to conduct thorough due diligence.The following table compares different financial ratios that are critical during due diligence, providing insight into their implications:

| Financial Ratio | Formula | Implication |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | A measure of a company’s short-term liquidity and ability to cover its short-term obligations. |

| Debt to Equity Ratio | Total Liabilities / Shareholders’ Equity | Indicates the relative proportion of debt and equity used to finance a company’s assets. |

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Shows the percentage of revenue that exceeds the cost of goods sold, indicating operational efficiency. |

| Return on Equity (ROE) | Net Income / Shareholders’ Equity | Measures a company’s profitability in relation to shareholders’ equity, reflecting how effectively management is using equity financing. |

| Cash Flow Margin | Cash Flow from Operations / Revenue | Indicates the efficiency of a company in converting sales into actual cash, highlighting liquidity health. |

The role of cash flow analysis in financial due diligence cannot be overstated.

Understanding the cash flow of a business is critical in evaluating its financial health and future viability. Cash flow analysis not only reveals how well a company generates cash to meet its obligations but also serves as a crucial indicator of its operational efficiency and sustainability. In the realm of financial due diligence, cash flow analysis offers insights into both past performance and future projections, allowing stakeholders to make informed decisions.Cash flow analysis involves evaluating the inflows and outflows of cash within a company over a specific period.

This analysis is essential for several reasons. Primarily, it helps assess the company’s ability to maintain liquidity, fund operations, and invest in future growth opportunities. By examining cash flow statements, stakeholders can identify trends that may indicate financial stability or distress. Robust cash flow management is indicative of a company’s operational effectiveness and its capability to weather economic fluctuations.

Methods for identifying cash flow trends and potential red flags

Analyzing cash flow trends requires a systematic approach that focuses on various metrics and indicators. Here are some effective methods for identifying cash flow trends and detecting potential issues during due diligence:

Historical Cash Flow Comparison

Analyzing cash flow statements over multiple periods allows stakeholders to identify consistent patterns or abnormalities. A sudden decline in cash flow could signal operational issues or market challenges.

Operating Cash Flow Analysis

Distinguishing between cash generated from operations versus cash from financing or investing activities provides insight into the core business’s health. A company heavily reliant on financing for cash flow may be at risk.

Cash Flow Ratios

Utilizing ratios such as Cash Flow Margin, Operating Cash Flow to Current Liabilities, and Free Cash Flow helps in understanding the relationship between cash flows and revenues, liabilities, and overall cash availability.

Seasonality Trends

Many businesses experience seasonal fluctuations in cash flow. By analyzing these patterns, stakeholders can anticipate periods of high and low cash availability, which is crucial for managing working capital.

Forecasting Future Cash Flows

Creating cash flow projections based on past performance, market conditions, and planned operational changes can reveal potential future liquidity issues.Recognizing potential pitfalls in cash flow assessment is just as important as the analysis itself. Stakeholders should be aware of the following common pitfalls:

-

Overemphasis on net income: Cash flow can diverge significantly from net income due to non-cash expenses, leading to misleading conclusions.

- Neglecting timing: Cash flow timing discrepancies can occur, where cash inflows and outflows do not align with reporting periods.

- Ignoring capital expenditures: Failing to consider necessary capital expenditures can result in an inflated view of cash availability.

- Relying on projections without historical context: Forecasting cash flows without considering historical trends can lead to unrealistic expectations.

- Inadequate focus on working capital management: Poor management of accounts receivable and accounts payable can significantly affect cash flow.

By employing these methods and being aware of common pitfalls, stakeholders can gain a comprehensive understanding of a company’s cash flow dynamics, ultimately leading to more informed decisions during the financial due diligence process.

Evaluating a target company’s debt obligations is a vital part of financial due diligence.

Assessing a target company’s debt obligations is crucial for investors seeking to understand the financial health and risks associated with a potential investment. A thorough evaluation of a company’s debt structure not only provides insight into its current financial stability but also helps forecast its future performance. Evaluating a company’s debt structure involves a detailed analysis of its liabilities, repayment schedules, and the types of debt it holds.

This assessment will help identify any potential risks or red flags that could impact the overall investment.

