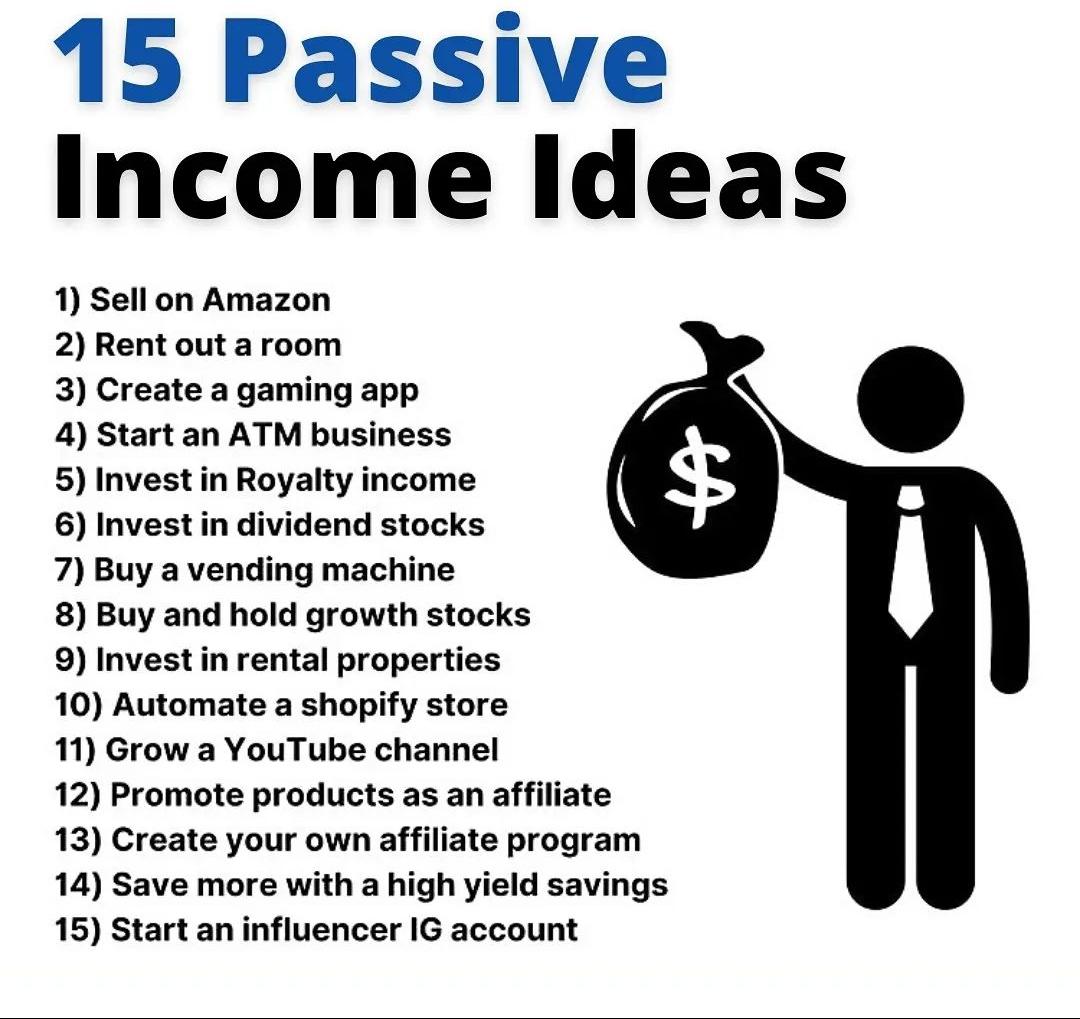

Passive income ideas take center stage as they present an enticing opportunity for individuals seeking to enhance their financial well-being. By allowing money to work for you rather than the other way around, passive income offers a pathway to financial independence and security. This concept encompasses a variety of income-generating strategies that require minimal ongoing effort once established, enabling individuals to enjoy a more liberated lifestyle.

From investing in real estate to creating digital products and exploring affiliate marketing, the possibilities are vast and varied. Understanding the fundamental concepts of passive income is crucial for anyone looking to diversify their income streams and build sustainable wealth over time.

