Understanding the mortgage calculator is essential for anyone looking to navigate the world of home financing. This powerful tool allows potential buyers and homeowners alike to estimate their monthly payments, compare various loan options, and gain insights into their overall financial health. With just a few simple inputs, users can unlock a treasure trove of information about their mortgage scenarios, making the home-buying journey smoother and more informed.

By delving into the mechanics of how a mortgage calculator operates and the critical factors it considers, such as interest rates, down payments, and loan types, individuals can make more strategic decisions when planning their finances. This comprehensive overview aims to equip you with the knowledge needed to utilize mortgage calculators effectively, ensuring you’re well-prepared for every step of the home financing process.

Understanding the Basics of a Mortgage Calculator

A mortgage calculator is a vital tool for anyone looking to finance a home. It helps individuals estimate their monthly mortgage payments, making it easier to understand how much they can afford and plan their finances accordingly. By providing a clear picture of potential expenses, a mortgage calculator aids in the decision-making process of purchasing a home.

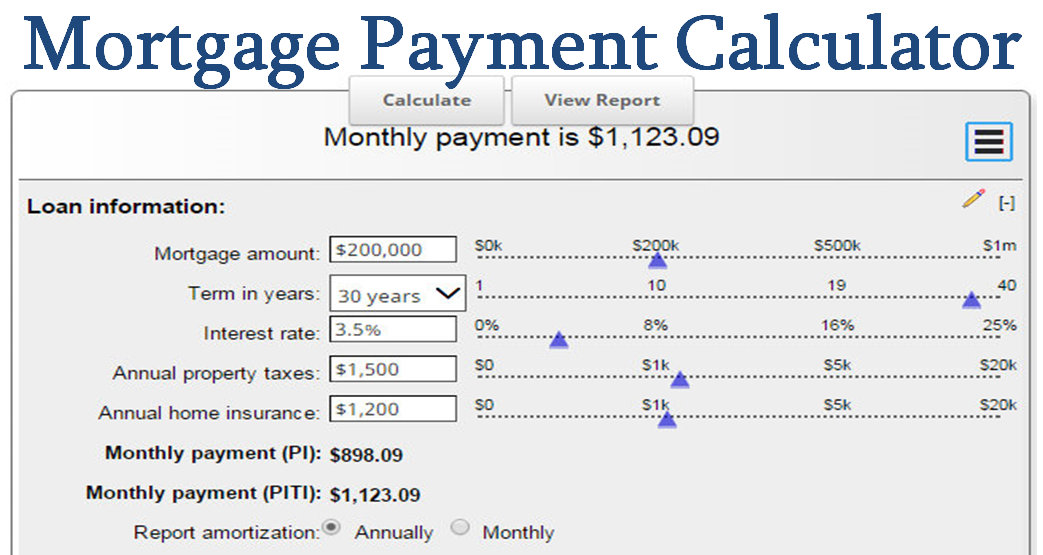

Mortgage calculators work by taking various inputs related to the mortgage terms and translating them into an estimated monthly payment. Typically, users input the home price, down payment percentage, interest rate, loan term, and additional costs such as property taxes and homeowners insurance. The calculator then uses this information to generate a monthly payment estimate. The formula commonly used incorporates the principal amount, interest rate, and the loan term to determine the payment amount.

Examples of Different Mortgage Scenarios

Exploring various mortgage scenarios can help buyers visualize their options and understand potential financial outcomes. Below are examples of different scenarios that can be analyzed using a mortgage calculator:

- Fixed-Rate Mortgage: In this scenario, a buyer might consider a $300,000 home with a 20% down payment ($60,000), a fixed interest rate of 3.5%, and a 30-year term. With these figures, the estimated monthly payment would be approximately $1,078, excluding taxes and insurance.

- Adjustable-Rate Mortgage (ARM): For an adjustable-rate mortgage, suppose a buyer looks at the same $300,000 house, but opts for a 5/1 ARM with an initial interest rate of 2.5% for the first five years. Afterward, it adjusts annually based on market rates. The initial monthly payment would be around $1,185, with potential increases thereafter as rates adjust.

