Finance management is an essential discipline that underpins both personal and corporate financial health. It serves as the backbone of sound financial decision-making, ensuring that resources are allocated wisely and effectively. Within this realm, the interplay of budgeting, forecasting, and financial reporting plays a pivotal role, forming the foundation for understanding financial statements and their implications on strategic choices.

This exploration of finance management dives deep into its core components, highlighting the importance of personal finance principles and the strategies businesses employ to optimize their financial performance. The influence of technology, ethical considerations, and global trends further enriches our understanding of how finance management adapts and evolves in response to changing environments.

Understanding the Fundamentals of Finance Management

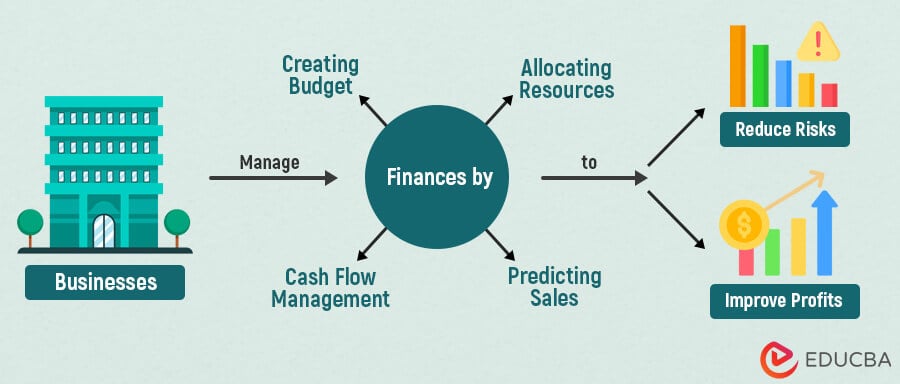

Finance management encompasses the strategic planning, organizing, directing, and controlling of financial activities in an organization. It involves the application of management principles to financial resources, ensuring that a company can operate efficiently and achieve its goals. Understanding the core components of finance management is vital for effective decision-making and long-term sustainability in any business. The fundamental components that define finance management include financial planning, capital budgeting, and financial control.

Financial planning is the process of determining the financial goals of a business and devising strategies to achieve them. It lays the groundwork for decision-making by assessing the current financial situation, forecasting future financial performance, and identifying necessary resources. Capital budgeting involves evaluating potential major investments or expenditures to determine their viability and alignment with organizational goals. This process ensures that financial resources are allocated effectively, maximizing returns and minimizing risks.

Significance of Budgeting, Forecasting, and Financial Reporting

Budgeting, forecasting, and financial reporting are integral to finance management, each serving a unique purpose that contributes to overall organizational success. Budgeting is the process of creating a financial plan that Artikels expected revenues and expenditures over a specific period. It is significant because it provides a framework for managing resources, ensuring that the organization can meet its financial obligations and invest in opportunities for growth.Forecasting complements budgeting by predicting future financial conditions based on historical data and market trends.

This practice allows organizations to anticipate changes in revenue, expenses, and cash flow, enabling proactive adjustments to financial strategies. Accurate forecasting aids in risk management and helps businesses prepare for economic fluctuations.Financial reporting is crucial for transparency and accountability. It involves the preparation of financial statements such as income statements, balance sheets, and cash flow statements. These documents provide stakeholders with a comprehensive view of an organization’s financial health.

The insights garnered from financial reports directly influence decision-making processes, as they highlight profitability, liquidity, and operational efficiency.

Effective financial reporting is essential for fostering trust among investors, creditors, and regulatory authorities.

The impact of financial statements on decision-making cannot be overstated. They serve as the basis for assessing the performance of the business, guiding strategic plans, and identifying areas for improvement. By analyzing financial statements, management can make informed choices regarding investments, cost control, and resource allocation, ultimately steering the company toward its long-term objectives.

The Importance of Personal Finance Management

Effective personal finance management is crucial for achieving financial stability and peace of mind. It empowers individuals to make informed decisions about their money, ensuring that they can meet their current needs while planning for future goals. Managing finances well can lead to a more comfortable lifestyle, reduced stress, and the ability to build wealth over time. Adhering to key principles of personal finance helps individuals avoid common pitfalls and develop robust savings and investment strategies.

