Startup financing is a crucial topic for any aspiring entrepreneur looking to turn their innovative ideas into successful businesses. Understanding the various stages of financing—from seed funding to Series A and beyond—equips founders with the knowledge needed to navigate the complex landscape of funding options available. By familiarizing themselves with these concepts, entrepreneurs can make informed decisions that significantly impact their startup’s success and sustainability.

In today’s rapidly evolving startup ecosystem, financing has become more diverse and accessible. From traditional methods like angel investors and venture capital to modern avenues such as crowdfunding and bootstrapping, entrepreneurs have multiple pathways to secure funding. Each option comes with its own set of advantages and challenges, making it essential for founders to grasp the nuances of each financing type.

This knowledge not only helps in securing the necessary capital but also in building a robust business strategy that aligns with their long-term goals.

Understanding the Basics of Startup Financing

Startup financing is a critical aspect for entrepreneurs looking to bring their innovative ideas to life. Understanding the different stages and types of funding available can significantly influence the growth trajectory of a new business. Assembling the right financial resources is not just about capital; it involves strategic planning, knowing your audience, and aligning with investors who share your vision.

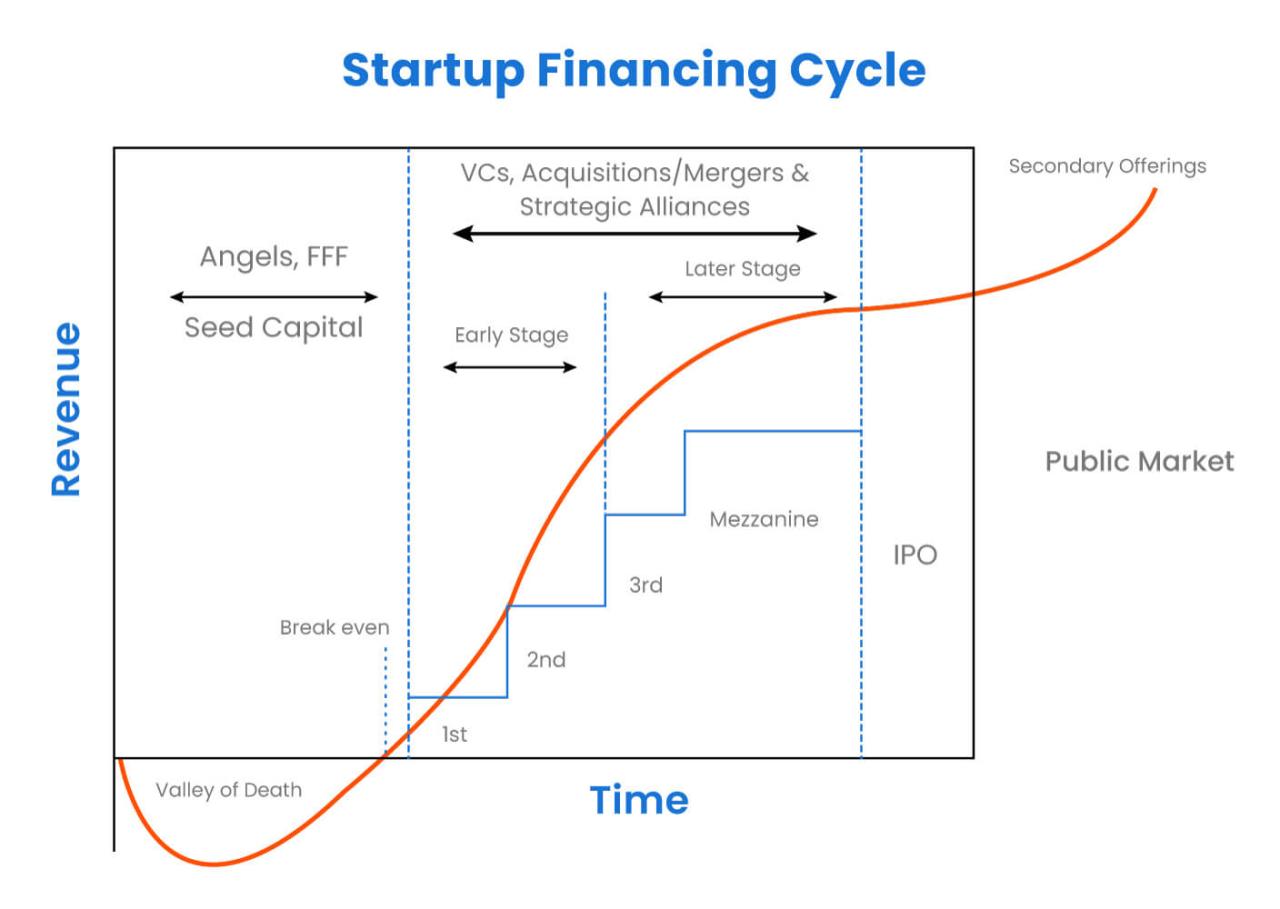

Thus, grasping the basics of startup financing is essential for anyone embarking on this entrepreneurial journey.Startup financing can be categorized into various stages, each serving a unique purpose in the business development lifecycle. The initial stage, often called the Seed Stage, involves funding that helps entrepreneurs establish their business concept and develop a prototype. This stage is typically funded by personal savings, family, and friends, or angel investors.

For example, a tech startup may secure $100,000 in seed funding to build an initial version of their app.Once the business has demonstrated its potential, it may move on to the Series A financing stage, where venture capitalists invest in the startup to scale its operations and improve its product. An example might be a health tech company that raises $2 million in Series A funding to enhance its marketing efforts and expand its user base.

Following Series A, companies may pursue Series B and beyond financing rounds, where the focus shifts towards scaling the business further, increasing market share, or entering new markets. A Series B round may attract $10 million from investors for a software startup looking to enhance its technology infrastructure.Understanding the types of financing available is crucial for new entrepreneurs, as it allows them to tailor their fundraising strategies effectively.

Each financing type comes with its own set of expectations, costs, and benefits. For instance, equity financing may dilute ownership, whereas debt financing requires repayment with interest. Being well-versed in these options can help entrepreneurs make informed decisions, ensuring they choose the right path for their growth and sustainability.

