Blockchain finance is transforming the way transactions are conducted by introducing unprecedented levels of security, transparency, and efficiency. As this innovative technology gains momentum, it beckons financial professionals and enthusiasts alike to explore its vast potential. From decentralized finance (DeFi) to smart contracts, the applications of blockchain are reshaping traditional financial models and paving the way for new, exciting possibilities.

At its core, blockchain technology relies on decentralized networks to enhance trust and eliminate intermediaries, allowing for more direct and secure transactions. This system not only addresses the limitations of traditional finance but also opens doors to innovative financial solutions across various industries. With a growing number of real-world applications, it’s evident that blockchain finance stands at the cutting edge of a financial revolution.

The Fundamental Principles of Blockchain in Financial Services

Blockchain technology serves as a revolutionary framework in the financial sector, providing a decentralized and secure approach to transactions. The core principles of blockchain include transparency, immutability, decentralization, and security. These principles not only enhance the efficiency of financial transactions but also foster trust among users. By eliminating intermediaries, blockchain enables direct peer-to-peer transactions, thereby reducing costs and streamlining processes.Decentralization is one of the most significant advantages of blockchain technology.

Traditional financial systems typically rely on centralized authorities, such as banks, which pose risks of fraud, data breaches, and single points of failure. In contrast, blockchain distributes the control across a network of participants, making it difficult for any single entity to manipulate the system. Each transaction is recorded on multiple nodes within the network, ensuring that alterations are nearly impossible without consensus from the majority.

This decentralization enhances security and transparency, as all participants can verify transactions independently, creating a robust system of checks and balances.

Real-World Applications of Blockchain in Finance

The real-world applications of blockchain in finance are diverse, showcasing its potential to transform traditional practices. Key examples include:

- Cryptocurrencies: Bitcoin, the first decentralized cryptocurrency, exemplifies how blockchain can facilitate secure, anonymous transactions without the need for intermediaries. It has gained significant traction as a digital asset and a means of exchange.

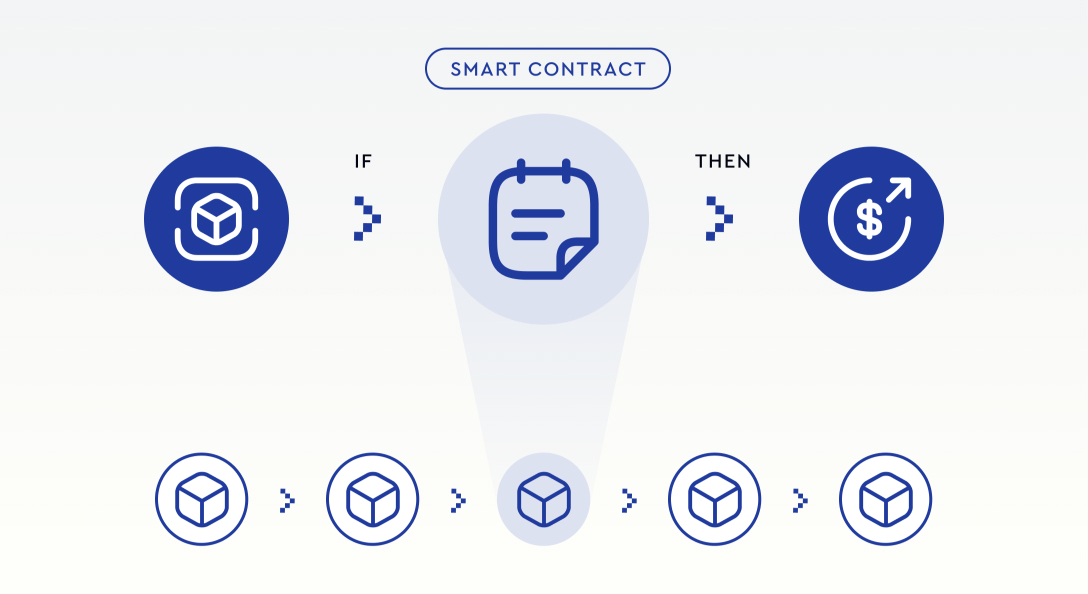

- Smart Contracts: Smart contracts are self-executing contracts with the terms directly written into code. They execute transactions automatically when predetermined conditions are met, reducing the need for legal intermediaries in agreements, particularly in sectors like real estate and insurance.

