Financial planning is a crucial aspect of managing your personal finances effectively. It goes beyond just budgeting; it’s about creating a roadmap to achieve your financial goals, whether they’re short-term or long-term. By understanding the fundamentals of financial planning, you empower yourself to make informed decisions, allocate resources wisely, and ultimately secure a stable financial future.

A comprehensive financial plan encompasses various components, including budgeting, investment strategies, insurance, emergency funds, tax implications, and retirement planning. Each of these elements plays a significant role in ensuring that you are prepared for life’s uncertainties and can enjoy the fruits of your labor down the line.

Understanding the Fundamentals of Financial Planning

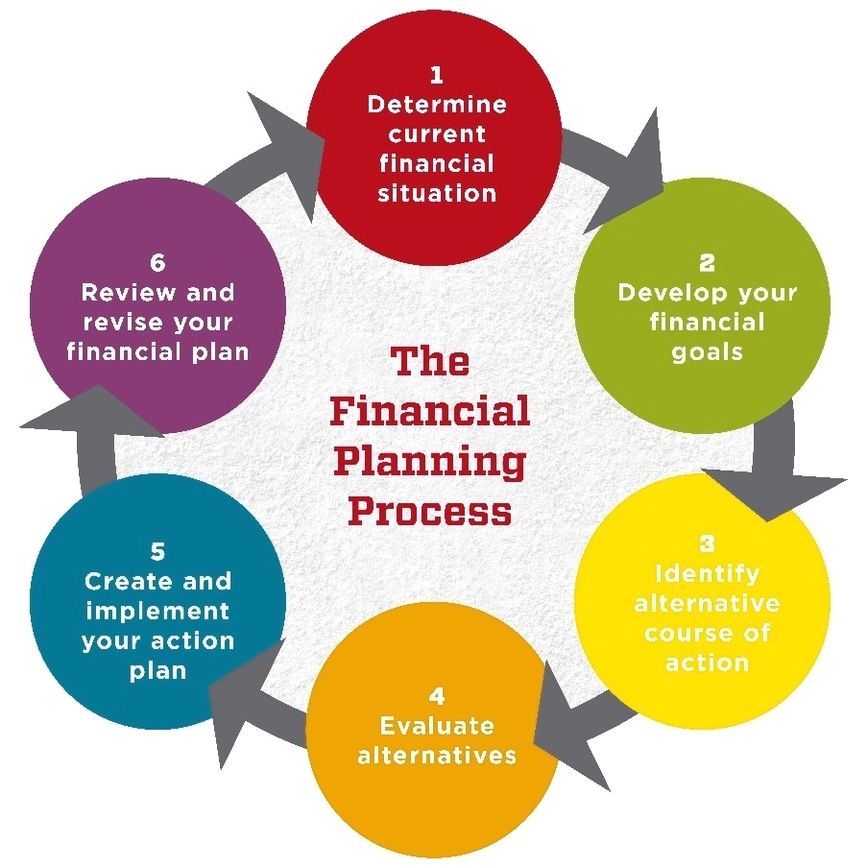

Financial planning is a systematic approach to managing one’s finances to achieve specific life goals. It involves evaluating your current financial situation, setting goals, and creating strategies to achieve those goals efficiently. In personal finance management, financial planning is crucial as it helps individuals make informed decisions regarding spending, saving, and investing. By understanding financial planning, individuals can secure their future, manage risks, and optimize their resources.A comprehensive financial plan covers various components that work together to provide a holistic view of one’s financial health.

These components include budgeting, saving, investing, tax planning, risk management through insurance, retirement planning, and estate planning. Each element serves a distinct purpose while interlinking with others to ensure a balanced financial strategy.

Components of a Comprehensive Financial Plan

The components of a comprehensive financial plan are essential for understanding one’s financial landscape. Each of these components contributes critical insights and strategies that aid in achieving both short-term and long-term financial goals.

1. Budgeting

This serves as the foundation of effective financial management. A well-structured budget allows individuals to track income and expenses, ensuring that spending aligns with financial goals.

2. Saving

Setting aside funds for emergencies, major purchases, or future investments is crucial. An emergency fund is particularly important for handling unforeseen circumstances.

3. Investing

Investing in stocks, bonds, or mutual funds helps in wealth accumulation over time. Understanding risk tolerance and investment horizons is vital in this component.

4. Tax Planning

Effective tax planning minimizes tax liabilities and maximizes returns, allowing individuals to keep more of their earnings.

