Online payment solutions set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The rapid evolution of technology has transformed how we transact online, making it easier for businesses and consumers to engage in commerce. As digital transactions become the norm, understanding the intricacies of online payment solutions becomes essential for both shoppers and sellers.

This discussion will explore the various facets of online payment systems, highlighting their significance in today’s e-commerce landscape.

From secure payment options that instill consumer trust to the rise of mobile payments, this overview will delve into how these solutions have revolutionized shopping experiences. We’ll also touch on the impact of regulations and emerging technologies that are shaping the future of digital transactions. As we navigate through this topic, it’s clear that online payment solutions are not just tools; they are key players in the growth and evolution of e-commerce.

Online payment solutions as a catalyst for e-commerce growth

The evolution of online payment solutions has significantly reshaped the e-commerce landscape, enabling businesses to reach wider audiences while providing consumers with more convenient ways to shop. As these payment options have become increasingly sophisticated, they have not only enhanced transaction efficiency but have also played a crucial role in fostering customer loyalty and driving overall market growth. The surge in e-commerce can be credited to the seamless integration of these payment solutions, which have transformed the shopping experience from traditional methods to a more dynamic and user-friendly approach.The role of secure payment options in building consumer trust cannot be overstated.

Payment security directly impacts a customer’s willingness to engage with an online store. Consumers today are more cautious than ever regarding their financial information due to rising incidents of fraud and data breaches. As a result, e-commerce platforms that offer secure payment solutions are better positioned to cultivate trust and encourage purchases. Secure payment methods, such as encrypted transactions, two-factor authentication, and payment gateways that comply with global security standards, create a sense of safety for consumers.

When shoppers feel secure in their transactions, they are more likely to complete their purchases, leading to higher conversion rates for retailers.Consider the following aspects that highlight the importance of secure payment solutions:

- Increased conversion rates: Research indicates that up to 18% of online shopping carts are abandoned due to concerns over payment security. By reassuring customers through secure payment options, businesses can significantly reduce cart abandonment rates.

- Enhanced customer loyalty: When customers perceive that their financial information is protected, they are more likely to return for future purchases. Reliable payment options foster a sense of loyalty, making consumers more inclined to recommend the platform to others.

- Compliance with regulations: Many regions have strict regulations regarding data protection. E-commerce platforms that utilize secure payment solutions can ensure compliance, avoiding fines and enhancing their reputation in the marketplace.

- Broader market reach: Secure payment options can facilitate international transactions, allowing e-commerce businesses to expand their customer base beyond domestic markets. This globalization of e-commerce further fuels growth.

