Renters insurance is a crucial safeguard for tenants, ensuring that your personal belongings and liabilities are protected in various situations. In today’s rental market, where uncertainties can arise at any moment—from theft to natural disasters—having renters insurance provides peace of mind and financial security. This policy is designed not just to cover personal property, but also to offer liability protection, which is essential for anyone renting a home.

The reality is that many tenants underestimate the importance of renters insurance, often believing it’s an unnecessary expense. However, understanding the basic concepts and benefits can highlight its significance. By clarifying key terms and common misconceptions, this guide aims to empower renters with the knowledge they need to make informed decisions about their insurance needs.

Understanding the Basics of Renters Insurance

Renters insurance is a crucial safety net for tenants, providing financial protection against a variety of potential mishaps. Unlike homeowners insurance, which covers the structure of a house, renters insurance focuses on the personal property of the tenant and liability coverage. It is designed to safeguard against unforeseen events such as fire, theft, or water damage, making it an essential consideration for anyone renting a home.Understanding the fundamental concepts of renters insurance involves recognizing its key components.

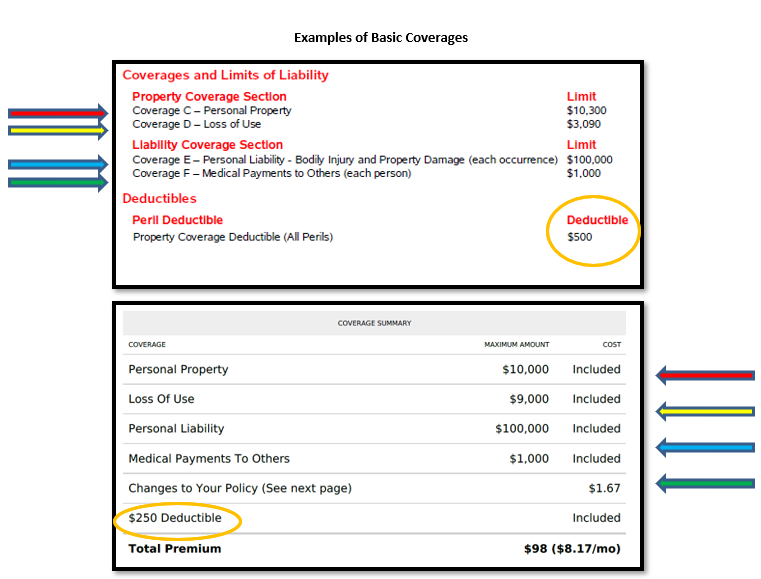

The three primary categories of coverage include personal property, liability, and loss of use. Personal property coverage protects your belongings within the rented space. This includes furniture, electronics, clothing, and other personal items. If your items are stolen or damaged, this coverage helps replace them or cover the repair costs. Liability coverage, on the other hand, protects you against claims resulting from injuries or damages sustained by others on your property.

For instance, if a guest slips and falls in your apartment, liability coverage can help cover legal fees and medical expenses. Lastly, loss of use coverage provides financial assistance when you are unable to live in your rented space due to a covered loss, such as fire or severe water damage. This can cover additional living expenses like hotel bills or temporary housing.

Importance of Renters Insurance in Today’s Rental Market

In today’s rental market, renters insurance is not just a wise choice; it is becoming increasingly essential. Many landlords now require tenants to have renters insurance before signing a lease, recognizing the protection it offers against potential liabilities. With the rising cost of living and frequent occurrences of natural disasters, having this insurance can save tenants from significant financial strain.

The following points illustrate the importance of renters insurance:

- Financial Security: Protecting personal assets against theft or damage preserves your financial stability.

- Liability Protection: Coverage against lawsuits resulting from accidents that occur in your rented space safeguards your financial future.

- Peace of Mind: Knowing you are covered in case of unexpected events helps reduce stress in your daily life.

- Affordability: Renters insurance is often inexpensive, with policies available for a relatively low monthly premium, making it accessible for many tenants.

- Landlord Requirements: Increasingly, landlords require proof of renters insurance, making it essential for securing a rental unit.

“Renters insurance is a small price to pay for peace of mind and protection of your personal property.”

Key Benefits of Renters Insurance

Renters insurance is often overlooked, yet it serves as a vital safety net for individuals renting a home or apartment. It provides financial protection against unexpected events that could cause loss or damage to personal belongings, ensuring peace of mind for renters. By understanding the essential benefits of renters insurance, individuals can better appreciate its value and the security it offers.One of the primary advantages of having renters insurance is the protection it provides for personal belongings.

