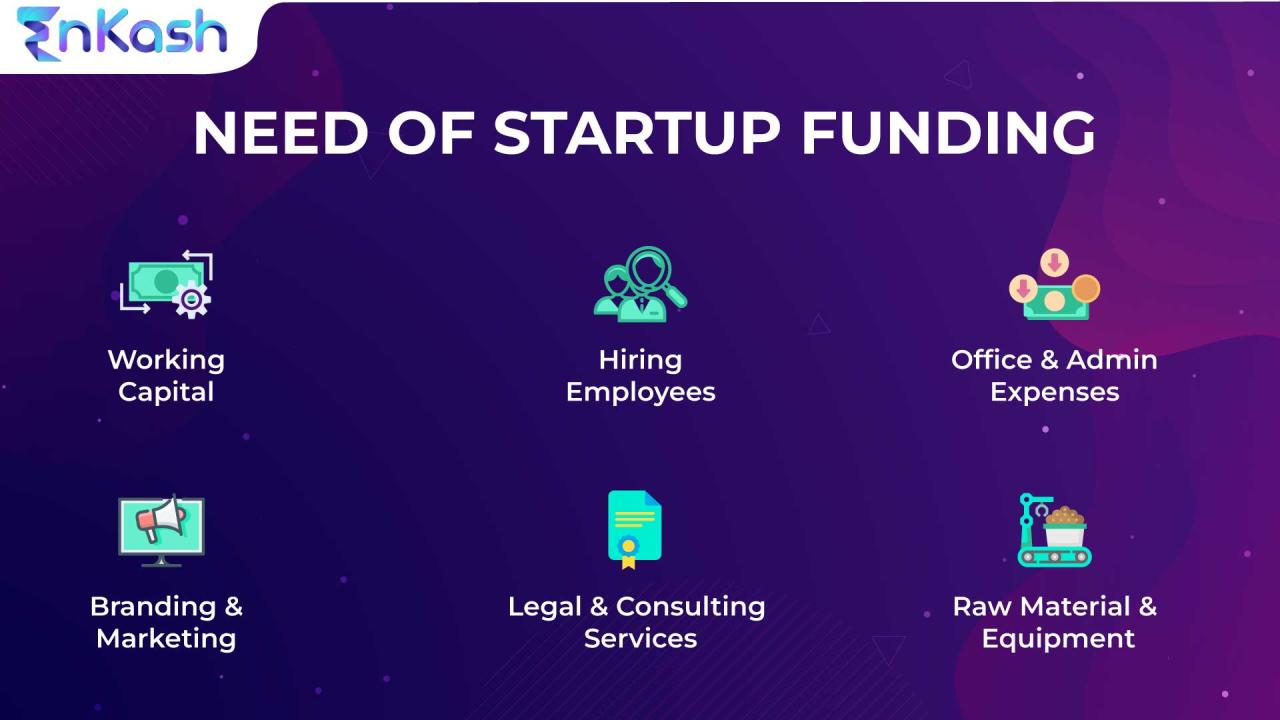

Startup funding plays a crucial role in transforming innovative ideas into thriving businesses, providing the necessary resources for growth and development. Understanding the various stages of funding, from seed investment to Series A, B, and beyond, is essential for entrepreneurs aiming to secure financial backing.

As startups navigate these stages, they encounter unique challenges and opportunities that shape their trajectory. Exploring key sources of funding, crafting compelling pitch decks, and leveraging legal insights can empower founders to effectively attract investors and foster sustainable growth.

Understanding the Different Stages of Startup Funding

Startup funding is crucial for entrepreneurs aiming to turn their innovative ideas into thriving businesses. Over the years, startups typically progress through a series of funding stages, each designed to meet their evolving needs and to support the company’s growth trajectory. From initial seed funding to various rounds like Series A, B, and beyond, understanding these stages is essential for both founders and investors to navigate the complex landscape of startup financing.Funding for startups generally begins with seed funding, which is often the first round of capital raised after bootstrapping or personal investments.

Seed funding usually comes from angel investors, family, or crowdfunding platforms. It serves to cover initial costs such as product development, market research, and building a minimal viable product (MVP). A notable example of a company that successfully navigated this stage is Airbnb, which began with seed funding to develop its online marketplace for lodging.As startups validate their business model and demonstrate potential for growth, they typically seek Series A funding.

