Credit score sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Your credit score is more than just a three-digit number; it’s a key player in your financial life, influencing everything from loan approvals to interest rates and even everyday transactions like renting an apartment or securing insurance.

Understanding its significance can empower you to make informed financial decisions and navigate the complexities of credit management.

As we delve deeper into the world of credit scores, we’ll explore what contributes to your score, dispel common myths, and provide practical tips for improvement. This journey will not only illuminate the importance of maintaining a healthy credit score but also equip you with the knowledge to enhance your financial well-being.

Understanding the Importance of a Credit Score

A credit score is a crucial aspect of modern financial decision-making that significantly influences an individual’s financial life. It serves as a numerical representation of a person’s creditworthiness, compiled from their credit history and behavior. Banks, lenders, and even landlords use this score to gauge the risk of lending money or entering into financial agreements with an individual. Understanding the importance of credit scores can empower individuals to make informed financial decisions and manage their financial health effectively.Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

A high credit score often opens doors to favorable loan approvals and lower interest rates. For instance, individuals with scores above 700 are generally viewed as low-risk borrowers, allowing them to secure mortgages or personal loans with interest rates that can save them thousands of dollars over time. On the contrary, those with scores below 600 face challenges in obtaining loans and may encounter significantly higher interest rates due to perceived higher risk.

Implications of Credit Scores on Financial Transactions

The implications of credit scores extend beyond loans and interest rates, affecting various everyday transactions. For example, when renting an apartment, landlords frequently conduct credit checks to assess potential tenants. A tenant with a high credit score signals reliability and financial responsibility, making them more appealing to landlords. Conversely, a low credit score could lead to a rental application being denied or result in a requirement for larger security deposits.Additionally, credit scores also play a role in securing insurance policies.

Insurance companies often consider credit scores when determining premium rates. A high credit score can lead to lower premiums, as insurers associate responsible credit management with lower risk. In contrast, individuals with poor credit histories may face higher premiums or even difficulty in obtaining certain types of coverage.In summary, a credit score not only impacts significant financial undertakings like loans but also influences daily decisions like renting a home or buying insurance.

Understanding and maintaining a healthy credit score can lead to better financial opportunities and overall stability.

Factors That Influence Your Credit Score

Understanding your credit score is paramount for maintaining financial health. Various elements contribute to its calculation, directly influencing your ability to secure loans and favorable interest rates. Recognizing these factors enables effective management of your credit profile and can improve your score over time.

Key Factors Affecting Credit Scores

The following factors play a significant role in determining your credit score. Each has a various percentage of influence, and learning how to optimize these can lead to a better financial standing.

| Factor | Weightage (%) | Tips for Improvement |

|---|---|---|

| Payment History | 35 | Make all payments on time; set up automatic payments or reminders. |

| Credit Utilization | 30 | Keep your credit utilization ratio below 30%; pay down credit card balances. |

| Length of Credit History | 15 | Maintain older credit accounts; avoid closing them unless necessary. |

| Types of Credit Used | 10 | Diversify your credit mix with installment loans and revolving credit. |

Payment history is the most crucial component, comprising 35% of your score. A single late payment can drop your score significantly. According to the data, individuals with a flawless payment history see scores rise well above 750. Credit utilization, which reflects how much credit you’re using compared to your total credit limit, contributes 30%. Keeping this ratio low can improve your score by as much as 100 points.

The length of your credit history accounts for 15%. Longer histories, particularly with on-time payments, can enhance your credibility. Lastly, the types of credit used, which makes up 10%, shows lenders your experience with different credit forms, with a diverse mix often leading to higher scores.

Common Myths Surrounding Credit Scores

Understanding credit scores can be daunting, especially with the plethora of information available. Unfortunately, not all of it is accurate. Many myths circulate about credit scores that can mislead individuals into making poor financial choices. By debunking these myths, we can better navigate our financial futures.Misinformation about credit scores can lead to significant consequences, often resulting in unfavorable financial decisions.

When individuals act on these misconceptions, they may damage their credit scores, miss opportunities for favorable loans, or incur unnecessary fees. By clarifying common myths, we can empower people to make informed decisions.

Debunking Credit Score Myths

Below are some prevalent myths regarding credit scores, accompanied by the factual truths that dispel them. Understanding these differences can help individuals take control of their financial health.

- Myth: Checking your credit score lowers it.

Your credit score is not affected when you check your own score.

Fact: This is known as a “soft inquiry,” which does not impact your score. Only “hard inquiries,” such as applying for new credit, can lower your score.

- Myth: Closing old accounts improves your score.