Key Principles of Effective Personal Finance Management

To manage personal finances effectively, several key principles should be considered. These include budgeting, tracking expenses, establishing an emergency fund, and planning for retirement. By adhering to these principles, individuals can create a solid financial foundation.Budgeting is the cornerstone of personal finance. It involves creating a detailed plan that Artikels income sources and all expected expenditures. A useful approach to budgeting is the 50/30/20 rule, where 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment.

Regularly tracking expenses allows individuals to identify spending habits and make adjustments where necessary, ensuring they live within their means.Establishing an emergency fund is another critical principle. This fund provides a financial safety net for unexpected expenses, such as medical emergencies or job loss. Financial experts typically recommend saving three to six months’ worth of living expenses in an easily accessible account.Retirement planning is essential, and starting early is key.

Utilizing employer-sponsored retirement plans or individual retirement accounts (IRAs) can help build a significant nest egg over time. The power of compounding interest makes early contributions grow substantially.

Common Pitfalls in Personal Finance

Despite the best intentions, many individuals fall into common pitfalls that can derail their financial plans. Recognizing these pitfalls and understanding how to avoid them can lead to better financial outcomes.One major pitfall is lifestyle inflation, where individuals increase their spending as their income rises. This can lead to a cycle of overspending and debt. To combat this, it’s important to maintain a disciplined approach to budgeting and prioritize saving even when income increases.Another common mistake is neglecting debt management.

High-interest debts, such as credit cards, can accumulate quickly if not handled properly. Prioritizing debt repayment strategies, like the avalanche or snowball method, can help individuals pay off debts more effectively and save on interest costs.Misunderstanding investment risks is also prevalent. Many individuals are drawn to ‘get-rich-quick’ schemes or high-risk investments without understanding the potential losses involved. Educating oneself about investment options and diversifying the portfolio can mitigate risk and enhance returns.

Strategies for Effective Savings and Investment Planning

Implementing effective savings and investment strategies is essential for long-term financial success. These strategies can help individuals build wealth and ensure that they are prepared for future financial goals.One effective strategy is to automate savings. Setting up automatic transfers from checking to savings accounts can simplify the saving process. This “pay yourself first” approach ensures that saving becomes a priority rather than an afterthought.Investing in a diversified portfolio is another critical strategy.

Diversification reduces risk by spreading investments across various asset classes, such as stocks, bonds, and real estate. This approach can lead to more stable returns over time.Additionally, regularly reviewing and adjusting investment portfolios is important as life circumstances change. Factors such as age, income, and financial goals should influence portfolio adjustments to ensure alignment with current financial situations.Setting specific, measurable financial goals can also enhance savings and investment efforts.

Whether it’s saving for a home down payment or retirement, having clear objectives can motivate individuals to adhere to their financial plans and track their progress.

“Effective personal finance management is not just about making money but also about making smart decisions with the money you have.”

Corporate Finance Management Strategies

Corporate finance management is essential for guiding a company’s financial decisions and strategies. This area focuses on how businesses can optimize their financial resources to achieve their overall goals while maintaining a balance between risk and profitability. Understanding corporate finance management strategies allows organizations to make informed decisions regarding capital structure, investments, and risk management, ultimately driving growth and sustainability.One of the primary strategies in corporate finance management revolves around capital structure optimization.

This involves determining the right mix of debt and equity financing to minimize the overall cost of capital. A well-optimized capital structure can enhance a company’s value and reduce financial risk. For example, a company might utilize a higher proportion of debt financing when interest rates are low, as debt can be less expensive compared to equity financing. However, businesses must be cautious, as excessive debt can lead to financial distress.

A notable example is the case of Tesla, which has used various financing mechanisms, including debt, to fund its expansion while balancing the risk associated with its capital structure.Another significant strategy involves the use of financial forecasting and budgeting. This practice helps businesses plan for future revenues and expenses, allowing them to allocate resources efficiently. Accurate financial forecasts enable companies to identify potential cash flow shortages and make proactive decisions to mitigate risks.