This coverage typically includes items such as furniture, electronics, clothing, and jewelry. In various scenarios, renters insurance can prove its worth significantly. For example, if a fire were to damage a rented apartment, renters insurance would cover the cost of replacing lost possessions. Similarly, if a tenant’s belongings were stolen during a burglary, the policy would help reimburse them for their losses.

Protection Against Personal Property Loss

Understanding how renters insurance protects personal belongings is crucial for any renter. The following examples illustrate common situations where renters insurance can be beneficial:

1. Theft

If a renter experiences a break-in and high-value items like laptops or video game consoles are stolen, renters insurance can help cover the cost of replacing these items.

2. Natural Disasters

Events such as floods, hurricanes, or tornadoes can wreak havoc. If personal items are damaged or destroyed due to such natural disasters, renters insurance can help recover the costs incurred in replacements.

3. Accidental Damage

In cases where personal items are accidentally damaged, such as a spilled drink ruining an electronic device, renters insurance can provide financial relief for repairs or replacement.

4. Liability Protection

Renters insurance often includes liability coverage, which can protect against legal claims if someone is injured in the rented space. For instance, if a guest slips and falls in a renter’s apartment, liability coverage can help cover medical expenses and legal fees.Statistics indicate that renters insurance is an effective means of safeguarding personal property. According to the Insurance Information Institute, more than 50% of renters do not have insurance, which leaves a significant number at risk.

On the other hand, those with renters insurance can file claims for various losses, with an average claim amounting to around $30,000. This statistic highlights the importance of having coverage to mitigate the financial burden that loss can create.In summary, renters insurance is an essential investment that safeguards personal belongings against a myriad of risks, offering financial protection and peace of mind to renters when they need it most.

Common Myths Surrounding Renters Insurance

Many people hold misconceptions about renters insurance that can lead to significant financial risks. Understanding the facts behind these myths can help individuals make informed decisions about their coverage. This section delves into some of the most prevalent myths surrounding renters insurance and clarifies the truths that debunk them.

Misconceptions About Coverage

A common belief is that renters insurance is only necessary for high-value items. In reality, renters insurance covers much more than just expensive belongings. It provides protection against loss or damage to personal property due to events like theft, fire, or water damage. Additionally, it offers liability coverage in case someone is injured in your rental property. This means that even modest possessions can add up, and the financial protection renters insurance provides is invaluable.

“Renters insurance isn’t just about protecting your electronics; it’s about ensuring your entire lifestyle is safeguarded.”

Many believe that their landlord’s insurance policy covers their personal belongings. However, this is a misconception. Landlords typically only cover the physical structure of the building and may have their own liability coverage, but they do not insure tenants’ personal possessions. Therefore, without renters insurance, tenants risk losing everything they own in a disaster.

Consequences of Not Having Renters Insurance

Failing to obtain renters insurance can lead to dire financial consequences. Without this coverage, individuals are left vulnerable to unexpected events that could result in substantial losses. For instance, in 2019, a fire in an apartment complex left dozens of residents without their possessions. Those who had renters insurance received financial assistance to replace their belongings, while others faced the harsh reality of starting over without any help.

The financial impact of losing personal items can be staggering. A report from the National Association of Insurance Commissioners indicates that the average renter owns about $20,000 worth of personal property. Without insurance, replacing such items after a loss could result in financial strain, leaving individuals to cover expenses that could have otherwise been managed through insurance.

“Imagine losing everything you own in a fire—without renters insurance, that’s a reality many renters face.”

In addition to property loss, liability claims can add up quickly. If a visitor is injured in a rented space, the tenant could be held financially responsible for medical bills and other related costs, potentially leading to overwhelming debt. Renters insurance can help alleviate these burdens by covering legal fees and compensation claims, protecting tenants from unexpected liabilities.By debunking these myths and emphasizing the importance of renters insurance, individuals can take proactive steps to secure their financial future and enjoy peace of mind in their living situation.

Factors Influencing Renters Insurance Premiums

Renters insurance premiums can vary significantly based on a range of factors. Understanding what influences these costs can help renters make informed decisions when purchasing their policies. Key elements include the location of the rental, the type and amount of coverage required, and even the renter’s personal history. By being aware of these variables, individuals can better navigate the insurance landscape and potentially save on their premiums.Several factors contribute to the overall cost of renters insurance premiums.