Closing accounts can actually hurt your credit utilization rate.

Fact: Old accounts contribute to your credit history length. A longer credit history can positively impact your score, while closing accounts can reduce available credit and increase utilization ratios.

- Myth: Paying off a debt removes it from your credit report.

Paid debts can still remain on your credit report for several years.

Fact: While paying off debts is crucial, the history of that debt will stay on your report. Most negative marks, like missed payments, can stay for up to seven years.

- Myth: All debts are treated equally by credit scoring models.

Different types of debt can impact your score in various ways.

Fact: Revolving credit (like credit cards) and installment loans (like mortgages) are evaluated differently. It’s important to maintain a balance of both types of credit to help improve your score.

- Myth: A credit score of 700 is ‘perfect.’

Scores can range from 300 to 850, and higher is better but ‘perfect’ can be subjective.

Fact: While a score of 700 is considered good, the highest tier of 850 is rarely achieved. Different lenders have varied thresholds for what they consider an acceptable score.

By recognizing these myths and understanding the facts behind them, individuals can make more informed financial decisions that positively influence their credit scores and overall financial health.

Steps to Improve Your Credit Score

Improving your credit score is a vital step towards achieving financial health. A better credit score can open doors to lower interest rates, better loan terms, and increased chances of credit approval. Here’s a detailed step-by-step guide to help you enhance your credit score over time.

Step-by-Step Guide to Enhance Your Credit Score

Understanding and taking deliberate actions can significantly influence your credit score positively. Below are steps that can aid you in this journey:

- Check Your Credit Report: Start by obtaining your credit report from authorized agencies. Review the report for inaccuracies or errors that could negatively impact your score.

- Dispute any Errors: If you find discrepancies, file a dispute with the credit bureau. Correcting errors can lead to an immediate improvement in your score.

- Pay Your Bills on Time: Consistently paying bills by their due date is crucial. Late payments can severely damage your credit score, while timely payments show financial responsibility.

- Reduce Your Credit Utilization Ratio: Aim to keep your credit utilization below 30%. This means if you have a credit limit of $10,000, try to keep your balances below $3,000.

- Avoid Opening New Accounts Frequently: Each time you apply for credit, a hard inquiry occurs, which can slightly reduce your score. Limit new credit applications to necessary instances.

- Maintain Old Credit Accounts: The length of your credit history matters. Keep older accounts open, as they contribute to your average credit age, positively impacting your score.

- Consider a Secured Credit Card: If you have low credit, using a secured credit card responsibly can help rebuild your credit history and improve your score over time.

- Become an Authorized User: Ask a family member or friend with a good credit score if you can be added as an authorized user on their credit card. Their positive payment history can reflect on your report.

- Monitor Your Credit Regularly: Use free credit monitoring tools to stay informed about your credit standing. Regular checks allow you to catch issues early and track your progress.

- Work with a Credit Counselor: If you’re struggling to manage your credit, consider reaching out to a credit counseling service for personalized guidance and strategies.

“After years of struggling with my credit score, I followed a structured plan to improve it. Within a year, my score jumped over 100 points, allowing me to qualify for a mortgage with favorable terms!”

Jamie L.

The Role of Credit Reports in Credit Scoring

Credit reports and credit scores are integral components of the financial landscape, influencing everything from loan approvals to interest rates. A credit report is essentially a snapshot of your credit history, detailing your borrowing behavior, while a credit score is a numerical representation of that history. Understanding the relationship between the two can empower individuals to manage their financial health more effectively.Credit scores are generated based on the information contained in credit reports.

Credit reporting agencies, such as Equifax, Experian, and TransUnion, compile data from your financial behavior, including payment history, amounts owed, length of credit history, types of credit in use, and new credit inquiries. Each of these factors contributes to your score, typically ranging from 300 to 850. For instance, consistently paying off credit cards on time positively impacts your score, while late payments can significantly lower it.

Importance of Regularly Checking Your Credit Report

Monitoring your credit report is crucial for maintaining a healthy credit score. Errors on your credit report can lead to inflated credit scores, affecting your ability to secure loans or credit lines. Regular checks allow you to catch discrepancies early and dispute them to prevent damage to your financial reputation. According to the Federal Trade Commission, about 1 in 5 consumers find errors on their credit reports.