Moreover, businesses can employ scenario analysis to evaluate the potential impact of different economic conditions on their financial performance.

Importance of Risk Management

Risk management is a cornerstone of corporate finance management, playing a critical role in decision-making processes. It involves identifying, assessing, and mitigating financial risks that could adversely affect the organization. Effective risk management strategies can protect businesses from unexpected financial downturns and enhance their ability to capitalize on opportunities.Key components of risk management include credit risk assessment, market risk evaluation, and operational risk management.

By conducting thorough credit assessments, companies can minimize the risk of default from clients and partners. Market risk evaluation helps organizations understand the volatility of their investment portfolios and the potential impact of economic changes on their financial health. Operational risk management focuses on minimizing risks associated with day-to-day operations, such as fraud or system failures.In conclusion, the integration of capital structure optimization and robust risk management strategies is essential for effective corporate finance management.

By carefully balancing the use of debt and equity while proactively addressing potential risks, companies can achieve financial stability and long-term growth. It is through these strategies that businesses can navigate the complexities of the financial landscape and secure their foothold in the marketplace.

The Role of Technology in Finance Management

The integration of technology in finance management has revolutionized how organizations handle their financial operations. From automating mundane tasks to facilitating real-time analysis, technology has become an indispensable part of modern finance management. As businesses increasingly adopt digital tools, the efficiency, accuracy, and accessibility of financial data have significantly improved, paving the way for more informed decision-making.Financial software has transformed reporting and analysis by enabling organizations to gather and interpret data like never before.

Traditional methods of financial reporting often involved cumbersome manual processes that were prone to errors and delays. With the advent of advanced financial software, businesses can now generate real-time financial reports, dashboards, and visualizations that provide insights into their financial health. This immediate access to data enhances strategic planning and helps finance professionals identify trends, forecast future performance, and allocate resources more effectively.

Advantages and Challenges of Using Fintech Solutions in Finance Management

Embracing fintech solutions offers numerous advantages that can streamline finance management processes. The following points Artikel some key benefits:

- Increased Efficiency: Automation of repetitive tasks reduces the time spent on manual data entry and analysis, allowing finance professionals to focus on strategic initiatives.

- Cost Savings: Many fintech services operate on a subscription basis, often resulting in lower operational costs compared to traditional finance management methods.

- Enhanced Accuracy: Technology minimizes the risk of human error, ensuring more reliable financial data and reports.

- Improved Data Security: Advanced security measures in fintech solutions protect sensitive financial information against breaches and fraud.

- Real-Time Insights: The ability to access and analyze data in real time empowers organizations to make timely decisions based on current financial conditions.

Despite these advantages, there are challenges associated with the adoption of fintech solutions. These include:

- Integration Issues: Incorporating new technology with existing systems can be complex and may require additional resources.

- Compliance Risks: Adhering to financial regulations and standards can be challenging when implementing new technologies.

- Dependence on Technology: Over-reliance on fintech solutions may lead to vulnerabilities, particularly in the event of system outages or failures.

- Skill Gaps: Employees may need training to effectively utilize new software, leading to initial productivity losses.

The balance between leveraging technology for its numerous benefits while managing the associated risks is crucial for successful finance management in today’s digital landscape.

Ethics and Compliance in Finance Management

In the realm of finance management, ethical considerations and compliance are paramount. As organizations navigate the complex financial landscape, they must adhere to legal regulations while fostering a culture of integrity. Ethics in finance management establishes a foundation for trust among stakeholders and promotes long-term success, while compliance ensures that organizations operate within the boundaries of the law. This combination of ethics and compliance is essential not only for risk mitigation but also for enhancing an organization’s reputation and sustainability.The interplay between ethics and compliance in finance management is critical because financial decisions carry profound implications for all stakeholders involved.

Ethical finance practices involve making decisions that prioritize honesty, transparency, and accountability, while compliance refers to adhering to established laws and regulations. Organizations must implement policies and strategies that align with these principles to ensure effective finance management.

