Payday loans are a short-term financial solution that caters to individuals in urgent need of cash. These loans are designed to help borrowers bridge the gap between paychecks, providing immediate relief for unexpected expenses. However, understanding the nuances of payday loans, including their terms and implications, is crucial for anyone considering this option.

This overview delves into the essential aspects of payday loans, their advantages and disadvantages, the application process, and alternatives, equipping readers with the knowledge to make informed financial decisions.

Understanding the Concept of Payday Loans

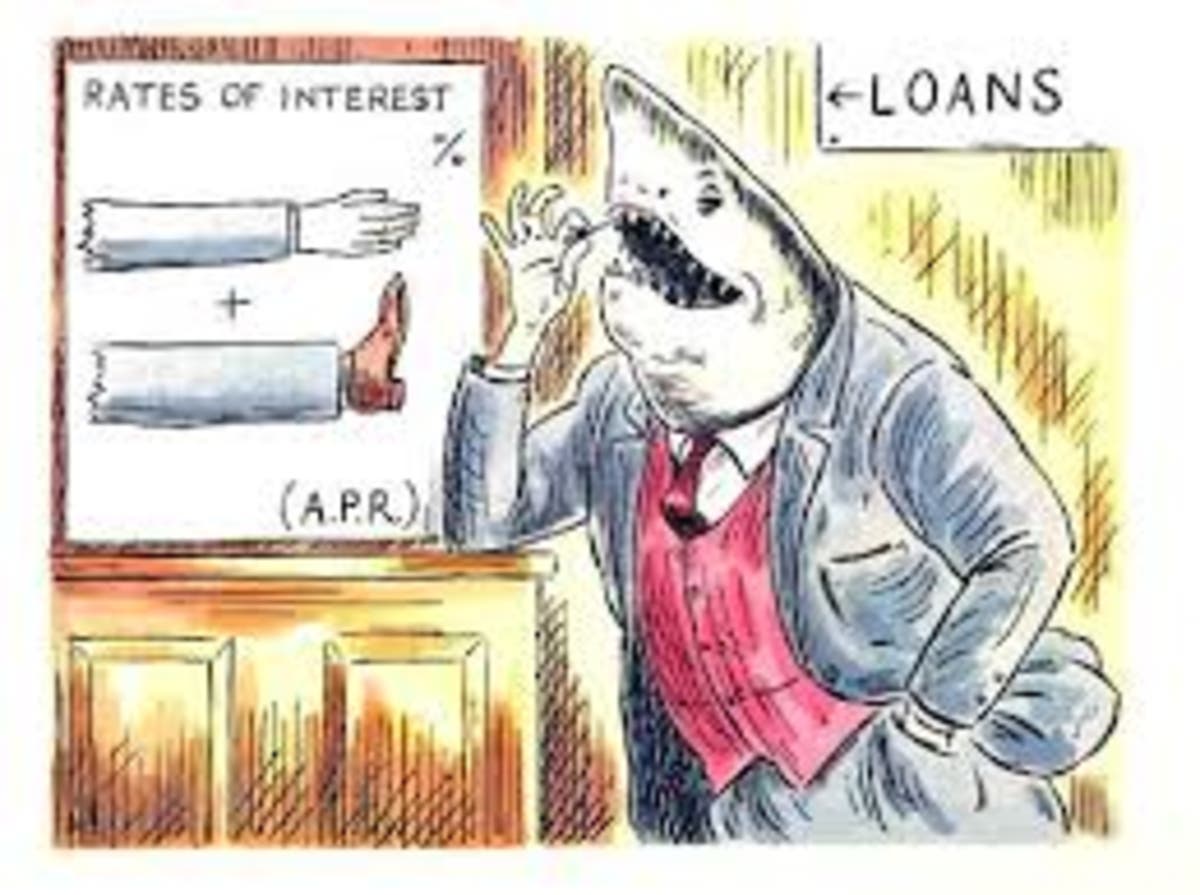

Payday loans are short-term, high-interest loans that are typically issued to borrowers who are in need of quick cash. They are designed to help individuals cover unexpected expenses or bridge the gap between paychecks. Borrowers often utilize these loans for emergencies, such as medical bills, car repairs, or essential household expenses. Given the immediacy of their purpose, payday loans have become a prominent option within the financial landscape for those who may not have access to traditional forms of credit.The terms associated with payday loans can vary significantly from state to state and lender to lender.

