Financial forecasting is a vital tool that helps businesses navigate the complexities of the market and make informed decisions. It serves as a roadmap, guiding companies through uncertain financial landscapes and enabling them to allocate resources wisely. With accurate forecasts, organizations can not only anticipate future revenue and expenditures but also identify investment opportunities and potential risks. This strategic foresight allows businesses to stay competitive and agile in an ever-changing economic environment.

Moreover, financial forecasting encompasses various methodologies and technologies that enhance accuracy and reliability. By harnessing the power of data analytics, businesses can refine their predictions and respond proactively to market shifts. As we delve deeper into this topic, we will explore the significance of financial forecasting in strategic planning, the different methods employed, the role of technology, and the challenges organizations face along the way.

The importance of financial forecasting in business strategy

Financial forecasting plays a crucial role in shaping the strategic direction of a business. It involves estimating future financial outcomes based on historical data, market trends, and economic indicators. By understanding potential future scenarios, businesses can make informed decisions that align with their long-term goals. This proactive approach not only enhances operational efficiency but also provides a framework for navigating uncertainties in the ever-evolving marketplace.Accurate financial forecasting is integral to effective resource allocation and investment decisions.

When businesses have a clear picture of their expected revenues and expenses, they can allocate resources more efficiently, ensuring that capital is deployed where it is most needed. This capability is particularly vital in times of economic volatility when businesses must adapt quickly to changing conditions. For instance, during a downturn, companies may need to cut costs or pivot their strategies to maintain profitability.

Conversely, when the economy is strong, accurate forecasting can signal opportunities for expansion or innovation.Several prominent companies have leveraged financial forecasting to gain a strategic advantage. For example, Amazon utilizes sophisticated forecasting models to predict consumer behavior and manage inventory effectively. By analyzing purchasing patterns and seasonal trends, Amazon can optimize its supply chain, reducing costs and enhancing customer satisfaction.

Another notable example is Procter & Gamble, which employs forecasting to streamline its product development processes. By anticipating market demands, the company can introduce new products that resonate with consumers, thus maintaining its competitive edge.Moreover, companies like Tesla have demonstrated how financial forecasting can guide investment decisions. By projecting future sales and growth in the electric vehicle market, Tesla has successfully attracted significant investment to support its expansion efforts.

This strategic foresight has allowed the company to innovate continuously and set ambitious targets for production and sales.In conclusion, financial forecasting is more than just a budgeting tool; it is a vital component of strategic planning that empowers businesses to navigate uncertainties, optimize resource allocation, and seize opportunities. Accurate forecasts enable organizations to stay ahead of the curve, ensuring they are well-positioned to achieve their long-term objectives.

Different methods of financial forecasting used by organizations

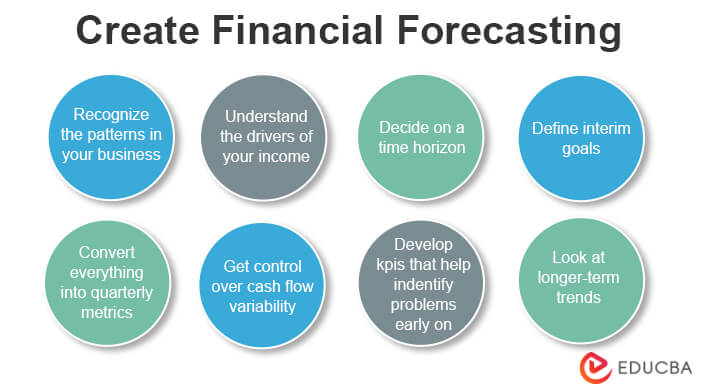

Financial forecasting plays a pivotal role in guiding businesses toward achieving their financial goals. Organizations regularly assess their financial performance and future prospects, often employing various forecasting methods. These methods help in budgeting, resource allocation, and strategic planning. Knowing the strengths and weaknesses of different forecasting techniques can empower businesses to make informed decisions.Several methods are available for financial forecasting, broadly categorized into quantitative and qualitative approaches.

Quantitative forecasting uses historical data and statistical models, while qualitative forecasting relies on subjective judgment and market insights. Here is a detailed examination of both methods, including their advantages, disadvantages, and appropriate applications.

Quantitative Forecasting Methods

Quantitative forecasting methods involve the analysis of numerical data to generate predictions about future financial performance. This can include techniques such as time series analysis, regression analysis, and econometric modeling.

