Navigating the financial landscape can be a daunting task, but a net worth calculator makes it simpler and more manageable. This tool is designed to help individuals assess their financial health by providing a clear snapshot of their assets and liabilities. Understanding your net worth is crucial as it serves as a benchmark for your financial progress and helps you make informed decisions about spending, saving, and investing.

By calculating your net worth, you can track how your financial situation evolves over time and gain insights into where you stand in relation to your financial goals. This process not only enhances your awareness of your overall financial picture, but it also empowers you to take control of your finances with greater confidence and clarity.

Understanding the Concept of a Net Worth Calculator

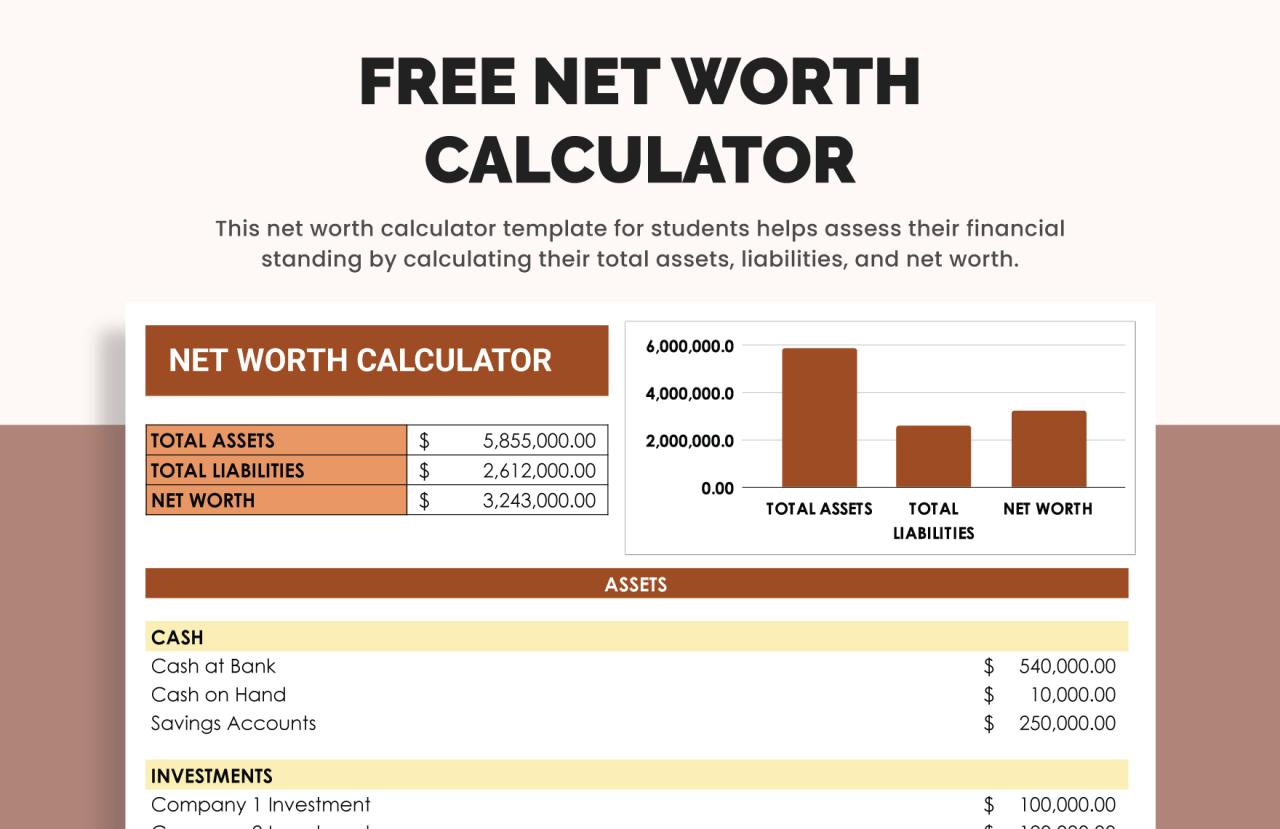

A net worth calculator serves as a vital tool in personal finance management. It enables individuals to assess their financial health by providing a clear picture of their assets and liabilities. Understanding one’s net worth is crucial as it helps in setting financial goals, planning for retirement, and making informed investment decisions. Essentially, a net worth calculator simplifies the process of evaluating personal wealth over time, enabling better financial planning and management.To calculate net worth, one must determine the total value of assets, subtracting the total liabilities.