Understanding the Concept of Passive Income

Passive income refers to earnings derived from ventures in which an individual is not actively involved. Unlike traditional employment, where time and effort directly correlate to financial compensation, passive income generates revenue with minimal ongoing effort. This financial approach allows individuals to build wealth while maintaining greater flexibility and freedom over their time. The fundamental principle behind passive income is the idea of creating systems or investments that yield returns without continuous input.

To understand passive income more comprehensively, it is essential to differentiate between active income and passive income sources. Active income is earned through direct involvement, such as working a job, freelancing, or running a business where personal labor is required. In contrast, passive income does not necessitate ongoing effort after the initial setup. This distinction highlights the difference in how each income type is generated and maintained.

Differences Between Active and Passive Income

The contrast between active and passive income can be illustrated through various characteristics and examples. Active income is typically characterized by:

- Time Sensitivity: The income is directly tied to the amount of time spent working.

- Effort Requirement: Continuous effort is needed to sustain earnings.

- Job-Dependent: Earnings are reliant on employment or direct client interaction.

Passive income, on the other hand, can be recognized by:

- Initial Investment: It often requires a significant initial investment of time, money, or resources.

- Minimal Ongoing Effort: Earnings continue with little to no ongoing involvement.

- Revenue Streams: It can generate multiple streams of income simultaneously.

Within the landscape of passive income models, traditional examples include rental properties and dividends from stocks. Owning real estate allows for rental income, which can be collected with minimal day-to-day management. Similarly, dividends from investments in well-established companies provide regular income without requiring active participation in business operations.On the modern front, digital assets such as online courses, e-books, and affiliate marketing have emerged as innovative passive income sources.

For instance, once an online course is created and uploaded to a platform, it can generate sales indefinitely without the need for further involvement, aside from occasional updates.

The essence of passive income lies in creating sustainable systems that yield financial returns with minimal intervention.

Exploring Real Estate as a Passive Income Source

Investing in real estate has long been recognized as a viable method for generating passive income. By acquiring rental properties, investors can create a steady stream of income while also benefiting from potential property appreciation over time. This dual advantage makes real estate an appealing option for those looking to diversify their income sources and build long-term wealth.One of the most effective ways to generate continuous income streams is through rental properties.

When individuals purchase residential or commercial properties and lease them to tenants, they receive monthly rent payments. This consistent revenue can significantly contribute to an investor’s overall financial stability. Furthermore, the property value may appreciate, offering a potential profit upon resale.

Strategies for Managing Real Estate Investments Effectively

Successful real estate investment requires effective management strategies. Implementing these strategies not only maximizes income but also minimizes potential risks associated with property ownership. The following approaches can enhance the management of real estate investments:

- Regular Property Maintenance: Maintaining the property in good condition is crucial. Regular inspections and timely repairs can prevent small issues from escalating into costly problems, ensuring tenant satisfaction and retention.

- Screening Tenants: A thorough tenant screening process reduces the risk of non-payment and property damage. This involves checking credit histories, rental references, and employment verification.

- Setting Competitive Rental Rates: Researching local market trends allows landlords to set rental prices that are competitive yet profitable. Overpricing can lead to extended vacancies, while underpricing may result in lost revenue.

- Utilizing Property Management Services: For those who prefer a hands-off approach, hiring a property management company can streamline operations. These companies handle tenant relations, maintenance, and rent collection, allowing investors to focus on other ventures.

Potential Risks and Rewards Associated with Real Estate Investments

Investing in real estate also comes with its set of risks and rewards. Understanding these can help investors make informed decisions and strategize effectively. The following points highlight some key aspects:

- Market Fluctuations: Real estate values can fluctuate based on economic conditions. A downturn in the economy may lead to decreased property values and rental demand, impacting income.

- Property Management Challenges: Inexperienced landlords may encounter difficulties with tenant management, leading to vacancies or tenant disputes, which can affect profitability.

- Tax Benefits: Real estate investors can benefit from various tax deductions such as mortgage interest, property depreciation, and property management expenses, which can enhance overall returns.

- Leverage Opportunities: Real estate allows for leveraging funds, meaning investors can use borrowed money to purchase properties. This can amplify returns if property values increase, showcasing the potential for significant gains.