- Cross-Border Payments: Blockchain simplifies cross-border payments by enabling faster and cheaper transactions compared to traditional banking systems. Companies like Ripple use blockchain technology to facilitate instant money transfers across different currencies, significantly reducing transaction times and costs.

- Supply Chain Finance: Financial institutions are leveraging blockchain to monitor and finance supply chain transactions. By providing a transparent and immutable ledger of transactions, stakeholders can track goods, verify authenticity, and ensure timely payments, enhancing overall supply chain efficiency.

- Digital Identity Verification: Blockchain can enhance identity verification processes in finance. Projects like uPort aim to provide individuals with a secure and portable digital identity that can be used for KYC (Know Your Customer) processes, reducing the risk of identity theft and fraud.

“Blockchain technology creates a trustworthy environment for financial services, reducing the risks associated with fraud and enhancing overall transaction efficiency.”

Innovative Use Cases of Blockchain Finance Across Industries

The adoption of blockchain technology in finance is reshaping various industries by offering solutions that enhance transparency, security, and efficiency. Through decentralized systems, organizations can minimize operational costs, streamline processes, and improve stakeholder trust. Here, we explore three unique use cases of blockchain finance, showcasing how different sectors leverage this technology to address specific challenges.

Supply Chain Finance

Blockchain technology fundamentally improves supply chain finance by providing real-time tracking of goods and transactions. This innovation ensures that all stakeholders—from manufacturers to distributors and retailers—have access to a shared, immutable ledger. Such transparency minimizes disputes and enhances accountability.

- Real-Time Data Access: Stakeholders can track shipments in real time, reducing the risk of fraud and errors.

- Streamlined Payments: Smart contracts automate payments once goods are delivered, reducing delays and enhancing cash flow.

- Increased Trust: The immutable nature of blockchain increases trust among parties as all transactions are visible and verifiable.

The supply chain industry benefits from increased efficiency and reduced operational costs, which ultimately lead to improved customer satisfaction. Companies like Walmart and IBM are already implementing blockchain systems to optimize their supply chains.

Decentralized Finance (DeFi)

DeFi represents a revolutionary shift in the financial sector, where traditional financial services are replicated using decentralized technologies. This use case allows users to borrow, lend, and trade cryptocurrencies without the need for intermediaries like banks.

- Accessibility: DeFi platforms are accessible to anyone with an internet connection, democratizing financial services.

- Lower Costs: By eliminating intermediaries, transaction fees are significantly reduced, making financial transactions more affordable.

- Enhanced Security: Blockchain’s encryption ensures that funds and transactions are secure from hacking attempts.

DeFi is transforming personal finance by enabling peer-to-peer transactions that were once only possible through banks, increasing financial inclusion for underserved populations.

Digital Identity Verification

In the financial sector, blockchain is increasingly being used for digital identity verification to combat fraud and identity theft. By securely storing identity information on a blockchain, institutions can efficiently verify customer identities without the need for extensive paperwork.

- Improved Security: Biometric data and personal information can be encrypted and securely stored, reducing the risk of data breaches.

- Time Efficiency: Streamlined verification processes lead to quicker onboarding of customers.

- Data Ownership: Individuals have better control over their personal information, deciding what to share and with whom.

Industries such as banking and insurance are reaping the benefits of blockchain-based identity verification, enhancing customer trust and reducing costs associated with fraud.

Regulatory Challenges Facing Blockchain in Finance

The integration of blockchain technology into the financial sector has ushered in a wave of innovation, promising greater efficiency, transparency, and security. However, this technological evolution is not without its challenges, particularly in terms of regulatory compliance. Financial regulators around the globe are grappling with how to oversee blockchain finance without stifling innovation or hindering market growth.The main regulatory hurdles facing blockchain finance vary by jurisdiction but often include issues related to licensing, anti-money laundering (AML) requirements, consumer protection, and the classification of digital assets.

These challenges can create a complex landscape for businesses looking to operate within the blockchain finance domain. Navigating these regulatory waters is crucial for fostering a secure environment that encourages growth while protecting stakeholders.

Main Regulatory Hurdles in Blockchain Finance

Several key regulatory challenges impact the development and deployment of blockchain finance solutions. These hurdles can shape the future of the sector significantly. Below are the primary issues encountered:

- Licensing and Registration: Many jurisdictions require businesses involved in blockchain finance to obtain specific licenses. This can be time-consuming and expensive, particularly for startups seeking to build innovative products.