“Understanding your financing options can mean the difference between thriving and merely surviving as a startup.”

The Role of Angel Investors in Startup Financing

Angel investors play a pivotal role in the startup ecosystem by providing essential capital and resources for early-stage companies. Typically high-net-worth individuals, these investors not only bring financial support but also valuable mentorship and industry connections. Their investments often serve as a crucial lifeline for startups that may struggle to secure funding from traditional sources like banks or venture capitalists.

Understanding the characteristics, motivations, and the dynamics of working with angel investors is vital for any entrepreneur seeking to accelerate their growth.

Characteristics and Motivations of Angel Investors

Angel investors are generally characterized by their willingness to take risks on new ventures, as they often invest in early-stage companies based on the potential for high returns rather than established performance metrics. Key motivations for angel investors include:

- Financial Returns: They seek substantial returns on their investments, often looking for opportunities that can yield 20% or more annually.

- Passion for Entrepreneurship: Many angel investors have entrepreneurial backgrounds themselves and enjoy supporting new ideas and innovations.

- Networking and Influence: They often aim to expand their networks and influence within certain industries or markets, adding value to their portfolios.

- Philanthropy: Some angels are motivated by a desire to give back to their communities by helping startups that address social issues or challenges.

While angel investing has its advantages, it also comes with potential downsides for startups.

Advantages and Disadvantages of Seeking Funding from Angel Investors

Securing funding from angel investors can offer numerous benefits, but it also poses certain challenges. Understanding both sides is crucial for entrepreneurs.

- Advantages:

- Access to Capital: Angel investors provide necessary funds that can be pivotal in the product development and initial marketing stages.

- Mentorship and Guidance: Many angels offer invaluable advice, mentorship, and industry expertise, which can significantly enhance a startup’s growth trajectory.

- Networking Opportunities: Investors often introduce entrepreneurs to other potential investors and business partners, expanding their reach and opportunities.

- Disadvantages:

- Equity Dilution: Startups may have to give up a significant portion of equity, impacting future funding rounds and ownership.

- Investor Influence: Angel investors may demand a say in business decisions, which can lead to conflicts in vision and strategy.

- Expectations for Returns: Angels expect significant returns within a certain timeframe, which can pressure startups to scale quickly.

Effective Pitching to Angel Investors

When approaching angel investors, crafting a compelling pitch is essential. Successful pitches typically include:

- Clear Business Model: Entrepreneurs should convey how their business will generate revenue and the market need it addresses.

- Strong Value Proposition: Clearly articulating what sets the startup apart from competitors can capture an investor’s interest.