This round focuses on scaling the business and expanding market reach. Venture capital firms often participate in Series A investments, providing larger sums of money in exchange for equity. Companies like Uber and Dropbox successfully raised Series A rounds, which allowed them to enhance their technology and scale operations significantly.Following Series A, startups may pursue Series B funding to further expand their market presence and refine their products or services.

This stage is crucial as it often involves larger amounts of capital and sometimes multiple investors. A prime example of success in Series B fundraising is Slack, which leveraged the funds to improve its platform and increase its user base.However, each funding stage presents unique challenges. In the seed stage, startups may struggle to attract investors due to a lack of proven traction.

To overcome this, founders should focus on building a compelling business plan and demonstrating early customer interest. During Series A, startups often face pressure to show significant growth metrics. Maintaining strong communication with investors and providing transparent updates can help alleviate concerns and secure funding.In Series B and beyond, startups can encounter challenges related to market competition and operational scaling.

Developing a robust strategy that includes hiring experienced talent and optimizing processes is vital. Entrepreneurs should also be prepared to pivot or adapt their models based on market feedback and investor advice, ensuring they remain competitive in a rapidly evolving landscape.Understanding these stages of funding, the successful navigation of challenges, and learning from the experiences of companies like Airbnb, Uber, Dropbox, and Slack can provide valuable insights for new ventures aiming to secure the necessary capital for growth.

Key Sources of Startup Funding Available Today

Startups today have a plethora of funding options to consider, each with its unique characteristics and implications for growth. Understanding these different sources allows entrepreneurs to navigate their funding journey more effectively. This section will explore five key sources of startup funding, detailing their suitability and the best approaches for engaging with potential investors.

Angel Investors

Angel investors are high-net-worth individuals who provide capital to startups in exchange for equity. They often bring valuable experience and connections to the table, making them not just a funding source but also potential mentors.

- Characteristics: Typically invest between $25,000 to $100,000; often invest in early-stage companies; may provide mentorship.

- Suitability: Ideal for startups in need of initial funding and guidance.

- Approach: Build personal relationships; attend networking events where angels are present; prepare a compelling pitch that highlights both financial potential and personal passion.

Angel investors can play a crucial role in turning a fledgling idea into a successful business.

Venture Capital

Venture capital (VC) firms invest in startups with high growth potential in exchange for equity. They typically provide larger amounts of funding than angel investors.

- Characteristics: Investments usually range from $1 million to $10 million or more; firms seek substantial equity; often involved in strategic guidance.

- Suitability: Best for startups with a proven business model seeking substantial growth.

- Approach: Target VCs that specialize in your industry; prepare detailed business plans and financial projections; focus on scalability and the potential for high returns.

Venture capital can propel startups to new heights through significant funding and strategic support.

Crowdfunding

Crowdfunding platforms allow startups to raise small amounts of money from a large number of people. This can be through rewards-based, equity-based, or donation-based models.

- Characteristics: Accessible to various business types; can generate marketing buzz; funding amounts vary widely.

- Suitability: Great for startups with a compelling product or service and a strong community following.

- Approach: Create an engaging campaign with clear rewards or equity offers; leverage social media to reach potential backers; ensure transparent communication throughout the campaign.

Crowdfunding democratizes funding by allowing anyone to support new ideas and businesses.

Government Grants and Loans

Various government programs offer grants and loans to support startups, especially in sectors aligned with public policy goals.

- Characteristics: Non-dilutive funding; may require matching funds; often have specific eligibility criteria.

- Suitability: Suitable for startups in innovation, technology, and social impact fields.

- Approach: Research available programs thoroughly; prepare detailed grant applications or loan proposals; demonstrate alignment with government priorities.

Government funding can provide a vital lifeline without the pressure of equity dilution.

Incubators and Accelerators

These programs provide startups with funding, mentorship, and resources in exchange for equity or participation fees. They often culminate in a demo day where startups pitch to investors.

- Characteristics: Offer structured support over a fixed term; access to networks and resources; may provide initial seed funding.

- Suitability: Ideal for early-stage startups needing guidance and resources.

- Approach: Research and apply to programs that fit your business model; leverage your application to showcase your team and market potential; be prepared for a rigorous selection process.

Incubators and accelerators can catalyze growth by providing not just funding, but also essential support and mentorship.

