Installment loans are a vital financial tool that many consumers rely on to manage significant expenses and achieve their goals. Whether you’re looking to purchase a car, fund a home renovation, or manage unexpected bills, these loans provide a structured repayment plan that makes budgeting easier. By breaking down the total amount borrowed into smaller, fixed payments over a set term, installment loans can help consumers maintain control over their finances while still accessing necessary funds.

As we delve into the world of installment loans, we’ll explore their various types, the application process, interest rates, repayment options, and their impact on personal finance. Understanding these elements not only aids borrowers in making informed decisions but also sheds light on how these loans contribute to overall financial health.

Understanding the basics of installment loans requires a comprehensive look at their definition and purpose.

Installment loans are a crucial element of the financial landscape, offering consumers a way to borrow money for various purposes while providing a structured repayment plan. These loans are characterized by their fixed payment schedules, which typically consist of regular monthly payments over a set period. This predictability is beneficial for budgeting, making it easier for borrowers to manage their finances while repaying their debts.

The significance of installment loans lies in their accessibility and flexibility, catering to a range of financial needs, from purchasing a vehicle to funding personal projects or consolidating existing debts.

The functioning of installment loans in financial markets is vital for both lenders and borrowers. Lenders gain confidence in offering these loans due to the structured repayment system, reducing the risk of defaults. For consumers, installment loans empower them to make significant purchases or investments without needing to pay the total amount upfront. This financing option is instrumental in enabling consumers to achieve their financial goals while maintaining a manageable repayment schedule.

Common Types of Installment Loans

Many types of installment loans are available, each serving specific borrower needs. Below are examples of common installment loans:

- Personal Loans: These loans can be used for various purposes, including medical expenses, home improvements, or debt consolidation. Personal loans are often unsecured, meaning they don’t require collateral.

- Auto Loans: These loans are designated for purchasing vehicles and are typically secured by the car itself. If the borrower defaults, the lender can repossess the vehicle.

- Mortgage Loans: Designed for home purchases, these secured loans are tied to the property purchased. Borrowers make fixed monthly payments over an extended term, usually 15 to 30 years.

- Student Loans: These loans help finance education costs and can be either secured or unsecured, depending on the lender and the terms.

The distinction between secured and unsecured installment loans is critical for borrowers to understand. Secured loans are backed by collateral, which lowers the lender’s risk; thus, they often have lower interest rates. If a borrower defaults on a secured loan, the lender has the right to seize the collateral. Conversely, unsecured loans do not require collateral, which typically means higher interest rates due to the greater risk to the lender.

Borrowers must weigh the implications of each type carefully, considering their financial situation and ability to repay the loan.

The application process for obtaining installment loans is critical for potential borrowers to understand.

Understanding the application process for installment loans is essential for anyone considering borrowing. With a clear grasp of the steps involved and the necessary documentation, borrowers can navigate the process more smoothly and make informed decisions. Below, we detail the typical application procedure, the information lenders require, and the common pitfalls to avoid.

Step-by-step procedure for applying for installment loans

The application process for installment loans involves several key steps that applicants need to follow. This ensures that both the lender and borrower have a clear understanding of the loan terms and requirements.

- Research Lenders: Start by researching different lenders to compare interest rates, terms, and customer reviews. This can help you find the best loan options that suit your financial situation.

- Check Eligibility: Each lender has its own eligibility criteria. Ensure you meet these criteria, including credit score and income requirements, to increase your chances of approval.

- Gather Documentation: Prepare the necessary documents that lenders require for verification. This typically includes proof of income, employment verification, and identification.

- Complete the Application: Fill out the loan application form either online or in person, providing accurate information to avoid delays.

- Review Loan Terms: Once approved, carefully review the loan terms, including interest rates, repayment schedule, and any fees involved.

- Sign the Agreement: After agreeing to the terms, sign the loan agreement to finalize the process and receive your funds.

Essential documentation and information for lenders

When applying for installment loans, lenders typically require specific documents and information to evaluate your application. Being prepared with these documents can streamline the process and prevent delays.The common requirements include:

- Proof of Income: Recent pay stubs, tax returns, or bank statements demonstrating your monthly income.