- Market Research: Presenting solid market analysis shows investors that the entrepreneur understands the landscape and has a plan for growth.

- Financial Projections: Realistic and well-supported financial forecasts can instill confidence in the investor regarding potential returns.

- Team Credibility: Highlighting the strengths and expertise of the founding team can demonstrate the capability to execute the business plan.

A well-prepared pitch that resonates with the characteristics and motivations of angel investors can greatly enhance the likelihood of securing the needed funding.

Exploring Venture Capital and Its Impact on Startups

Venture capital (VC) plays a crucial role in the growth and success of startups, providing them with the necessary funds to innovate, expand, and scale their operations. This form of financing is not just about the money, but also about the strategic support that comes from experienced investors who have a vested interest in the startup’s success. Understanding the venture capital process and its implications can empower entrepreneurs to navigate the funding landscape effectively.The venture capital process typically involves several stages.

Initially, startups prepare a detailed business plan and pitch to attract potential investors. These investors, usually organized in VC firms, evaluate the business based on a variety of criteria, including the startup’s market potential, team capabilities, and innovative edge. Once a startup piques a VC’s interest, due diligence follows, where the investors scrutinize the startup’s financials, projections, and overall business model.

If everything aligns, the VC firm will present a term sheet to Artikel the investment terms, which includes the amount of capital and the equity stake the VC will acquire. This process often culminates in a negotiation phase, leading to the final investment agreement.

Key Factors Venture Capitalists Evaluate

Several critical factors influence a venture capitalist’s decision-making process when considering an investment in a startup. Understanding these factors can help entrepreneurs tailor their approaches when seeking funding. Key elements include:

- Market Opportunity: VCs assess the size and growth potential of the market the startup targets. A large and expanding market is more attractive for potential returns.

- Team Experience: The founding team’s expertise and track record in executing their business plan are pivotal. VCs prefer teams with a mix of skills and a history of success.

- Product Viability: The uniqueness and feasibility of the startup’s product or service are crucial. VCs look for innovations that can disrupt existing markets or create new ones.

- Business Model: The clarity and scalability of the business model matter. VCs want to see how the startup plans to generate revenue and grow sustainably.

- Competitive Advantage: A startup needs to demonstrate its competitive edge, whether through proprietary technology, strong branding, or exclusive partnerships.

Comparing venture capital funding with other financing options, such as loans and crowdfunding, highlights distinct differences. Venture capital provides not only funding but also mentorship, networking opportunities, and credibility in the market. In contrast, loans require repayment regardless of the startup’s success and can burden early-stage companies with debt. Crowdfunding, while allowing for community involvement and validation, often yields smaller amounts of capital and can dilute ownership more rapidly due to the number of backers involved.

Each funding avenue has its advantages, but the active involvement of venture capitalists in shaping the startup’s future significantly impacts its growth trajectory.In essence, venture capital is an essential engine for startup growth, providing not just financial backing but also a wealth of knowledge and industry connections. Recognizing the elements that attract venture capitalists can greatly enhance a startup’s chances of securing the funding needed to thrive in a competitive landscape.

The Importance of Crowdfunding in Modern Startup Financing

The landscape of startup financing has undergone a significant transformation in recent years, with crowdfunding emerging as a vital alternative to traditional funding sources. This method allows entrepreneurs to raise small amounts of money from a large number of people, typically via the internet. Crowdfunding has democratized access to capital, enabling innovative ideas to flourish without the need for substantial backing from venture capitalists or banks.The evolution of crowdfunding can be traced back to the early 2000s, with platforms like Kickstarter launching in 2009.

Initially, crowdfunding was primarily used for creative projects, but it has since expanded to encompass a wide range of sectors including technology, fashion, and social enterprises. This shift underscores the significance of crowdfunding in modern startup financing, as it gives entrepreneurs the ability to gauge market interest and validate their ideas before making substantial investments. Moreover, successful crowdfunding campaigns can provide valuable marketing exposure, build a community of loyal supporters, and establish a brand presence ahead of a product launch.

Diverse Crowdfunding Platforms for Entrepreneurs

Various crowdfunding platforms cater to different needs and project types, allowing entrepreneurs to choose the right fit for their business model. Below are some of the most popular platforms:

- Kickstarter: Focused on creative projects, it operates on an all-or-nothing model where funds are only collected if the funding goal is met.