Crafting a Compelling Pitch Deck for Investors

Creating an engaging pitch deck is pivotal for capturing investor interest and securing funding for your startup. A well-structured deck not only communicates your business idea clearly but also showcases your entrepreneurial vision and potential for growth. This guide will walk you through the essential elements of a pitch deck and how to tailor it to resonate with different audiences.

Essential Elements of a Pitch Deck

A compelling pitch deck typically consists of several key sections that collectively tell your startup’s story. Each element plays a critical role in effectively conveying your message and persuading investors.

- Introduction: Start with a brief introduction that includes your company name, logo, and tagline. This serves as the first impression and should encapsulate your business’s essence.

- Problem Statement: Clearly define the problem your startup is addressing. Outlining a relatable issue engages investors and highlights the significance of your solution.

- Solution: Present your product or service as the solution to the problem. Use visuals or prototypes to enhance understanding and interest.

- Market Opportunity: Provide data on your target market, including size, growth potential, and trends. Illustrating the market landscape helps investors see the revenue potential.

- Business Model: Explain how you plan to make money. Include your pricing strategy and sales channels to demonstrate the sustainability of your business.

- Traction: Highlight key milestones and achievements to build credibility. This may include user statistics, partnerships, or revenue to date.

- Marketing and Sales Strategy: Discuss your go-to-market strategy and how you plan to attract customers. This section should reflect a deep understanding of the market.

- Competition: Identify your competitors and articulate your unique value proposition. This demonstrates awareness of the competitive landscape.

- Financial Projections: Present realistic financial forecasts that include projections for revenue, expenses, and profits over the next 3-5 years. This provides a clear picture of your business’s potential.

- Team: Introduce your team, highlighting their backgrounds and relevant experience. Investors often invest in people as much as in ideas.

- Funding Ask: Clearly state how much funding you are seeking and how it will be utilized. This provides a roadmap for investors on how their money will be spent.

Tailoring Your Pitch for Different Audiences

Understanding your audience is crucial for effective communication. Tailoring your pitch based on the type of investor and their specific interests can significantly enhance your chances of success.

- Angel Investors: Focus on the passion behind your startup and your vision for the future. Highlight personal stories and experiences that led to your business idea.

- Venture Capitalists: Emphasize scalability and market potential. VCs are often looking for opportunities that promise high returns, so provide robust data and forecasts.

- Corporate Investors: Position your startup as an innovative solution that complements their existing operations or product lines. Discuss strategic partnerships that could arise from the investment.

“A pitch deck is more than a presentation; it’s your startup’s story told in a way that resonates with potential investors.”

By ensuring that each of these essential elements is present and tailored to your audience, you significantly increase your chances of capturing investor interest and securing the needed funding for your startup.

Navigating the Legal Aspects of Startup Funding

When startups seek funding, understanding the legal landscape is crucial. Legal considerations are not just formalities; they can significantly impact a startup’s ability to attract investment and grow successfully. From intellectual property rights to compliance with regulations, navigating these aspects is essential for laying a solid foundation for your business.Startups must address several critical legal considerations when seeking funding. These include understanding the different types of funding agreements, ensuring compliance with securities laws, and protecting intellectual property.

A misstep in any of these areas can lead to serious consequences, including loss of funding or legal disputes.

Critical Legal Considerations in Funding Agreements

Various types of funding agreements come with specific legal requirements that startups must adhere to. Awareness of these requirements can help avoid complications down the line. Key considerations include:

- Equity vs. Debt Financing: It’s essential to understand the implications of giving away equity versus taking on debt. Equity financing means sharing ownership, while debt requires repayment, often with interest.

- Securities Compliance: Startups must ensure that any equity offered complies with local securities laws to avoid legal issues. This often involves filing necessary documentation and disclosures.

- Negotiation of Terms: The terms of funding agreements can vary widely. Being well-informed about the implications of terms regarding valuation, control, and exit strategies is vital.

- Investor Rights: Understanding what rights investors will have, such as voting rights or board representation, is critical for maintaining control over the business.

Avoiding Common Legal Pitfalls

Startups can easily fall into legal traps when navigating funding. By being aware of these pitfalls, entrepreneurs can take proactive measures to avoid them:

- Inadequate Documentation: Failing to create thorough documentation for agreements can lead to misunderstandings. Clear agreements should detail all terms and expectations associated with the funding.