Real estate investment can be a highly rewarding avenue for generating passive income, provided that investors approach it with the right strategies and an understanding of the associated risks.

Creating Digital Products for Passive Income

Creating digital products is an effective avenue for generating passive income, offering flexibility and scalability. These products can range from eBooks and online courses to downloadable resources like templates and software applications. The appeal lies in their ability to provide ongoing revenue with minimal active involvement once they are established and marketed effectively.Identifying a target audience and niche is critical when developing digital products.

A well-defined niche allows for effective marketing strategies that resonate with the intended audience, ultimately driving sales and ensuring the longevity of the product. Understanding the needs, preferences, and pain points of the audience facilitates the creation of products that provide genuine value.

Steps to Launching a Successful Digital Product

The following steps Artikel a structured approach to launching a digital product, ensuring that it reaches the intended market effectively and generates passive income:

1. Market Research

Conduct thorough research to identify gaps in the market and to understand the preferences of your target audience. Utilize surveys, social media polls, and online forums to gather insights.

2. Product Development

Create your digital product based on the insights gathered from your research. This could include writing an eBook, developing an online course, or designing digital templates. Focus on quality and usability to enhance customer satisfaction.

3. Branding and Positioning

Develop a strong brand identity that resonates with your target audience. Consider creating a professional website and social media profiles, and ensure that your product is presented in a way that highlights its benefits.

4. Marketing Strategy

Craft a marketing strategy that includes content marketing, email marketing, social media campaigns, and potentially paid advertising. Utilize platforms like blogs and podcasts to create awareness and provide value.

5. Launch Plan

Prepare for the launch by creating a buzz about your product. Consider offering pre-launch promotions, early-bird discounts, or exclusive access to subscribers on your mailing list.

6. Feedback and Iteration

After launching, gather feedback from users to understand what works and what doesn’t. Use this information to make improvements and updates to your product, enhancing its value and appeal.

7. Automating Sales and Customer Support

Implement systems that automate the sales process and customer support. This can include setting up an e-commerce platform that handles transactions, as well as utilizing automated emails for customer inquiries.

8. Continuous Marketing and Updates

Maintain a consistent marketing effort even after launch. Regularly update your product based on customer feedback and market trends to keep it relevant and valuable.

“Investing time in understanding your audience and refining your product is key to achieving long-term passive income.”

By following these steps, individuals can successfully create and launch digital products that not only generate passive income but also establish a reputable brand in their chosen niche.

Utilizing Dividend Stocks as a Passive Income Strategy

Investing in dividend stocks is a popular strategy among investors seeking to generate passive income while also benefiting from potential capital appreciation. This approach not only provides regular income through dividends but also allows investors to participate in the growth of the companies they invest in. Understanding how dividend stocks work and the benefits they offer is essential for any investor looking to enhance their portfolio.Dividend stocks are shares in companies that return a portion of their profits directly to shareholders as dividends, typically on a quarterly basis.

This return can provide a steady income stream, independent of market fluctuations, thus making them an attractive option for long-term investors. Benefits of investing in dividend stocks include consistent cash flow, the potential for share price appreciation, and the advantage of compounding returns when dividends are reinvested.

Criteria for Selecting Dividend-Paying Stocks

When choosing dividend-paying stocks, it is crucial to evaluate several key criteria that indicate the reliability and potential growth of the dividend payments. The following points should be considered:

- Dividend Yield: This is a measure of how much a company pays out in dividends each year relative to its stock price. A higher yield may indicate a better return on investment, but excessively high yields may signal potential instability.

- Dividend History: Analyzing a company’s dividend payment history helps gauge its reliability. Consistent or growing dividends over time indicate strong financial health and commitment to returning value to shareholders.

- Payout Ratio: This is the percentage of earnings paid out as dividends. A lower payout ratio suggests that a company has room to grow and can sustain its dividend payments even during downturns.

- Financial Stability: Investors should look at the company’s revenue, profit margins, and overall financial health. Companies with strong fundamentals are better positioned to maintain and increase dividends.

- Growth Potential: Assessing the company’s market position, potential for expansion, and historical growth rates can help in understanding future dividend growth prospects.