1. Time Series Analysis

This method utilizes historical data points, often collected at regular intervals, to identify trends and seasonal patterns. For example, a retail company may analyze sales data over several years to predict future sales during holiday seasons.

2. Regression Analysis

This statistical method examines the relationship between variables. Businesses can use regression to identify how factors such as advertising spend or economic indicators impact sales. For instance, car manufacturers often use regression models to forecast sales based on consumer income levels.

3. Econometric Modeling

This advanced technique integrates economic theory with statistical analysis to model complex relationships. Firms might apply econometric models to forecast the impact of economic policy changes on their financial performance.The advantages of quantitative forecasting include its objectivity and ability to handle large data sets, leading to more precise predictions. However, the reliance on past data can be a limitation, especially in volatile markets where historical trends may not be reliable indicators of future performance.

Qualitative Forecasting Methods

Qualitative forecasting methods primarily rely on expert opinions, market research, and subjective judgment. Techniques include market research, focus groups, and the Delphi method.

1. Market Research

Businesses can gather insights from customer surveys and focus groups to gauge consumer preferences. For instance, a tech company might conduct market research to assess interest in a new product before launching it, helping to forecast sales.

2. Focus Groups

Engaging small groups of target customers can provide qualitative insights into consumer behavior and preferences, aiding businesses in understanding market trends.

3. Delphi Method

This systematic forecasting approach gathers expert opinions through rounds of questionnaires, refining predictions based on feedback. Industries such as pharmaceuticals often employ the Delphi method to estimate demand for new drugs based on expert insights.Qualitative forecasting is advantageous for capturing intangible factors and emerging trends not evident in historical data. However, it can be subjective, potentially leading to biases in predictions.

This method is particularly effective in situations of high uncertainty or when launching new products, as it helps businesses understand consumer sentiment.In summary, quantitative methods are generally most effective when historical data is abundant and reliable, while qualitative methods shine in dynamic environments or when exploring innovative products. Organizations often benefit from a hybrid approach, combining both methods to enhance the accuracy of their financial forecasts.

For example, a start-up may rely on qualitative insights for initial product launches and shift to quantitative forecasting as more data becomes available post-launch.

The role of technology in enhancing financial forecasting accuracy

The landscape of financial forecasting is undergoing a dramatic transformation thanks to advancements in technology. Artificial Intelligence (AI) and machine learning are at the forefront of this revolution, allowing financial professionals to not only streamline their forecasting processes but also enhance the precision of their predictions. With these technologies, organizations can analyze vast amounts of data, identify patterns, and generate insights that were previously unimaginable.Machine learning algorithms have proven particularly effective in modeling complex financial behaviors.

By applying these algorithms to large datasets, financial analysts can create predictive models that adapt and improve over time. For instance, a retail company might leverage machine learning to predict sales trends based on historical data, seasonal fluctuations, and even external factors like economic indicators or social media trends. This enables businesses to make informed decisions regarding inventory management, staffing, and marketing strategies, ultimately driving profitability.

Popular software tools in financial forecasting

There are several software tools that have gained traction in the financial forecasting domain, each offering unique features aimed at improving forecast accuracy and efficiency. The following tools are particularly noteworthy:

- Oracle Crystal Ball: This tool uses Monte Carlo simulations to assess risk and uncertainty in forecasts, allowing businesses to visualize potential outcomes and make data-driven decisions.

- IBM Planning Analytics: A powerful solution that integrates AI capabilities to streamline planning, budgeting, and forecasting processes, providing real-time insights into financial performance.

- Adaptive Insights: This cloud-based platform focuses on financial planning and analysis, enabling users to create dynamic forecasts that can be easily adjusted as business conditions change.

The selected tools emphasize the importance of integrating technology into financial forecasting. They allow for real-time data analysis and enable businesses to pivot quickly, responding to market changes with agility.

Impact of big data analytics on forecast precision and reliability

Big data analytics is a game-changer for financial forecasting, as it provides organizations with the ability to sift through enormous volumes of data to extract valuable insights. Companies can utilize structured and unstructured data from various sources—like transaction histories, customer behavior patterns, and macroeconomic trends—to refine their forecasts.By leveraging big data analytics, organizations can achieve improved accuracy in their predictions.