- Employment Verification: A letter from your employer or recent employment contracts to confirm your job status.

- Identification: A government-issued ID, such as a driver’s license or passport, to verify your identity.

- Credit History: Lenders will check your credit score and report to assess your creditworthiness.

Common pitfalls to avoid when applying for installment loans

Being aware of common mistakes can save borrowers time and financial strain during the application process. Recognizing these pitfalls can help ensure a smoother experience.Some common issues include:

- Not Comparing Lenders: Failing to shop around can lead to missing out on better interest rates and terms.

- Ignoring Your Credit Score: Not checking your credit score beforehand may result in unexpected denials or unfavorable terms.

- Overborrowing: Taking out more than you can afford to repay can lead to financial difficulties in the long run.

- Skipping the Fine Print: Not reading the terms and conditions carefully may result in hidden fees or unfavorable terms that could affect repayment.

“It’s crucial to approach installment loans with a clear understanding of the process and requirements to avoid unnecessary complications.”

Interest rates play a significant role in the overall cost of installment loans and vary based on multiple factors.

Understanding interest rates is crucial when considering installment loans, as they significantly influence the total amount you will repay. These rates can fluctuate based on various elements, including market conditions, loan terms, and individual borrower circumstances. Knowing how these rates are determined helps borrowers make informed decisions that align with their financial goals.Interest rates for installment loans are determined by a combination of factors, including the lender’s cost of borrowing, the overall economic environment, and individual borrower qualifications.

Lenders assess the risk associated with each loan application; therefore, they base their interest rates on several criteria, including:

- Credit Score: A higher credit score often results in lower interest rates, as it signifies lower risk to lenders.

- Loan Amount and Term: Typically, larger loans or longer terms may come with higher rates due to increased risk over time.

- Market Rates: Economic factors, such as the Federal Reserve’s interest rate decisions, directly influence the rates lenders offer.

- Debt-to-Income Ratio: A lower ratio indicates better financial health, often leading to more favorable interest rates.

- Loan Type: Different loans have varying risk levels, which can affect the rates offered.

Comparison of Fixed-Rate and Variable-Rate Installment Loans

When selecting an installment loan, borrowers typically choose between fixed-rate and variable-rate options. Understanding the differences between these two types is essential, as each offers distinct benefits and drawbacks.

- Fixed-Rate Loans: These loans feature interest rates that remain constant throughout the loan term. This stability can help with budgeting, as monthly payments do not fluctuate, making it easier for borrowers to plan their finances.

- Advantages of Fixed-Rate Loans:

- Stable payments provide predictability.

- No exposure to interest rate changes in the market.

- Disadvantages of Fixed-Rate Loans:

- Potentially higher initial interest rates compared to variable options.

- Less flexibility if market rates decrease.

- Variable-Rate Loans: These loans have interest rates that can change based on market conditions, typically linked to an index. Monthly payments may vary, potentially offering lower initial rates than fixed loans.

- Advantages of Variable-Rate Loans:

- Lower initial rates can lead to smaller payments in the early stages of the loan.

- If market rates decline, borrowers can benefit from reduced payments.

- Disadvantages of Variable-Rate Loans:

- Payments can increase if market rates rise, leading to uncertainty.

- Budgeting can be more challenging due to fluctuating payments.

The impact of a borrower’s credit score on the interest rates offered cannot be overstated. A higher credit score, typically above 700, often qualifies borrowers for the most competitive rates. For instance, a borrower with a score of 750 might receive a rate of 4%, while another with a score of 620 may face rates as high as 10% or more.

This disparity underscores the importance of maintaining good credit health, as even a few points can significantly affect the cost of borrowing.

“Improving a credit score by just a few points can save thousands over the life of an installment loan.”

Repayment terms associated with installment loans are essential for managing personal finances effectively.

Understanding the repayment terms of installment loans is crucial for individuals looking to manage their finances responsibly. These terms dictate how and when borrowers will return the funds they have borrowed, thereby influencing their overall financial health. Knowing the details of repayment options, schedules, and potential repercussions of late payments enables borrowers to plan better and avoid financial pitfalls.Repayment options for installment loans can vary widely and significantly impact a borrower’s budget.