One of the main elements is the location of the rental property. Areas with higher crime rates often see increased premiums due to the greater risk of theft or vandalism. The size and type of the rented space also matter; larger apartments or those with more expensive finishes might incur higher costs. Additionally, the amount of personal property being insured directly impacts the premium.

Renters with valuable items, such as electronics or jewelry, may need more coverage, consequently raising their costs.

Ways to Lower Renters Insurance Costs

Renters can take several steps to reduce their insurance costs while maintaining adequate coverage. Implementing security measures, such as installing deadbolt locks or security cameras, can lead to lower premiums as they reduce the risk of theft. Bundling renters insurance with other policies like auto insurance is another effective strategy, often resulting in a discount. Additionally, maintaining a good credit score can positively influence premium rates, as insurers view it as an indicator of responsibility.

It’s crucial for renters to explore various discount options offered by insurance companies. Here are some common discounts that might be available:

- Multi-Policy Discount: Combining renters insurance with auto or life insurance can lead to significant savings.

- Security System Discount: Having monitored security systems in place can decrease risk and lower premiums.

- Claims-Free Discount: Renters who have not filed claims over a certain period may qualify for reduced rates.

- Association Membership Discounts: Some insurance providers offer discounts to members of certain organizations or professional groups.

- Good Credit Discount: Maintaining a strong credit history can lead to lower premium costs.

- Paid in Full Discount: Paying the annual premium upfront can sometimes result in a discount.

Understanding these factors and employing smart strategies can help renters make the most of their insurance policies while keeping costs manageable.

The Process of Choosing the Right Renters Insurance Policy

Selecting the right renters insurance policy is a crucial step for anyone looking to protect their belongings and ensure peace of mind while renting. With various options available, understanding the process to choose the most suitable coverage can be overwhelming. This guide aims to simplify the decision-making process by outlining essential steps and providing a comparative analysis of coverage options.

Steps to Select Renters Insurance

Choosing the right renters insurance policy involves several key steps that help tailor coverage to specific needs. Here’s a structured approach to guide you through the selection process:

- Assess Your Needs: Start by evaluating the value of your belongings. Consider items like electronics, furniture, and clothing to determine the amount of coverage you require.

- Understand Coverage Types: Familiarize yourself with the different types of coverage available, such as actual cash value versus replacement cost. This knowledge will help you make informed decisions based on your needs.

- Research Insurance Providers: Look for reputable insurance companies that offer renters insurance. Online reviews and ratings can provide insights into customer experiences and satisfaction.

- Compare Quotes: Request quotes from multiple insurers to understand the price range and coverage options available. Pay attention to how premiums change based on different coverage levels.

- Review Policy Details: Read the fine print of each policy carefully, particularly the exclusions and limits of coverage. Understanding these details will prevent surprises later.

- Ask About Discounts: Inquire if the insurer offers any discounts for bundled policies, security systems, or being a member of specific organizations.

- Choose a Policy and Purchase: Once you have compared all options, select the policy that best fits your needs and complete the purchase process.

Types of Renters Insurance Coverage Options

Understanding the various types of coverage is vital for selecting the right renters insurance policy. Here are the primary types of coverage available, each catering to different needs:

- Personal Property Coverage: This covers the loss or damage of personal belongings due to incidents like theft, fire, or vandalism. It’s essential for protecting your valuables.

- Liability Coverage: This protects you in case someone is injured while on your property or if you accidentally cause damage to someone else’s property. It typically covers legal fees and damages up to the policy limit.

- Loss of Use Coverage: If your rental becomes uninhabitable due to a covered loss, this coverage helps pay for additional living expenses such as hotel bills or temporary accommodations.

Checklist for Evaluating Insurers

Before making a final decision on a renters insurance policy, it’s important to evaluate various insurers and their offerings. Use this checklist to ensure you cover all necessary considerations:

- Company Reputation: Research the insurer’s reputation through reviews and ratings on consumer websites.

- Financial Stability: Check the financial ratings of the company to ensure they can handle claims.

- Coverage Options: Confirm the types of coverage offered align with your needs.

- Premium Costs: Compare premium costs for similar coverage across different insurers.

- Customer Service: Investigate the insurer’s customer service track record for responsiveness and claims handling.

- Claims Process: Understand the claims process, including how to file a claim and the time frame for resolution.

- Discount Availability: Inquire about available discounts that might reduce your premium costs.

“Choosing the right renters insurance is about understanding your needs and the coverage options available; it’s not just about the cost.”