5. Risk Management

Insurance products protect against financial risks associated with health, property, and life events. Proper risk management ensures that financial goals are not derailed by unforeseen circumstances.

6. Retirement Planning

Establishing a retirement fund ensures financial security in later years, allowing individuals to maintain their desired lifestyle post-retirement.

7. Estate Planning

This involves preparing for the transfer of assets after death, ensuring that one’s wishes are honored and minimizing estate taxes.The role of financial goals is pivotal in shaping a financial plan. Financial goals provide direction and motivation, guiding the financial planning process. They help prioritize decisions, allocate resources efficiently, and establish timelines for achieving objectives. Whether it’s saving for a house, funding education, or planning for retirement, clearly defined financial goals create a roadmap that leads to successful financial outcomes.

Identifying Short-term and Long-term Financial Goals

Understanding the distinction between short-term and long-term financial goals is essential for effective financial planning. By clearly identifying these goals, you can create a roadmap for your financial future, ensuring that you are prepared for both immediate and future financial needs. Differentiating short-term and long-term financial goals primarily revolves around the timeline and nature of the objectives. Short-term financial goals are typically those that you aim to achieve within a year or less.

These goals often require less capital and are more immediate in nature. In contrast, long-term financial goals usually span several years, often requiring extensive planning, disciplined saving, and investment strategies.

Examples of Common Short-term Financial Goals

To comprehend short-term financial goals better, consider the following common examples which many individuals strive to accomplish:

- Building an emergency fund: Saving three to six months’ worth of living expenses to cover unexpected situations.

- Paying off credit card debt: Eliminating high-interest debt within a year to improve financial health.

- Saving for a vacation: Setting aside money for an upcoming trip within the next year.

- Purchasing a new appliance or gadget: Saving for necessary household items that enhance your living experience.

- Funding a short-term course or certification: Investing in skill development to enhance career prospects within a year.

Establishing these goals allows for immediate focus on financial matters, ensuring that minor yet significant aspects are addressed promptly.

Methods to Prioritize Financial Goals Effectively

Prioritizing your financial goals is crucial for successful planning. A structured approach helps in managing resources efficiently. Here are some strategies to effectively prioritize your financial goals:

- Assess urgency and importance: Evaluate which goals require immediate attention and which can be deferred. Prioritizing based on urgency helps in addressing pressing financial needs.

- Consider financial impact: Analyze how achieving a particular goal can impact your overall financial situation. Goals that significantly enhance your financial stability should take precedence.

- Set a timeline: Assign realistic deadlines for each goal. Goals with shorter timelines often require more immediate action, while long-term goals can be planned over time.

- Review and adjust: Regularly revisit your financial goals and their priorities. Life circumstances change, requiring adjustments to your financial plan.

By utilizing a structured framework for prioritization, you can ensure that your financial resources are being allocated effectively, allowing you to reach both short-term and long-term goals with greater ease.

Effective financial planning is about aligning your goals with your values and the timelines you envision for your future.

The Role of Budgeting in Financial Planning

Budgeting serves as the cornerstone of effective financial planning, acting as a roadmap for individuals and families to achieve their financial goals. By outlining income and expenses, budgeting allows one to allocate resources efficiently, prioritize spending, and identify areas for saving. It is essential for building a secure financial future, as it provides visibility into where money is going and helps to avoid unnecessary debt.

Without a solid budget, financial goals can become elusive, and individuals may find themselves in precarious financial situations.Creating a realistic and effective budget involves several key techniques that ensure financial stability and growth. To begin with, it is important to track all sources of income, including salaries, bonuses, and any side hustles. Once income is established, detailed tracking of all expenses is crucial.

Categorizing expenses into fixed (rent, utilities) and variable (entertainment, dining out) allows for more precise management. One effective method is the 50/30/20 rule, where 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment. This simple guideline can help people maintain a balanced financial life while still enjoying their earnings.In addition to these foundational techniques, several common budgeting pitfalls can undermine financial planning efforts.

Many individuals underestimate their expenses, leading to unrealistic budgets that do not reflect true spending habits. This discrepancy can result in overspending and increased debt. Another common issue is failing to adjust the budget over time. Life circumstances change, and so should your budget. Regular reviews and adjustments are essential to accommodate new financial situations, such as a job change, relocation, or unexpected medical expenses.

A proactive approach to budgeting is key to staying on track and reaching financial goals.