Typically, borrowers can choose from fixed or variable interest rates, which form the backbone of their repayment structure. With a fixed interest rate, borrowers can predict their monthly payments, making it easier to budget. In contrast, variable rates can fluctuate, resulting in varying monthly payments and added uncertainty. Additionally, repayment periods usually range from a few months to several years, affecting the amount paid each month.

Understanding Repayment Schedules

A repayment schedule Artikels the timeline for repaying a loan, detailing monthly payment amounts, due dates, and the total loan duration. Familiarity with the repayment schedule is vital for borrowers as it aids in financial planning. The following elements should be carefully considered:

- Monthly Payment Amounts: Knowing the precise amount due each month allows borrowers to allocate their resources effectively, ensuring they can meet their obligations without financial strain.

- Loan Duration: A longer loan term typically results in lower monthly payments but may lead to higher total interest paid over the life of the loan. Conversely, shorter terms mean higher monthly payments but less interest.

- Amortization Schedule: This schedule shows how each payment affects both the principal and interest, helping borrowers understand how quickly they are paying down the loan.

Understanding these components prepares borrowers to handle their loans responsibly. Failing to adhere to repayment schedules can lead to serious implications.

Implications of Late Payments or Default

Late payments or defaulting on an installment loan can have dire consequences. Borrowers who miss payments may incur late fees, which can increase the total amount owed. Additionally, repeated late payments can damage credit scores, making future borrowing more expensive or difficult.The legal implications of defaulting are also significant. A lender may initiate collection efforts, which can include wage garnishment or legal action to recover the owed funds.

Furthermore, defaulting can lead to repossession of secured assets, such as vehicles or property, if the loan is tied to collateral.

“The repercussions of late payments extend beyond immediate financial penalties; they can hinder future opportunities for credit and financial growth.”

In summary, being aware of repayment terms, scheduling, and the potential implications of late payments is essential for effectively managing personal finances and ensuring long-term financial stability.

The role of credit scores in securing favorable terms on installment loans cannot be overstated.

Understanding the significance of credit scores is essential when navigating the landscape of installment loans. A credit score serves as a numerical representation of an individual’s creditworthiness, reflecting their financial behavior and repayment history. In the world of lending, this score can greatly influence the approval process and the terms offered by lenders, making it crucial for borrowers to be aware of their scores and how to manage them effectively.The relationship between credit scores and loan approval is direct and significant.

Lenders typically categorize credit scores into ranges that determine the likelihood of approval and the conditions attached to the loan. Generally, scores are segmented as follows:

- 300-579: Considered poor, individuals in this range face challenges in obtaining loans and may encounter higher interest rates if approved.

- 580-669: This fair range may result in loan approval, but terms are likely to be less favorable, with elevated interest rates.

- 670-739: Borrowers with this good credit score range are more likely to receive approval with competitive interest rates.

- 740-799: Very good scores lead to better loan terms, including lower interest rates and higher borrowing limits.

- 800-850: Excellent credit scores afford borrowers the best terms available in the market, often including lower interest rates and flexible repayment options.

To improve credit scores prior to applying for an installment loan, borrowers can take several proactive steps. It is important to note that even small changes can lead to improvements over time. Here are some effective strategies:

- Regularly check credit reports for errors and dispute inaccuracies to ensure the score reflects true financial behavior.

- Pay bills on time, as consistent, timely payments significantly enhance credit scores.

- Reduce outstanding debt by paying down credit cards, which lowers credit utilization ratios and positively impacts scores.

- Avoid opening new credit accounts shortly before applying for a loan, as this can lead to hard inquiries reducing the score.

- Maintain a healthy mix of credit types, such as installment loans and revolving credit, to show responsible credit management.

Lenders assess creditworthiness through various criteria, which often include not only the credit score but also the applicant’s income, employment history, and existing debt levels. This holistic view helps lenders evaluate the risk associated with approving a loan. Key criteria typically considered include:

- Debt-to-Income Ratio (DTI): This ratio compares monthly debt payments to gross monthly income, providing insight into a borrower’s ability to manage additional debt.

- Credit History Length: A longer credit history can indicate stability and reliability, positively influencing the lender’s decision.