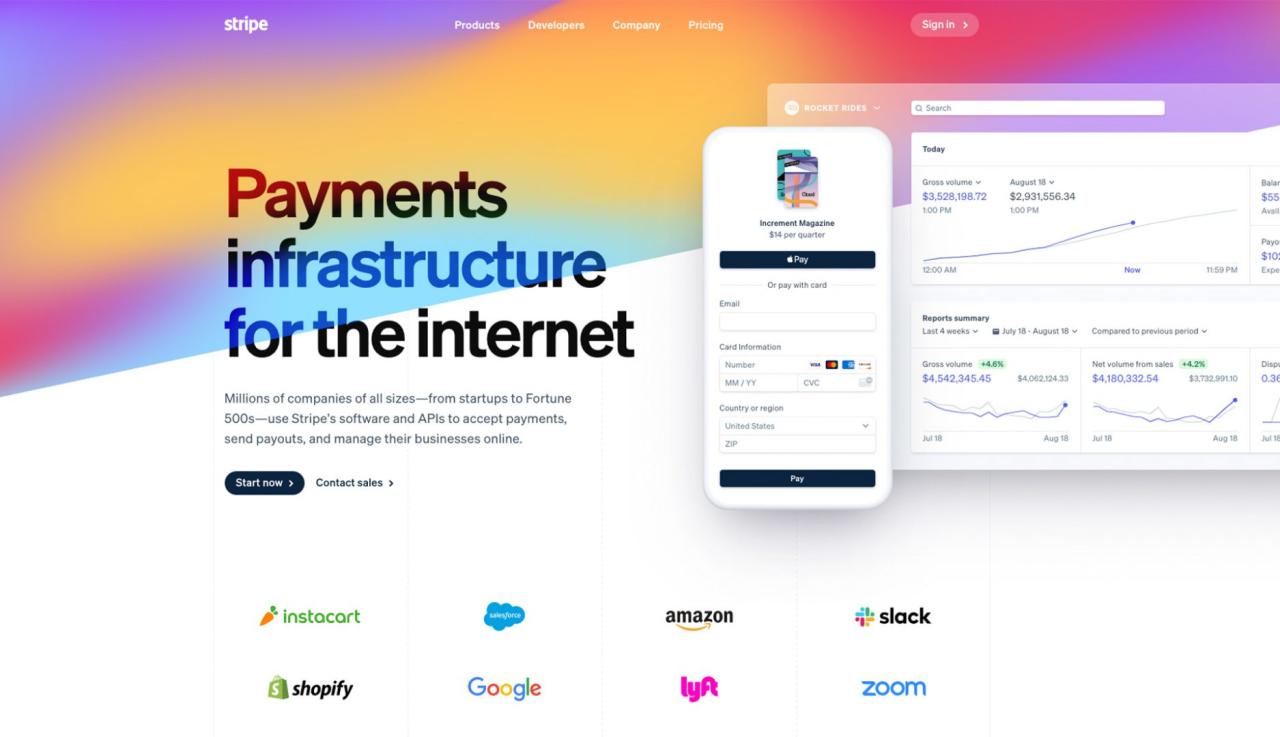

Prominent e-commerce platforms like Amazon and Shopify have effectively implemented secure online payment solutions, illustrating their importance in fostering growth. Amazon’s use of advanced encryption technologies and user-friendly payment interfaces has made it a leader in trustworthiness among consumers. Shopify, on the other hand, provides merchants with a variety of secure payment gateways and fraud detection tools, enabling small businesses to operate confidently in the e-commerce space.

These examples underscore how integrating secure payment solutions not only enhances consumer trust but also acts as a catalyst for e-commerce growth, setting the stage for responsive and profitable digital marketplaces.

The evolution of online payment methods over the last decade

The last decade has witnessed an extraordinary transformation in online payment methods, driven by technological advancements and changing consumer behaviors. The shift from traditional paper-based transactions to digital solutions has revolutionized the way we conduct financial exchanges. This evolution is characterized by increased security, convenience, and the integration of innovative technologies that cater to a diverse range of consumer preferences.Mobile payments have emerged as a significant force in the online payment landscape, rapidly gaining traction among consumers.

The rise of smartphones has played a pivotal role in shaping this trend. Mobile payment solutions, such as Apple Pay, Google Wallet, and various apps like Venmo and Cash App, have made it easier for users to conduct transactions directly from their devices. According to a report by Statista, mobile payment transaction value is projected to exceed $10 trillion globally in 2025, reflecting a dramatic increase in consumer confidence and adoption of this payment method.The implications of mobile payments on consumer behavior are profound.

Firstly, they offer unparalleled convenience; consumers can make purchases at the tap of a finger, eliminating the need to carry cash or cards. This ease of use fosters a culture of impulse buying, as the friction of payment is significantly reduced. Additionally, mobile payments often integrate loyalty programs and discounts, which incentivize users to engage more frequently with brands. As a result, businesses are increasingly adopting mobile payment solutions to enhance customer experience and drive sales.

Key players in the online payment market

The online payment ecosystem is enriched by numerous key players, each contributing to the evolution of payment solutions in unique ways. A brief overview of these influential entities demonstrates their impact on the growth and transformation of online payment methods.

- PayPal: As one of the pioneers in online payments, PayPal offers a secure platform for consumers and merchants alike. Its acquisition of Braintree and Venmo expanded its reach into mobile payments, making it a significant player in the industry.

- Square: Founded by Jack Dorsey, Square revolutionized point-of-sale systems and allowed small businesses to accept card payments easily. Their Cash App further popularized mobile transactions among younger demographics.