Filing a Claim for Renters Insurance

When accidents happen, knowing how to file a claim for renters insurance can be crucial for getting back on your feet. Understanding the step-by-step process can save you time and frustration during what is often a stressful period. Here’s a comprehensive guide on how to navigate the claim process effectively.The procedure for filing a renters insurance claim generally involves several important steps.

First, it’s essential to notify your insurance company as soon as possible after the incident. You can usually do this by calling their claims department or submitting a claim through their website. Keep in mind that most insurers have specific time limits for reporting a claim, so timely action is critical.

Procedures for Filing a Claim

The claim process typically involves the following steps:

1. Initial Notification

Contact your insurance provider via phone or online portal. Provide them with details about the incident, such as when and how it occurred.

2. Claim Assignment

After your initial notification, a claims adjuster will be assigned to your case. This person will be your main point of contact throughout the process.

3. Investigation

The adjuster will investigate the claim, which may involve visiting your property, taking photos, and interviewing you for more details.

4. Documentation Submission

You will need to submit documentation to support your claim, which will be discussed further below.

5. Claim Decision

After the investigation is complete, the insurance company will make a decision regarding your claim and communicate it to you.

6. Claim Settlement

If your claim is approved, you’ll receive your payment based on the terms of your policy.

Documentation Needed to Support a Claim, Renters insurance

Gathering the right documentation is a pivotal step in ensuring the success of your claim. Here’s what you’ll typically need:

Proof of Loss

A detailed description of the incident, including the date, time, and nature of the loss.

Items Affected

A list of all items that were damaged or stolen, including their estimated value and purchase receipts if available.

Photographic Evidence

Photos of the damage or loss can significantly strengthen your claim. Make sure to capture multiple angles and any relevant details.

Witness Statements

If there were any witnesses to the incident, their written accounts can provide additional support.

Police Report

If your claim involves theft or vandalism, a police report may be required.To gather this information effectively, create a checklist and keep all documents organized in one location, whether physical or digital. This will not only streamline the process but also ensure you don’t miss any critical components.

Common Challenges Renters Encounter During the Claim Process

Navigating the claim process can sometimes come with its own set of challenges. Here are some common hurdles and strategies to overcome them:

Delayed Responses

Sometimes, insurance companies may take longer than expected to respond. To mitigate this, follow up regularly with your claims adjuster to keep your claim moving forward.

Disputes Over Coverage

You may find that your insurer does not cover certain items or damages as you expected. To avoid surprises, thoroughly review your policy before filing a claim. Understanding your coverage can help in managing expectations.

Insufficient Documentation

Claims can be denied due to a lack of supporting evidence. Ensure that you’ve collected and submitted all necessary documentation to strengthen your position.

Emotional Stress

Dealing with loss can be overwhelming. Don’t hesitate to lean on friends, family, or even professionals for emotional support during this time.By preparing in advance and anticipating these challenges, you can navigate the claims process with greater confidence and efficiency.

The Role of Renters Insurance in Natural Disasters

Renters insurance plays a crucial role in protecting tenants from the financial fallout of natural disasters. While many may think of it as merely a safeguard against theft or damage to personal belongings, its importance amplifies significantly in the face of calamities like floods, hurricanes, and wildfires. Understanding the specific coverages included in renters insurance policies can help tenants navigate the aftermath of such events more effectively.When a natural disaster strikes, renters insurance can provide coverage for personal property loss, additional living expenses, and liability protection.

Typical policies cover belongings damaged by fire, wind, hail, or water (from designated sources), while also covering costs incurred while finding temporary housing if the rental unit is uninhabitable. However, there are important exclusions; for example, standard policies often do not cover flood damage unless additional flood insurance is purchased.

Typical Coverage and Exclusions

It’s essential for tenants to know what their renters insurance policy typically includes and excludes in the context of natural disasters. Understanding these aspects can prepare them better for potential issues.

- Covered Perils: Most renters insurance policies will cover damages to personal belongings from fires, theft, vandalism, windstorms, and certain types of water damage (like burst pipes).

- Additional Living Expenses: If a natural disaster makes a rental unit uninhabitable, this coverage can pay for temporary housing costs, such as hotel stays and meals.

- Liability Protection: In case someone is injured on the rental property due to a disaster-related incident, liability coverage can protect the tenant against legal claims.

However, there are certain exclusions that tenants should be aware of:

- Flood Damage: Standard renters insurance typically does not cover damage resulting from floods. Tenants in flood-prone areas should consider purchasing separate flood insurance.

- Earthquake Damage: Damages from earthquakes are commonly excluded from standard policies, requiring additional earthquake coverage if desired.