This straightforward calculation provides insight into the financial standing of an individual or household. A positive net worth indicates that assets exceed liabilities, suggesting financial stability, while a negative net worth reveals that liabilities surpass assets, potentially indicating financial distress.

Assets and Liabilities in Net Worth Calculation

When calculating net worth, it’s essential to include a comprehensive list of both assets and liabilities. Assets are anything of value that one owns, while liabilities are debts or obligations one owes. Understanding the distinction between these categories is necessary for an accurate net worth assessment.The following are examples of assets that should be considered in the calculation:

- Cash and Cash Equivalents: This includes money in checking and savings accounts.

- Investments: Stocks, bonds, mutual funds, and retirement accounts, like a 401(k) or IRA.

- Real Estate: The market value of any residential or commercial properties owned.

- Personal Property: Items such as vehicles, jewelry, and valuable collectibles.

- Other Assets: Business ownership or other income-generating assets.

In contrast, liabilities encompass various forms of debt that must be accounted for in the calculation:

- Mortgages: Any outstanding balances on home loans.

- Car Loans: Remaining amounts owed on financed vehicles.

- Credit Card Debt: Total outstanding balances on credit cards.

- Student Loans: Remaining balances on any educational loans.

- Other Liabilities: Any other debts or obligations, such as personal loans or medical bills.

By clearly distinguishing between these two categories, individuals can accurately determine their net worth, facilitating better financial decisions and strategies for wealth accumulation. This holistic view of one’s financial situation is essential for effective personal finance management.

The Benefits of Using a Net Worth Calculator

Tracking your net worth is a crucial part of managing your finances effectively. It gives you a clear picture of your financial health by comparing your assets to your liabilities. By regularly calculating your net worth, you can identify trends in your financial status, helping you make informed decisions about spending, saving, and investing. Using a net worth calculator simplifies this process, making financial tracking not just easier but also more accurate.A net worth calculator helps individuals and families in financial planning and budgeting by providing a comprehensive overview of their financial situation.

It allows users to input various assets such as cash, investments, and real estate, while also accounting for liabilities like loans and mortgages. This tool presents the information in a digestible format, making it easier to see where you stand financially at any given moment. By regularly updating this information in the calculator, you can set realistic financial goals, monitor your progress over time, and adjust your budget accordingly.

Comparison of Manual Calculations and Online Tools

While calculating net worth manually can be done using a simple formula— Net Worth = Assets – Liabilities—this method is often prone to errors and can become cumbersome, especially as financial situations grow in complexity. There are numerous advantages to utilizing an online calculator compared to manual calculations:

1. Time Efficiency

Online calculators often require you to input data once, automatically calculating your net worth. This saves time compared to manually adding and subtracting each line item.

2. Accuracy

Automated calculations reduce the risk of human error. Mistakes in accounting for debts or assets can lead to inaccurate reporting of your net worth, which can mislead your financial decisions.

3. Comprehensive Analysis

Many online calculators provide additional insights, such as trends in your net worth over time, helping you visualize financial growth or decline.

4. User-Friendly Interface

Most calculators come with easy-to-navigate dashboards, offering a more engaging way to interact with your financial data compared to spreadsheets or pen-and-paper methods.

5. Integration with Financial Tools

Some advanced calculators link directly with your bank accounts or investment platforms, allowing for real-time updates on your net worth as your financial circumstances change.By leveraging these advantages, individuals can manage their finances with greater accuracy and clarity, ensuring more informed financial decisions. Utilizing a net worth calculator, instead of manual calculations, leads to a streamlined process that enhances financial literacy and proactive financial management.

Different Types of Net Worth Calculators Available

Net worth calculators are essential tools for individuals seeking to understand their financial health. These calculators can provide insights into assets, liabilities, and overall wealth. With the rise of technology, various types of net worth calculators have emerged, catering to different user needs and preferences. From mobile apps to online tools, the diversity in functionalities allows users to track their progress toward financial goals effectively.