For instance, a multinational corporation might analyze customer feedback from social media alongside sales data to anticipate product demand more effectively. This holistic view of data enables businesses to not only anticipate shifts in consumer preferences but also align their supply chain and marketing efforts accordingly.

“Data-driven decision-making powered by big data analytics enhances the reliability of financial forecasts, reducing uncertainties and improving overall business strategies.”

Moreover, the capacity to run complex data models in real time allows for ongoing adjustments to forecasts, ensuring that organizations remain responsive to changes in both internal and external environments. This adaptability is crucial in today’s fast-paced market, where the ability to predict trends accurately can be the difference between success and failure.

Challenges faced in financial forecasting and how to overcome them

Financial forecasting is an essential practice for organizations aiming to predict their future financial performance. However, businesses encounter several challenges that can impact the accuracy and effectiveness of their forecasts. These challenges stem from a variety of factors, including data quality, market volatility, and technological limitations. Understanding these hurdles and implementing strategies to overcome them is crucial for effective financial planning and decision-making.One of the primary challenges in financial forecasting is data quality.

Accurate forecasting relies heavily on high-quality data; however, businesses often face issues such as incomplete, outdated, or inconsistent data. When the underlying data is unreliable, it can lead to erroneous forecasts that misguide strategic decisions.Another significant obstacle is market volatility. Economic conditions, competitive landscapes, and unexpected events, such as natural disasters or geopolitical issues, can cause rapid changes in a business’s financial environment.

This unpredictability makes it challenging to create accurate forecasts over time. Technological limitations also pose a challenge for many organizations. Some businesses may lack access to advanced forecasting tools and technologies, leading to a reliance on outdated methods that cannot adequately capture complex market dynamics. Furthermore, not all organizations have the expertise to interpret data effectively, which can hinder the forecasting process.

Strategies for overcoming forecasting challenges

To navigate the challenges associated with financial forecasting, organizations can adopt several strategies and best practices. First and foremost, improving data management processes can significantly enhance data quality. This includes establishing robust data collection and validation protocols, ensuring data is regularly updated, and utilizing software tools that facilitate data integration from various sources.In addressing market volatility, businesses should embrace a more flexible approach to forecasting.

This could involve using rolling forecasts that are updated regularly, allowing companies to adapt to changing conditions quickly. Scenario planning can also be beneficial, as it prepares organizations for multiple potential outcomes and enables them to make informed decisions based on various market conditions.Additionally, investing in advanced forecasting technologies can help mitigate technological limitations. Tools such as predictive analytics and machine learning algorithms can provide more accurate forecasts by analyzing vast amounts of data and identifying patterns that may not be apparent through traditional methods.Case studies highlight successful navigation of forecasting challenges.

For instance, Coca-Cola implemented an advanced analytics platform that not only improved its demand forecasting accuracy but also enabled better inventory management, ultimately resulting in reduced costs. Similarly, Procter & Gamble adopted a rolling forecast approach, allowing them to respond swiftly to market fluctuations and maintain a competitive edge.By understanding and addressing these challenges through strategic initiatives, organizations can enhance their financial forecasting processes, leading to more informed decision-making and improved financial performance.

The significance of scenario planning in financial forecasting

Scenario planning is an essential tool in the realm of financial forecasting, allowing organizations to prepare for a variety of potential futures. Unlike traditional forecasting, which often relies on historical data and linear projections, scenario planning embraces uncertainty, encouraging businesses to envision different realities based on varying external and internal factors. This approach is not only about predicting the future but also about understanding the implications of different events and choices, thus enabling companies to craft flexible strategies.The relevance of scenario planning in forecasting lies in its ability to enhance decision-making processes in uncertain environments.

It encourages organizations to think creatively and critically about the future, providing a framework to assess risks and opportunities. By developing multiple scenarios, businesses can avoid the pitfalls of relying on a single forecast, which may lead to misinformed decisions. The focus on dynamic scenarios facilitates a deeper understanding of market fluctuations, competitive landscapes, and operational challenges that may arise.

Comparison of traditional forecasting methods and scenario planning

Traditional forecasting methods typically involve quantitative analysis, relying heavily on historical data trends to project future outcomes. While these methods can provide a baseline projection, they often lack the flexibility to account for unexpected events. Scenario planning, in contrast, emphasizes qualitative assessments alongside quantitative data, allowing businesses to explore how various factors might interact in unforeseen ways.Key differences between the two methodologies include:

- Data Dependency: Traditional forecasting often relies on past performance data, while scenario planning considers a broader range of variables, including market conditions and potential disruptions.