Major Regulations Impacting Finance Management

Several key regulations significantly influence finance management practices, shaping how organizations operate and report their financial activities. Understanding these regulations is essential for compliance and ethical decision-making. The Sarbanes-Oxley Act (SOX) is one of the most notable regulations established to enhance corporate governance and accountability. Enacted in 2002, SOX mandates strict reforms to improve financial disclosures and prevent accounting fraud.

Organizations are required to implement internal controls and ensure accurate financial reporting, which emphasizes the importance of ethical conduct among finance professionals. Another significant regulation is the Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in response to the 2008 financial crisis. This legislation aims to reduce risks in the financial system by increasing transparency and accountability among financial institutions.

It includes provisions that govern derivatives trading, consumer protection, and the establishment of the Consumer Financial Protection Bureau (CFPB), highlighting the need for ethical practices that protect consumers and promote sound financial practices.The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) also play crucial roles in finance management. These frameworks set the accounting standards that organizations must follow for financial reporting.

Adhering to these standards ensures transparency and fairness in financial statements, fostering trust among investors and stakeholders. The implications of these regulations for organizations are profound. Non-compliance can lead to severe penalties, including fines and legal repercussions, which can damage reputation and erode stakeholder trust. Moreover, ethical lapses in financial management can result in significant financial losses and long-lasting impacts on organizational culture.

Importance of Ethical Decision-Making in Financial Practices

Ethical decision-making in financial practices is vital for fostering a sustainable business environment. The consequences of unethical behavior can be extensive, affecting not only the organization but also its employees, customers, and the broader community. Ethical finance practices help build a strong organizational culture that prioritizes integrity and accountability.Incorporating ethics into financial decision-making encourages transparency and trust. For instance, organizations that prioritize ethical practices are more likely to attract investors and retain clients, as stakeholders increasingly value corporate responsibility.

This shift towards ethical finance is reflected in the growing trend of socially responsible investing, where investors seek to align their financial choices with their values.Furthermore, ethical decision-making can mitigate risks associated with financial misconduct. Organizations that proactively promote ethics within their finance teams can identify potential issues early, thus preventing major scandals and legal challenges. This proactive approach not only safeguards the organization’s reputation but also enhances employee morale and loyalty, as individuals feel more connected to a company that values ethical principles.In conclusion, the integration of ethics and compliance into finance management is essential for promoting accountability, transparency, and trust.

By adhering to major regulations and fostering a culture of ethical decision-making, organizations can ensure long-term success and contribute positively to the financial ecosystem.

Global Trends Influencing Finance Management

The landscape of finance management is continuously evolving under the influence of various global trends. These trends are not only reshaping how financial organizations operate but also how they strategize and implement their practices. Economic conditions, globalization, and technological advancements play significant roles in defining modern finance management, forcing firms to adapt and innovate to remain competitive.Economic conditions worldwide have a profound impact on finance management practices.

The fluctuations in economic growth rates, inflation, and employment levels directly influence financial planning and decision-making processes. For example, during periods of economic downturn, companies often tighten their budgets and revise their forecasts to mitigate risks. Conversely, in a thriving economy, businesses tend to be more optimistic and might invest more aggressively. The recent inflationary pressures faced in many countries have compelled finance managers to adjust their strategies to accommodate higher costs and changing consumer behaviors.

Globalization and Its Impact on Finance Management

Globalization has transformed the way companies conduct their financial operations. With markets now interconnected, finance managers must navigate complex international regulations and diverse economic environments. This integration not only opens access to new markets but also presents challenges such as currency fluctuations and varying financial reporting standards. Different regions adapt their finance management approaches based on their specific local challenges, including:

- Regulatory Environment: Countries like the United States have rigorous compliance requirements, while emerging markets may offer more flexibility but less oversight.

- Cultural Factors: Finance practices often reflect local cultures; for instance, attitudes toward risk and investment vary significantly between Western and Eastern economies.

- Market Maturity: Developed economies may focus on sophisticated financial instruments, while developing regions might prioritize basic financial education and access to capital.

