As mortgage rates today take center stage, the dynamics of the housing market are more crucial than ever. Fluctuations in these rates can significantly influence buyer behavior, shaping decisions and trends in real estate. Understanding how these rates relate to property prices and analyzing historical patterns provides valuable insights for potential buyers and investors navigating this complex landscape.

Current mortgage rates are not just numbers; they reflect broader economic conditions and have a direct impact on affordability and housing demand. With various factors, such as the Federal Reserve’s policies and inflation rates, playing a role, it’s essential to stay informed about how these elements intertwine to affect the mortgage landscape today.

The significance of current mortgage rates in the housing market

Current mortgage rates play a critical role in shaping the dynamics of the housing market. They not only influence the cost of borrowing but also serve as a barometer for economic health, impacting buyer sentiment and market activity. With mortgage rates fluctuating based on various economic indicators, understanding their significance can help both potential homebuyers and investors make informed decisions.Mortgage rates significantly influence buyer behavior in the housing market.

When rates are low, borrowing costs decrease, making homeownership more accessible for many. This often leads to an increase in demand, as more buyers enter the market looking for homes. Conversely, when rates rise, the cost of monthly mortgage payments increases, which can deter potential buyers and decrease demand. This shift can lead to a slowdown in market activity and potentially lower property prices as sellers adjust their expectations.

Mortgage rates and property prices

The relationship between mortgage rates and property prices is complex and often interdependent. Lower mortgage rates typically correlate with rising property prices, as increased buyer demand pushes home values upward. In contrast, higher rates can suppress demand, leading to stagnation or even declines in property prices. Several factors contribute to this relationship, including:

- Affordability: When mortgage rates decrease, buyers have more purchasing power, which can lead to higher bids on properties, driving prices up.

- Market Sentiment: Low rates can create a sense of urgency among buyers, as they may fear rates will increase again, further fueling competition and price increases.

- Investor Activity: Lower rates often attract real estate investors looking for rental properties, which can drive prices up in certain neighborhoods.

Historical trends demonstrate the effects of varying mortgage rates on market activity. For example, during the early 2000s, the housing market experienced a surge as mortgage rates fell to historic lows. This led to a buying frenzy, contributing to rapid price increases. Conversely, during the financial crisis in 2008, mortgage rates skyrocketed, resulting in a dramatic slowdown in the housing market.

Property values fell significantly as buyers retreated, and many homes went into foreclosure.

“Understanding the trends of mortgage rates is crucial for making informed investment decisions in real estate.”

Recent data indicates that even slight changes in mortgage rates can have a pronounced impact on buyer behavior and overall market health. As rates fluctuate, potential homebuyers should stay informed about market conditions to navigate their purchasing decisions effectively. This vigilance can lead to more favorable outcomes in both home buying and investment opportunities.

Factors that determine mortgage rates today

Understanding the factors that influence mortgage rates is essential for homebuyers and investors alike. Various economic indicators and decisions made by financial institutions can significantly affect the cost of borrowing money for purchasing a home. This information helps borrowers make informed decisions about their mortgages and timing their purchases.The mortgage rates are primarily determined by a combination of economic indicators, the policies of the Federal Reserve, and prevailing inflation rates.

These elements work together to shape the lending landscape, impacting both lenders and borrowers.

Economic Indicators that Influence Mortgage Rates

Several key economic indicators play a crucial role in determining mortgage rates. These indicators provide insights into the overall health of the economy, which in turn influences interest rates. The following are some of the most significant indicators:

- Gross Domestic Product (GDP): A growing GDP typically signals a robust economy, leading to higher mortgage rates as lenders anticipate increased demand for loans.

- Employment Rates: Higher employment rates can boost consumer confidence and spending, which may prompt lenders to raise rates in anticipation of increased borrowing.

- Consumer Price Index (CPI): This reflects inflation levels. A higher CPI indicates rising costs of goods and services, often resulting in increased mortgage rates.

- Bond Yields: Mortgage rates often follow the yield on 10-year Treasury bonds. When bond yields rise, mortgage rates generally increase as well.

Role of the Federal Reserve in Setting Interest Rates

The Federal Reserve, often referred to as the Fed, plays a pivotal role in influencing interest rates, including mortgage rates. The Fed adjusts the federal funds rate, which is the interest rate at which banks lend to each other overnight. Changes in this rate can ripple through the economy, impacting borrowing costs for consumers and businesses alike.

The Federal Reserve’s monetary policy decisions directly affect short-term interest rates, which ultimately influence long-term mortgage rates.