- Negligence: Damage due to a tenant’s negligence, such as failing to prepare for severe weather, may not be covered.

“Understanding your coverage limits and exclusions is vital to ensure you are adequately protected in the event of a natural disaster.”

Strategies for Mitigating Risks and Preparedness

Taking proactive steps can significantly mitigate risks associated with natural disasters. Here are some strategies to consider:

- Emergency Plan: Establish a clear emergency plan with all household members, including evacuation routes and communication methods.

- Stay Informed: Regularly monitor local weather reports and alerts regarding potential natural disasters.

- Document Belongings: Keep an updated inventory of personal property, including photos and receipts, to facilitate claims in case of loss.

- Strengthen the Rental: If permitted, take steps to reinforce windows and doors or use storm shutters to protect the property from extreme weather.

By being aware of the protections renters insurance provides during natural disasters and preparing adequately, tenants can ensure they are better equipped to handle potential challenges that arise during these unpredictable events.

Understanding Liability Coverage in Renters Insurance Policies

Liability coverage is a core component of renters insurance that protects tenants from financial fallout arising from accidental damage or injury to others. This coverage serves as a safety net, ensuring that renters are not solely responsible for hefty legal costs or damages that could arise from various incidents, ultimately providing peace of mind.Liability coverage typically encompasses a variety of situations that could lead to lawsuits or claims against the renter.

It is crucial for renters to understand the limits of this coverage, as different policies may offer varying amounts of protection. Most policies provide liability limits ranging from $100,000 to $500,000, which can be tailored to meet individual needs. This coverage includes incidents such as slip-and-fall accidents on the rented property, damage to a neighbor’s property, or harm caused by pets.

Types of Incidents Covered by Liability Insurance

Understanding the specific incidents covered under liability insurance is essential for renters, as this knowledge can help them navigate potential risks. The following scenarios highlight typical occurrences that liability coverage can address:

- Injury to Visitors: If a guest trips on a loose floor tile in your apartment and sustains an injury, liability coverage can help cover their medical expenses and any legal fees if they decide to sue.

- Property Damage to Neighbors: Accidental damage, such as a water leak from your unit that damages your neighbor’s belongings, falls under liability coverage. This can include repair costs or replacement of damaged items.

- Pet-Related Incidents: If your dog bites a visitor and they file a claim for medical expenses or damages, your liability coverage can assist in covering those costs, protecting you from out-of-pocket expenses.

The importance of having adequate liability coverage cannot be overstated. For example, consider a renter who hosts a small gathering. If a guest slips on a wet floor and suffers a serious injury, they might pursue legal action for damages. Without sufficient liability coverage, the renter could face overwhelming financial responsibility, potentially jeopardizing their financial stability. Thus, liability coverage serves as a crucial protective measure against unpredictable events that could result in significant legal exposure.

“Liability coverage in renters insurance can save you from devastating financial consequences in the event of unexpected incidents.”

Overall, understanding liability coverage is vital for renters, ensuring they are adequately protected against unforeseen accidents and legal claims. By investing in the appropriate amount of liability coverage, renters can navigate their living situation with confidence, knowing they have the necessary protection in place.

The Impact of Pets on Renters Insurance

When it comes to renters insurance, having pets can significantly influence both coverage and premiums. Many landlords and insurance providers recognize that pets can pose unique risks, which can lead to higher costs for pet owners. Understanding these factors is essential for renters who want to protect their furry companions as well as their belongings.Insurance coverage for renters with pets often varies based on the type of pet and the insurance provider’s policies.

Commonly, incidents involving pets that may be covered include damage caused by pets to the property or injuries inflicted by pets on visitors. However, some insurance policies may exclude specific breeds or types of pets that are deemed high-risk, such as certain dog breeds known for aggression. It’s crucial for renters to be aware of these nuances to avoid unexpected gaps in coverage.

Types of Pet-Related Incidents Covered or Excluded

To ensure comprehensive coverage, renters should familiarize themselves with the specific incidents related to pets that can be covered or excluded in their policies. These considerations can help in choosing the right insurance plan:

- Property Damage: Coverage typically includes damage to the rental property caused by pets, like scratches on floors or torn furniture.

- Bodily Injury: If your pet injures someone, liability coverage may help cover medical expenses or legal fees.

- Breed Restrictions: Some insurers may exclude coverage for specific breeds, like Rottweilers or Pit Bulls, due to perceived risks.

- Pet-Related Incident Exclusions: Certain policies may exclude coverage for incidents caused by pets, including bites, unless specified otherwise.