- Flexibility: Scenario planning allows for adaptability in strategy, as it prepares organizations for multiple potential futures, whereas traditional methods may result in a rigid approach based on a singular forecast.

- Focus: Traditional forecasting centers on achieving accuracy in predictions, while scenario planning prioritizes understanding the implications of different potential outcomes and preparing for them.

The benefits of scenario planning include improved risk management, enhanced strategic thinking, and increased organizational agility. This method equips businesses with the tools needed to navigate uncertainty effectively, allowing for timely adjustments to plans as new information emerges.

Examples of scenarios in financial forecasting

In the financial forecasting process, various scenarios can be considered to better prepare for the unexpected. These scenarios can range from optimistic to pessimistic, reflecting a spectrum of possibilities an organization might face. A few examples include:

- Market Expansion: A company might forecast increased sales growth based on successful entry into a new geographic market, anticipating changes in consumer behavior and competition.

- Economic Downturn: Preparing for a recession involves analyzing how reduced consumer spending and tighter credit conditions could affect revenue and costs.

- Regulatory Changes: A scenario might include the introduction of new regulations affecting operational costs or market access, requiring adjustments in financial forecasts to account for compliance expenses.

- Technological Disruption: Businesses may consider the impact of emerging technologies on their industry, evaluating how innovations could revolutionize operations or alter competitive dynamics.

- Supply Chain Disruptions: Forecasting scenarios may include potential disruptions in the supply chain due to geopolitical events or natural disasters, assessing their impact on production costs and delivery timelines.

Through scenario planning, organizations can proactively prepare for uncertainties, ensuring they remain resilient and adaptable in an ever-changing financial landscape.

The impact of economic factors on financial forecasting outcomes

Financial forecasting plays a critical role in strategic planning for businesses, facilitating informed decision-making based on projected economic conditions. However, the accuracy of these forecasts can be significantly influenced by various macroeconomic factors. Understanding how indicators such as GDP growth, inflation, unemployment rates, and consumer confidence affect financial forecasting outcomes is essential for forecasters seeking to provide reliable predictions. The interplay between these economic elements can lead to drastic changes in the business environment, ultimately impacting revenue and growth expectations.Macroeconomic indicators are vital in shaping the landscape within which businesses operate.

Forecasters must consider a range of economic factors, as they can dramatically affect financial predictions. These indicators provide insights into the overall economic health and consumer behavior, which are crucial for predicting future performance. A decline in GDP, for instance, often signals reduced consumer spending, which can lead to lower sales forecasts for businesses. Alternatively, if indicators show economic growth, companies may project higher revenues and expansion opportunities.

Key economic factors affecting financial forecasting

Several key economic factors that forecasters must analyze include:

- Gross Domestic Product (GDP): GDP is a primary measure of economic activity. A declining GDP often indicates a recession, prompting businesses to lower their forecasts due to anticipated lower consumer spending.

- Inflation Rates: High inflation can erode purchasing power, leading consumers to cut back on spending. This can result in businesses revising their sales forecasts downward. Conversely, moderate inflation may signal a healthy economy, encouraging investment and expansion.

- Unemployment Rates: High unemployment typically leads to decreased disposable income, which negatively affects consumer spending and business revenues. On the other hand, low unemployment can boost consumer confidence and spending, enhancing forecasts.

- Consumer Confidence Index (CCI): The CCI measures how optimistic consumers feel about the economy. A high CCI usually correlates with increased spending, allowing positive adjustments in financial forecasts. In contrast, a declining CCI may necessitate more conservative projections.

- Interest Rates: Changes in interest rates can significantly influence business operations. Lower rates can encourage borrowing and investment, which might lead to optimistic forecasts. Higher rates, however, can dampen spending and investment, prompting downward revisions of forecasts.

The historical context provides valuable lessons regarding the impact of economic shifts on forecasting outcomes. For example, during the 2008 financial crisis, many companies faced unexpected downturns as consumer confidence plummeted and credit markets froze. Numerous forecasts that had predicted steady growth were rendered obsolete as businesses adjusted to a suddenly contracting economy. Similarly, the COVID-19 pandemic in 2020 drastically altered economic projections globally.