This emphasizes the importance of vigilance when it comes to your credit history.Key components included in a credit report are crucial for understanding your creditworthiness. Below is a table summarizing these key elements:

| Component | Description |

|---|---|

| Personal Information | Includes your name, address, Social Security number, and date of birth. |

| Credit Accounts | Details of your credit accounts, including credit cards, mortgages, and installment loans, along with payment history. |

| Credit Inquiries | Records of inquiries made by lenders when you apply for credit, affecting your score temporarily. |

| Public Records | Bankruptcies, liens, and judgments can appear in this section, impacting your creditworthiness. |

| Collections | Information about accounts that have been sent to collections due to non-payment. |

The Impact of Credit Utilization on Your Score

Credit utilization refers to the ratio of your current credit card balances to your total credit limits across all accounts. This metric plays a crucial role in determining your credit score, accounting for approximately 30% of it. A lower credit utilization rate indicates to lenders that you are not overly reliant on credit and can manage your debts responsibly. Maintaining a good credit score is essential for securing loans, obtaining favorable interest rates, and enhancing overall financial health.Credit utilization is important because it provides insight into your financial behavior.

When you consistently use a large portion of your available credit, it may signal to creditors that you are a higher risk for default. Ideally, it is recommended to keep your credit utilization below 30%, but striving for a rate under 10% is even more beneficial.

Strategies for Managing Credit Utilization

Effectively managing credit utilization can significantly enhance your credit score. Here are some strategies to consider:

Pay off balances regularly

Aim to pay your credit card balances in full each month to avoid accruing high utilization rates.

Request credit limit increases

If your financial situation allows, requesting an increase in your credit limits can lower your utilization ratio, provided you don’t increase your spending concurrently.

Spread out expenses

Instead of charging all purchases to one card, distribute your expenses across multiple credit accounts to maintain lower utilization on each.

Use credit monitoring tools

Stay informed about your credit utilization through monitoring services, which can alert you to any changes that may impact your score.When considering optimal utilization rates, it’s essential to understand how different types of accounts can impact your credit score based on their specific utilization recommendations:

- Credit Cards: Aim for utilization below 30%, ideally under 10% for the best impact.

- Retail Credit Accounts: Generally, keep utilization below 30%, but lower is preferable.

- Personal Loans: Utilization is typically not applicable as these are installment loans, but timely payments are crucial for a good score.

Maintaining a low credit utilization ratio not only supports a healthy credit score but also reflects responsible financial behavior to potential lenders.

How Long Do Negative Items Affect Your Credit Score?

Negative items on your credit report can significantly impact your credit score, and understanding their duration is crucial for financial planning. Various negative entries stay on your credit report for different lengths of time, influencing your score and overall financial health. Knowing these durations can help you strategize ways to improve your credit score over time.The duration that negative items remain on your credit report varies based on the type of item.

Here’s a breakdown of typical negative items and how long they usually affect your credit score:

Duration of Negative Items on Credit Reports

Several factors determine how long negative items remain on a credit report and affect your score. Here are the common types of negative items and their timelines:

- Late Payments: Can stay on your report for up to 7 years from the date of the missed payment.

- Bankruptcies: A Chapter 7 bankruptcy can appear for up to 10 years, while Chapter 13 typically remains for 7 years.

- Foreclosures: Generally reported for 7 years from the date of the initial missed payment.

- Collections: Accounts in collections can remain on your report for up to 7 years from the date of delinquency.

- Charge-offs: These remain on your credit report for 7 years from the date of the charge-off.

The concept of ‘aging’ of credit items is essential in understanding their influence on score recovery. As negative items age, their impact on your credit score diminishes. Newer negative items affect your score more significantly than older ones. Therefore, as time passes, if no new negative information is added, your score can gradually recover, especially if you maintain positive credit behaviors, such as paying bills on time and reducing debt levels.

Visual Timeline of Negative Item Impacts

To illustrate the duration of negative items and their declining impact, one can visualize a timeline. This timeline can show key points at which particular negative items are reported and their gradual fading from influence over the years:

| Negative Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7+ |

|---|---|---|---|---|---|---|---|

| Late Payments | High Impact | Moderate Impact | Low Impact | Low Impact | Minimal Impact | Minimal Impact | Removed |

| Bankruptcies | High Impact | High Impact | Moderate Impact | Moderate Impact | Low Impact | Low Impact | Removed (10 years) |

| Foreclosures | High Impact | High Impact | Moderate Impact | Low Impact | Low Impact | Removed | Removed (7 years) |

Understanding these timelines can empower individuals to make informed financial decisions and work towards improving their credit health over time.

The Benefits of Credit Counseling

Credit counseling offers a pathway for individuals seeking to improve their financial health and enhance their credit scores. By engaging with professional services, clients can gain a deeper understanding of their financial situation and develop actionable strategies to manage their debts effectively. Credit counselors provide personalized guidance, which can lead to significant improvements in creditworthiness over time.One of the primary advantages of credit counseling is the tailored advice and education it provides to individuals struggling with debt.