Generally, these loans are characterized by their short repayment periods, often requiring repayment within a few weeks, usually by the next paycheck. Interest rates on payday loans can be extremely high, often exceeding 400% APR, which can lead to a cycle of debt for borrowers if they are unable to repay the loan on time. Understanding these terms is crucial for anyone considering a payday loan, as it allows them to weigh the benefits against potential financial pitfalls.

Comparison with Other Forms of Credit

Payday loans differ substantially from other forms of credit such as personal loans and credit cards. While payday loans are typically smaller in amount and have very short repayment terms, personal loans offer larger sums and longer repayment periods. Here’s a brief comparison outlining key differences:

- Loan Amount: Payday loans generally range from $100 to $1,000, while personal loans can extend from $1,000 to $50,000 or more.

- Repayment Term: Payday loans are due within a few weeks, whereas personal loans usually have repayment terms from 1 to 5 years.

- Interest Rates: Interest on payday loans can exceed 400% APR, while personal loans vary but typically range from 6% to 36% APR.

- Credit Checks: Payday lenders often do not conduct thorough credit checks, making them accessible to those with poor credit, while personal loans usually require credit assessments.

- Usage: Payday loans are often used for emergencies or immediate cash needs, while personal loans can be used for various purposes, including debt consolidation, home improvement, and major purchases.

Understanding these distinctions is vital for individuals to make informed financial decisions and choose the right type of credit that aligns with their financial situation and needs. Additionally, it is important for borrowers to be mindful of the potential risks associated with payday loans, such as high fees and the possibility of falling into a cycle of debt, which can occur if the loans are not managed responsibly.

“Payday loans can provide quick relief, but they come with significant financial risks that must be acknowledged.”

The Pros and Cons of Utilizing Payday Loans

Payday loans can serve as a quick financial solution for individuals facing unexpected expenses. However, like any financial product, they come with their own set of advantages and disadvantages that require careful consideration. Understanding the nuances of payday loans can help borrowers make informed decisions when they find themselves in a financial crunch.

Advantages of Payday Loans

Payday loans offer several benefits, particularly for those needing immediate financial relief. Here are some of the key advantages:

- Quick Access to Funds: Payday loans typically provide rapid approval and access to cash, often within 24 hours. This speed can be crucial in emergencies such as medical bills or urgent repairs.

- Minimal Requirements: Compared to traditional bank loans, payday loans usually have fewer eligibility requirements, making them accessible to individuals with poor credit or no credit history.

- Convenience: Many payday lenders offer online applications, allowing borrowers to apply from the comfort of their homes without the need for lengthy paperwork or visits to a physical location.

Potential Drawbacks and Risks

While payday loans can be beneficial, they also come with significant drawbacks that borrowers should be aware of:

- High Interest Rates: The cost of borrowing can be steep, with annual percentage rates (APRs) reaching up to 400% or more. This makes payday loans one of the most expensive borrowing options available.

- Debt Cycle Risk: Borrowers may find themselves in a cycle of debt if they are unable to repay the loan on time. This can lead to taking out additional loans to cover previous debts, exacerbating financial strain.

- Limited Loan Amounts: Payday loans typically offer smaller loan amounts, which may not be sufficient for larger financial needs.

Comparison with Other Short-Term Borrowing Options

When considering payday loans, it’s essential to compare them with other short-term borrowing alternatives such as credit cards or personal loans. This comparison can illuminate the most suitable choice for urgent financial needs.

- Cost Comparison: Credit cards usually have lower interest rates than payday loans but may involve fees if the balance isn’t paid on time. Personal loans often have more favorable terms than payday loans, with manageable repayment plans.

- Accessibility: While payday loans are easy to access for individuals with poor credit, personal loans might have stricter credit requirements. Credit cards may also be harder to obtain for those with low credit scores.

- Payment Flexibility: Personal loans often offer more flexible repayment options compared to the lump-sum payment required by payday loans. This can reduce financial pressure for borrowers.

Understanding the pros and cons of payday loans is crucial for making informed financial decisions, especially during emergencies.