Reinvesting dividends plays a pivotal role in building long-term wealth. By choosing to reinvest dividends, investors can purchase additional shares of the stock, which may compound their returns significantly over time. This strategy allows investors to benefit from the power of compound interest, as their investment grows not only based on the initial capital but also on the reinvested dividends.

For instance, if an investor holds shares in a company that consistently pays dividends, reinvesting those dividends could lead to exponential growth in their total shares and, consequently, their total dividends over the years.

“Reinvesting dividends can turn a modest investment into a substantial wealth generator over time.”

Exploring Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending has emerged as an innovative financial tool that connects borrowers directly with lenders, enabling them to avoid traditional financial institutions. This model offers a unique opportunity for individuals seeking to diversify their investment portfolios while earning interest income from the loans they provide. P2P lending platforms facilitate the process by allowing borrowers to create profiles and specify the amount they wish to borrow.

Lenders can then browse these profiles and choose the borrowers they feel comfortable lending to based on the provided information and their risk assessment. This direct lending approach can yield attractive returns, often higher than those available through conventional savings accounts or bonds.

Understanding the Risks of Peer-to-Peer Lending

Evaluating the risks associated with peer-to-peer lending is essential for making informed investment decisions. While the potential for high returns is appealing, there are several factors that could affect the safety of your investment. To effectively assess the risks, consider the following:

- Creditworthiness of Borrowers: Thoroughly review the credit scores and financial history of potential borrowers. Platforms typically provide a credit rating that reflects the likelihood of repayment.

- Diversification: Spread your investments across multiple loans rather than concentrating on a single borrower. This practice mitigates the impact of default on your overall investment.

- Economic Conditions: Be aware of the broader economic environment, as recessions or downturns can increase borrower defaults.

- Platform Stability: Research the reputation and operational history of the lending platform. Ensure they have appropriate measures in place for loan management and risk assessment.

- Loan Terms: Understand the terms of the loans, including interest rates and repayment schedules, to evaluate their feasibility and your potential return on investment.

Real-life examples can illustrate the variability in borrower reliability. For instance, during the COVID-19 pandemic, many borrowers faced financial difficulties, leading to a spike in defaults on various P2P platforms. This underscores the importance of assessing individual borrower risks in conjunction with prevailing economic conditions.

Reputable Peer-to-Peer Lending Platforms

Several P2P lending platforms have gained recognition for their reliability and user-friendly interfaces. The following examples are notable for their solid track records and commitment to transparency:

- LendingClub: One of the largest and most established P2P lending platforms in the United States, it offers personal loans and small business financing with detailed credit risk assessments.

- Prosper: Prosper allows individuals to invest in personal loans while providing borrowers with competitive rates. The platform offers a range of tools to help lenders assess risk.

- Funding Circle: Focused on small business loans, Funding Circle connects investors with SMEs seeking capital, aiming to foster economic growth.

- Mintos: A European platform that aggregates various loan originators, giving investors access to a diversified portfolio of loans, including personal and business loans.

In conclusion, peer-to-peer lending presents a viable avenue for generating passive income, provided investors approach it with due diligence and an understanding of the associated risks. Selecting reputable platforms and utilizing thorough risk assessment strategies can enhance the chances of a successful lending experience.

The Role of Affiliate Marketing in Generating Passive Income

Affiliate marketing has emerged as a prominent avenue for generating passive income, leveraging the internet’s vast reach to connect consumers with products and services. By promoting these offerings through unique referral links, individuals can earn commissions on sales generated through their marketing efforts. This method not only allows for income generation without the need for product creation but also provides flexibility in how and when one chooses to work.The mechanism of affiliate marketing operates on a revenue-sharing model, whereby affiliates earn a commission for driving traffic or sales to a merchant’s website.

Typically, this process involves four key players: the merchant, the affiliate, the consumer, and the affiliate network. Merchants provide the products or services, affiliates promote them, consumers make purchases, and networks facilitate the relationship by tracking sales and managing payments. Potential earnings can vary significantly, depending on the program structure, product type, and marketing effectiveness. For instance, while some programs offer commissions as low as 5%, others in high-ticket niches can pay affiliates upwards of 50% per sale.