- Stripe: Known for its developer-friendly API, Stripe empowers businesses of all sizes to integrate payment processing into their websites and applications seamlessly, promoting innovation in e-commerce.

- Adyen: This global payment company offers a unified payment solution across different channels, enabling merchants to deliver a consistent payment experience to their customers worldwide.

- Apple and Google: With their respective payment platforms, Apple Pay and Google Pay, these tech giants have seamlessly integrated mobile payments into everyday transactions, pushing the adoption rate among consumers significantly.

The impact of online payment solutions on small businesses

Online payment solutions have revolutionized the way small and medium-sized enterprises (SMEs) operate, allowing them to compete on a level playing field with larger organizations. By enabling quick and secure transactions, these solutions have opened up avenues for increased sales, better cash flow, and enhanced customer satisfaction. In a market where every edge counts, embracing online payments can be a game-changer for small businesses.With the rise of e-commerce and digital transactions, SMEs can now reach customers beyond their local markets.

Online payment systems empower small businesses to offer a variety of payment methods, catering to consumer preferences. This flexibility not only boosts customer convenience but also encourages impulse buying, leading to higher conversion rates. Moreover, by integrating payment processing into their websites, small businesses can streamline their operations and reduce overhead costs associated with traditional payment methods.

Success Stories of Small Businesses Utilizing Online Payments

Many small businesses have successfully integrated online payment solutions, transforming their operations and expanding their customer base. For instance, a local bakery, “Sweet Delights,” began offering online ordering and payment options through their website. This shift resulted in a 40% increase in sales within just six months. The bakery now caters to local events and delivers baked goods directly to customers, enhancing their reach without significant overhead costs.Another example is “Tech Gadgets,” a small electronics retailer that integrated a mobile payment solution.

This allowed them to process transactions directly from their store app, providing customers with a seamless shopping experience. As a result, Tech Gadgets saw a 30% increase in foot traffic and repeat customers, as payments became quicker and more convenient.These stories highlight how vital online payment solutions are in empowering small businesses, enabling them to enhance their operations and drive growth.

Comparison of Online Payment Options for Small Businesses

When selecting an online payment solution, small businesses have various options tailored to their specific needs. Understanding these options can guide SMEs to make informed decisions that align with their operational goals.

| Payment Solution | Key Features | Best For |

|---|---|---|

| PayPal | Wide acceptance, seller protection, easy integration | Businesses needing a quick setup |

| Square | POS system, inventory management, mobile payments | Retailers and service providers |

| Stripe | Customizable API, subscription billing, fraud protection | Online businesses and startups |

| Shopify Payments | Integrated with Shopify store, multi-currency support | E-commerce businesses |

| Authorize.Net | Recurring billing, fraud detection, extensive reporting | Established businesses with complex needs |

This comparison provides a glimpse into the variety of online payment solutions available, helping small businesses choose the right platform to boost their operations and enhance customer experience.

Challenges faced by consumers in using online payment solutions

As online payment solutions become increasingly popular, consumers face a range of challenges that can complicate their purchasing experiences. Understanding these issues is essential for navigating the digital marketplace securely. Common concerns include transaction security, identity theft, and the complexity of various payment options available. Users often feel overwhelmed by the number of platforms and the differences in security measures they employ, which can deter them from fully embracing online payments.One of the most pressing concerns for consumers revolves around security.

With the rise of cybercrime, the importance of educating consumers about security measures and fraud prevention cannot be overstated. Many users remain unaware of the risks associated with online transactions, making them vulnerable to scams and data breaches. It’s vital for consumers to understand that while online payment platforms implement robust security protocols, individual responsibility plays a significant role in safeguarding personal information.

Educating consumers about the importance of strong passwords, recognizing phishing attempts, and the necessity of two-factor authentication can greatly reduce the likelihood of falling victim to fraud.Moreover, consumers should be informed about the implications of using unsecured networks, such as public Wi-Fi, when making payments. Transactions conducted over these networks can easily be intercepted by malicious actors. Regularly monitoring bank statements and reporting unauthorized transactions immediately is also crucial.