- Account Types: Having a variety of credit accounts, such as credit cards, mortgages, and installment loans showcases the borrower’s ability to manage different types of credit responsibly.

Understanding how these factors interplay can help borrowers better prepare for the loan application process, ultimately leading to more favorable terms on installment loans.

Comparing installment loans to other types of loans is necessary for informed borrowing decisions.

When navigating the world of borrowing, understanding the different types of loans available is crucial for making informed decisions. Among these, installment loans and revolving credit options like credit cards stand out due to their differing structures and repayment terms. By analyzing these differences, borrowers can choose the financing option that best meets their needs.

Key Differences Between Installment Loans and Revolving Credit

Installment loans and revolving credit serve different financial purposes. An installment loan is a lump sum borrowed for a specific purpose, which is repaid in fixed monthly payments over a predetermined period. In contrast, revolving credit allows borrowers to access funds up to a specific limit, with the flexibility to borrow and repay as needed. This fundamental difference impacts the borrowing experience and overall cost.In scenarios where large purchases or specific financial goals are involved, installment loans may be more beneficial.

For example:

- A person seeking to buy a car might benefit from an auto loan, where the fixed monthly payments correlate with the vehicle’s depreciation.

- If someone is planning a significant home renovation, a personal installment loan can provide the necessary funds with predictable repayment schedules.

In contrast, a credit card may be more appropriate for ongoing expenses, such as groceries or unexpected repairs, due to its flexibility in borrowing. However, using a credit card for large purchases can lead to high-interest charges if the balance isn’t paid off promptly.

Advantages and Disadvantages of Installment Loans Compared to Other Options

When considering installment loans against payday loans or personal lines of credit, there are important factors to weigh. Each option has distinct advantages and disadvantages that can impact a borrower’s financial health.Advantages of installment loans include:

Predictable payments

Fixed monthly payments allow for easier budgeting.

Lower interest rates

Generally lower than payday loans, making them more affordable long-term.

Structured repayment

Helps in building credit when payments are made on time.However, there are disadvantages as well:

Less flexibility

Once the loan is taken, the borrower cannot access more funds without taking out a new loan.

Eligibility requirements

Stricter credit checks may exclude some borrowers.In comparison, payday loans offer quick access to cash but come with high-interest rates and short repayment terms, often leading to a cycle of debt. Personal lines of credit provide flexible borrowing but can also encourage overspending due to their revolving nature. Understanding these differences can empower borrowers to select the right financing option tailored to their needs, ensuring responsible borrowing that aligns with their financial goals.

The impact of installment loans on personal financial health is a topic of considerable importance.

Managing personal finances can be a challenging endeavor, and understanding the role of installment loans is crucial to achieving financial stability. These loans, which allow for borrowing a fixed amount and repaying it over a specified period, can influence an individual’s financial health positively or negatively, depending on how they are handled. Responsible management of installment loans can play a significant role in building a positive credit history and enhancing one’s overall financial standing.

When borrowers make timely payments on their installment loans, they not only demonstrate their ability to manage debt effectively but also contribute to a solid credit score. A good credit score is vital as it opens doors to better financial opportunities, such as lower interest rates on future loans and more favorable terms on credit products.

Risks of Over-reliance on Installment Loans

While installment loans can be beneficial, over-reliance on them poses substantial risks. Individuals may find themselves in financial distress if they borrow more than they can afford to repay, leading to a cycle of debt that is hard to escape. High monthly payments can strain budgets, and missing payments can severely damage credit scores. The risks involved include:

- Increased Financial Burden: Regular payments can become overwhelming if borrowers take on multiple loans or choose high amounts.

- Accumulation of Interest: Failing to pay off loans quickly can lead to accumulating interest, which increases the total repayment amount.

- Reduced Credit Score: Missing payments or defaulting on loans can lead to a significant drop in credit scores, impacting future borrowing capacity.

- Limited Financial Flexibility: Heavy reliance on installment loans can reduce available cash flow for essential expenses, leading to potential emergency fund depletion.