- Indiegogo: Offers flexible funding options, allowing creators to keep funds raised even if they don’t meet the goal. It supports a vast range of projects, from tech to non-profits.

- GoFundMe: Primarily used for personal causes and charitable projects, it allows individuals to raise money for specific needs without any project funding goal.

- SeedInvest: Targets startups looking for equity funding, connecting investors with companies in exchange for equity stakes.

- Patreon: A membership platform that allows creators to receive recurring funding directly from fans, ideal for artists and content creators.

Navigating these options requires an understanding of the audience and the type of funding needed. Each platform has its unique structure, fees, and community, which can impact the overall success of a crowdfunding campaign.

Steps to Launch a Successful Crowdfunding Campaign

Launching a successful crowdfunding campaign involves careful planning and execution. Here’s a structured guide to help entrepreneurs navigate the process:

1. Define Your Project

Clearly articulate your idea and its value proposition. Ensure that it resonates with your target audience.

2. Set a Realistic Funding Goal

Calculate how much money you need to successfully launch your project, considering production costs, marketing, and platform fees.

3. Choose the Right Platform

Based on your project type and target audience, select a platform that aligns with your goals.

4. Create Engaging Content

Develop a compelling campaign page that includes high-quality visuals, a detailed description of your project, and a persuasive video pitch.

5. Plan Your Rewards

Offer attractive rewards for backers at various levels of support. This could range from early access to products, exclusive merchandise, or equity stakes.

6. Build a Pre-Launch Audience

Engage with potential backers before launching. Use social media, blogs, and email lists to generate interest and build a community around your project.

7. Launch and Promote

Once live, actively promote your campaign through various channels, including social media, PR outreach, and influencer partnerships.

8. Maintain Communication

Keep backers informed throughout the campaign with regular updates. Transparency fosters trust and can lead to increased support.

9. Deliver on Promises

After the campaign, ensure timely delivery of rewards and maintain the relationship with backers for future projects.Successful crowdfunding is not just about raising funds; it’s about building a community and fostering relationships that can support the startup in the long run.

Bootstrapping vs. External Financing

Bootstrapping and external financing are two prevalent approaches for startups seeking to fuel their growth. Each has its own set of advantages and disadvantages that can significantly impact the trajectory of a business. Understanding these differences is crucial for entrepreneurs as they navigate the financial landscape of launching and scaling their ventures. Bootstrapping refers to the practice of starting and growing a business with minimal external funding, relying primarily on personal savings, revenue generated from the business, and organic growth.

On the other hand, external financing involves obtaining funds from outside sources, such as angel investors, venture capitalists, or loans, which can provide a substantial influx of capital but often comes with certain obligations and dilution of control.

Comparison of Bootstrapping and External Financing

When evaluating the merits and pitfalls of both bootstrapping and seeking external financing, several factors must be considered. Bootstrapping allows entrepreneurs to maintain complete control over their business, ensuring that their vision and values are upheld without outside interference. It promotes a disciplined approach to financial management, as founders learn to operate within their means and make strategic decisions based on immediate cash flow.

Successful examples of bootstrapped companies include:

- Mailchimp: Founded in 2001, Mailchimp started as a side project and grew into one of the largest email marketing services globally, all without external investment. They used the profits from their services to reinvest in the business.

- Basecamp: Originally known as 37signals, Basecamp has always been bootstrapped since its inception in 1999. The company focused on developing a sustainable business model and remained profitable for years without venture capital.

However, bootstrapping can limit growth potential, as personal funds and revenue may not be sufficient for rapid expansion or to seize market opportunities. Additionally, it places significant financial risk on the founders, who may face personal financial strain if the business struggles.In contrast, external financing can provide the necessary capital to scale quickly, invest in product development, and capture market share.

Startups that secure funding are often able to hire talent, execute marketing campaigns, and enhance their infrastructure. Yet, this path can lead to loss of control, as investors may demand a say in business decisions or a share of future profits.There are scenarios where bootstrapping may not be feasible, particularly for startups that require substantial upfront investment in technology, manufacturing, or marketing campaigns.

Industries such as biotechnology or hardware often necessitate significant capital outlays that are difficult to cover through bootstrapping alone. Furthermore, businesses operating in highly competitive markets may need to scale rapidly to establish their presence, making external financing a more viable option.Ultimately, the choice between bootstrapping and external financing depends on the individual startup’s goals, industry, and market conditions. Entrepreneurs must carefully weigh their options to determine the best strategy for their unique circumstances.