- Additional Coverage: Some renters opt for additional pet liability insurance to cover potential costs associated with their pets.

Renters with pets should take proactive steps to ensure adequate coverage. It’s essential to review insurance policies carefully, disclose all pets to the insurance provider, and inquire about any breed-specific restrictions. Additionally, maintaining a safe and well-trained pet can help mitigate risks that might lead to claims. Keeping documentation of pet vaccinations and training can also be beneficial in case of any disputes with the insurance provider.

“Understanding your pets can save you from unexpected financial burdens.”

Future Trends in Renters Insurance

As the landscape of renters insurance evolves, several emerging trends are shaping the policies available to tenants. These changes are a reflection of broader societal shifts, driven by technology, urbanization, and changing dynamics within rental markets. Understanding these trends can provide valuable insights for renters looking to secure the right coverage for their needs.Technological advancements are revolutionizing the way renters purchase and manage their insurance.

The use of online platforms and mobile applications has streamlined the process, making it easier for individuals to compare policies, obtain quotes, and manage their coverage from the convenience of their devices. Furthermore, the integration of artificial intelligence (AI) and machine learning is enhancing the underwriting processes, allowing insurers to assess risk more accurately and tailor policies to individual needs.

Technological Advancements in Renters Insurance

Emerging technologies are not only simplifying the purchase process but also transforming policy management. The following innovations are particularly noteworthy:

- Mobile Applications: Renters can now manage their policies, file claims, and receive updates directly through mobile apps, enhancing accessibility and user experience.

- AI Underwriting: Insurers are leveraging AI to analyze data and assess risks with greater precision, which leads to more personalized policy offerings.

- Telematics: Some insurance providers are embracing telematics, gathering real-time data to understand tenant behavior and adjust premiums accordingly.

- Virtual Assistants: The use of chatbots and virtual assistants is improving customer support, providing instant answers to queries regarding policies and claims.

Another significant trend is the increasing urbanization across the globe, which affects the rental market and, by extension, renters insurance. As more people move into urban centers, demand for rental properties rises, impacting the way insurance is approached. This influx is leading to an increase in multi-family units, which often necessitate specific coverage types catering to shared living spaces.

Impact of Urbanization on Renters Insurance

Urbanization is reshaping the renting landscape, prompting the need for adaptive insurance solutions. Here are key implications of this trend:

- Higher Risk Exposure: Dense urban environments may experience higher incidents of theft, vandalism, and natural disasters, requiring enhanced coverage options.

- Short-Term Rentals: The rise of platforms like Airbnb has led to a surge in short-term rental arrangements, necessitating specialized insurance tailored to transient tenants.

- Community Coverage Options: Insurers are increasingly offering community-based policies that cover multiple units together, providing a cost-effective solution for renters in urban settings.

- Policy Customization: Insurers are recognizing the need for flexible policies that cater to the diverse needs of urban renters, such as pet coverage or roommate arrangements.

As these trends continue to develop, the future of renters insurance will likely include a blend of customization, technology integration, and responsiveness to urban dynamics. Renters can expect more tailored options that reflect their unique situations, making it essential to stay informed about these changes to ensure they choose the right coverage.

Epilogue

Ultimately, renters insurance serves as an invaluable asset for tenants, providing not only protection for personal belongings but also safeguarding against potential liabilities. As we explored the various aspects of renters insurance—from its benefits and myths to the claims process—it’s clear that having this coverage is more than just a precaution; it’s a smart move for anyone looking to rent.

Understanding your policy and knowing how it works can significantly enhance your rental experience, allowing you to focus more on enjoying your home and less on what-ifs.

Query Resolution

What does renters insurance typically cover?

Renters insurance usually covers personal property, liability protection, and additional living expenses in case of a loss.

Is renters insurance mandatory?

No, renters insurance is not legally required, but landlords may require tenants to have it.

Can I get renters insurance with bad credit?

Yes, you can still obtain renters insurance with bad credit, though it may affect your premium rates.

How much does renters insurance cost?

The cost of renters insurance varies but typically ranges from $15 to $30 per month, depending on coverage and location.

Does renters insurance cover theft outside my home?

Yes, renters insurance often covers theft of personal belongings, even if they are stolen outside your home.

How do I file a claim for renters insurance?

To file a claim, contact your insurance company, provide documentation of the loss, and complete the required forms.

Are pets covered under renters insurance?

Coverage for pets varies by policy; some may cover damages caused by pets, while others may have exclusions.