- High-Value Loan: Considering a luxury home priced at $1,000,000 with a 10% down payment ($100,000) and a 4% interest rate over 30 years results in a significantly higher monthly payment of about $3,797. This scenario emphasizes the importance of knowing how high-value loans impact monthly budgets.

- Shorter Loan Term: A buyer may also choose a 15-year fixed mortgage to pay off a $250,000 home with a 20% down payment at a 3.0% interest rate. The monthly payment in this case would be approximately $1,732, illustrating how a shorter loan term can increase monthly payments but decrease total interest paid over the life of the loan.

Each of these scenarios provides insights into how different factors influence mortgage payments, helping prospective buyers make informed financial decisions. Using a mortgage calculator can clarify the impacts of various down payments, interest rates, and loan terms on overall affordability and long-term financial health.

The Importance of Interest Rates in Mortgage Calculations

Understanding interest rates is crucial when navigating the world of mortgages. These rates significantly influence both your monthly payments and the overall cost of your loan. A minor change in the interest rate can have a profound effect on the total amount paid over the life of the mortgage, making it essential for potential homeowners to grasp this important aspect before signing any agreements.Interest rates directly affect how much you will pay each month and how much you will pay in total over the duration of the loan.

A lower interest rate means lower monthly payments, resulting in substantial savings over the life of the mortgage. For instance, on a $300,000 loan with a 3% fixed interest rate over 30 years, the monthly payment would be about $1,265. In contrast, at a 5% interest rate, the same loan would increase to approximately $1,610 per month. This difference of $345 per month translates to over $124,000 more paid in interest over the life of the loan.

Comparison of Fixed-Rate and Adjustable-Rate Mortgages

When considering your mortgage options, it’s essential to understand the significant differences between fixed-rate and adjustable-rate mortgages (ARMs). Each option has its unique characteristics that can impact your financial future.Fixed-rate mortgages provide stability as the interest rate remains constant throughout the loan’s life. This means your monthly payments will not change, making budgeting easier. On the other hand, adjustable-rate mortgages offer initially lower rates that can fluctuate over time based on market conditions.

Below is a comparison of the two:

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|---|

| Interest Rate Stability | Fixed for the life of the loan | Variable; changes at specified intervals |

| Initial Payment | Higher initial payments | Lower initial payments |

| Long-term Costs | Predictable total cost | Potentially lower or higher total cost |

| Risk Level | Lower risk, stable payments | Higher risk due to fluctuating payments |

Several factors influence interest rates, including economic indicators, inflation, and the Federal Reserve’s policies. Market conditions can lead to fluctuations; for example, during a strong economy, rates might rise due to increased demand for borrowing. Conversely, in a weak economy, rates may decrease to encourage spending. Understanding these influences helps borrowers anticipate changes in their mortgage payments and plan accordingly.

“Interest rates can significantly impact the total cost of your loan, affecting both current affordability and long-term financial planning.”

Monthly Payment Breakdown When Using a Mortgage Calculator

When considering a mortgage, understanding the monthly payment breakdown is essential to manage finances effectively. A mortgage calculator can help visualize how much of your payment goes towards different components, ensuring you’re prepared for the responsibilities of homeownership. Knowing the details of your monthly payment can provide clarity and help you make informed decisions.The monthly mortgage payment typically consists of four main components: principal, interest, taxes, and insurance, often referred to as PITI.

Each component plays a crucial role in determining the overall payment amount and understanding your financial obligations.

Components of a Monthly Mortgage Payment

The components of a monthly mortgage payment include principal, interest, property taxes, and homeowners insurance. Understanding each component not only illuminates how mortgage payments are structured but also emphasizes the importance of accurate budgeting when purchasing a home.

Principal: This is the amount borrowed from the lender to purchase the home. Paying down the principal builds equity in the property.

Interest: This is the cost of borrowing the principal amount, usually expressed as a percentage (the interest rate). The lender charges this fee for providing the loan.

Taxes: Property taxes are levied by local governments and vary based on the property’s assessed value. These taxes are typically collected monthly and held in escrow for payment.