The Process of Obtaining a Payday Loan

Obtaining a payday loan typically involves a straightforward process, primarily designed to provide individuals with quick access to cash to cover unexpected expenses. Understanding the steps and requirements can streamline the experience and help borrowers navigate through it efficiently.The typical application process for acquiring a payday loan generally consists of a few key steps. Borrowers often start by researching potential lenders, which can be traditional banks or online platforms.

Most lenders require an application form that includes personal information, employment details, and the amount requested. Documentation usually needed includes:

- Proof of identity (e.g., government-issued ID)

- Proof of income (e.g., paycheck stubs or bank statements)

- Social Security number

- Active checking account information

Once the application is submitted, lenders evaluate the information provided to determine eligibility.

Evaluation Criteria for Eligibility

To assess a borrower’s eligibility for a payday loan, lenders typically consider several evaluation criteria, which help them gauge the risk involved in lending. These criteria include:

- Income stability: A steady source of income demonstrates the borrower’s ability to repay the loan.

- Credit history: While many payday lenders do not conduct extensive credit checks, a history of consistent repayment can favorably impact decisions.

- Employment status: Full-time employment is often preferred, indicating reliability and financial stability.

- Existing debt levels: Lenders may review current financial obligations to ensure the borrower can manage additional debt.

Understanding these criteria can help borrowers prepare adequately, mitigating the chances of rejection.

Role of Online Platforms versus Traditional Lenders

Online platforms have transformed the payday loan landscape, offering a more accessible alternative to traditional lenders. Compared to conventional banks, online platforms often provide a quicker application process, enabling borrowers to receive funds in as little as one business day. Online lenders typically utilize technology to streamline the application process, allowing for instant approval decisions based on the data submitted.

This contrasts with traditional lenders, who may require more extensive documentation and take longer to process applications. A few advantages of online platforms include:

- Accessibility: Online lenders are available 24/7, allowing applicants to apply at their convenience.

- Less stringent requirements: Many online lenders have more flexible eligibility criteria compared to traditional banks.

- Faster funding: Approval and disbursement of funds can occur within hours, which is critical for emergency financial needs.

In summary, while traditional lenders offer a more conventional approach, online platforms provide efficiency and convenience that many borrowers find appealing, especially in urgent financial situations.

Alternatives to Payday Loans

Payday loans may seem like a quick fix for financial emergencies, but they often come with high fees and interest rates that can lead to a cycle of debt. Fortunately, there are several alternatives that can provide financial relief without the burdensome terms associated with payday loans. Exploring these options can empower consumers to make informed decisions that better suit their financial situations.

Community resources, credit unions, and personal loans are all viable alternatives to consider. These options typically offer lower interest rates, more flexible repayment terms, and a focus on helping borrowers rather than trapping them in debt. By understanding these alternatives, you can take a proactive approach to your financial needs.

Community Resources

Local community organizations often provide resources for individuals facing financial challenges. These resources may include assistance programs, food banks, and financial counseling services. Engaging with these organizations can help you find support and guidance tailored to your specific situation.

A few notable community resources include:

- Non-profit organizations: Many organizations offer financial assistance or low-interest loans for families in need.

- Government assistance programs: Programs like Temporary Assistance for Needy Families (TANF) can provide temporary financial support.

- Community action agencies: These agencies often provide a range of services, including emergency financial aid and budgeting assistance.

Credit Unions

Credit unions are not-for-profit financial institutions that aim to serve their members rather than generate profit. They typically offer lower interest rates on loans and higher returns on savings compared to traditional banks. For people considering payday loans, a credit union can be a more affordable alternative.

Key benefits of credit unions include:

- Lower interest rates: Credit unions often provide personal loans at rates significantly lower than payday loans.

- Flexible terms: Repayment terms can be more accommodating, helping borrowers manage their payments more effectively.

- Financial education: Many credit unions offer resources to help members improve their financial literacy and planning.

Personal Loans

Personal loans from banks or other financial institutions can serve as a suitable replacement for payday loans. They allow borrowers to access funds for various needs while offering structured repayment plans that can help avoid falling into a debt trap.

Important aspects of personal loans include:

- Fixed terms: Personal loans typically come with fixed interest rates and clear repayment timelines, making budgeting easier.

- Potential for better credit scores: Successfully repaying a personal loan can positively impact your credit score, paving the way for better financial options in the future.

- Transparency: Reputable lenders provide clear terms and conditions, helping borrowers understand their obligations and avoid hidden fees.