Additionally, emotional spending can derail a budget. Many individuals turn to shopping or dining out as a way to cope with stress, leading to impulsive financial decisions that can jeopardize long-term planning. Implementing strategies like setting spending limits for discretionary categories or using cash for certain purchases can help mitigate these challenges. By recognizing these pitfalls and implementing preventive measures, individuals can enhance their financial planning efforts and establish a path toward achieving their financial aspirations.

Investment Strategies for Different Financial Objectives

When it comes to managing finances, aligning investment strategies with specific financial goals is essential. Different financial objectives, such as retirement, buying a home, or funding a child’s education, require tailored approaches to investment. Understanding various investment strategies not only helps in achieving these goals but also allows for better risk management and potential for returns.Investment strategies can be broadly categorized into conservative and aggressive approaches, each catering to different risk tolerances and financial objectives.

Conservative investment strategies prioritize capital preservation and stable returns, making them suitable for individuals who are risk-averse or nearing their financial goals. On the other hand, aggressive strategies focus on maximizing returns, often involving higher risks, and are typically favored by younger investors or those with a longer time horizon before needing their funds.

Comparison of Conservative and Aggressive Investment Strategies

Conservative and aggressive investment strategies differ significantly in terms of risk and potential returns. Here’s a closer look at their characteristics:

- Conservative Strategies: These strategies typically include investments in government bonds, high-grade corporate bonds, and dividend-paying stocks. The goal is to provide steady income and preserve capital. For instance, investing in U.S. Treasury bonds can yield lower returns but offers security and minimal risk of loss.

- Aggressive Strategies: Investments in this category may include stocks, real estate, venture capital, and cryptocurrencies. While these options present the potential for higher returns, they also carry a greater risk of loss. For example, investing in tech start-ups might yield high rewards if the company succeeds but could also lead to significant losses if it fails.

Understanding the risk levels associated with each strategy is crucial. Conservative investments offer lower returns but provide peace of mind due to their stability. In contrast, aggressive investments, while potentially lucrative, expose investors to greater volatility and the possibility of losing principal.

Importance of Diversification in Investment Planning

Diversification is a vital component of effective investment planning. It involves spreading investments across various asset classes to mitigate risk. By diversifying a portfolio, investors can potentially reduce the impact of a poor-performing asset on their overall financial health.Investing in a mix of stocks, bonds, real estate, and other asset types can lead to a more balanced portfolio. For instance, during economic downturns, bonds may provide stability while stocks may suffer.

Conversely, in a booming economy, stocks might outperform bonds. The importance of diversification lies in its ability to smooth out returns over time, lowering the risk profile of the investment portfolio.

“The greatest risk is not taking one.” – Anonymous

In conclusion, aligning investment strategies with specific financial goals is key to successful financial planning. Understanding the differences between conservative and aggressive approaches, along with the importance of diversification, can ensure a well-rounded investment strategy tailored to individual needs.

Understanding Insurance as a Financial Planning Tool

Incorporating insurance into your financial planning strategy is essential for safeguarding your investments and ensuring a stable future. While often seen as merely a safety net, insurance serves as a multifaceted tool that can enhance your overall financial security and strategy. From protecting your assets to providing peace of mind, understanding its various roles can significantly impact your financial well-being.Insurance can protect you against unforeseen events that could jeopardize your financial stability.

It acts as a risk management tool, allowing you to transfer potential financial burdens to the insurer. This transfer helps you maintain your financial goals and protects your income from unexpected disruptions. Notably, there are several types of insurance that can be integral to financial planning, each serving a distinct purpose.

Types of Insurance for Financial Protection

When considering insurance as a financial planning tool, it’s crucial to evaluate the various types available, as each can safeguard your financial future in different ways. Here are the prominent types of insurance that should be included in your financial strategy:

- Life Insurance: Provides financial support to your beneficiaries in the event of your death, ensuring they can maintain their standard of living and cover debts such as mortgages or education expenses.

- Health Insurance: Covers medical expenses, reducing the financial burden of healthcare costs that could otherwise deplete your savings or investments.

- Disability Insurance: Offers income replacement if you become unable to work due to illness or injury, preserving your financial stability during challenging times.

- Property Insurance: Protects your physical assets, such as homes and vehicles, against damage or loss, helping you recover financially after unexpected events like natural disasters.

- Liability Insurance: Safeguards against legal claims that could arise from injuries or damages to others, protecting your assets from lawsuits.