Government Grants and Loans for Startup Financing

Government funding serves as a vital resource for startups seeking to establish themselves in competitive markets. Various government programs are designed specifically to support new ventures by providing grants and loans that can significantly reduce the financial burden associated with launching a business. Understanding these options can empower entrepreneurs to leverage financial resources effectively.Government grants often come from federal, state, and local agencies aimed at fostering innovation, job creation, and economic development.

These grants are typically non-repayable, making them an attractive option for startups. On the other hand, government loans allow businesses to borrow capital at lower interest rates compared to traditional banks, with favorable repayment terms.

Available Government Programs for Startup Funding

Numerous programs exist to assist startups in obtaining the necessary funding. Below are some notable government grants and loans available to entrepreneurs:

- Small Business Innovation Research (SBIR) Program: Offers competitive grants to small businesses engaged in research and development. This program encourages innovation and research collaborations.

- Small Business Technology Transfer (STTR) Program: Similar to SBIR, it funds joint ventures between small businesses and research institutions, enhancing the commercialization of scientific discoveries.

- Economic Development Administration (EDA) Grants: Provides funding to support economic development projects, especially for communities in need, fostering regional innovation and competitiveness.

- Community Development Financial Institutions (CDFI) Fund: Supports loans to small businesses in underserved communities, promoting economic growth and job creation.

- State and Local Grants: Many states have their own grant programs aimed at stimulating economic development. These can vary widely by region and industry focus.

Eligibility criteria for these programs often require that the business be a registered entity, demonstrating a viable business plan and potential for growth. Specific applications may involve submitting detailed project proposals, financial statements, and, in some cases, matching funds.Utilizing government funding provides several advantages for startups. These funding sources can alleviate the pressure of initial costs, allowing entrepreneurs to focus on building their products and services.

Additionally, securing government grants can enhance credibility, making it easier to attract private investors.

“Receiving government funding can be a game-changer for startups, opening doors to additional resources and partnerships.”

Equity Financing

Equity financing is a method through which startups and established businesses raise capital by selling shares of their ownership. This approach not only provides necessary funds for growth and expansion but also brings in investors who may offer valuable expertise and connections. However, it also means giving up a portion of ownership and control, which can have long-term implications for entrepreneurs.Equity financing entails a range of possibilities, from angel investors and venture capitalists to initial public offerings (IPOs).

Each option presents unique advantages and challenges. When an entrepreneur seeks equity financing, they may approach individual investors or larger institutions looking for promising companies where their investment can yield significant returns. This type of financing is particularly appealing for startups that may struggle to secure loans due to a lack of established credit histories or collateral.

Comparison with Debt Financing

Understanding the differences between equity financing and debt financing is crucial for entrepreneurs in making informed funding decisions. Debt financing involves borrowing funds that must be repaid over time, often with interest. This method allows entrepreneurs to retain full ownership of their businesses; however, the obligation to repay loans can strain cash flow, particularly in the early stages when revenue may be unpredictable.

In contrast, equity financing does not require repayment, as investors buy shares in the company. While this alleviates immediate financial pressure, it does dilute the ownership stake of the founders and can lead to conflicts in decision-making.The risks associated with each financing method vary significantly. One major risk of debt financing is the potential for insolvency if the business cannot meet its repayment obligations.

Entrepreneurs must carefully consider their cash flow and market conditions when taking on debt. On the other hand, equity financing risks include the loss of control over the business, especially if a significant amount of equity is sold. Additionally, if the company does not perform well, it can lead to strained relationships with investors.To provide a clearer understanding of the different types of equity financing available, the following table Artikels various options, along with examples and descriptions:

| Type of Equity Financing | Description | Example |

|---|---|---|

| Angel Investors | Wealthy individuals who provide capital in exchange for equity, often in the startup phase. | A local entrepreneur seeking $100,000 to launch a tech startup. |

| Venture Capital | Investment funds that manage pooled capital from many investors to invest in high-potential startups. | Silicon Valley firms investing in tech companies with significant growth potential. |

| Crowdfunding | Raising small amounts of capital from a large number of people, typically via online platforms. | Platforms like Kickstarter or Indiegogo used to fund creative projects. |

| Initial Public Offerings (IPOs) | The process of offering shares of a private corporation to the public for the first time. | A tech company going public to raise capital for expansion. |

Equity financing can be a powerful tool for entrepreneurs, providing not just funding but also strategic partnerships and mentorship. As entrepreneurs weigh their options, they must consider the long-term implications of equity dilution versus the burden of debt repayment, ultimately finding the right balance that aligns with their business goals.