Budgeting Strategies and Financial Planning

Developing effective budgeting strategies and engaging in financial planning can help prevent the need for payday loans in the first place. By actively managing your finances, you can position yourself to handle emergencies without resorting to high-cost borrowing.

Consider implementing the following budgeting strategies:

- Track your expenses: Monitoring where your money goes can help you identify areas for savings.

- Establish an emergency fund: Setting aside money for unexpected expenses can reduce reliance on loans.

- Prioritize needs over wants: Assessing the difference between necessary expenses and discretionary spending can lead to smarter financial decisions.

By utilizing these alternatives and focusing on sound financial practices, individuals can navigate their financial needs without falling into the payday loan trap, leading to a more stable and secure financial future.

State Regulations and Legal Aspects of Payday Loans

In the United States, payday loans are subject to a complex web of state regulations that significantly influence their availability, terms, and the protections afforded to consumers. Each state has the authority to enact its own laws governing these short-term loans, leading to a diverse landscape of regulations that can vary widely from one jurisdiction to another. Understanding these legal frameworks is crucial for both borrowers seeking assistance and lenders operating in the market.The impact of state regulations on payday loan practices is profound.

Regulations can dictate the maximum allowable interest rates, loan amounts, repayment terms, and even the number of loans a borrower can take out simultaneously. Such measures are designed to protect consumers from predatory lending practices while also ensuring that lenders can operate sustainably.

Legal Framework Governing Payday Loans

States regulate payday loans through various statutes, which can include specific licensing requirements, interest rate caps, and mandatory disclosures. The following points illustrate key elements of the legal framework across different states:

- Interest Rate Caps: Many states impose strict caps on interest rates and fees that lenders can charge, often limiting the annual percentage rate (APR) to 36% or lower. For instance, in New York, payday lending is illegal, while in Texas, lenders can charge fees that translate to an APR of over 600%.

- Loan Amounts: States often define the maximum loan amount a borrower can receive. For example, Ohio permits loans up to $1,000, whereas some states, like Florida, allow loans only up to $500.

- Repayment Terms: Regulations can stipulate the minimum and maximum repayment periods. In Illinois, borrowers can have up to 45 days to repay their loans, creating a more manageable repayment schedule compared to states with shorter terms.

- Consumer Protections: Many states require lenders to provide clear disclosures about loan terms and obligations, ensuring borrowers understand their commitments before taking out a loan. This includes providing information about fees, APR, and the total cost of the loan.

Impact of Regulation on Loan Practices

The regulatory environment plays a crucial role in shaping the practices of payday lenders. States with stringent regulations tend to see a reduction in predatory lending practices. In states like California, where regulations are enforced, borrowers have access to more favorable loan terms and protections against rollover loans, which can trap them in a cycle of debt.

“The presence of strong regulatory frameworks can significantly reduce the risk of consumer exploitation in the payday lending industry.”

Conversely, states with lax regulations may experience rampant predatory lending. In such environments, lenders may exploit loopholes to impose exorbitant fees and penalties on borrowers, often leading to financial distress. For example, in states like Alabama, where regulations are minimal, borrowers frequently face challenges like hidden fees and aggressive collection practices.

Comparison of Regulations Across States

An examination of payday loan regulations across various states reveals stark contrasts that impact borrowers significantly. The following comparisons highlight how different states approach payday lending:

- State With Strict Regulations: In Massachusetts, payday loans are limited to an APR of 23%, significantly protecting consumers. Lenders are required to be licensed, and the state mandates loan terms that include a minimum repayment period.

- State With Moderate Regulations: In Ohio, although payday lending is legal, lenders must adhere to regulations that require them to disclose all loan terms upfront, including the total cost and interest rates.

- State With Lax Regulations: In South Dakota, there are virtually no restrictions on interest rates for payday loans, allowing lenders to charge APRs exceeding 500%, which can lead to severe financial implications for borrowers.

Overall, the legal landscape governing payday loans is essential for understanding how these financial products operate in different states and the implications for consumers seeking short-term financial assistance. By being informed about the regulatory environment, borrowers can make better decisions and advocate for their rights.

The Impact of Payday Loans on Credit Scores

Payday loans are often marketed as quick solutions for financial emergencies, but they can have far-reaching implications on an individual’s credit history and credit score. Understanding these impacts is crucial for anyone considering this type of loan, especially regarding how it affects their financial reputation over time.Payday loans typically do not require a credit check, which can make them seem attractive to those with poor credit histories.