- Anti-Money Laundering Compliance: Regulators are concerned about the potential for blockchain to facilitate illicit activities. As a result, stringent AML requirements are often imposed, which can be burdensome for companies trying to adhere to compliance while innovating.

- Consumer Protection Laws: The decentralized nature of blockchain raises questions about accountability and consumer rights. Regulators are working to establish frameworks that protect consumers without compromising the technology’s core principles.

- Taxation Issues: Unclear tax regulations regarding digital assets can hinder financial institutions and investors from engaging with blockchain finance, as compliance becomes complicated and uncertain.

- Cross-Border Regulations: Blockchain finance often operates on a global scale, leading to complications regarding compliance with various national laws and regulations simultaneously.

Implications of Regulations on Innovation and Market Growth

Regulatory frameworks significantly impact innovation and market growth in blockchain finance. Striking a balance between regulation and innovation is critical. Regulations can provide necessary safeguards and build trust with consumers, but overly restrictive measures can stifle creativity and limit market entry for new players. In many cases, a lack of clear regulations can lead to uncertainty, causing companies to hesitate in investing their resources into blockchain initiatives.

For instance, ambiguous legal definitions of cryptocurrencies create a chilling effect on investment and innovation.

Comparative Regulatory Environments

Countries worldwide adopt varied approaches to blockchain finance regulation. The following table Artikels how different nations are addressing these challenges, showcasing the diversity in regulatory environments:

| Country | Regulatory Approach | Key Features |

|---|---|---|

| United States | Fragmented | State-by-state regulations; SEC oversees securities, while CFTC handles commodities. |

| European Union | Proposed Framework | Markets in Crypto-Assets (MiCA) regulation aims to provide comprehensive guidelines. |

| China | Restrictive | Crackdown on cryptocurrency trading; focus on state-backed digital currency (CBDC). |

| Switzerland | Supportive | Crypto-friendly regulations; established frameworks for ICOs and digital asset businesses. |

| Singapore | Progressive | Licensing regime under the Payment Services Act; proactive approach to fostering innovation. |

The Role of Smart Contracts in Financial Transactions

Smart contracts are a revolutionary element in the landscape of blockchain technology, serving as self-executing contracts with the terms of the agreement directly written into code. They automate and streamline financial transactions, offering a level of efficiency and trust that traditional contracts struggle to achieve. By eliminating intermediaries and reducing the potential for disputes, smart contracts have become a pivotal tool in various financial applications.Smart contracts function by running on blockchain networks, which guarantee transparency and security.

Once certain predetermined conditions are met, these contracts automatically execute the agreed terms without the need for human intervention. This not only minimizes the risk of manual errors but also ensures that transactions are completed faster and at lower costs.

Industries Utilizing Smart Contracts

Several industries have embraced smart contracts, each reaping unique benefits from their implementation. Notable sectors include:

- Real Estate: Smart contracts enable secure and transparent property transactions. Buyers and sellers can agree on terms that automatically trigger the transfer of ownership once payment is verified, significantly reducing the time and cost involved in real estate dealings.

- Insurance: Insurers can automate claim processing through smart contracts. For instance, flight insurance can automatically trigger payouts if a flight is delayed, eliminating claims paperwork and expediting relief for affected passengers.

- Supply Chain Management: Companies can utilize smart contracts to track goods and enforce compliance in real-time. For example, a shipment can be automatically paid for upon delivery confirmation, ensuring all parties adhere to the agreed timeline and conditions.

The outcomes in these industries showcase enhanced efficiency, reduced operational costs, and increased trust among participants.

Risks and Limitations of Smart Contracts

Despite their advantages, smart contracts come with inherent risks and limitations that must be acknowledged. It is important to recognize that:

- Code Vulnerabilities: Smart contracts are only as good as their code. Any flaws or bugs in the programming can be exploited, leading to significant financial losses.

- Legal Recognition: The legal status of smart contracts varies across jurisdictions, which may create uncertainty regarding enforceability during disputes.

- Irreversibility: Once executed, transactions through smart contracts cannot be undone. This poses a risk if errors occur during execution, as there is no recourse to reverse the action.

Given these risks, stakeholders in financial transactions must conduct thorough audits and risk assessments before integrating smart contracts into their operations.