When the Fed raises interest rates to combat inflation, borrowing costs increase, leading mortgage rates to rise. Conversely, if the Fed lowers rates to stimulate economic growth, mortgage rates may decrease, making home buying more accessible.

Impact of Inflation Rates on Mortgage Lending Costs

Inflation rates are a critical factor affecting mortgage lending costs. When inflation rises, the purchasing power of money declines, prompting lenders to increase interest rates to maintain their profit margins. This relationship creates a direct effect on mortgage rates.For instance, if inflation is reported at a 5% annual increase, lenders may raise mortgage rates by a corresponding amount to offset the anticipated decrease in money value, leading to higher costs for borrowers.

Higher inflation leads to higher mortgage rates, which can significantly impact home affordability for prospective buyers.

As inflation continues to fluctuate, borrowers must stay informed about these changes to secure the best possible mortgage terms, especially in a volatile economic environment.

Comparing fixed-rate and adjustable-rate mortgages in today’s context

In the current landscape of mortgage options, the choice between fixed-rate and adjustable-rate mortgages (ARMs) is more relevant than ever. Understanding the nuances of these two types of mortgages can significantly impact your long-term financial health, especially given the evolving interest rate environment.

Advantages and disadvantages of fixed-rate mortgages

Fixed-rate mortgages provide stability and predictability, making them an attractive option for many borrowers. With a fixed-rate mortgage, the interest rate remains the same throughout the loan’s duration, which means monthly payments are consistent. This feature is particularly beneficial in today’s climate of fluctuating interest rates, allowing homeowners to budget effectively without worrying about future increases.However, there are notable downsides to fixed-rate mortgages as well.

One major disadvantage is that they tend to have higher initial interest rates compared to ARMs. Additionally, if interest rates decrease, those locked into a fixed mortgage may miss out on potential savings. Key advantages and disadvantages of fixed-rate mortgages include:

- Advantages:

- Predictable monthly payments

- Protection against rising interest rates

- Long-term financial planning ease

- Disadvantages:

- Higher initial interest rates

- Less flexibility if rates decline

Benefits and risks of adjustable-rate mortgages

Adjustable-rate mortgages offer an initial lower interest rate compared to fixed-rate mortgages, which can make them appealing to first-time homebuyers or those looking to minimize upfront costs. In the current environment, where rates may fluctuate, an ARM can provide significant savings during the initial fixed-rate period, often lasting several years.Nonetheless, ARMs come with inherent risks. After the initial fixed period, the interest rate adjusts periodically, which can lead to increased monthly payments if rates go up.

This variability can create budgeting challenges and financial strain. Borrowers must also consider the potential for rates to rise significantly, which could lead to a much higher total cost over the life of the loan.The benefits and risks associated with adjustable-rate mortgages can be summarized as follows:

- Benefits:

- Lower initial interest rates

- Potential for lower monthly payments initially

- Risks:

- Uncertainty in future monthly payments

- Possibility of higher total costs if rates rise

Financial implications of both mortgage types

When considering the long-term financial implications of fixed-rate and adjustable-rate mortgages, it’s crucial to analyze the current interest rates and market trends. Fixed-rate mortgages offer long-term security, especially in a rising rate environment, while ARMs might present short-term savings but could lead to higher costs if interest rates increase.For example, a $300,000 mortgage at a fixed rate of 4% results in a monthly payment of approximately $1,432, which remains unchanged over 30 years.

In contrast, an ARM starting at 3% might initially set you back $1,265 per month, but if rates climb to 5% after the initial period, your payment could increase significantly.

“Choosing the right mortgage type can save or cost you thousands over the life of the loan.”

Evaluating your financial situation and future plans is essential when deciding between these two options. Homebuyers must weigh their comfort with risk and financial goals against current mortgage offerings to make an informed decision that aligns with their circumstances.

How to secure the best mortgage rates available today

Securing a favorable mortgage rate can significantly impact your overall financial health. The key to unlocking the best rates lies in preparation and strategic decision-making. This guide will walk you through actionable steps to improve your credit score, effectively shop around for lenders, and understand how timing can influence your mortgage rate.

Improving credit scores to qualify for better rates

A higher credit score can lead to lower mortgage rates, saving you thousands over the life of your loan. Here are essential steps to enhance your creditworthiness:

- Check your credit report: Obtain a free copy of your credit report from all three major credit bureaus. Review it for errors that could negatively affect your score and dispute any inaccuracies.

- Pay bills on time: Ensure all your bills, particularly credit card payments and loans, are paid promptly. Late payments can significantly lower your credit score.

- Reduce credit card balances: Aim to keep your credit utilization ratio below 30%. This means that if you have a total credit limit of $10,000, your outstanding balance should be less than $3,000.