Industries such as hospitality and travel experienced unprecedented declines, forcing companies to revisit their forecasts in real-time as new data emerged.In summary, the influence of macroeconomic indicators on financial forecasting is profound. Companies must continuously monitor these factors to refine their forecasts and remain agile in the face of economic changes. Accurate financial forecasting requires a holistic view of the economic environment, enabling businesses to navigate uncertainties effectively.

As history has shown, overlooking these indicators can lead to significant miscalculations and consequences that may affect long-term viability.

The role of collaboration and communication in the forecasting process

Collaboration and communication are crucial components of effective financial forecasting. These elements enable organizations to harness diverse insights and expertise, fostering a more holistic view of the financial landscape. When different departments work together, the accuracy and reliability of forecasts improve, ultimately supporting better decision-making and strategic planning.Cross-departmental collaboration is essential in financial forecasting for several reasons. Diverse teams bring unique perspectives to the forecasting process, allowing for a comprehensive understanding of market dynamics, customer behavior, and operational challenges.

For example, the finance team possesses quantitative skills vital for analyzing historical data, while sales teams contribute valuable insights into customer trends and market demand. When these departments actively collaborate, the resulting forecasts are more robust and reflective of real-world scenarios.

Methods for enhancing communication between finance, sales, and operations teams

Enhancing communication among finance, sales, and operations teams is critical for achieving better forecasting outcomes. Establishing regular cross-functional meetings can help ensure all departments are aligned on goals, share updates, and discuss any changes in market conditions. Here are some effective methods to improve communication:

Integrated Software Solutions

Utilizing cloud-based forecasting tools allows teams to collaborate in real-time, sharing data and insights seamlessly. This fosters transparency and reduces the risk of miscommunication.

Centralized Data Repositories

Creating a shared database where all departments can access and input relevant data streamlines the forecasting process. This ensures all teams are working from the same information, minimizing discrepancies.

Collaborative Workshops

Hosting workshops that bring together finance, sales, and operations staff can aid in brainstorming sessions, aligning on objectives, and refining forecasting models based on collective insights.

Feedback Mechanisms

Implementing structured feedback loops allows teams to analyze past forecasting performance and make adjustments for future predictions. An open line of communication encourages continuous improvement.Organizations have successfully improved their forecasting accuracy through enhanced communication practices. For instance, Procter & Gamble (P&G) adopted a collaborative forecasting approach that integrated inputs from sales, marketing, and supply chain teams. This initiative led to a 20% reduction in forecasting errors, enabling the company to respond more effectively to market changes.

Similarly, Dell Technologies emphasized teamwork between engineering and sales, resulting in more precise inventory forecasting and improved customer satisfaction.In summary, fostering collaboration and effective communication among finance, sales, and operations teams is imperative for accurate financial forecasting. By leveraging diverse insights and establishing clear communication channels, organizations can enhance their forecasting processes and decision-making capabilities.

Conclusive Thoughts

In summary, financial forecasting emerges as a cornerstone of effective business strategy, enabling organizations to make data-driven decisions and minimize risks. Whether it’s leveraging advanced technology or navigating economic factors, the insights gained from financial forecasts empower businesses to adapt and thrive. As we have discussed, embracing best practices in forecasting can significantly enhance a company’s ability to plan for the future, ensuring that they remain resilient and poised for growth.

FAQ Resource

What is financial forecasting?

Financial forecasting is the process of estimating future financial outcomes based on historical data, market trends, and economic conditions.

Why is financial forecasting important?

It helps businesses make informed decisions regarding budgeting, resource allocation, and strategic planning, ultimately driving financial success.

What are the common methods of financial forecasting?

Common methods include quantitative techniques like time series analysis and qualitative techniques such as expert opinions and market research.

How does technology improve financial forecasting?

Technology, including AI and machine learning, enhances accuracy by analyzing large datasets and identifying patterns that might not be visible through traditional methods.

What challenges do businesses face in financial forecasting?

Common challenges include data inaccuracy, rapidly changing market conditions, and the complexity of integrating forecasts across departments.

How can scenario planning benefit financial forecasting?

Scenario planning allows businesses to prepare for various potential future states, increasing flexibility and resilience in their financial strategies.

What economic factors influence financial forecasting?

Macroeconomic indicators such as inflation, unemployment rates, and interest rates play a significant role in shaping forecasting outcomes.