Insurance: Homeowners insurance protects against damages to the property and liability for injuries. Lenders often require this coverage and may also include mortgage insurance for low down payments.

To illustrate how these components contribute to your monthly mortgage payment, consider the following hypothetical example:

| Component | Amount ($) |

|---|---|

| Principal Payment | 800 |

| Interest Payment | 300 |

| Property Taxes | 200 |

| Homeowners Insurance | 100 |

| Total Monthly Payment | 1,400 |

In this example, the total monthly payment is $1,400, with each component contributing to the overall cost of homeownership. Understanding this breakdown helps potential homeowners prepare for the financial commitments associated with a mortgage and aids in budget planning for both current and future expenses.

Exploring Additional Features of Mortgage Calculators

Mortgage calculators have evolved to include a variety of advanced features that can enhance the home-buying experience. Beyond basic calculations, these tools offer capabilities that can help borrowers make informed decisions about their mortgages. Understanding these additional features can provide significant benefits, from managing monthly payments to optimizing loan terms.

Extra Payment Options and Amortization Schedules

Many mortgage calculators now incorporate options for making extra payments towards the principal. This feature is particularly valuable for those looking to reduce the overall interest paid on their mortgage or to pay off their loan more quickly. By simulating extra payments, users can see the impact on their loan balance and the overall interest savings. In addition, amortization schedules are provided, which Artikel the breakdown of each payment over the term of the loan.

This schedule details how much of each payment goes towards interest versus principal, allowing borrowers to track their progress towards full repayment. The following points highlight the importance of these features:

- Extra payments can lead to significant long-term savings on interest.

- Amortization schedules enable better financial planning by illustrating payment distribution.

- Users can visualize the effects of different payment scenarios on their mortgage terms.

“Making just one extra payment per year can significantly reduce the total interest paid over the lifetime of a mortgage.”

Comparison of Online Mortgage Calculators

With numerous mortgage calculators available online, it is essential to understand their unique features and advantages. Some calculators offer specific tools tailored to different mortgage types, while others provide comprehensive analyses including taxes and insurance. When comparing these tools, consider the following:

- Bankrate Mortgage Calculator: Offers detailed breakdowns including taxes, insurance, and PMI, making it ideal for estimating total monthly payments.

- Zillow Mortgage Calculator: Provides a user-friendly interface and includes a variety of loan options, making it suitable for first-time homebuyers.

- Mortgage Calculator by NerdWallet: Features an extensive set of tools for extra payments, refinancing, and amortization schedules, catering to more advanced users.

Each calculator has its strengths, allowing users to choose one that best fits their needs for planning and managing their mortgage.

Using a Mortgage Calculator for Refinancing Scenarios

Refinancing a mortgage can be a strategic financial decision, and a mortgage calculator is an invaluable tool in this process. By inputting current loan details along with potential new loan terms, borrowers can assess whether refinancing will save them money. To effectively use a mortgage calculator for refinancing, consider the following steps:

- Input the remaining balance and interest rate of your current mortgage.

- Add the new interest rate and loan term you are considering for refinancing.

- Calculate the potential monthly payment and total interest savings over the life of the new loan.

This process allows homeowners to make an informed decision about whether to proceed with refinancing based on the financial implications reflected in the calculator’s output.

Real-World Applications of Mortgage Calculators for Homebuyers

Mortgage calculators serve as a powerful tool for prospective homebuyers, simplifying the process of evaluating potential purchases. By inputting various financial parameters, buyers can gain insight into their monthly payments, overall affordability, and how different mortgage terms affect their financial commitments. This understanding can significantly shape their home search, guiding them towards properties that fit their budgetary constraints.Before diving into the house-hunting process, it’s crucial for buyers to calculate their affordability using a mortgage calculator.

This calculation provides a clear picture of what they can realistically afford, helping prevent the disappointment of falling in love with a home that is beyond their financial reach. By assessing factors such as income, debt, and interest rates, buyers can establish a price range that aligns with their financial situation.