Maintaining Balance Between Installment Loan Debt and Financial Obligations

Maintaining a healthy balance between installment loan debt and other financial responsibilities is essential for financial well-being. Here are some strategies to achieve this balance:

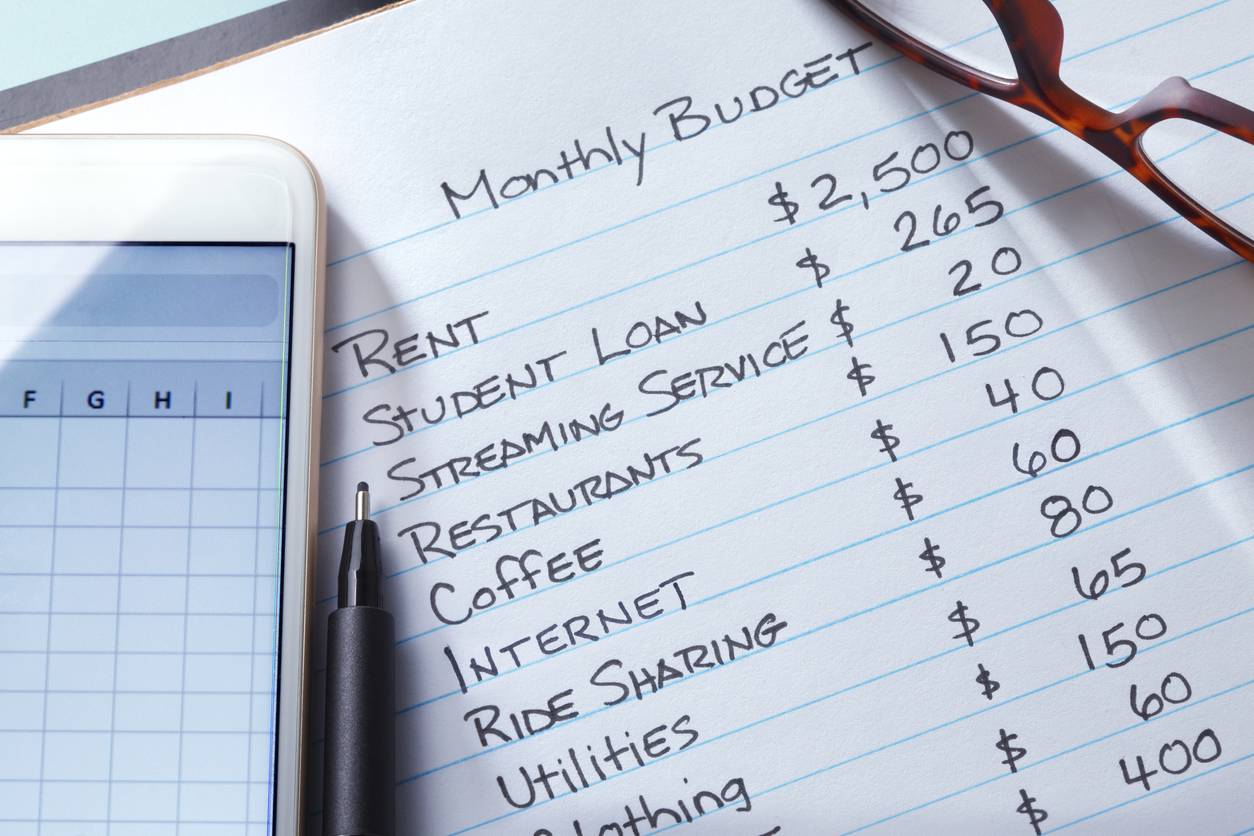

- Budgeting: Create a detailed budget that includes all sources of income and regular expenses, ensuring that loan repayments are factored in.

- Prioritizing Payments: Prioritize debt payments to avoid late fees and protect your credit score, focusing on high-interest loans first.

- Limit New Debt: Avoid taking on new installment loans unless absolutely necessary, particularly if existing debts are not managed well.

- Regular Financial Review: Continuously review your financial situation and loan agreements to adapt to changing circumstances and ensure loans remain manageable.

“Managing installment loans effectively can pave the way toward enhanced creditworthiness and financial health.”

By embracing these strategies and being aware of the potential pitfalls associated with installment loans, individuals can navigate their financial journeys with greater confidence and security.

Industry trends affecting installment loans are constantly evolving and require attention.