Assessing Debt Structure and Liabilities

The procedure for evaluating a company’s debt structure includes several key steps. Initially, investors should gather financial statements such as the balance sheet and income statement to review the company’s total debt and compare it to equity and assets. The next step is to break down the debt into categories, which typically includes both current and long-term liabilities. Each category should be assessed for repayment terms, interest rates, and any covenants attached.

Further, it’s essential to analyze cash flow statements to ascertain the company’s ability to generate adequate cash flow to meet its debt obligations. The debt-to-equity ratio is another critical metric that offers insight into the financial leverage the company is utilizing. A high ratio could indicate excessive debt, potentially leading to higher risk for investors.

Secured vs. Unsecured Debt

Understanding the difference between secured and unsecured debt is vital during due diligence. Secured debt is backed by collateral, which provides a safety net for lenders. In contrast, unsecured debt lacks such backing and typically carries a higher interest rate due to the elevated risk involved. When evaluating a target company’s debt, investors should consider the implications of each debt type.

Should the company face financial difficulties, secured creditors will have priority over unsecured creditors regarding asset claims during liquidation. This risk assessment is crucial, particularly in industries prone to volatility.

Key Factors for Debt Evaluation

A comprehensive evaluation of a company’s debt obligations requires considering several key factors. Investors should carefully analyze the following elements:

- Debt Maturity Profile: Understanding when debts are due helps gauge the company’s liquidity and refinancing needs.

- Interest Coverage Ratio: This ratio shows how easily a company can pay interest on outstanding debt, indicating financial health.

- Covenants and Restrictions: Reviewing any covenants attached to the debt can reveal operational restrictions and risk factors.

- Market Conditions: The economic environment can impact a company’s ability to service its debt, affecting its overall stability.

- Debt Ratings: Credit ratings from agencies provide insight into the perceived risk associated with the company’s debt.

- Historical Performance: Analyzing past performance concerning debt management can offer insights into future risk levels.

- Peer Comparison: Comparing the target company’s debt metrics with industry peers can highlight competitive advantages or disadvantages.

Understanding the impact of tax considerations during financial due diligence is essential for making informed decisions.

During financial due diligence, understanding the tax implications is critical as it can significantly affect the valuation of a target company and influence the overall deal structure. Tax considerations can shape the attractiveness of an investment, as they may lead to unforeseen liabilities or opportunities that require careful analysis.The due diligence process involves identifying various tax implications that can arise from business operations, transactions, and structures.

Common tax issues include income tax obligations, sales and use tax considerations, and potential exposure to tax audits. Each of these factors contributes to the overall financial health of the entity being evaluated and can lead to substantial financial impacts if overlooked.

Tax Implications During Due Diligence, Financial due diligence

It is crucial to analyze potential tax implications thoroughly to avoid pitfalls that could arise post-transaction. Consider the following key tax implications:

- Income Tax Liabilities: Assessing current and future tax liabilities is essential. Companies may have deferred tax assets or liabilities that could impact cash flow post-transaction.

- Transfer Pricing: If the target operates internationally, transfer pricing regulations must be scrutinized to ensure compliance with local tax laws and avoid penalties.

- Sales and Use Tax: Evaluating sales tax obligations related to inventory, services provided, and geographic operations can reveal hidden liabilities.

- Tax Credits and Incentives: Understanding available tax credits or incentives can provide significant financial benefits and reduce overall tax burdens.

- Net Operating Losses (NOLs): Identifying any NOLs that can be carried forward can be critical for future tax planning and reducing taxable income.

The financial impact of these tax implications can drastically alter the perceived value of a transaction. For example, if a potential buyer fails to recognize a significant tax liability, the purchase price may need to be adjusted, leading to increased costs or reduced returns on investment.

Strategies for Mitigating Tax Risks

Identifying tax risks during due diligence is only the first step; developing strategies to mitigate these risks is equally important. The following strategies can be employed:

- Engage Tax Professionals: Involving tax advisors with expertise in the relevant jurisdictions can uncover potential tax issues early in the process and provide tailored solutions.

- Conduct Comprehensive Tax Reviews: A thorough review of the target’s tax compliance, filings, and positions can help identify any discrepancies or areas of concern.