By fostering an understanding of these security measures, consumers can approach online payments with greater confidence and awareness.

Best practices for online payments

Implementing best practices when making online payments can significantly enhance security and reduce the risk of fraud. Below is a list of essential practices that consumers should follow:

- Always use secure and reputable payment platforms; look for HTTPS in the website URL.

- Create strong, unique passwords for each payment account and update them regularly.

- Enable two-factor authentication wherever possible to add an extra layer of security.

- Avoid using public Wi-Fi for online transactions; opt for a secure, private connection.

- Keep software and antivirus programs updated to protect against malware.

- Regularly check bank statements and online accounts for any unauthorized charges.

- Be wary of unsolicited emails or messages asking for personal information or payment details.

“An ounce of prevention is worth a pound of cure.”

By adhering to these practices, consumers can significantly mitigate risks and enjoy a safer online shopping experience.

The role of regulatory frameworks in shaping online payment solutions

The development of online payment solutions is significantly influenced by government regulations that aim to ensure the security and stability of financial systems. Regulatory frameworks serve as the backbone for establishing trust and safety within digital transactions, which has become increasingly paramount in our cashless society. They not only provide guidelines for compliance but also shape the evolution of payment technologies, balancing innovation with consumer protection.Government regulations play a crucial role in the development and security of online payment systems.

They establish a set of rules that ensure that payment processors, financial institutions, and vendors adhere to standards that protect user data and prevent fraud. This is particularly important given the rise in cyber threats and data breaches that have targeted online payment platforms. Regulatory bodies, such as the Payment Card Industry Security Standards Council (PCI SSC) and various national financial authorities, set stringent security requirements that online payment solutions must comply with.

These regulations require businesses to implement advanced security measures, such as encryption, tokenization, and secure authentication protocols, making it more challenging for cybercriminals to exploit vulnerabilities.

Balance between innovation and compliance

In the ever-evolving landscape of digital transactions, companies must navigate a delicate balance between fostering innovation and adhering to regulatory compliance. The push for groundbreaking payment technologies, such as cryptocurrencies and blockchain solutions, often encounters regulatory hurdles that can stifle creativity. While regulations are essential for safeguarding consumer interests, they can also slow down the pace of innovation as companies work to align their technologies with compliance requirements.The importance of this balance is evident in various case studies from around the world.

For instance, in the European Union, the implementation of the Revised Payment Services Directive (PSD2) has revolutionized online payments by promoting open banking, allowing third-party providers to access customer bank data with permission. This has spurred innovation by enabling new payment solutions and services while ensuring that stringent consumer protection measures are in place.Conversely, in the United States, the lack of a unified regulatory framework for cryptocurrencies has led some states to create their own regulations, resulting in a fragmented approach.

This inconsistency can create uncertainty for companies looking to innovate within the space, as they face varying compliance requirements across state lines. In Asia, countries like Singapore have taken a proactive approach by establishing clear guidelines for digital payments, encouraging the growth of fintech while maintaining consumer protection. The Monetary Authority of Singapore (MAS) has launched the Payments Services Act, which streamlines regulatory requirements for different payment activities.

This regulatory clarity fosters an environment conducive to innovation while also ensuring that companies prioritize security and compliance.As businesses develop online payment solutions, it is imperative they stay informed about the regulatory landscape. Engaging with regulators and participating in industry discussions can help companies anticipate changes and adapt their solutions accordingly. Ultimately, navigating the relationship between innovation and compliance requires a strategic approach to stay ahead of the competition while ensuring consumer trust and safety.

Future trends in online payment technologies

The landscape of online payment technologies is rapidly evolving, driven by advancements in various fields, particularly blockchain and artificial intelligence (AI). As consumers demand faster, more secure, and more efficient payment options, these emerging technologies hold the potential to significantly transform how digital transactions are conducted. The integration of such innovations can streamline processes, enhance security, and improve user experiences in the payment ecosystem.