However, this does not mean they are without consequences. When a payday loan is taken out, it can still affect your credit history if the lender reports your payment behaviors to credit bureaus. If you default on the loan or fail to repay it as agreed, the negative information may be reported, leading to a decrease in your credit score.

Consequences of Defaulting on a Payday Loan

Defaulting on a payday loan can lead to severe repercussions. There are several key consequences that borrowers should be aware of:

1. Credit Score Damage

Defaulting can lower your credit score significantly. A drop in score can affect your ability to secure future loans or favorable interest rates.

2. Increased Fees and Interest

Once you miss a payment, you may incur additional fees and higher interest rates on the remaining balance, making it even more challenging to settle the debt.

3. Collections

Many lenders will send your account to collections after defaulting. This means a collections agency will pursue the debt, which can further damage your credit score and lead to persistent collection attempts.

4. Legal Actions

In some cases, lenders can take legal action to recover the owed amount, potentially resulting in court judgments against you.

5. Bank Account Seizures

Some lenders may be able to garnish your wages or access your bank account to recover funds, complicating your financial situation even further.

Managing Payday Loans Responsibly

Responsible management of payday loans is essential to mitigate their negative effects on credit. Here are practical steps borrowers can take:

1. Assess Financial Needs

Before taking out a payday loan, evaluate if it’s truly necessary. Explore alternative options such as personal loans from credit unions or payment plans with creditors that could be more manageable.

2. Understand Terms and Conditions

Be clear about the repayment terms, including the total amount to be repaid, interest rates, and any fees involved. This understanding helps in planning your repayment.

3. Set a Repayment Plan

Create a budget that includes your payday loan repayment. Prioritize repayments over non-essential expenses to avoid defaulting.

4. Communicate with Lenders

If you anticipate difficulties in making payments, communicate with your lender. They may offer extensions or payment plans that can prevent default.

5. Monitor Your Credit

Regularly check your credit report for any inaccuracies or changes. This can help you understand how payday loans are affecting your credit score and take corrective actions if necessary.By taking these steps, borrowers can navigate payday loans more effectively and minimize any adverse impact on their credit scores, ensuring they maintain a healthier financial position in the long term.

Consumer Experiences and Testimonials Related to Payday Loans

Payday loans have become a common financial resource for many individuals facing unexpected expenses or urgent cash needs. While the convenience of obtaining quick funds is appealing, the experiences of consumers can vary widely, leading to a spectrum of emotional and psychological impacts. Here, we delve into real-life stories and sentiments expressed by individuals who have sought payday loans and explore the broader implications of these financial decisions.

Real-life Stories of Payday Loan Users

Consumer testimonials reveal a mix of positive and negative experiences with payday loans. Some individuals share stories of how these loans provided immediate relief during financial emergencies. For instance, one user recounted how a payday loan helped cover a sudden medical expense, allowing them to focus on recovery rather than financial stress. However, alongside these positive experiences, there are numerous accounts highlighting the difficulties faced when trying to repay the loans.

Reports of escalating debt, increased stress levels, and feelings of hopelessness are common among those who have struggled to meet repayment deadlines.

Emotional and Psychological Impacts

Relying on payday loans can lead to significant emotional and psychological effects for consumers. Many report feelings of anxiety and shame associated with borrowing money, particularly if they experience difficulty in repayment. The pressure of looming due dates can exacerbate stress, leading to sleepless nights and strained relationships. A study conducted by the Pew Charitable Trusts found that nearly 70% of payday loan borrowers experience anxiety about their ability to repay loans, highlighting a troubling trend in mental health concerns tied to financial dependencies.

Trends in Consumer Satisfaction and Dissatisfaction

The landscape of consumer satisfaction surrounding payday loans is complex. While some users express relief and satisfaction with the quick access to funds, others voice dissatisfaction due to high interest rates and perceived predatory lending practices. The following points summarize key trends observed in consumer testimonials:

- Many borrowers appreciate the speed and ease of securing funds, especially in emergencies.

- A significant number of individuals express frustration over the high fees and interest rates associated with payday loans.

- Repeat borrowers often report feeling trapped in a cycle of debt, leading to greater dissatisfaction.