- Negotiate Tax Indemnities: Structuring the deal to include tax indemnities can protect buyers against unexpected tax liabilities that may arise post-acquisition.

- Utilize Tax Loss Carryforwards Effectively: Consulting with tax advisors on how to best utilize any NOLs or credits can optimize the tax position of the acquiring entity.

- Plan for Post-Transaction Integration: Developing a tax-efficient integration plan can help minimize the tax impact of merging the operations of the two entities.

A structured flowchart of the key tax considerations in financial due diligence can serve as a visual guide during the process. The flowchart should include the following steps:

Start

Initiate due diligence process.

Identify Tax Obligations

Review corporate structure, operations, and compliance status.

Assess Risks

Identify potential liabilities, credits, and NOLs.

Strategize

Determine appropriate risk mitigation strategies.

Execute Findings

Incorporate tax considerations into the transaction structure.

Monitor Compliance

Post-transaction follow-up to ensure ongoing compliance and optimization.This structured approach ensures that tax considerations are front and center during financial due diligence, leading to informed decision-making and strategic planning.

The importance of compliance reviews as part of the financial due diligence process should not be overlooked.

In the realm of financial due diligence, compliance reviews play a crucial role in safeguarding investors from unforeseen risks. These reviews help ensure that the target company adheres to legal standards and regulatory requirements, mitigating potential liabilities. A thorough understanding of compliance issues can significantly influence the decision-making process, making it essential for investors to prioritize this aspect.Compliance issues can manifest in various forms, ranging from regulatory breaches to tax-related discrepancies.

The implications of these issues can be severe, including financial penalties, reputational damage, and even legal action against the investors involved. For instance, non-compliance with industry regulations can lead to hefty fines and operational shutdowns, which can drastically affect a company’s profitability and attractiveness to investors.

Types of Compliance Issues and Their Implications

Several types of compliance issues can arise during financial due diligence, each with distinct implications for investors. Understanding these issues is key to making informed decisions. The following points Artikel common compliance concerns:

- Regulatory Non-compliance: Companies failing to adhere to industry regulations can face fines and sanctions that impact their financial health.

- Tax Compliance Issues: Inaccurate tax filings or failures to comply with tax regulations can lead to back taxes owed, interest, and penalties, affecting cash flow and profitability.

- Environmental Compliance Failures: Non-compliance with environmental laws can result in significant fines and remediation costs, alongside reputational damage.

- Anti-Money Laundering (AML) Violations: Breaches in AML regulations can lead to severe legal consequences and loss of business credibility.

- Data Protection and Privacy Violations: Failing to comply with data protection laws can result in financial penalties and loss of customer trust.

Best Practices for Conducting Compliance Reviews

Implementing effective compliance reviews within the financial due diligence framework is essential to mitigating risks. Here are some best practices to consider:

- Develop a Comprehensive Compliance Checklist: Ensure the checklist covers all relevant regulations and compliance areas related to the industry.

- Engage Experienced Compliance Professionals: Employ experts who understand the legal landscape and can identify potential compliance risks effectively.

- Conduct Thorough Documentation Reviews: Scrutinize financial records, contracts, and regulatory filings to ensure accuracy and compliance.

- Utilize Technology Tools: Leverage compliance software that can help automate the review process and identify red flags efficiently.

- Regular Training and Updates: Implement ongoing training for staff on compliance requirements and updates to regulations.

Historical Examples of Compliance Failures and Consequences

The repercussions of compliance failures can be profound, leading to significant consequences for investors and companies alike. Notable historical cases illustrate the risks associated with neglecting compliance reviews:

- Enron Scandal: Enron’s collapse was partly due to accounting fraud and regulatory non-compliance, resulting in billions lost for investors and a complete overhaul of regulatory standards.

- Volkswagen Emissions Scandal: VW faced massive fines and reputational damage for manipulating emissions tests, highlighting the importance of ethical compliance in corporate governance.

- Lehman Brothers Bankruptcy: The financial institution’s collapse was exacerbated by non-compliance with risk management regulations, leading to one of the largest bankruptcies in U.S. history.