Smart contracts represent a fundamental shift in how agreements can be executed, providing a clear path toward automation and efficiency in financial transactions.

Impact of Blockchain on Traditional Banking Systems

Blockchain technology is increasingly recognized as a transformative force in the financial services industry, particularly in the realm of traditional banking. The decentralized nature of blockchain offers a stark contrast to the centralized operational models that traditional banks have followed for centuries. This shift not only influences how transactions are processed but also redefines the roles and responsibilities of various stakeholders within the banking ecosystem.The operational model of traditional banks relies heavily on intermediaries to facilitate transactions, manage records, and ensure compliance.

This often results in higher costs, longer processing times, and increased vulnerability to fraud. In contrast, blockchain technology enables peer-to-peer transactions that eliminate the need for intermediaries. Transactions on a blockchain are recorded on a public ledger that is immutable and transparent, which enhances security and reduces the potential for errors or fraud. As a result, banking processes such as cross-border payments, loan approvals, and identity verification could undergo significant disruption.

For instance, cross-border payments, which can take several days through traditional banking channels, can be processed almost instantaneously with blockchain, significantly lowering transaction costs. A well-known example of this is Ripple, which uses blockchain technology to facilitate real-time cross-border transactions for banks and financial institutions. Additionally, smart contracts—self-executing contracts with the terms directly written into code—can automate processes such as loan disbursement and escrow services, streamlining operations and reducing the time and labor involved.As banks contemplate the adoption of blockchain technology, it is essential to consider the potential advantages and disadvantages that come with it.

Here’s a closer look at the pros and cons of banks adopting blockchain:

Advantages and Disadvantages of Blockchain Adoption in Banks

The integration of blockchain technology into banking systems presents both opportunities and challenges. Understanding these factors can help banks navigate the complexities of this innovative technology.

- Pros:

- Enhanced security due to cryptographic encryption and an immutable ledger.

- Lower operational costs by reducing the need for intermediaries.

- Faster transaction speeds, especially for cross-border payments.

- Increased transparency and trust among parties involved in transactions.

- Potential for innovative financial products and services leveraging smart contracts.

- Cons:

- Regulatory uncertainty regarding the use of blockchain in various jurisdictions.

- High initial investment costs associated with technology integration.

- Potential job losses in roles primarily focused on transaction processing.

- Interoperability issues with existing banking systems and other blockchains.

- Concerns over privacy and data security in public blockchain networks.

In summary, the transition towards blockchain technology could fundamentally alter the landscape of traditional banking systems, driving efficiency and innovation while also presenting distinct challenges that need to be addressed through careful planning and strategic implementation.

The Future of Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) marks a transformative shift in the financial landscape, challenging traditional banking systems and providing unprecedented access to financial services. DeFi leverages blockchain technology to create an open and permissionless financial ecosystem that allows anyone with an internet connection to participate. This evolution poses significant implications for how we view and interact with money, lending, and investing.DeFi has rapidly evolved from niche markets to robust ecosystems, integrating various financial services like lending, trading, and insurance on decentralized platforms.

As these platforms gain traction, they threaten to disrupt traditional financial institutions that have long dominated the landscape. The implications of this shift extend beyond just finance; they encompass regulatory considerations, economic inclusivity, and the way value is exchanged globally.

Key Technologies Driving DeFi

Several key technologies underpin the DeFi movement, each contributing to its growth and the potential reformation of the financial sector. Here are some of the prominent technologies influencing DeFi:

- Smart Contracts: These self-executing contracts with the terms directly written into code eliminate the need for intermediaries, thereby reducing costs and increasing transaction speed.

- Blockchain Technology: The backbone of DeFi, blockchain provides transparency, security, and immutability, making it ideal for financial transactions.

- Decentralized Applications (dApps): Built on blockchain networks, these applications facilitate a wide range of financial services without centralized control, enhancing accessibility and user autonomy.

- Oracles: These are services that provide real-world data to smart contracts, enabling them to interact with external systems and ensuring accurate execution of contracts based on real-time conditions.

The impact of these technologies is profound, as they democratize access to financial services, potentially leading to reduced costs for consumers and increased efficiency in financial transactions. As the DeFi ecosystem expands, these technologies will continue to drive innovation and reshape how traditional finance operates.