- Consumers indicate a desire for more transparent lending practices and better alternatives to high-cost loans.

“I felt like I was in a hole that kept getting deeper, and every loan was just another shovel of dirt.”

This feedback from borrowers paints a vivid picture of the dual-edged nature of payday loans. While they may offer immediate financial assistance, the long-term consequences can lead to emotional distress and a challenging financial landscape for many individuals.

The Future of Payday Loans in the Financial Market

The future of payday loans is poised for significant transformation as the financial landscape adapts to changing consumer needs and technological advancements. As the economy evolves, the payday loan industry faces both challenges and opportunities that could reshape its relevance in the financial market. Current trends indicate a growing scrutiny of payday lending practices, driven by increasing regulatory pressures and consumer advocacy for more transparent and fair lending options.

Many lenders are re-evaluating their practices to align with these shifts, prompting innovations that could redefine the industry. Additionally, the rise of alternative lending sources and financial technology (FinTech) companies is further influencing how payday loans are perceived and utilized.

Technological Advancements in Payday Lending

Technological innovations have the potential to revolutionize the payday loan industry by enhancing efficiency and improving customer experiences. The integration of data analytics, artificial intelligence (AI), and mobile applications is simplifying the loan application process and facilitating quicker access to funds. Key technological advancements include:

- Instant Approval Systems: Leveraging AI algorithms to assess creditworthiness in real-time allows for instant loan approvals, reducing the waiting period for consumers.

- Mobile Lending Platforms: A significant shift towards mobile applications provides users with the convenience of applying for loans anytime, anywhere, enhancing accessibility for borrowers.

- Blockchain Technology: This technology offers transparent and secure transactions, which can help reduce fraud in the payday loan sector and build trust among consumers.

- Automated Customer Service: Chatbots and automated systems are streamlining customer inquiries, making it easier for borrowers to get assistance and information on their loans.

The implications of these advancements could lead to more responsible lending practices and improved borrower engagement, ultimately benefiting consumers.

Changing Consumer Behavior and Demand for Payday Loans

Consumer behavior is shifting as financial literacy improves and alternative payment solutions become more widely known. Many individuals are exploring alternatives to traditional payday loans, such as credit unions, peer-to-peer lending platforms, and other financial products that offer more favorable terms. The changing landscape indicates several factors affecting the demand for payday loans:

- Increased Awareness: Consumers are more informed about the risks associated with payday loans and are seeking products with lower interest rates and better repayment terms.

- Financial Education Initiatives: Programs aimed at enhancing financial literacy are helping individuals make informed decisions about borrowing and managing their finances effectively.

- Alternative Financing Options: The rise of buy-now-pay-later services and other short-term financing options is providing consumers with alternatives that may be more appealing than payday loans.

- Economic Factors: Economic instability or fluctuations in employment rates can create a higher demand for short-term loans, including payday loans, as consumers seek quick financial relief.

In summary, the future of payday loans in the financial market will depend on technological advancements, evolving consumer behavior, and regulatory changes that emphasize responsible lending and financial inclusion. The industry’s adaptation to these dynamics will be crucial in maintaining its relevance in an increasingly competitive financial landscape.

Closing Notes

In conclusion, payday loans can offer a quick financial lifeline but come with their own set of challenges and risks. By weighing the pros and cons and exploring alternatives, borrowers can better navigate their financial landscape. Remember, making informed choices is key to managing your finances and ensuring a stable future.

Key Questions Answered

What are payday loans used for?

Payday loans are typically used for urgent expenses such as medical bills, car repairs, or unexpected bills.

How much can I borrow with a payday loan?

The amount you can borrow usually ranges from $100 to $1,000, depending on state regulations and lender policies.

How long do I have to repay a payday loan?

Repayment terms typically range from two weeks to a month, depending on your next payday.

Will a payday loan affect my credit score?

Payday loans may not directly affect your credit score unless you default, which can lead to negative reporting.

What happens if I can’t repay my payday loan on time?

If you can’t repay on time, you may incur additional fees, and the lender might pursue debt collection actions.

Are there any fees associated with payday loans?

Yes, payday loans often come with high fees and interest rates that can significantly increase the total amount owed.

Can I get a payday loan with bad credit?

Yes, many payday lenders do not require a credit check, making loans accessible even to those with poor credit history.