- Avoid opening new credit accounts: Each time you apply for credit, it can slightly lower your score. Avoid unnecessary applications while you’re trying to improve your score.

- Maintain older credit accounts: The length of your credit history matters. Keep older accounts open, as they contribute positively to your credit score.

Shopping around and negotiating with lenders

Finding the right lender can be just as critical as improving your credit score. Consider these strategies to effectively shop for and negotiate mortgage rates:

- Compare multiple lenders: Don’t settle for the first offer you receive. Obtain quotes from several lenders, including banks, credit unions, and online mortgage providers, to find the best rate.

- Ask about discounts: Some lenders offer discounts for first-time homebuyers or for those who choose to set up automatic payments. Always inquire about available discounts.

- Negotiate fees: Lenders often have flexibility on closing costs and origination fees. Don’t hesitate to negotiate these fees to lower your overall mortgage cost.

- Understand the loan terms: Focus not just on the interest rate but also on the terms of the loan. A lower rate on a longer-term loan may not be as favorable as a slightly higher rate on a shorter-term loan.

Importance of timing and market conditions

The timing of your mortgage application can have a significant impact on the rate you secure. Here are important factors to consider:

- Monitor interest rate trends: Keep an eye on market conditions and economic indicators that can affect mortgage rates. For instance, when the Federal Reserve raises interest rates, mortgage rates typically follow suit.

- Time your application: Applying during periods of low demand or when economic conditions are favorable can help you secure better rates. Research historical data to identify patterns in rate fluctuations.

- Consider the season: Historically, spring and summer tend to be busier months for the housing market, which can lead to higher rates due to increased demand. Conversely, winter may offer less competition.

Securing the best mortgage rates requires proactive planning and awareness of market conditions.

The impact of mortgage rates on refinancing opportunities

As mortgage rates fluctuate, homeowners often find themselves weighing the benefits of refinancing their existing loans. Understanding the right conditions for refinancing is crucial to maximizing potential savings and minimizing costs associated with the process. Current market trends can create unique opportunities for those looking to optimize their financial situations through refinancing.When mortgage rates drop significantly compared to the homeowner’s existing rate, refinancing can become advantageous.

Homeowners may consider refinancing if they can secure a lower interest rate, which can lead to reduced monthly payments. Furthermore, refinancing might be beneficial if homeowners wish to change the loan term, consolidate debt, or tap into equity for other financial needs. For example, if a homeowner currently has a 4% mortgage rate and the market offers rates at 3%, the potential savings could be substantial over time.

Potential savings and costs associated with refinancing

It’s essential to evaluate the potential savings against the costs of refinancing. Various factors come into play, including the loan amount, the interest rate differential, and the closing costs. Homeowners should calculate the break-even point, which indicates how long it will take to recoup the costs of refinancing through the savings on monthly payments.Costs typically associated with refinancing include:

- Closing Costs: These may include fees for appraisals, title searches, and attorney fees, often ranging from 2% to 5% of the loan amount.

- Prepayment Penalties: Some loans have penalties for paying off the mortgage early, which should be factored into the equation.

- Credit Report Fees: Lenders usually require an updated credit report to assess the homeowner’s creditworthiness, which can incur additional costs.

Homeowners should also consider the long-term implications of refinancing. A lower monthly payment can provide immediate relief, but extending the loan term may result in paying more interest over the life of the loan.

Refinancing process and factors to consider

The refinancing process typically involves several steps that require careful consideration. Homeowners should start by assessing their current mortgage rate and determining the desired outcome of refinancing.Key factors to consider include:

- Credit Score: A higher credit score can qualify homeowners for lower interest rates, making it critical to check and improve credit standing prior to refinancing.

- Loan-to-Value Ratio (LTV): The LTV ratio is essential for determining eligibility; a lower ratio may secure better rates and terms.

- Loan Type: Understanding the differences between fixed-rate and adjustable-rate mortgages can influence the decision on which type to choose during refinancing.

The overall refinancing process entails gathering necessary documentation, applying with lenders, and undergoing underwriting. Homeowners should shop around for the best rates and terms, ensuring they understand all associated costs before committing to a new loan.

“Refinancing should be approached as a strategic decision, balancing short-term savings with long-term financial goals.”