Effective Strategies for Promoting Affiliate Products Online

To successfully promote affiliate products and maximize earnings, employing effective strategies is essential. These strategies not only enhance visibility but also improve conversion rates, thereby increasing potential income. Below are several key approaches to consider:

- Content Marketing: Creating high-quality, valuable content that addresses the needs and interests of your target audience can effectively attract organic traffic. This includes blog posts, videos, and infographics that incorporate affiliate links naturally.

- Email Marketing: Building an email list allows affiliates to directly communicate with potential customers. Sending newsletters that include product recommendations and exclusive offers can drive conversions.

- Social Media Promotion: Leveraging platforms like Instagram, Facebook, and Pinterest to share product reviews and recommendations can significantly expand reach. Engaging with followers and using targeted ads can also enhance visibility.

- Optimization: Implementing search engine optimization techniques can improve the ranking of your content in search engine results, leading to increased traffic. Utilizing relevant s and focusing on user experience are crucial components.

- Webinars and Online Courses: Hosting educational sessions related to the products or services can position you as an authority and build trust with your audience, leading to higher conversion rates.

Common Mistakes to Avoid When Starting with Affiliate Marketing

Entering the world of affiliate marketing can be rewarding, yet it is essential to be aware of potential pitfalls that could hinder success. Recognizing these common mistakes can help aspiring affiliates navigate this landscape more effectively:

- Choosing Irrelevant Products: Promoting products that do not align with your audience’s interests or needs can lead to poor engagement and low conversion rates.

- Lack of Transparency: Not disclosing affiliate relationships can damage credibility with your audience. Transparency is crucial to maintaining trust.

- Neglecting to Track Performance: Failing to monitor metrics such as click-through rates and conversion rates can prevent you from optimizing your strategies and determining what works best.

- Overlooking Audience Engagement: Ignoring feedback and not engaging with your audience can result in missed opportunities for connection and conversion.

- Putting All Eggs in One Basket: Relying solely on one affiliate program can be risky. Diversifying your affiliate partnerships can provide stability and increased earning potential.

Creating a Blog or YouTube Channel for Passive Income: Passive Income Ideas

Establishing a blog or YouTube channel can serve as a lucrative avenue for generating passive income over time. This process involves creating engaging content that attracts an audience, ultimately leading to monetization through various channels such as advertising, sponsorships, and affiliate marketing. The combination of creativity and strategic planning is essential to ensure the longevity and profitability of these platforms.To initiate the establishment of a blog or YouTube channel focused on monetization, it is imperative to select a niche that resonates with both personal interests and market demand.

This selection should be based on thorough research to identify trending topics, audience preferences, and gaps in existing content. Understanding your target audience is crucial as it will guide content creation and marketing strategies.

Monetization Strategies and Content Ideas

A variety of content ideas can lead to passive income through different monetization strategies such as advertising and sponsorships. Creating high-quality, valuable content that attracts viewers or readers is key to success. Here are several effective content ideas to consider:

- Product Reviews: Writing or filming reviews of popular products in your niche can attract both viewers and sponsors. Companies often seek influencers to promote their products in exchange for compensation.

- Tutorials and How-To Guides: Creating instructional content that helps people solve problems or learn new skills can establish authority in your niche, attracting a loyal audience and potential ad revenue.

- Travel Vlogs or Blogs: Sharing travel experiences, tips, and guides can captivate an audience, particularly with the inclusion of affiliate links to travel services or products.

- Lifestyle Content: Covering topics related to health, wellness, or personal finance can engage a broad audience. Sponsored content from brands in these sectors can also provide income.

- Interviews and Guest Appearances: Collaborating with other creators or experts can benefit both parties by expanding reach and attracting new audience segments.

Building an audience and maintaining engagement requires consistent effort and strategic communication. The following approaches can help cultivate a dedicated following:

- Regular Posting Schedule: Consistency in posting new content, whether it’s weekly or bi-weekly, helps keep the audience engaged and encourages return visits.

- Interactive Content: Engaging with the audience through polls, Q&A sessions, or live streams can foster community and encourage viewers to feel invested in the channel or blog.