Counselors analyze a client’s financial position, educating them on credit utilization, debt management, and budgeting practices. This support helps clients make informed decisions that contribute to better credit scores. For instance, a client might learn the importance of paying bills on time and reducing credit card balances, essential factors that influence credit scores.

Criteria for Choosing a Reputable Credit Counseling Agency

When selecting a credit counseling agency, it is crucial to consider several key factors to ensure you receive quality support. The following points highlight what to look for in a trustworthy agency:

- Accreditation: Choose agencies accredited by recognized organizations such as the National Foundation for Credit Counseling (NFCC) or the Council on Accreditation (COA).

- Transparency: A reputable agency will be open about its services, fees, and the process involved in credit counseling.

- Experience: Look for agencies with certified counselors who have a proven track record of helping clients improve their credit scores.

- Client Reviews: Research testimonials from previous clients to gauge the agency’s effectiveness and customer service.

Success stories are abundant in the realm of credit counseling. For example, a client named Sarah, struggling with overwhelming credit card debt, sought counseling after realizing her credit score had dropped significantly. Through a structured debt management plan, she managed to pay off her debts within two years. Sarah’s credit score improved by over 100 points, enabling her to qualify for a mortgage at favorable rates.

Such testimonials illustrate the transformative effects of credit counseling, demonstrating that with the right guidance, individuals can achieve financial stability and restore their credit health.

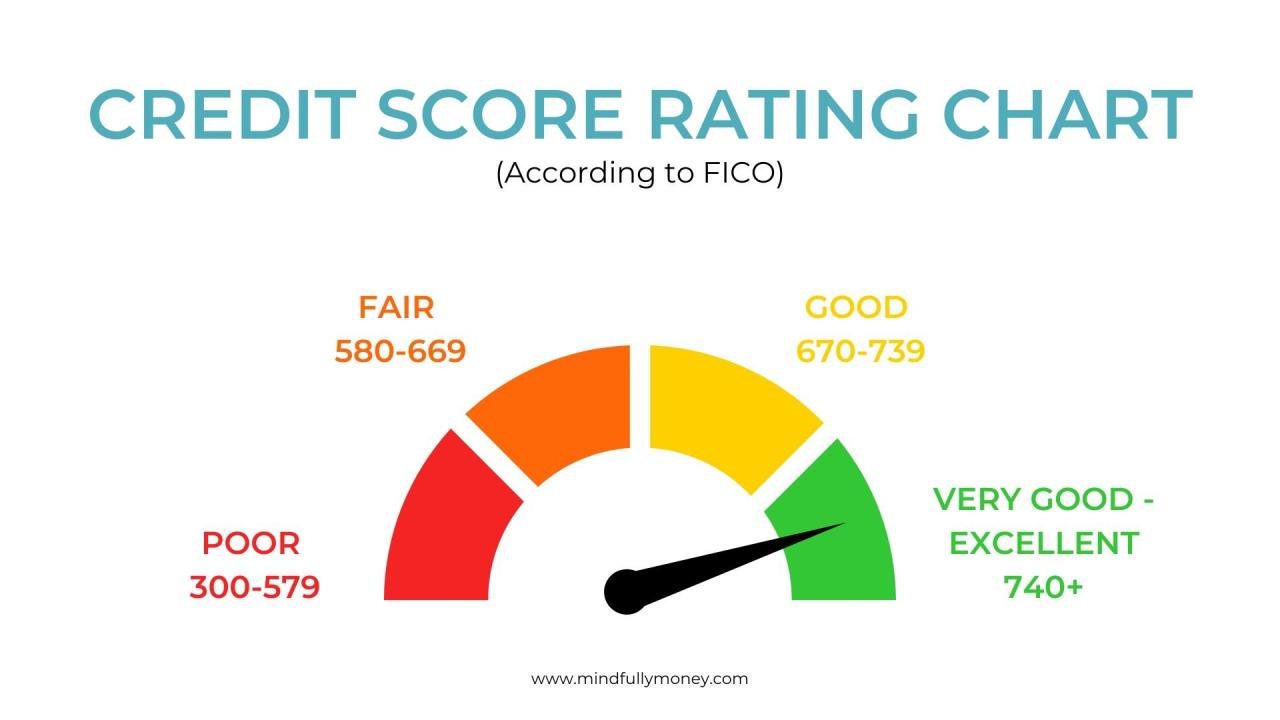

Understanding Credit Score Ranges and Their Implications

Credit scores play a crucial role in a consumer’s financial life. They can affect everything from loan approvals to interest rates on mortgages. Understanding the various credit score ranges is essential for consumers to navigate their financial options effectively. Credit scores typically range from 300 to 850, and each range signifies different financial trustworthiness and access to credit.The following ranges highlight where consumers typically stand regarding their credit scores:

Credit Score Ranges and Their Significance

Each credit score range has distinct implications for consumers, impacting their ability to secure loans, credit cards, and favorable interest rates. The ranges are categorized as follows:

| Credit Score Range | Category | Implications | Possible Financial Products |

|---|---|---|---|

| 300 – 579 | Poor | Considered a high risk by lenders, often results in loan denials or very high interest rates. | Secured credit cards, high-interest personal loans, or no credit checks. |

| 580 – 669 | Fair | May qualify for some credit products, but with higher than average rates. | Standard credit cards, personal loans with higher interest rates. |

| 670 – 739 | Good | Generally considered acceptable by lenders, leading to better interest rates. | Low-interest credit cards, auto loans, and mortgages. |

| 740 – 799 | Very Good | Enjoys favorable terms and competitive rates from lenders. | Premium credit cards, low-interest mortgages, and auto loans. |

| 800 – 850 | Excellent | Regarded as a low-risk borrower, leading to the best rates and terms. | Top-tier credit cards, the lowest interest loans, and exclusive financial products. |

Understanding where you fall within these ranges is vital for making informed financial decisions. For example, a score in the “Poor” range may necessitate additional steps to improve creditworthiness, such as paying off debts and ensuring timely payments. Conversely, individuals in the “Excellent” range can leverage their scores to negotiate better loan terms or credit offers. The significance of each range is crucial for consumers looking to maximize their financial potential and minimize costs on borrowed funds.

By recognizing their current standing, individuals can take proactive steps toward improving their credit profiles, ultimately leading to better financial opportunities.

The Future of Credit Scoring Models

As the financial landscape evolves, so too does the method by which creditworthiness is assessed. Traditional credit scoring models have relied heavily on historical data, but emerging trends indicate a shift towards more nuanced and inclusive methodologies. Understanding these changes is essential for consumers as they navigate the lending space.The integration of technology and alternative data sources is poised to revolutionize credit scoring models.

With advancements in artificial intelligence and machine learning, lenders can analyze vast amounts of data beyond just credit history, including social media activity, utility payments, and even shopping habits. This shift not only allows for a more comprehensive view of a consumer’s financial behavior but also opens doors for individuals who may have historically been overlooked by traditional scoring methods.

For instance, a person without a credit history might still be eligible for loans based on their timely payment of rent or utility bills.

Impact of Technology and Alternative Data Sources, Credit score

The shift towards alternative data and advanced technology brings both opportunities and challenges for consumers. Here are some important points to consider regarding how these changes might affect individuals in the lending environment:Understanding the potential benefits and challenges can help consumers navigate the changing landscape of credit scoring:

- Increased access to credit: More inclusive scoring models may help individuals with limited credit histories secure loans.

- Potential for lower interest rates: A more accurate assessment of risk could result in better loan terms for consumers.

- Personalized lending solutions: Lenders may offer products tailored to individual financial behaviors and circumstances.

- Concerns over data privacy: The use of non-traditional data raises questions about how personal information is collected and utilized.

- Risk of algorithmic bias: Reliance on automated systems may inadvertently perpetuate existing biases in lending practices.

- Need for consumer education: As new models emerge, consumers must stay informed about how their data is used and the implications for their credit status.

As technology and alternative data reshape credit scoring, consumers must remain vigilant and informed to leverage these changes effectively.

Last Point

In conclusion, understanding your credit score is a vital step towards achieving financial stability and making informed decisions. Armed with knowledge about how credit scores work, the factors influencing them, and strategies for improvement, you can take proactive steps to secure your financial future. Remember, a good credit score opens doors and can lead to favorable terms on loans and insurance, ultimately paving the way for a more prosperous life.

FAQ

What is a credit score?

A credit score is a numerical representation of your creditworthiness, reflecting your ability to repay debts based on your credit history.

How often should I check my credit score?

It’s advisable to check your credit score at least once a year to ensure accuracy and monitor for any fraudulent activity.

Can I improve my credit score quickly?

While some improvements can be made quickly, like paying down credit card balances, significant changes typically take time and consistent effort.

Do credit inquiries affect my score?

Yes, hard inquiries can temporarily affect your credit score, but their impact diminishes over time.

Is it possible to have no credit score?

Yes, if you have not used credit or have limited credit history, you may not have a credit score at all.