Categories of Net Worth Calculators

Different types of net worth calculators can be categorized based on features and user-friendliness. Understanding these categories can help users select the right tool for their financial planning. Below is a table that Artikels various types of calculators, highlighting their key features:

| Calculator Type | Features | User-Friendliness |

|---|---|---|

| Mobile Apps | Track assets and liabilities, real-time updates, expense tracking | Highly user-friendly, accessible, often with intuitive designs |

| Online Tools | Comprehensive financial analysis, graphs and charts, export options | Moderately user-friendly, may require more navigation |

| Spreadsheet Templates | Customizability, manual input, allows for detailed breakdowns | Less user-friendly, requires knowledge of spreadsheet software |

| Financial Planning Software | Integrated planning tools, investment tracking, forecasting | Can be complex, suited for advanced users |

Many popular calculators showcase unique functionalities that set them apart. For instance, Personal Capital offers a robust online tool that integrates with bank accounts to provide real-time net worth updates and investment tracking. In contrast, Mint serves as a mobile app that combines budgeting and net worth calculation, allowing users to view their financial status seamlessly. Another example is YNAB (You Need A Budget), which emphasizes budgeting while also providing insights into net worth through its app.

Each of these tools not only calculates net worth but also serves as a comprehensive financial management solution, catering to diverse user needs and preferences.

How to Use a Net Worth Calculator Effectively

Using a net worth calculator is an excellent way to gain insight into your financial health. It allows you to see the big picture of your assets versus liabilities and helps you make informed decisions regarding your finances. However, to get the most accurate results, it’s essential to understand how to use the calculator effectively.The calculation process involves several essential steps, and being prepared with the necessary information is crucial.

Below is a step-by-step guide to help you navigate through it seamlessly.

Step-by-Step Guide to Using a Net Worth Calculator

Follow these steps carefully to ensure an accurate net worth calculation:

1. Gather Financial Information

Collect data regarding all your assets and liabilities. This includes anything of value that you own, as well as debts or obligations you owe.

2. List Your Assets

Write down everything you own that has monetary value. Common assets include:

Cash and cash equivalents (savings accounts, checking accounts)

Investments (stocks, bonds, mutual funds)

Real estate (home, rental properties)

Personal property (vehicles, jewelry, valuable collectibles)

3. List Your Liabilities

Next, document all your debts. This includes: – Mortgages

Student loans

Credit card debts

Personal loans

4. Input Your Data

Using the net worth calculator, enter the total value of your assets and liabilities. Most calculators will prompt you to input these figures separately.

5. Calculate Your Net Worth

Subtract your total liabilities from your total assets. The formula looks like this:

Net Worth = Total Assets – Total Liabilities

6. Review and Analyze

Once you have your net worth figure, take the time to analyze what it means for your financial situation and future goals.

Checklist of Information Needed

Before starting the calculation process, ensure you have the following information readily available:

Assets

Total cash (bank accounts)

Value of investments

Current market value of real estate

Estimated value of personal property –

Liabilities

Remaining mortgage balance

Total student loan balance

Outstanding credit card debt

Other personal loan amounts

Having these details organized will streamline the calculation process and yield accurate results.

Common Mistakes to Avoid

While using a net worth calculator, it’s important to be aware of common pitfalls that can result in inaccurate calculations:

Overlooking Assets

Many people forget to include all their assets, such as collectibles or secondary properties. Make sure to consider everything of value.

Underestimating Liabilities

It’s easy to overlook small debts, but these can add up. Include all liabilities for a true picture of your net worth.

Using Outdated Values

Ensure that the values you input are current. For instance, property values can fluctuate, so research the latest estimates.

Inconsistent Accounting

Use consistent valuation methods for both assets and liabilities. For example, if you’re estimating real estate value, use the same approach for similar properties.

Neglecting to Update Regularly

Your net worth is not static. Regular updates to the calculator can reflect your financial progress or setbacks.By following this structured approach and being mindful of common mistakes, you can effectively use a net worth calculator to track your financial journey and make informed decisions moving forward.

Tracking Changes in Net Worth Over Time

Monitoring your net worth is an essential practice for anyone looking to maintain or improve their financial health. By regularly assessing your net worth, you can gain insights into your financial progress, identify areas for improvement, and make informed decisions about spending and saving. This process involves more than just a yearly check-in; it requires a systematic approach to track changes over time.To effectively track and interpret changes in your net worth, you’ll want to establish a clear baseline.

Start by listing all your assets, such as cash, investments, real estate, and personal property, along with any liabilities, including loans, credit card debt, and mortgages. Subtract your total liabilities from your total assets to calculate your net worth. Regular updates are crucial; many financial experts recommend reviewing your net worth quarterly or at least semi-annually. This frequency allows you to notice trends and react accordingly without making the process feel overwhelming.