- Utilizing Social Media: Promoting your blog or YouTube channel across various social media platforms can enhance visibility, attract new followers, and drive traffic to your content.

- Email Newsletters: Building an email list enables direct communication with your audience, providing updates on new content and exclusive insights, which can enhance loyalty.

- Feedback and Adaptation: Encouraging and responding to audience feedback allows for the adjustment of content to better serve viewer preferences, ensuring sustained interest.

In conclusion, the journey of creating a blog or YouTube channel for passive income is a blend of creativity, strategic planning, and audience engagement. By focusing on relevant content and effective monetization strategies, individuals can establish a sustainable source of passive income over time.

Investing in Index Funds for Steady Passive Income

Investing in index funds has gained popularity as a reliable method for generating passive income. Index funds are a type of mutual fund or exchange-traded fund (ETF) that aim to replicate the performance of a specific market index, such as the S&P 500. This approach to investing allows individuals to benefit from the overall growth of the market without the need to actively manage their investments.Index funds serve as a passive investment strategy by providing investors with exposure to a broad spectrum of securities within a particular index.

They are designed to minimize risk through diversification, as they typically consist of many stocks or bonds, reflecting the overall market. Investors can enjoy steady returns over time, as these funds tend to perform in line with market averages.

Advantages of Low Fees and Diversification, Passive income ideas

One significant advantage of index funds is their relatively low fees compared to actively managed funds. Because index funds do not require a team of analysts and managers to make investment decisions, their operating expenses are generally lower. This feature allows investors to keep a more substantial portion of their returns. Additionally, the inherent diversification of index funds helps mitigate risks associated with investing in individual stocks.

By holding a wide array of securities, index funds can reduce the impact of a poor-performing stock on the overall portfolio. Consider the following points regarding low fees and diversification:

- Cost Efficiency: Index funds typically have lower expense ratios, which can lead to higher long-term gains. For example, an actively managed fund may charge 1% or more in fees, while an index fund might only charge 0.1% to 0.5%.

- Broad Market Exposure: Investing in an index fund provides immediate diversification, as your investment is spread across many sectors and companies. This can enhance overall portfolio stability.

- Lower Tax Efficiency: Due to minimal trading activity and lower turnover, index funds often result in fewer capital gains distributions, potentially leading to lower tax liabilities for investors.

Choosing the Right Index Funds

Selecting the appropriate index funds to align with one’s financial goals requires careful consideration. Factors such as investment horizon, risk tolerance, and financial objectives play a critical role in this decision-making process. Investors should evaluate index funds based on several key criteria, including:

- Fund Performance: While past performance is not indicative of future results, reviewing the historical performance of index funds can provide valuable insights into their reliability and consistency.

- Expense Ratio: Lower expense ratios are preferable. A small difference in fees can significantly impact overall returns over the long term.

- Tracking Error: This measures how closely the fund’s performance matches that of the index. A lower tracking error indicates better alignment with the index’s performance.

- Fund Size: Larger funds may benefit from economies of scale, resulting in lower fees and better liquidity.

Investing in index funds is not just a strategy; it’s a way to engage with the market while minimizing costs and maximizing potential returns.

Conclusive Thoughts

In conclusion, passive income ideas provide a compelling array of opportunities for individuals to secure their financial future. Whether through real estate, digital products, or investment strategies, embracing these concepts can lead to a more fulfilling and financially stable life. By taking the first steps toward implementing these ideas, individuals can embark on a rewarding journey toward lasting financial success.

Answers to Common Questions

What is passive income?

Passive income refers to earnings derived from ventures in which a person is not actively involved, such as investments or rental properties.

How can I start generating passive income?

You can start by identifying your interests, researching potential income streams like real estate or digital products, and taking actionable steps to invest time and resources into these areas.

Are there risks associated with passive income?

Yes, like any investment, passive income opportunities carry risks, including market fluctuations, property management challenges, and potential loss of capital.

Can I rely solely on passive income for my living expenses?

While passive income can significantly contribute to your financial stability, it’s advisable to maintain a diversified income strategy for security.

How much time is needed to establish a passive income stream?

The time required varies depending on the income source; some may require considerable effort upfront, while others may offer quicker returns.