- Ignoring Legal Counsel: Many startups underestimate the importance of legal advice. Engaging a knowledgeable attorney can help navigate complexities and prevent costly mistakes.

- Failure to Disclose: Transparency with investors is crucial. Not fully disclosing financials or business risks can result in legal repercussions or a loss of trust.

- Overlooking Exit Strategies: Not having clear exit strategies can create conflicts later on. Startups should address how and when investors can exit the investment.

Importance of Intellectual Property Protection

Before approaching investors, securing intellectual property (IP) protection is fundamental. Investors often want to see that a startup has taken steps to protect its ideas and innovations, as this can significantly enhance valuation and investor confidence. Key aspects include:

- Patents: For inventions, securing a patent can prevent others from using your idea, making your startup more attractive to investors.

- Trademarks: Protecting brand identity through trademarks helps in establishing a strong market presence, which is appealing to potential investors.

- Copyrights: For creative works, copyrights protect original content and can be a valuable asset for startups in creative industries.

- Non-Disclosure Agreements (NDAs): Using NDAs when discussing sensitive information with potential investors can safeguard proprietary information.

Leveraging Government Grants and Programs for Startup Funding

Startups often face challenges in securing funding, but government grants and programs provide a valuable opportunity to support innovation and growth. These initiatives are designed to empower entrepreneurs by offering financial assistance that can help bring their ideas to life. Understanding how to access these resources is crucial for startups aiming to leverage government funding effectively.Government grants and funding programs are typically established to stimulate economic growth, promote research and development, and foster innovation within specific industries.

Startups can access these funds through various channels, including federal, state, and local government programs. Most of the grants focus on technology, health, renewable energy, and other sectors crucial for the future.

Accessing Government Grants and Funding Programs

The process of accessing government grants involves several steps, and it’s important for startups to be well-prepared. The application process often requires detailed project proposals, budgets, and Artikels of how the funding will be used. The following are common eligibility requirements that startups need to meet in order to apply for government grants:

- Registered as a business entity, such as an LLC or corporation.

- Demonstration of innovative technology or business model.

- Clear plan for how the funding will be utilized for development or research.

- Alignment with the goals and focus areas of the funding program.

Successful navigation of the application process may require collaboration with experts in grant writing, as well as an understanding of the specific requirements of each program.

Examples of Successful Startups Funded by Government Initiatives

Numerous startups have successfully utilized government grants to accelerate their growth and development. For instance, a prominent example is Zipline, a drone delivery service specializing in medical supplies. Zipline secured government funding to develop its logistics network, which has significantly improved access to healthcare in remote areas.Another notable case is Formlabs, a 3D printing company that benefited from grants through the National Science Foundation.

These funds helped Formlabs innovate in the realm of affordable and accessible 3D printing technology.These examples illustrate the potential impact of government funding on startups’ ability to bring groundbreaking products and services to market, emphasizing the importance of exploring available grants and programs to support entrepreneurship.

Evaluating the Role of Accelerators and Incubators in Startup Funding

The landscape of startup funding has evolved considerably, with accelerators and incubators playing a pivotal role in aiding new businesses. These programs provide more than just financial backing; they offer mentorship, networking opportunities, and resources that can significantly enhance a startup’s chances of success. Understanding the distinctions between these two entities is essential for entrepreneurs seeking the right support for their ventures.Accelerators and incubators are designed to support startups, but they serve different purposes and follow unique structures.

Accelerators typically offer a fixed-term program where startups receive seed money in exchange for equity. The focus here is on rapid growth, and participants often culminate their experience with a demo day to pitch to investors. On the other hand, incubators provide a nurturing environment for startups at the idea or early stage, focusing on developing the business model and product rather than immediate funding.

They often do not require equity in return for the support they provide, allowing startups to progress without the pressure of equity dilution.

Differences Between Accelerators and Incubators

Recognizing the unique features of each program type is crucial for choosing the right path for your startup. Here’s a breakdown of key aspects that differentiate accelerators from incubators:

- Funding Structure: Accelerators typically offer initial capital in exchange for equity, while incubators may provide resources without equity stakes.

- Program Duration: Accelerator programs usually last a few months with a clear end date, whereas incubators can support startups over a more extended period, often years.