The landscape of installment loans is continually shaped by various industry trends and economic factors. As the lending environment adapts to new regulations and shifts in consumer behavior, it’s essential for both lenders and borrowers to stay informed about these changes. Understanding the dynamics of the market can help individuals make better financial decisions and improve their access to credit options.Regulatory updates play a significant role in how installment loans are structured and offered.

Recent changes in lending regulations, including stricter requirements for creditworthiness and transparency, have led lenders to reevaluate their practices. This focus on consumer protection aims to prevent predatory lending while ensuring borrowers can comfortably repay their loans. The implementation of the Consumer Financial Protection Bureau’s guidelines has prompted lenders to prioritize responsible lending, resulting in a shift towards more favorable terms for consumers.

Economic factors influencing installment loan dynamics

Several economic factors are influencing the demand for installment loans and their overall popularity. Interest rates and inflation are two key elements that significantly impact borrowing costs and consumer behavior.The fluctuations in interest rates directly affect the affordability of installment loans. When interest rates rise, potential borrowers may be discouraged from taking on new debt due to higher repayment costs.

Conversely, lower interest rates generally increase the attractiveness of installment loans, making them a more viable option for consumers looking to finance purchases. Inflation also plays a crucial role in shaping the lending landscape. As the cost of goods and services rises, consumers may find their budgets stretched thinner, leading them to seek financing solutions like installment loans to manage expenses.

This increased demand can lead to a greater variety of loan options available in the market, as lenders respond to consumer needs.The following points Artikel key economic influences on installment loans:

- Interest Rates: As rates fluctuate, they can either encourage or deter borrowing. For instance, the recent trend of increasing rates may lead to a decline in new loan applications.

- Inflation Rates: With rising inflation, households may rely more on installment loans to cope with increased living costs, which could lead to an uptick in demand.

- Employment Trends: Job stability and wage growth can impact loan accessibility. Higher employment rates generally enhance consumers’ ability to secure loans with favorable terms.

Future predictions for installment loans

Based on current market trends and consumer behaviors, the future of installment loans appears to be evolving towards more flexible and inclusive options. Lenders are increasingly leveraging technology to streamline the application process, making it easier for consumers to access funds quickly and efficiently.The rise of fintech companies is transforming the lending landscape, offering innovative solutions such as peer-to-peer lending and quicker approval times through the use of artificial intelligence.

This tech-driven approach is expected to enhance competition among lenders, further improving borrower options.As consumer preferences shift towards more personalized financial products, we can anticipate the following trends in installment loans:

- Increased Personalization: Lenders will likely offer tailored loan solutions that align with individual financial situations, promoting responsible borrowing.

- Integration of Sustainable Practices: As environmental concerns grow, lenders may introduce eco-friendly loan options that support sustainable purchases.

- Enhanced Digital Experiences: With the ongoing rise of mobile banking, borrowers can expect more seamless digital interfaces and quicker access to funds.

Overall, the installment loan market appears poised for change as it adapts to a new economic landscape and evolving consumer needs. Staying informed about these developments can help borrowers make educated decisions in their financial journeys.

Closing Summary

In summary, installment loans offer a practical solution for those in need of financial assistance, providing manageable repayment options that can support a range of personal goals. While they present significant benefits, it’s essential for borrowers to navigate the application process thoughtfully and stay informed about interest rates, repayment terms, and their credit score implications. By doing so, consumers can harness the power of installment loans to enhance their financial well-being while avoiding potential pitfalls.

FAQ Guide

What is the typical duration for an installment loan?

Installment loans can range from a few months to several years, depending on the loan type and lender.

Are there any prepayment penalties associated with installment loans?

Some lenders may charge prepayment penalties, while others allow you to pay off the loan early without fees.

Can I get an installment loan with bad credit?

Yes, some lenders specialize in providing installment loans to borrowers with bad credit, though interest rates may be higher.

Is it possible to refinance an installment loan?

Yes, borrowers can refinance an installment loan to secure better terms or lower interest rates, depending on their current financial situation.

What happens if I miss a payment on my installment loan?

Missing a payment can lead to late fees, a negative impact on your credit score, and possible legal action if the loan goes into default.