The future outlook for mortgage rates and housing affordability

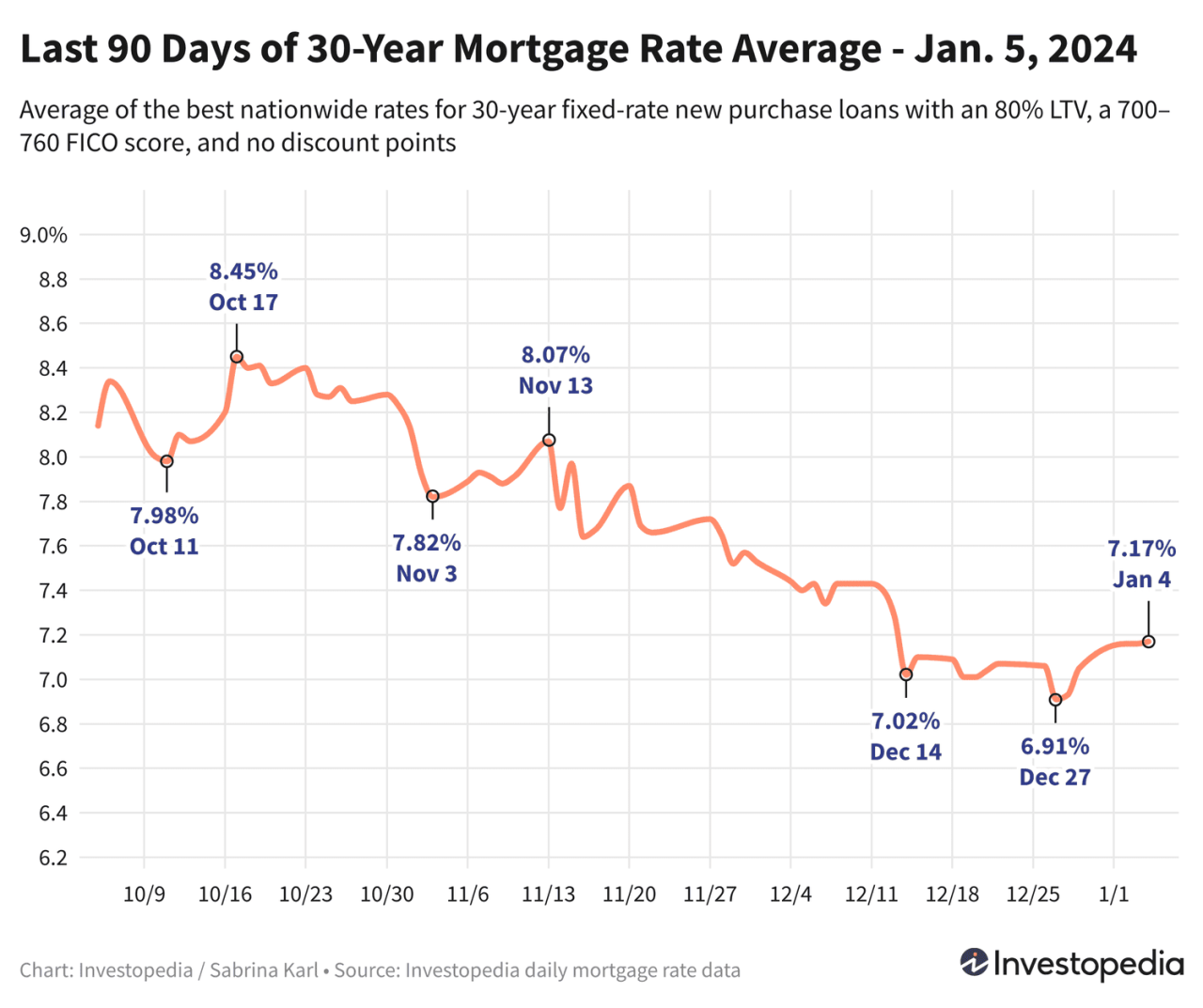

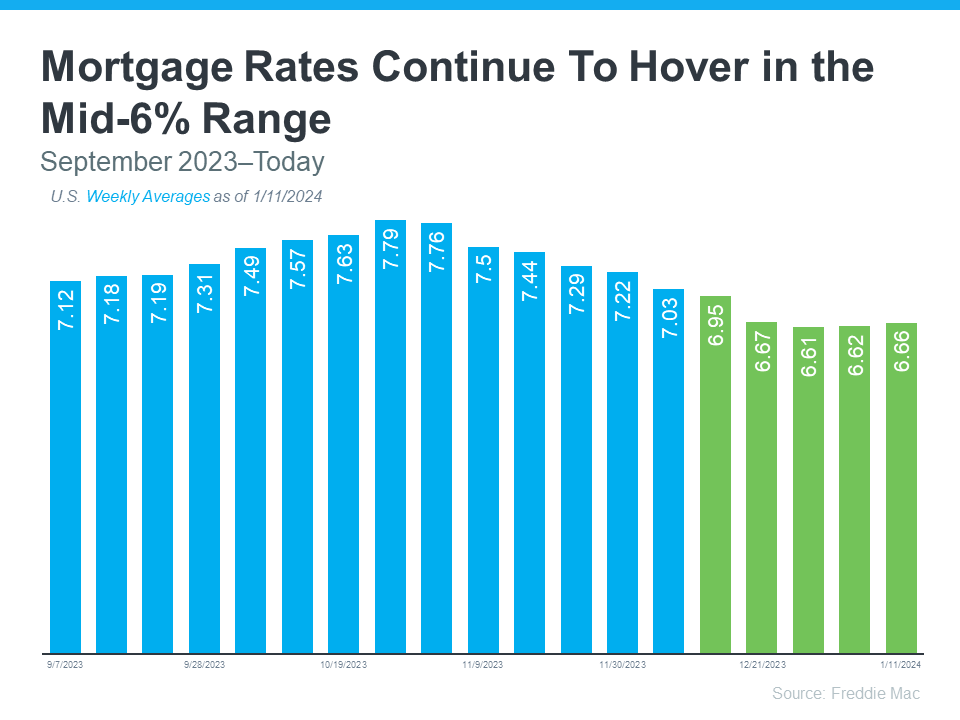

As we look towards the future, the landscape of mortgage rates and housing affordability is marked by a complex interplay of economic indicators and market dynamics. Recent trends suggest that mortgage rates may experience fluctuations, influenced by a variety of factors including inflation, Federal Reserve policies, and overall economic recovery. Potential homebuyers must stay informed about these trends, as they significantly impact the affordability of homes.The predictions for mortgage rates in the upcoming months indicate a cautious optimism among analysts.

With inflation showing signs of stabilization, some forecasts suggest that mortgage rates may plateau or even decrease slightly by early next year. However, uncertainties remain, particularly with ongoing geopolitical events and domestic economic shifts that could sway these rates upward. The current consensus among economists is that while rates may not return to the historic lows seen in previous years, they are unlikely to leap dramatically higher, creating a more stable environment for potential buyers.

Implications of Rate Changes on Housing Affordability

Monitoring mortgage rate changes is crucial for understanding their effects on housing affordability. As rates fluctuate, so do monthly mortgage payments, which directly impact a buyer’s purchasing power.

- When rates rise, homes become more expensive to finance, leading to higher monthly payments.

- A significant increase in rates could push potential buyers out of the market, particularly first-time homeowners.

- Conversely, if rates decrease or remain stable, this could incentivize more buyers to enter the market, potentially driving up home prices due to increased demand.

For example, if a prospective buyer locks in a mortgage rate of 4% versus a rate of 5%, the difference in total interest paid over the life of a 30-year loan can be substantial. This illustrates why even small changes in mortgage rates can have significant implications for affordability and accessibility in the housing market.Economic conditions play a pivotal role in shaping future mortgage rate trends.