- Focus on Growth vs. Development: Accelerators emphasize rapid scaling and market readiness, while incubators concentrate on refining ideas and creating sustainable business models.

- Networking Opportunities: Accelerators often culminate in pitch events, attracting investors and potential partnerships, while incubators may focus more on building a supportive community.

Choosing the right program requires assessing your startup’s current status and future goals. It’s essential to evaluate what type of support you need at this stage. If you’re looking for quick scaling and visibility, an accelerator may be more suitable. Conversely, if your focus is on product development and establishing a solid foundation, an incubator could be the better choice.

Success Stories from Accelerator and Incubator Programs

Numerous startups have benefitted significantly from participating in accelerator or incubator programs, demonstrating the potential impact these entities can have. One notable success story is Airbnb, which participated in the Y Combinator accelerator program. Through their mentorship and network, Airbnb was able to refine its business model and gain early traction in the market. Today, Airbnb is a household name, showcasing the effectiveness of accelerator support.Similarly, the incubator Techstars has seen several startups flourish.

For instance, Sphero, the robotic ball company, initially received guidance and resources through Techstars. The mentorship provided helped Sphero secure funding and develop its product, eventually leading to widespread popularity and sales.These examples illustrate how accelerators and incubators can transform ideas into successful businesses by providing essential resources and support in critical early stages of development.

The Impact of Crowdfunding on Startup Funding

In recent years, crowdfunding has emerged as a transformative force in the startup funding ecosystem. By leveraging the power of the internet and social media, budding entrepreneurs can now tap into a global pool of potential investors who are willing to support innovative ideas and ventures. This shift has democratized access to capital, enabling startups to bypass traditional funding channels and engage directly with their target audience.

Crowdfunding platforms have become vital resources for entrepreneurs seeking to raise funds while simultaneously building a community around their products or services. These platforms allow startups to present their ideas to the public, garner support, and secure funding through small contributions from numerous individuals. This model not only helps in raising the necessary funds but also validates the business idea by measuring interest and demand directly from potential customers.

Comparison of Crowdfunding Platforms

Various crowdfunding platforms cater to different types of projects and funding needs, each with its unique features. Understanding these differences is essential for entrepreneurs looking to select the right platform to maximize their chances of success. Below are some notable platforms along with their distinct characteristics:

- Kickstarter: Known for its all-or-nothing funding model, Kickstarter is ideal for creative projects. If a funding goal is not met, no funds are collected, encouraging strong promotional efforts from creators.

- Indiegogo: Offers more flexible funding options, allowing campaigners to keep funds raised even if they don’t meet their goal. This platform supports a wide range of projects, from tech gadgets to social causes.

- GoFundMe: Primarily focused on personal causes and charitable projects, GoFundMe allows individuals to raise funds without offering rewards, making it suitable for those in need of support for personal situations.

- SeedInvest: A platform focused on equity crowdfunding, SeedInvest allows startups to offer equity to investors in exchange for funds, making it a good option for companies looking to build lasting investor relationships.

- WeFunder: This platform allows anyone to invest in startups for as little as $100, promoting a sense of community and shared ownership among investors.

The choice of platform can significantly impact a startup’s fundraising success, and understanding the nuances of each can help founders align their goals with the right audience and funding structure.

Benefits and Drawbacks of Crowdfunding

Crowdfunding presents unique advantages and challenges for startups. While it opens up access to capital, it also comes with certain risks that entrepreneurs must navigate. Below are key benefits and drawbacks of utilizing crowdfunding as a funding strategy:

- Benefits:

-

Access to a large audience:

Crowdfunding allows entrepreneurs to reach potential investors worldwide, increasing the chances of funding.

-

Market validation:

Successful campaigns can serve as market research, demonstrating demand and validating business ideas before launch.

-

Building a community:

Crowdfunding helps create a base of supporters who are invested in the success of the project, potentially leading to long-term customer loyalty.

-

Minimal upfront costs:

Unlike traditional funding options, many crowdfunding platforms require little to no upfront costs to launch a campaign.

-

- Drawbacks:

-

Time-consuming campaigns:

Preparing a successful campaign requires significant effort in marketing, planning, and execution, often consuming valuable resources.

-

Uncertain results:

There is no guarantee of reaching the funding goal, which can lead to disappointment and wasted efforts.