Significance of Regular Updates to Net Worth

Regularly reviewing your net worth helps you stay accountable to your financial goals and provides a clear picture of your financial situation. It enables you to assess your progress toward long-term objectives, such as retirement savings or purchasing a home. The following points illustrate the importance of routine updates:

- Identifying financial trends: Regularly tracking your net worth reveals patterns and trends that can speak volumes about your financial health. For instance, a consistent rise in net worth indicates effective management of assets and liabilities.

- Adjusting financial strategies: If you notice a decline in your net worth, it may prompt a reassessment of spending habits or investment choices, allowing for timely adjustments.

- Encouraging fiscal discipline: Frequent updates can motivate you to stick to budgets and savings plans, reinforcing positive financial behaviors.

- Preparing for significant life events: Keeping a close eye on your net worth helps you prepare for life changes, such as starting a family or retirement, by ensuring you’re on track financially.

Interpreting trends in your net worth can provide insights into your overall financial health. For example, if your net worth is increasing due to rising asset values, it may indicate sound investment choices. Conversely, if your liabilities are growing faster than your assets, it might signal financial strain.

“Understanding your net worth is like having a financial GPS—it shows you where you are and helps you navigate where you want to go.”

In practical terms, you might set up a simple spreadsheet to track your net worth over time. Include columns for the date, assets, liabilities, and net worth. By visualizing your financial journey through graphs or charts, you can more easily spot trends and make informed decisions. For instance, if you see your net worth spike after a significant investment, it may encourage you to pursue similar opportunities.

Conversely, if you notice a downturn during a particular period, you can investigate the reasons and make corrections.By establishing a routine that incorporates these strategies for tracking your net worth, you’ll not only gain clarity about your financial situation but also empower yourself to make better financial decisions as you move forward.

The Role of Net Worth in Financial Decision-Making

Understanding net worth is essential for individuals making significant financial decisions. Net worth, defined as the difference between total assets and total liabilities, provides a clear snapshot of financial health. It serves as a benchmark that individuals can refer to when contemplating major purchases or investments. Knowing one’s net worth helps to not only set financial goals but also to understand the implications of those decisions on overall financial stability.When it comes to making major purchases, such as buying a home, net worth plays a pivotal role.

Lenders typically evaluate an individual’s net worth alongside their income to determine their ability to repay loans. A higher net worth may lead to more favorable loan terms, including lower interest rates, because it indicates a greater capacity to handle debt. Conversely, if an individual has a low net worth, lenders may perceive them as a higher risk, which can lead to higher interest rates or even loan denials.

Net Worth and Credit Scores in Loans and Mortgages

The relationship between net worth and credit scores becomes particularly relevant in the context of loans and mortgages. A good credit score is generally a reflection of an individual’s financial behavior, including payment history and credit utilization, while net worth provides a broader view of overall financial health. High net worth can positively influence credit scores; individuals with more assets may be in a better position to pay off debts, resulting in a more robust credit profile.For instance, a person with a net worth of $500,000 and an excellent credit score of 750 may find it easier to secure a mortgage for a new home compared to someone with a net worth of $50,000 and a credit score of 600.

Lenders often use both metrics to gauge risk. Scenarios arise where net worth calculations impact personal financial choices significantly. Consider a couple looking to buy their first home. They have a net worth of $100,000, primarily in savings and investments. This net worth gives them confidence to approach lenders for a mortgage.

On the other hand, if they had a net worth of $10,000, they might reconsider the price range of homes they are willing to buy or delay the purchase until they can increase their net worth. Similarly, someone contemplating investing in a business may analyze their net worth to determine how much risk they can afford to take. If they find themselves with a negative net worth, they might decide to focus on paying down debts before engaging in new investments.

In summary, the interplay of net worth and financial decision-making is vital. It’s not just about how much money one has but understanding the broader financial picture that influences the ability to make informed decisions.

Advanced Features of Premium Net Worth Calculators

Premium net worth calculators offer a suite of advanced features that significantly enhance the user experience compared to their free counterparts. While free calculators may provide basic calculations, premium services typically incorporate a range of functionalities that address various financial needs and offer deeper insights into financial health. This added value is especially beneficial for users seeking to make informed financial decisions.One of the most notable distinctions between subscription-based services and free tools is the level of detail and personalization available.