The integration of technology and data analytics in financial due diligence can enhance the overall process.

The landscape of financial due diligence is rapidly evolving, driven by advancements in technology and data analytics. These innovations not only streamline processes but also provide deeper insights, making the due diligence process more effective and efficient. The application of cutting-edge tools enables teams to quickly assess financial statements, compliance issues, and potential risks with a level of accuracy and speed that traditional methods cannot achieve.Recent technological advancements in financial due diligence encompass a variety of tools that facilitate comprehensive analysis and risk assessment.

Automation software, cloud-based platforms, and artificial intelligence (AI) are at the forefront of these developments. These technologies provide numerous benefits, such as enhancing accuracy, reducing human error, and significantly cutting down the time required for thorough financial assessments.

Technological Advancements and Their Benefits

The integration of advanced technologies into financial due diligence processes brings forth several key advantages, which include:

- Automation: Automating routine tasks allows professionals to focus on more complex analyses. This not only saves time but also improves the accuracy of financial data handling.

- Artificial Intelligence: AI tools can analyze vast quantities of data to identify patterns and anomalies that a human analyst might overlook, thus providing deeper insights into potential risks.

- Cloud Computing: Cloud-based platforms enable real-time collaboration and access to data from anywhere, enhancing the speed and efficiency of the due diligence process.

- Machine Learning: With machine learning algorithms, systems can continuously learn from new data inputs, improving their predictive capabilities over time.

Data Analytics Uncovering Hidden Insights

Data analytics plays a pivotal role in transforming how financial due diligence is conducted. By leveraging big data, financial professionals can uncover trends and insights that traditional methodologies might miss. Advanced data analytics tools allow for deeper dives into financial metrics, revealing correlations and causations that inform better decision-making.

“The real power of data analytics lies in its ability to transform raw data into valuable insights that drive strategic decisions.”

For instance, by analyzing historical financial performance data alongside industry benchmarks, teams can identify outliers and potential red flags earlier in the due diligence process. This proactive approach not only safeguards against future risks but also enhances the overall accuracy of valuations and assessments.

Popular Software Tools in Financial Due Diligence

Numerous software tools have emerged in the market that streamline the financial due diligence process. The following table highlights some of the most popular tools, along with their primary features and benefits:

| Software Tool | Features | Benefits |

|---|---|---|

| Thomson Reuters Eikon | Real-time data, analytics, and market intelligence | Improved market insights and timely information |

| Alteryx | Data preparation, blending, and analytics | Streamlined workflows and enhanced data accuracy |

| Tableau | Data visualization and interactive dashboards | Enhanced decision-making through visual insights |

| Excel with Power Query | Data connection and transformation tools | Familiar interface with powerful data handling capabilities |

| Kapital | Financial modeling and risk assessment | Real-time collaboration and efficiency in valuations |

The combination of these advanced technological tools and data analytics not only simplifies the due diligence process but also enriches the evaluation, leading to more informed decisions and strategies in financial transactions.

Final Thoughts: Financial Due Diligence

In conclusion, financial due diligence is not merely a procedural step; it’s a strategic necessity for any investor aiming to make educated investment choices. By employing a thorough approach that includes careful examination of financial statements, cash flow trends, and compliance issues, investors can mitigate risks and optimize their portfolios. Ultimately, mastering financial due diligence empowers investors to seize opportunities while safeguarding their assets in a dynamic market.

Questions and Answers

What is financial due diligence?

Financial due diligence is the process of investigating a company’s financial records to assess its viability and potential risks before making an investment.

Why is financial due diligence important?

It helps investors make informed decisions, uncover hidden risks, and prevent potential financial losses by providing a thorough understanding of a company’s financial health.

What financial statements are crucial for due diligence?

Key financial statements include the balance sheet, income statement, and cash flow statement, as they reveal a company’s financial position, performance, and liquidity.

How can discrepancies in financial statements affect investments?

Discrepancies may indicate potential fraud, mismanagement, or financial instability, leading to poor investment decisions and significant financial losses.

What role does technology play in financial due diligence?

Technology enhances financial due diligence by enabling data analytics, automating processes, and providing tools that uncover insights that traditional methods might miss.