Impact of Home Prices on Mortgage Payments

Understanding how different home prices affect potential buyers’ mortgage payments is essential for making informed decisions. A mortgage calculator can illustrate how varying prices change monthly payments, enabling buyers to see the correlation between home value and financial obligation. For instance, consider the following examples:

Home Price

$250,000 Assuming a 30-year fixed mortgage at a 3.5% interest rate, the monthly payment (excluding taxes and insurance) would be approximately $1,125. This scenario helps buyers gauge affordability within a common price range.

Home Price

$350,000

With the same loan terms, the monthly payment rises to around $1,575. This increase illustrates how a higher purchase price directly impacts monthly budgeting.

Home Price

$450,000

At this price point, the monthly payment would be about $2,025. Buyers can use this information to assess whether their financial situation allows for such an increase in payment.Each example showcases how even modest increases in home prices can lead to significant jumps in monthly costs. The ability to manipulate variables in a mortgage calculator empowers homebuyers to make educated choices based on their financial capabilities and lifestyle preferences.

“Understanding your mortgage payment is key to ensuring you select a home that fits comfortably within your budget.”

This clarity not only helps in making sound financial decisions but also aids in reducing stress throughout the home-buying journey.

The Role of Down Payments in Mortgage Calculations

A down payment is a critical aspect of securing a mortgage and significantly impacts the overall loan amount and monthly payments. By contributing a portion of the home’s purchase price upfront, borrowers can reduce the amount they need to finance. This initial investment not only influences the loan terms but also plays a pivotal role in determining the affordability and long-term costs associated with homeownership.The amount of down payment you make can drastically change your mortgage equations.

Lenders typically require a down payment as a sign of commitment from the borrower, and it directly affects the principal loan amount and the interest rate offered. The more you put down, the less you need to borrow. This can lead to lower monthly payments and potentially better loan conditions.

Down Payment Percentages and Their Mortgage Implications

Understanding various down payment percentages is essential for assessing their implications on mortgage terms. Common down payment levels include 3%, 5%, 10%, and 20%. Each percentage leads to different financial outcomes for homebuyers. Below is a breakdown of what each percentage entails.For a clearer comparison, consider a hypothetical home purchase price of $300,000:

| Down Payment Percentage | Down Payment Amount | Loan Amount | Estimated Monthly Payment | Total Interest Paid (30 years) |

|---|---|---|---|---|

| 3% | $9,000 | $291,000 | $1,228 | $261,000 |

| 5% | $15,000 | $285,000 | $1,206 | $250,000 |

| 10% | $30,000 | $270,000 | $1,155 | $228,000 |

| 20% | $60,000 | $240,000 | $1,027 | $183,000 |

The table showcases that a higher down payment results in a lower loan amount and smaller monthly payments. Additionally, a substantial down payment can help in avoiding private mortgage insurance (PMI), which is typically required for down payments of less than 20%.

A larger down payment not only reduces your loan amount but also minimizes the total interest paid over the life of the loan.

For many buyers, the decision on how much to put down involves weighing the immediate financial burden against long-term savings on interest and monthly payments. In essence, understanding the dynamics of down payments is crucial for effective mortgage planning.

Closing Summary

In conclusion, the mortgage calculator proves to be an invaluable asset in the quest for homeownership and financial stability. By demystifying the complexities of mortgage calculations and offering a clearer picture of potential costs, it empowers buyers to make informed decisions. As you venture into the real estate market, remember that understanding and effectively using a mortgage calculator can significantly enhance your buying experience and set you on the path to financial success.

Top FAQs

What inputs do I need for a mortgage calculator?

You typically need the loan amount, interest rate, loan term, and any additional costs like property taxes and insurance.

Can a mortgage calculator show me my total interest paid?

Yes, many mortgage calculators can provide a breakdown of total interest paid over the life of the loan.

Is it accurate to rely solely on a mortgage calculator?

While mortgage calculators provide valuable estimates, it’s best to consult with a financial advisor for personalized advice.

Can I use a mortgage calculator for refinancing?

Absolutely! Many calculators allow you to input your current loan details to see potential savings from refinancing.

Do different mortgage calculators yield the same results?

Results may vary slightly depending on the calculator’s design and included features, but they generally provide similar estimates.