Premium calculators often allow users to integrate various financial accounts, including bank accounts, investments, and liabilities, into one cohesive platform. Additionally, they can generate personalized reports and projections based on user-defined financial goals. These reports can illustrate potential growth over time, helping users understand the impact of their financial decisions. Furthermore, premium calculators typically come with enhanced security features, ensuring sensitive financial data is protected.

Users gain access to customer support, often with financial advisors available to provide insights and answer questions. This support can be invaluable for individuals navigating complex financial situations.

Advanced Features Enhancing Financial Tracking

The following list highlights key advanced features offered by premium net worth calculators that can significantly improve the tracking of financial health:

- Account Aggregation: Seamlessly link multiple financial accounts for a consolidated view of your net worth.

- Personalized Financial Reports: Generate tailored reports that detail asset allocation, investment performance, and liability management.

- Goal Setting Tools: Set specific financial goals with tracking features to monitor progress toward achieving them.

- Risk Assessment Tools: Analyze investment risks and financial exposure based on current holdings and market conditions.

- Projection Modeling: Use various scenarios to project future net worth based on different investment strategies and saving habits.

- Tax Impact Analysis: Assess the potential tax implications of financial decisions and strategies.

- Debt Management Features: Tools that help manage and strategize debt repayment effectively.

- Mobile Access: Access your financial data on-the-go through mobile apps, ensuring you stay updated at all times.

- Financial Education Resources: Access articles, videos, and tutorials that enhance financial literacy and decision-making.

- Regular Updates and Insights: Receive timely updates on market trends and personalized insights to guide investment decisions.

These features not only enhance the usability of net worth calculators but also empower users to take charge of their financial future with greater confidence. Investing in a premium calculator can provide valuable tools tailored to individual financial journeys.

Common Misconceptions About Net Worth Calculators

When it comes to understanding personal finance, net worth calculators can be invaluable tools. However, several misconceptions surround their use, which can skew individuals’ financial perspectives. It’s crucial to address these misunderstandings to ensure that users can leverage these calculators effectively.

Misconceptions About Net Worth Calculators

Many people hold onto myths regarding net worth calculators that influence their financial decision-making. Clarifying these misconceptions can lead to better financial management and healthier financial habits. Here are three common misconceptions:

- Net worth calculators provide an exact figure. Many individuals believe that the number generated by a net worth calculator is definitive. In reality, these calculators offer estimates based on the information provided. Since assets and liabilities can fluctuate, the calculated net worth is a snapshot in time, not a precise measure.

- Net worth reflects overall financial health. A common belief is that a high net worth directly correlates to financial security. However, net worth does not consider cash flow, debt management, or financial obligations. Individuals with a high net worth may still struggle with liquidity or ongoing expenses that impact their financial stability.

- Only wealthy individuals need to calculate net worth. Some think that net worth calculators are only useful for the affluent. In truth, anyone can benefit from understanding their net worth, regardless of their financial status. Tracking net worth helps individuals identify their financial progress, set realistic financial goals, and improve their financial literacy.

These misconceptions can significantly impact how individuals view their financial situation. For instance, relying on the net worth figure without understanding its context can lead to misguided financial decisions or stress. To counter these misconceptions, it’s essential to remember the following factual statements:

Net worth figures are estimates that can vary over time based on market conditions and personal circumstances.

Financial health encompasses a broader spectrum than just net worth, including income stability and expense management.

Calculating net worth is a beneficial practice for everyone, as it provides insights into one’s financial journey and potential areas for improvement.

Closure

In conclusion, utilizing a net worth calculator is an invaluable step towards improving your financial literacy and decision-making. By regularly monitoring your net worth, you can identify trends, set goals, and make adjustments that will ultimately lead to a stronger financial future. Embracing this tool will not only illuminate your current financial standing but also provide a roadmap for achieving your long-term aspirations.

FAQ Summary

What is a net worth calculator used for?

A net worth calculator is used to assess the financial health of an individual by calculating the total value of assets minus liabilities.

Can I use a net worth calculator on my phone?

Yes, many net worth calculators are available as mobile apps, making it easy to calculate your net worth on the go.

How often should I update my net worth?

It’s recommended to update your net worth at least once a year or whenever there are significant changes in your assets or liabilities.

Is it necessary to include all of my assets?

Yes, including all assets provides the most accurate picture of your financial situation. This includes real estate, savings, investments, and personal property.

Can a net worth calculator help with budgeting?

Absolutely! By understanding your net worth, you can better allocate resources and create a budget that supports your financial goals.