Blockchain technology, primarily known for its role in cryptocurrencies, is increasingly being leveraged in online payments for its decentralized and secure nature. By utilizing blockchain, transactions can occur without intermediaries, reducing costs and transaction times. AI, on the other hand, is revolutionizing payment solutions by enabling personalized customer experiences, real-time fraud detection, and predictive analytics for spending behaviors. The combination of these technologies could ultimately lead to a more seamless, efficient, and secure payment process.

Anticipated features in upcoming payment solutions

As these trends unfold, several anticipated features are likely to emerge in the realm of online payment solutions. Understanding these features can give stakeholders insight into how the payment landscape will shift in the near future.

The integration of blockchain and AI into payment solutions is expected to produce a range of innovative features, including:

- Decentralized Finance (DeFi) Options: Payment solutions may integrate DeFi platforms, allowing users to access financial services without traditional intermediaries, significantly lowering costs and increasing transaction speeds.

- Enhanced Security Protocols: Blockchain’s inherent security features, combined with AI-driven anomaly detection, will provide heightened security against fraud and cyber threats, ensuring safer transactions for users.

- Instant Settlements: Leveraging blockchain technology can enable instant payment settlements, reducing the time from transaction to fund availability to mere seconds.

- Personalized User Experiences: AI algorithms can analyze user behavior to tailor payment solutions according to individual needs, offering customized promotions and loyalty rewards.

- Smart Contracts: These self-executing contracts with the terms directly written into code can automate transactions, reducing the need for manual processing and increasing operational efficiency.

- Multi-Currency and Cross-Border Transactions: Blockchain applications can facilitate seamless cross-border payments and currency conversions, making international transactions simpler and more cost-effective.

- Integrated Biometric Authentication: Future solutions may incorporate biometric verification methods, such as fingerprint or facial recognition, to enhance user security and streamline the authentication process.

These anticipated features reflect a significant shift towards more secure, efficient, and user-centric payment solutions, driven by the latest technological advancements. As adoption accelerates, stakeholders must stay informed and adaptive to leverage these emerging trends effectively.

The importance of user experience in online payment processing

In the realm of online commerce, the user experience (UX) during payment processing plays a pivotal role in influencing customer behavior and overall satisfaction. A well-designed user interface (UI) combined with intuitive navigation can significantly enhance the likelihood of customers completing their purchases. Consumers today expect seamless and hassle-free experiences, and any friction during the payment process can lead to cart abandonment, lost sales, and diminished brand loyalty.Effective UI design focuses on clarity and simplicity.

When customers encounter a payment page that is cluttered or confusing, their confidence in the transaction diminishes. On the other hand, a clean, user-friendly interface can create a sense of security and ease, encouraging users to proceed with their purchases. The navigation experience, from selecting a payment method to entering billing information, should be streamlined to minimize any potential barriers.

Connection between user experience and conversion rates in e-commerce

User experience directly impacts conversion rates in e-commerce, as a positive experience can significantly increase the likelihood of customers completing their purchases. Studies indicate that a well-optimized payment interface can boost conversion rates by up to 30% or more. This correlation stems from several key factors that influence how users interact with payment solutions.First, the speed of the checkout process is paramount.

Consumers are often discouraged by lengthy, complicated payment procedures. Research shows that reducing the number of steps in the checkout process leads to higher conversion rates. For instance, services like Amazon have implemented single-click purchasing options that allow users to finalize transactions with minimal effort, contributing to their high conversion rates.Second, trust and security are critical components of user experience.

An intuitive payment interface should prominently display trust signals, such as SSL certificates and recognizable payment option logos. Such indicators reassure customers that their personal and financial information is secure. Brands like PayPal have effectively communicated security measures, which has bolstered user confidence and increased usage rates.A study conducted by Baymard Institute highlighted that 69.57% of online shoppers abandon their carts primarily due to a complicated checkout process.

Simplifying the user journey by reducing unnecessary fields and providing auto-fill options for returning customers can significantly enhance the overall experience. Moreover, mobile responsiveness plays a crucial role, as many consumers now shop via their smartphones. Companies like Shopify have developed mobile-optimized payment solutions that offer users a seamless transition from browsing to purchasing on mobile devices, leading to higher conversion rates.In summary, the user experience in online payment processing is not just about aesthetics; it is a critical factor that influences conversion rates and overall customer satisfaction.