-

Potential for public failure:

If a campaign does not succeed, it can negatively impact the startup’s reputation and future funding opportunities.

-

Fees and charges:

Most platforms charge fees for their services, which can reduce the total funds raised.

-

In summary, while crowdfunding has revolutionized how startups access funding, it is crucial for entrepreneurs to weigh the benefits against the potential drawbacks to determine if it aligns with their business strategy and goals.

Building Relationships with Investors for Future Funding Rounds

Maintaining strong relationships with investors after securing initial funding is crucial for the long-term success of a startup. Investors are not only financial backers but also potential partners who can provide valuable insights, resources, and connections. By fostering these relationships, startups can ensure smoother funding processes in the future and increase their chances of achieving their business goals.Keeping investors engaged and informed about the progress of the startup is essential for building trust and confidence.

Regular communication helps in reinforcing their belief in the business and its leadership. This can be achieved through various strategies that keep investors in the loop about developments, challenges, and milestones.

Actionable Strategies for Investor Engagement

To maintain investor relationships effectively, consider adopting the following strategies:

- Regular Updates: Schedule quarterly or bi-annual updates to inform investors about the company’s performance, financial health, and key developments. Regularity builds a routine and sets expectations.

- Use of Newsletters: A well-crafted newsletter can provide insights into your startup’s progress, recent achievements, and upcoming goals. This keeps investors informed and engaged without overwhelming them with information.

- Personalized Communication: Tailor your communication based on the interests and expertise of your investors. Some may be more interested in financial metrics, while others might prefer insights into product development or market expansion.

- Invite Feedback: Encourage investors to provide feedback on strategic decisions or product development. This not only fosters collaboration but also shows that you value their input.

- Host Investor Meetings: Organize regular meetings, either virtual or in-person, to discuss progress and address any concerns. These meetings can also serve as networking opportunities among investors.

- Share Milestones: Celebrate and share your company’s achievements, whether it be a product launch, a partnership, or hitting revenue targets. This helps create a narrative of success and progress.

- Candidly Discuss Challenges: Be transparent about challenges or setbacks the company is facing. This builds credibility and trust, showing that you are not just sharing successes but are also open about difficulties.

Effective Communication of Updates and Milestones

Clear and effective communication is crucial for conveying updates and milestones to investors. The way you present information can significantly impact their perception of your startup’s progress.

“Transparency and clarity in communication are keys to building lasting relationships with investors.”

When communicating with investors, consider the following approaches:

- Visual Data Representation: Use graphs, charts, and visual aids to present financial data and milestones. Visual representation can make complex information easier to digest.

- Structured Reports: Create structured reports that Artikel key performance indicators, financial health, and strategic initiatives. Consistent formatting helps investors quickly find the information they need.

- Highlighting Key Milestones: Clearly Artikel significant milestones achieved since the last update. This can include funding rounds, user growth, revenue milestones, or product launches.

- Setting Future Goals: Alongside updates, discuss future objectives and how you plan to achieve them. This forward-looking perspective can enhance investor confidence.

- Soliciting Questions: Encourage investors to ask questions about the updates. An open dialogue fosters engagement and shows that you are invested in their concerns.

By implementing these strategies, startups can build and maintain strong relationships with their investors, ensuring a more favorable position for future funding rounds and ongoing support.

End of Discussion

In conclusion, navigating the complex landscape of startup funding requires a proactive approach and strategic thinking. By understanding the various funding stages, identifying suitable sources, and building strong relationships with investors, entrepreneurs can increase their chances of success and ensure their ventures thrive in a competitive market.

Answers to Common Questions

What is the difference between equity and debt funding?

Equity funding involves giving up a percentage of ownership in exchange for capital, whereas debt funding requires repayment of borrowed money with interest.

How much funding should a startup seek initially?

The initial funding amount depends on the business model and growth trajectory, but it’s generally advisable to secure enough to cover at least 12-18 months of operational expenses.

What factors do investors consider when funding a startup?

Investors typically evaluate the business model, market potential, team experience, traction, and financial projections before deciding to invest.

Can startups raise funds without a product?

Yes, startups can raise funds through concepts or prototypes, especially if they demonstrate strong market potential and business acumen to investors.

What is a convertible note?

A convertible note is a type of short-term debt that converts into equity, usually during a future financing round, allowing startups to secure funds while delaying valuation discussions.