Each of these insurance types plays a role in mitigating risks associated with various life events, thereby protecting your financial investments and future earnings.

Key Considerations for Choosing Insurance Policies

Selecting the right insurance policies involves careful consideration of several factors to ensure they align with your financial goals. The following points highlight essential aspects to evaluate when choosing insurance:

- Coverage Amount: Determine how much coverage you need based on your financial situation, dependencies, and specific risks.

- Premium Costs: Assess the affordability of premiums in relation to your budget and overall financial plan, ensuring you do not overextend your finances.

- Policy Terms: Review the terms and conditions, including exclusions and limitations, to understand what is covered and what is not.

- Insurance Provider Reputation: Research the insurer’s reliability, customer service, and claim settlement history to ensure they are trustworthy.

- Flexibility and Riders: Consider policies that offer flexibility to adapt to changing needs and options for additional coverage riders for enhanced protection.

Incorporating these considerations into your decision-making process can lead to a more effective insurance approach that aligns with your financial objectives, ultimately contributing to a more secure financial future.

The Importance of Emergency Funds in Financial Planning

In the realm of financial planning, one cannot underestimate the significance of an emergency fund. This crucial safety net acts as a buffer against unexpected financial shocks, allowing individuals to navigate challenging situations without derailing their long-term financial goals. An emergency fund provides peace of mind and financial stability, ensuring that you are prepared for life’s unpredictabilities.Building an emergency fund involves setting aside a specific amount of money that can be quickly accessed in case of urgent needs.

The recommended practice is to save three to six months’ worth of living expenses. This fund should be easily accessible, meaning it should be kept in a high-yield savings account or a money market account where it can earn interest while remaining liquid. Regular contributions, even if small, can help establish this fund over time. Setting up automatic transfers from your checking account to your emergency fund can make saving effortless and consistent.

Situations Benefiting from an Emergency Fund

Having an emergency fund can make all the difference in various unforeseen circumstances. Here are some situations where an emergency fund proves invaluable:

- Job Loss: Losing a job unexpectedly can lead to immediate financial strain. An emergency fund allows you to cover essential expenses such as rent, utilities, and groceries while searching for new employment.

- Medical Emergencies: Unexpected medical expenses can arise at any time. An emergency fund ensures that you can manage unexpected bills without resorting to high-interest credit cards or loans.

- Car Repairs: If your vehicle breaks down and requires costly repairs, your emergency fund can help cover these expenses without disrupting your monthly budget.

- Home Repairs: Major home repairs, like a leaky roof or a broken furnace, can happen suddenly. An emergency fund provides the means to address these issues promptly.

Determining the Appropriate Size of an Emergency Fund

Determining the ideal size for your emergency fund depends on various personal factors, including income, expenses, and overall financial stability. Here are key considerations to help you decide:

- Monthly Expenses: Calculate your essential monthly expenses, such as rent or mortgage, utilities, food, and transportation. This will serve as a baseline for the total amount needed in your emergency fund.

- Job Stability: If you have a stable job with little risk of layoff, you might opt for a smaller fund. Conversely, those in volatile industries should consider a larger safety net.

- Dependents: If you have dependents relying on your income, consider increasing your emergency fund to cover their needs in case of financial disruption.

- Personal Comfort Level: Ultimately, the size of your emergency fund should reflect your comfort with risk. Some individuals feel more secure with a larger fund, while others may find smaller amounts sufficient.

“An emergency fund is not just a safety net; it’s a pathway to financial resilience.”

The Impact of Taxes on Financial Planning

Taxes play a crucial role in shaping financial planning strategies. They can significantly affect an individual’s disposable income, investment decisions, and overall wealth accumulation. Understanding the intricacies of taxation is essential for effective financial planning, as it enables individuals to make informed choices that align with their long-term financial goals. The interplay between income, investments, and taxes often dictates how wealth is built and maintained over time.One of the key considerations in financial planning is the impact of tax rates on investment returns.

Higher tax liabilities can erode the gains from investments, thus influencing where and how individuals choose to allocate their resources. For instance, investments in tax-advantaged accounts, such as 401(k)s or IRAs, can help minimize tax impact while building retirement savings. Such accounts allow individuals to defer taxes until withdrawal, typically when they may be in a lower tax bracket.