As companies expand globally, they must also consider the implications of geopolitical events. Trade agreements, tariffs, and political stability can influence financial performance significantly. For instance, the trade war between the U.S. and China has led companies to reevaluate their supply chains and financial strategies to minimize exposure to tariffs and trade barriers.

Technological Advancements in Finance Management

Technological advancements are perhaps the most transformative force in finance management today. The rise of financial technologies (fintech) is revolutionizing traditional finance practices, enabling faster transactions and enhanced analytics capabilities. Automation and artificial intelligence are increasingly being integrated into finance departments, helping to streamline operations, reduce errors, and improve forecasting accuracy.The implementation of blockchain technology has further propelled this evolution by enhancing transparency and security in financial transactions.

Companies are leveraging blockchain for everything from payment processing to supply chain management. Additionally, data analytics allows finance managers to gain deeper insights into consumer trends, enabling more informed decision-making.

“In the digital age, data is the new oil; understanding it is crucial for effective finance management.”

These technological shifts also require finance managers to develop new skills and competencies, such as data literacy and cybersecurity awareness. As automation takes over routine tasks, finance professionals are increasingly focusing on strategic decision-making and value creation, shifting the traditional role of finance from back-office operations to a more strategic partnership within organizations.In conclusion, the interplay of economic conditions, globalization, and technological advancements is significantly shaping the finance management landscape.

Understanding these global trends is essential for finance managers aiming to develop effective strategies that cater to both local nuances and global demands.

Evaluating Financial Performance and Metrics

In the realm of finance management, evaluating financial performance is paramount for understanding an organization’s health and sustainability. Key performance indicators (KPIs) are essential tools that help stakeholders assess various aspects of financial performance such as profitability, liquidity, efficiency, and solvency. These metrics provide a comprehensive view, allowing decision-makers to take informed actions to enhance financial outcomes.Key performance indicators can be categorized into several types.

The most critical KPIs used in finance management include:

Common Key Performance Indicators

To gauge financial performance effectively, certain KPIs stand out due to their relevance and reliability. Understanding these indicators can empower stakeholders to make strategic decisions.

- Return on Investment (ROI): This metric measures the profitability of an investment relative to its cost. It is calculated as:

ROI = (Net Profit / Cost of Investment) x 100

A higher ROI indicates a more efficient investment.

- Gross Profit Margin: This ratio shows the percentage of revenue that exceeds the cost of goods sold (COGS), highlighting operational efficiency. The formula is:

Gross Profit Margin = (Gross Profit / Revenue) x 100

It is essential for understanding pricing strategy and cost control.

- Current Ratio: This liquidity ratio assesses a company’s ability to cover short-term liabilities with short-term assets.

Current Ratio = Current Assets / Current Liabilities

A ratio above 1 suggests good short-term financial health.

- Debt to Equity Ratio: This solvency ratio indicates the relative proportion of shareholders’ equity and debt used to finance a company’s assets. The formula is:

Debt to Equity Ratio = Total Liabilities / Shareholders’ Equity

A lower ratio is often preferred as it indicates less risk.

Evaluating financial performance involves several methods, each relevant to different stakeholders such as investors, management, and creditors. Financial statement analysis—using tools like vertical analysis and horizontal analysis—enables stakeholders to evaluate trends over time and assess performance relative to peers. Additionally, ratio analysis provides a framework to compare KPIs against industry benchmarks, thereby revealing competitive positioning. Techniques like variance analysis allow management to compare actual performance against budgeted figures, identifying areas for improvement.Tools such as financial modeling software and dashboards enhance financial analysis by visualizing data, simplifying complex computations, and facilitating scenario planning.

These tools empower stakeholders to forecast future performance based on trends and decision-making scenarios, ultimately contributing to a more strategic approach to finance management.

Future Challenges and Opportunities in Finance Management

As the landscape of finance management continues to evolve, professionals in the field are faced with several challenges that require innovative solutions. The rise of technology, fluctuating economic conditions, and the growing emphasis on sustainability are just a few factors influencing how finance is managed today. To navigate this dynamic environment successfully, finance management professionals must be proactive in addressing these challenges while also seizing the opportunities presented by advancements in technology.