Flowchart of a Typical DeFi Transaction vs. Traditional Transaction

Understanding the mechanics behind transactions is crucial for grasping the differences between DeFi and traditional finance. Below is a description of a typical flowchart that illustrates these processes. Traditional Transaction Flow:

- User initiates a transaction through a bank or financial institution.

- The bank verifies the identity and account balance.

- The transaction request is processed through a centralized clearinghouse.

- The transaction is settled, often taking several business days to finalize.

DeFi Transaction Flow:

- User connects their crypto wallet to a DeFi platform.

- The smart contract automatically verifies the transaction conditions (e.g., sufficient funds).

- The transaction is executed on the blockchain, taking place instantly.

- Funds are transferred directly between users, with the transaction recorded on the blockchain for transparency and auditability.

This flowchart highlights the streamlined and efficient nature of DeFi transactions compared to the often cumbersome and time-consuming traditional banking processes. The potential for real-time transactions and lower fees makes DeFi an appealing alternative for many users.

“The rise of DeFi is not just a technological evolution; it represents a paradigm shift in how we conceive of finance itself.”

Security Risks and Solutions in Blockchain Finance

The landscape of blockchain finance offers innovative solutions to traditional financial systems, but it also comes with unique security risks. As blockchain technology continues to evolve and attract more users, understanding these risks and implementing robust security measures becomes paramount. This discussion delves into the common security threats specific to blockchain finance and Artikels effective mitigation strategies.

Common Security Threats in Blockchain Finance

Blockchain finance is susceptible to various security threats that can undermine user trust and system integrity. Identifying these threats is the first step in protecting assets and sensitive information. Notable security risks include:

- Smart Contract Vulnerabilities: These are flaws in the code of smart contracts that can be exploited by malicious actors, potentially leading to significant financial loss.

- Phishing Attacks: Cybercriminals often employ phishing tactics to trick users into revealing private keys or sensitive information, gaining unauthorized access to their wallets.

- 51% Attacks: When a single entity controls over 50% of the network’s mining power, it can manipulate transaction confirmations, double-spend coins, and disrupt the network.

- Insufficient Key Management: Poor practices in managing cryptographic keys can lead to unauthorized access and loss of funds.

- Exchange Vulnerabilities: Cryptocurrency exchanges can be prime targets for hackers, often resulting in major breaches and theft of user assets.

Mitigation Strategies

To counter these security threats effectively, various mitigation strategies can be employed. By implementing the following measures, organizations and users can significantly reduce their vulnerability.

- Auditing Smart Contracts: Regularly conducting audits of smart contracts can help identify and rectify vulnerabilities before they can be exploited.

- Implementing Multi-Factor Authentication (MFA): Enforcing MFA on accounts adds an extra layer of security, making it harder for cybercriminals to gain unauthorized access.

- Distributed Consensus Mechanisms: Utilizing consensus methods that are robust against 51% attacks, such as Proof of Stake (PoS) or Delegated Proof of Stake (DPoS), can enhance network security.

- Best Practices for Key Management: Employing hardware wallets or secure, encrypted storage solutions for private keys is crucial in preventing unauthorized access.

- Regular Security Audits of Exchanges: Cryptocurrency exchanges should perform thorough security assessments and implement robust security measures to protect user funds.

Best Practices for Enhancing Security in Blockchain-Based Financial Applications

Enhancing security in blockchain finance requires adopting best practices that protect users and their assets. These practices are essential for building trust and ensuring the integrity of blockchain applications.

- User Education: Educating users about the risks and security best practices is essential for minimizing phishing and other social engineering attacks.

- Data Encryption: Employing strong encryption for sensitive data, both in transit and at rest, helps secure information from unauthorized access.

- Regular Software Updates: Keeping all software updated with the latest security patches reduces vulnerabilities that could be exploited by attackers.

- Collaboration with Security Experts: Partnering with cybersecurity firms can provide access to expertise and tools that enhance the security posture of blockchain applications.

- Intrusion Detection Systems: Implementing real-time monitoring systems can help detect and respond to suspicious activities promptly.

Essential Security Protocols for Blockchain Finance

The implementation of security protocols is vital in safeguarding blockchain finance systems. Below are key protocols that ensure security, privacy, and integrity:

- Transport Layer Security (TLS): This protocol encrypts data transmitted over the internet, ensuring secure communication between clients and servers.

- Zero-Knowledge Proofs: This cryptographic method allows one party to prove to another that a statement is true without revealing any additional information.