Tax-Efficient Investment Strategies

Implementing tax-efficient investment strategies can substantially minimize tax liabilities. Here are several approaches to consider:

- Utilizing Tax-Advantaged Accounts: Contributing to retirement accounts not only helps in long-term savings but also offers immediate tax benefits. Contributions to these accounts can be deducted from taxable income, thus reducing the overall tax burden.

- Investing in Municipal Bonds: Interest earned from municipal bonds is often exempt from federal taxes, and sometimes state taxes as well, making them an attractive option for tax-conscious investors.

- Capital Gains Management: Holding investments for over a year typically qualifies for lower long-term capital gains tax rates. Frequently trading can lead to higher short-term capital gains taxes, which are taxed at ordinary income rates.

- Tax-Loss Harvesting: This strategy involves selling investments at a loss to offset gains realized elsewhere in a portfolio, thus reducing the overall tax burden.

Understanding and leveraging common tax deductions and credits are also vital in effective financial planning.

Common Tax Deductions and Credits

Several tax deductions and credits can significantly improve financial strategies by lowering taxable income. These include:

- Standard Deduction: This is a fixed dollar amount that reduces your taxable income, which is available to all taxpayers who do not itemize their deductions.

- Itemized Deductions: Taxpayers can deduct specific expenses, such as mortgage interest, state and local taxes, and medical expenses, if they exceed the standard deduction.

- Education Credits: Tax credits like the American Opportunity Credit and the Lifetime Learning Credit can help offset the costs of higher education, making it financially easier for individuals to invest in their education.

- Child Tax Credit: Families can benefit from this credit, which provides a significant reduction in tax liability for each qualifying child, aiding in family financial planning.

Incorporating these strategies and understanding their implications on taxes can lead to more effective financial planning, ultimately fostering greater financial security and growth.

Retirement Planning as a Financial Priority

Retirement planning is a crucial aspect of financial health that often gets overlooked during the hustle of everyday life. Many individuals focus on immediate financial goals, yet neglect to allocate sufficient resources toward securing their future. A well-structured retirement plan allows individuals to enjoy their golden years without the stress of financial constraints, ensuring they maintain the lifestyle they desire.One of the critical aspects of retirement planning is understanding the various retirement accounts available and their benefits.

These accounts often provide tax advantages that can significantly enhance long-term financial health. The common types of retirement accounts include:

Types of Retirement Accounts and Their Benefits

Retirement accounts serve as vehicles for saving and investing funds designated for retirement. Each type of account offers unique advantages:

- 401(k) Plans: Offered by employers, these plans allow employees to save pre-tax income, reducing their taxable income for the year. Many employers offer matching contributions, essentially providing free money for retirement.

- Traditional IRA: Individuals can contribute pre-tax income, and taxes are paid upon withdrawal during retirement. This account is beneficial for those who expect to be in a lower tax bracket when they retire.

- Roth IRA: Contributions are made with after-tax dollars, allowing for tax-free withdrawals during retirement. This is ideal for younger savers who expect to see their income—and tax rate—increase over time.

- SEP IRA: Designed for self-employed individuals and small business owners, it allows for higher contribution limits, providing a great way to save significantly for retirement.

- Health Savings Accounts (HSAs): While not a traditional retirement account, HSAs offer tax advantages and can be used for medical expenses in retirement, making them a valuable part of a holistic financial strategy.

When estimating retirement needs, it’s essential to consider lifestyle choices and future expenses. Individuals should first assess their current lifestyle and the expected changes upon retirement. Key factors to consider include:

- Anticipated living expenses, including housing, healthcare, and leisure activities.

- Desired retirement age, as this influences how long savings must last.

- Life expectancy, which can affect the total amount needed.

A simple method for estimating retirement savings needs is the “80% Rule,” which suggests planning for approximately 80% of pre-retirement income to maintain a similar lifestyle. For instance, if your annual income is $100,000, aiming for $80,000 annually in retirement can provide a comfortable living standard.

“It’s essential to plan for both expected and unexpected expenses in retirement, as medical costs can rise significantly.”

By considering these factors and using retirement accounts strategically, individuals can build a robust financial plan that supports their desired lifestyle in retirement and ensures peace of mind.

Seeking Professional Guidance in Financial Planning

Navigating the financial landscape can be daunting, and that’s where the expertise of a financial advisor or planner comes in. These professionals possess the knowledge and experience necessary to help individuals and families craft a robust financial strategy that aligns with their goals. By consulting with a financial planner, clients can gain insights into investment opportunities, retirement planning, tax strategies, and more, ultimately fostering better financial health and security.When selecting a financial professional, several key attributes should be considered to ensure they are qualified to meet your needs.