In periods of recovery, increased consumer confidence can lead to greater spending and investment in housing, which can stimulate demand and subsequently drive up mortgage rates. Conversely, economic downturns often lead to lower rates as lenders compete for a dwindling pool of buyers. Overall, the future of mortgage rates and housing affordability hinges on various factors, including economic growth, inflation rates, and policy decisions by the Federal Reserve.

Buyers and investors should closely monitor these indicators to navigate the evolving housing landscape effectively.

Final Summary

In conclusion, the current state of mortgage rates is pivotal for anyone involved in the housing market. Whether you’re looking to buy, refinance, or simply understand the trends, being informed about today’s rates and their implications can lead to smarter financial decisions. As we look to the future, keeping an eye on economic indicators will continue to be vital in navigating this ever-evolving market.

Essential FAQs

What are the average mortgage rates today?

The average mortgage rates today can fluctuate daily, so it’s best to check current listings from reputable financial websites or lenders.

How often do mortgage rates change?

Mortgage rates can change daily based on market conditions, economic indicators, and Federal Reserve decisions.

Can I lock in my mortgage rate?

Yes, most lenders allow you to lock in your mortgage rate for a certain period, protecting you from future increases while your loan is processed.

What credit score do I need for the best mortgage rates?

A credit score of 740 or higher typically qualifies you for the best mortgage rates, but some lenders may offer competitive rates for slightly lower scores.

Is it better to get a fixed-rate or adjustable-rate mortgage?

This depends on your financial situation; fixed-rate mortgages offer stability, while adjustable-rate mortgages may start lower but can increase over time.