The Future of Startup Financing and Emerging Trends

As we venture deeper into the 21st century, the landscape of startup financing is rapidly evolving. Various factors, including technological advances, regulatory changes, and shifts in investor behavior, are reshaping how startups secure funding. Understanding these trends is essential for entrepreneurs, investors, and stakeholders in the startup ecosystem. Current trends influencing startup financing include the rise of alternative funding sources, increased focus on sustainability, and the democratization of investment opportunities.

Traditional venture capital is becoming just one of many options available to startups. Crowdfunding platforms, peer-to-peer lending, and equity crowdfunding are gaining traction, allowing a broader range of investors to participate in funding ventures that were once accessible only to a select few. This shift toward inclusivity is not only empowering entrepreneurs but also fostering a diverse array of ideas and innovations.

Impact of Technology on Funding Models

Technology is a driving force behind the evolution of funding models in the startup ecosystem. Digital platforms are streamlining the fundraising process, enabling startups to connect with potential investors more efficiently than ever before. Blockchain technology, for example, is facilitating transparent and secure transactions, particularly in the realm of initial coin offerings (ICOs) and security token offerings (STOs). The emergence of artificial intelligence (AI) and machine learning is also transforming how investors assess potential startup investments.

Algorithms can analyze vast amounts of data to identify promising startups based on predictive analytics. This technology not only reduces the time and costs associated with due diligence but also uncovers opportunities that might have been overlooked through traditional assessment methods.Moreover, online marketplaces for equity and debt funding are revolutionizing the way startups approach financing. Platforms like SeedInvest and Crowdcube allow startups to present their business models to a global audience of accredited and non-accredited investors.

This democratization of access to capital is set to create a more dynamic and competitive funding landscape.

Predictions for the Evolution of Startup Financing

Looking ahead, several key predictions can be made regarding the future of startup financing over the next decade. The integration of AI and big data analytics will continue to enhance decision-making for both startups and investors. Startups can expect to leverage data-driven insights to refine their pitches and tailor their offerings to meet investor preferences more effectively.In addition, the trend toward sustainable and socially responsible investing is likely to accelerate.

Investors are increasingly prioritizing companies that demonstrate a commitment to environmental, social, and governance (ESG) criteria. Startups focusing on sustainability and social impact may find it easier to attract funding, reflecting a broader shift in consumer and investor priorities.Furthermore, as regulations around cryptocurrencies and digital assets mature, we can anticipate a more structured approach to tokenized financing. This will likely lead to greater legitimacy for ICOs and STOs, encouraging more startups to explore these avenues for raising capital.Finally, the future will likely see the emergence of a more robust secondary market for startup equity, where investors can buy and sell stakes in startups after their initial funding rounds.

This could enhance liquidity for investors and provide startups with additional options for financing as they grow.The convergence of these trends and technological advancements suggests that the startup financing landscape will become increasingly innovative, accessible, and responsive to the needs of both entrepreneurs and investors alike.

Summary

In summary, startup financing plays a pivotal role in shaping the entrepreneurial journey. By exploring various funding options—ranging from government grants and angel investments to equity financing—entrepreneurs can find the best fit for their unique circumstances. As the landscape continues to evolve with technology and emerging trends, staying informed will be key to leveraging these opportunities effectively and achieving lasting success in the competitive startup arena.

General Inquiries: Startup Financing

What is startup financing?

Startup financing refers to the funding that new businesses seek to launch and grow, encompassing various methods like investments, loans, and grants.

How can I determine the best financing option for my startup?

Assess your business model, growth stage, and financial needs to choose the financing method that aligns with your goals and risk tolerance.

What is the average time it takes to secure startup funding?

The time can vary widely; it may take anywhere from a few weeks to several months depending on the type of funding and the preparation of your pitch.

Are there any risks involved in startup financing?

Yes, risks include loss of equity, debt obligations, and potential operational challenges associated with external funding.

Can I bootstrap my startup and still attract investors later?

Absolutely! Bootstrapping can demonstrate your commitment and resourcefulness, which may attract investors when you’re ready to seek external funding.