- Multi-Signature Wallets: These wallets require multiple signatures for transactions, adding an additional layer of security by preventing unauthorized transactions.

- Decentralized Identity Protocols: These protocols aim to enhance user privacy by allowing users to control their identity and personal data without relying on centralized authorities.

- Blockchain Analytics Tools: Utilizing tools that monitor transactions on the blockchain can help detect suspicious activities and enhance overall security.

The Role of Cryptocurrencies in Blockchain Finance

Cryptocurrencies serve as a pivotal component within the blockchain finance ecosystem, transforming traditional financial systems while providing innovative solutions for transactions and investment. Their unique properties, such as decentralization, security, and transparency, enable seamless exchanges and foster trust among users. Furthermore, the rise of cryptocurrencies has led to a paradigm shift in how individuals and institutions approach value transfer and investment opportunities.The significance of cryptocurrencies lies not only in their ability to function as digital currencies but also in their role as enablers of various financial ecosystems.

They facilitate smart contracts, decentralized finance (DeFi) applications, and tokenization, which can enhance liquidity and accessibility in financial markets. The use cases for cryptocurrencies extend beyond mere transactions; they encompass a broad range of financial activities including lending, borrowing, trading, and investment diversification.

Volatility of Cryptocurrencies and Its Effects on Adoption

The inherent volatility of cryptocurrencies presents both challenges and opportunities in their adoption within the finance sector. Price fluctuations can deter mainstream adoption, as users may be hesitant to utilize a medium of exchange that can experience drastic changes in value over short periods. However, volatility also attracts speculative investors looking to capitalize on rapid price movements. This volatility can be illustrated by the historical performance of Bitcoin, which has seen price surges and sharp declines multiple times since its inception.

For instance, in 2017, Bitcoin’s value skyrocketed to nearly $20,000, only to plummet below $3,000 a year later. Such patterns create uncertainty, impacting the confidence of businesses and consumers in using cryptocurrencies for everyday transactions.

Comparison of Various Cryptocurrencies in Financial Transactions

Understanding the distinct characteristics of various cryptocurrencies is essential for assessing their roles in financial transactions. Below is a comparison of some widely used cryptocurrencies, highlighting their features and utility:

| Cryptocurrency | Market Capitalization | Transaction Speed | Use Cases |

|---|---|---|---|

| Bitcoin (BTC) | Largest in market cap | 10 minutes (average) | Store of value, digital gold |

| Ethereum (ETH) | Second largest | 15 seconds (average) | Smart contracts, decentralized applications |

| Ripple (XRP) | Top ten | 3-5 seconds | Cross-border transactions, remittances |

| Litecoin (LTC) | Top twenty | 2.5 minutes | Peer-to-peer transactions, silver to Bitcoin’s gold |

| Cardano (ADA) | Top ten | 20 seconds | Smart contracts, decentralized finance |

This table illustrates the varying transaction speeds, market capitalizations, and primary use cases associated with these cryptocurrencies. Each has its unique advantages and limitations, influencing their adoption in finance. For example, while Bitcoin remains the dominant player as a store of value, Ethereum’s capability to facilitate smart contracts has positioned it as a cornerstone for DeFi applications. Overall, the integration of cryptocurrencies into the blockchain finance ecosystem continues to evolve, presenting opportunities for innovation while also confronting challenges related to volatility and regulatory scrutiny.

Ending Remarks

In summary, blockchain finance is not just a trend; it’s a fundamental shift in how we approach financial transactions and services. As we continue to witness the evolution of this technology, the implications for industries and consumers alike are profound. By understanding the principles, challenges, and opportunities presented by blockchain finance, we can better navigate the future of finance with confidence and insight.

Frequently Asked Questions

What is blockchain finance?

Blockchain finance refers to the integration of blockchain technology in financial services to enhance efficiency, security, and transparency in transactions.

How does decentralization benefit financial transactions?

Decentralization reduces reliance on intermediaries, enhancing security and transparency while minimizing transaction costs and times.

What are smart contracts?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, automating processes and reducing the need for intermediaries.

What industries are adopting blockchain finance?

Industries such as banking, insurance, supply chain management, and real estate are increasingly leveraging blockchain finance for its efficiency and security benefits.

What are the main regulatory challenges in blockchain finance?

Key regulatory challenges include compliance with existing financial laws, varying regulations across jurisdictions, and the general need for clear frameworks governing blockchain technology.