Companies that prioritize user-centric design and streamline their payment processes can see measurable increases in sales and customer loyalty, proving the importance of investing in user experience within the e-commerce landscape.

Cross-border online payment solutions and their significance

In today’s interconnected digital marketplace, cross-border online payment solutions play a crucial role in facilitating global commerce. As businesses expand beyond their local markets, they encounter unique challenges associated with international transactions. These challenges range from currency conversion issues to compliance with local regulations, all of which can hinder seamless business operations. Understanding these challenges and implementing effective solutions is essential for companies looking to tap into the vast potential of international markets.Conducting transactions across borders often involves navigating various complexities.

One major challenge is currency exchange; fluctuations in exchange rates can significantly impact the final amount received by vendors and consumers alike. Moreover, different countries have their own regulations regarding payment processing and data protection, complicating compliance efforts for businesses. Additionally, customers may face barriers related to payment methods accepted in their region, causing friction in the purchasing process. To address these challenges, companies can leverage various strategies, including adopting multi-currency payment gateways, partnering with local payment providers, and implementing robust fraud detection systems to protect against cross-border transaction risks.

Adapting payment solutions for international customers

To effectively cater to international customers, businesses must consider a range of factors when adapting their payment solutions. Understanding regional preferences and behaviors is vital for creating a seamless payment experience. This involves accepting various payment methods popular in different countries, such as digital wallets, bank transfers, and local credit cards. Furthermore, companies should ensure that their websites and payment processes are localized, including language and currency options, to enhance customer trust and convenience.Providing transparency regarding fees and exchange rates can also foster customer confidence.

Hidden charges can deter potential buyers, so clear communication about costs associated with cross-border transactions is essential. Additionally, businesses can improve their payment solutions by integrating features that support mobile transactions, as mobile commerce continues to rise globally. Here is a comparison of different cross-border payment solutions available today:

| Payment Solution | Supported Currencies | Transaction Fees | Settlement Time |

|---|---|---|---|

| PayPal | Over 100 | 2.9% + fixed fee | Instant |

| Stripe | Over 135 | 2.9% + 30¢ | 2-7 days |

| TransferWise (Wise) | 50+ | 0.5% – 2% | 1-2 working days |

| Payoneer | Over 150 | 1% to 3% per transaction | 1-3 days |

| Adyen | Over 200 | Variable based on methods | 1-2 days |

By carefully considering these aspects and selecting appropriate cross-border payment solutions, businesses can not only enhance their customer experience but also establish a strong global presence. Adapting to the evolving landscape of international payments is essential for sustained growth in the global marketplace.

Last Recap

In conclusion, online payment solutions are at the forefront of an exciting transformation within the e-commerce realm. As businesses adapt to new technologies and customer preferences, the importance of providing secure, efficient, and user-friendly payment options cannot be overstated. The challenges and innovations discussed reveal a dynamic landscape where success hinges on understanding consumer needs and regulatory requirements. As we look to the future, it is evident that the ongoing evolution of online payment solutions will continue to shape the shopping experience, making it more accessible and seamless for everyone involved.

FAQ

What are online payment solutions?

Online payment solutions refer to digital systems that allow consumers to make payments over the internet, using various methods such as credit cards, mobile wallets, and bank transfers.

How do online payment solutions enhance security?

They employ advanced encryption technologies, fraud detection systems, and secure server protocols to safeguard sensitive financial information during transactions.

Are online payment solutions suitable for small businesses?

Yes, they are often designed to be user-friendly and affordable, empowering small businesses to accept payments and compete effectively in the market.

What should consumers consider when choosing a payment solution?

Consumers should look for security features, transaction fees, ease of use, and the availability of customer support when selecting an online payment solution.

How can businesses improve their online payment process?

By optimizing their payment interfaces, providing clear instructions, and ensuring mobile compatibility to enhance user experience and reduce cart abandonment rates.