It’s essential to look for credentials such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Registered Investment Advisor (RIA). These designations indicate a level of expertise and adherence to ethical standards. Additionally, consider their experience in the industry, particularly in areas that pertain to your financial situation. A good financial advisor should also demonstrate strong communication skills, as they need to explain complex concepts in a way that is understandable.

Transparency about fees and services offered is crucial as well, ensuring you know what to expect without hidden costs.Assessing the value of financial planning services involves understanding how these services contribute to achieving your financial goals. The effectiveness of a financial planner can often be measured through their ability to create a comprehensive financial plan that addresses various aspects such as budgeting, saving, and investment strategies.

Evaluating the return on investment (ROI) from their services can be done through the following:

- Reviewing the progress towards your financial goals over time.

- Comparing the performance of your investment portfolio against benchmarks relevant to your financial objectives.

- Evaluating the tax savings or additional income generated through their strategic advice.

By keeping track of these factors, you can better understand how professional guidance translates into tangible financial benefits, thus solidifying the importance of involving a financial planner in your financial journey.

Adapting Financial Plans to Life Changes

Life is full of unexpected events and significant milestones that can alter your financial landscape. From starting a family to changing careers, each transition brings new opportunities and challenges that necessitate a reevaluation of your financial plan. Adapting your financial strategy to accommodate these life changes is crucial for maintaining financial health and ensuring long-term goals are met. Recognizing when it’s time to revise your financial plan can significantly impact your financial security.

Common life changes that require adjustments include:

- Marriage or Partnership: Joining finances can change your budgeting needs and investment strategies.

- Having Children: Expenses for childcare, education, and healthcare can significantly increase your financial responsibilities.

- Career Changes: Changes in income or benefits might require adjustments in savings and investment plans.

- Buying a Home: This typically involves significant upfront costs and ongoing expenses that need to be carefully evaluated.

- Retirement: As you approach retirement, your focus may shift from growth to preservation of wealth and income generation.

- Health Issues: Unexpected medical expenses can dramatically affect your finances and require immediate attention.

To stay on track with your financial goals, it is essential to implement a strategy for regularly reviewing and updating your financial plans. Consider the following methods:

Strategies for Reviewing Financial Plans

Maintaining an updated financial strategy is an ongoing process that involves regular check-ins and assessments. Here are effective strategies to ensure your financial plan remains aligned with your life circumstances:

- Set Regular Review Dates: Schedule annual or semi-annual reviews of your financial plan to evaluate your progress and adjust for any major life changes.

- Monitor Life Events: Keep an eye out for major milestones or changes in your life that may require a review, such as job changes, births, or aging.

- Utilize Financial Tools: Use budgeting and financial planning tools to track your expenses and savings, allowing for real-time adjustments.

- Consult a Financial Advisor: Regular meetings with a financial advisor can provide professional insight and help tailor your plan to current life circumstances.

- Adjust for Inflation: Remember to factor in inflation and changes in the economy when reviewing your financial goals and strategies.

Regularly reviewing your financial plan and adjusting for life changes is essential for achieving financial security and peace of mind.

By being proactive in adapting your financial plans to life changes, you can navigate life’s transitions with confidence and maintain a clear path toward your financial goals.

Conclusive Thoughts

In summary, financial planning is not just about crunching numbers; it’s about creating a strategy tailored to your unique life situation. By setting clear goals, building a solid budget, diversifying your investments, and accounting for life changes, you can navigate the complex world of personal finance with confidence. Ultimately, a well-structured financial plan can lead to peace of mind and a path to achieving your dreams.

FAQ Corner

What is financial planning?

Financial planning is the process of creating a comprehensive strategy to manage your finances, including budgeting, investing, and preparing for future expenses.

Why is budgeting important in financial planning?

Budgeting helps you track your income and expenses, ensuring that you live within your means and save for future goals.

How often should I review my financial plan?

It’s advisable to review your financial plan at least annually or whenever you experience significant life changes.

What role does insurance play in financial planning?

Insurance protects your financial investments and future earnings by mitigating risks associated with unexpected events.

What are some common financial planning mistakes?

Common mistakes include lack of a clear plan, neglecting to account for taxes, and failing to update your financial goals as life changes occur.

How can I start my financial planning journey?

Begin by identifying your financial goals, creating a budget, and seeking advice from a financial professional if needed.