Challenges Facing Finance Management Professionals

The financial industry is entering a transformative era, driven by rapid technological advancements and shifting regulatory frameworks. Several challenges are emerging that require finance professionals to adapt and evolve their strategies. Key challenges include:

- Technological Disruption: The integration of artificial intelligence (AI), machine learning, and blockchain technology is redefining traditional finance roles. Professionals must learn to leverage these technologies rather than fear them, as automation can enhance efficiency but may also result in job displacement.

- Regulatory Compliance: With increasing scrutiny from regulators globally, finance managers must navigate an increasingly complex compliance landscape. Staying updated on changes and ensuring adherence to regulations is essential to avoid penalties and maintain organizational integrity.

- Data Security and Privacy: As finance relies heavily on data analytics, concerns around data breaches and privacy are paramount. Finance managers must implement robust cybersecurity measures to protect sensitive financial information and maintain customer trust.

- Market Volatility: Economic fluctuations and geopolitical events create uncertainties that can impact financial forecasting and decision-making. Finance managers need to develop strategies that allow for agile responses to market changes.

- Talent Management: Attracting and retaining skilled finance professionals is becoming increasingly competitive. Organizations need to foster an inclusive and empowering work environment to appeal to top talent.

Opportunities Arising from Evolving Financial Technologies

The evolution of financial technologies presents numerous opportunities for finance management professionals to enhance their roles and deliver more value. Embracing these opportunities can lead to significant benefits, including:

- Enhanced Data Analysis: Technologies such as AI and big data analytics provide finance managers with deeper insights into financial performance, enabling more informed decision-making and strategic planning.

- Improved Efficiency: Automation of routine tasks allows finance professionals to focus on high-value activities, such as strategic planning and client engagement, enhancing overall productivity and job satisfaction.

- New Revenue Streams: The rise of fintech has opened avenues for innovative financial products and services, allowing finance managers to explore new business models and revenue streams.

- Increased Collaboration: Cloud-based platforms facilitate collaboration among teams and stakeholders, breaking down silos and improving communication within organizations.

- Sustainability Initiatives: The growing demand for sustainable finance offers finance managers an opportunity to align their strategies with environmental, social, and governance (ESG) principles, appealing to socially conscious investors.

Continuous Education and Adaptability in Finance Management Careers

In this rapidly changing environment, the importance of continuous education cannot be overstated. Finance management professionals must prioritize learning to stay relevant and competitive. As the industry evolves, the need for ongoing professional development becomes crucial for several reasons:

- Staying Current with Technology: Familiarity with emerging technologies requires ongoing training and education to ensure finance professionals can effectively utilize these tools in their daily operations.

- Enhancing Skill Sets: Continuous learning allows finance managers to acquire new skills, such as data analysis and risk management, which are increasingly necessary in today’s finance landscape.

- Adapting to Regulatory Changes: Ongoing education ensures that finance professionals remain informed about regulatory updates and compliance requirements, minimizing legal risks for their organizations.

- Career Advancement: Professionals who engage in continuous education are more likely to be recognized for their expertise, leading to better career opportunities and potential advancements.

In summary, the future of finance management is rife with both challenges and opportunities. Embracing technology, committing to continuous learning, and adapting to an ever-changing landscape will be pivotal in shaping the careers of finance professionals.

Final Wrap-Up

In summary, finance management is a dynamic field that encapsulates a variety of strategies, principles, and technological advancements. As we continue to navigate complex financial landscapes, the need for effective management becomes increasingly vital. By understanding the core components and adapting to future challenges and opportunities, individuals and organizations can enhance their financial well-being and ensure sustainable success.

Popular Questions

What is finance management?

Finance management refers to the strategic planning, organizing, directing, and controlling of financial activities to ensure the efficient use of an organization’s financial resources.

Why is budgeting important in finance management?

Budgeting is crucial as it helps plan resource allocation, monitor financial performance, and ensure that funds are used effectively to meet organizational goals.

What are common mistakes in personal finance management?

Common mistakes include failing to create a budget, neglecting to save for emergencies, and accumulating high-interest debt without a repayment strategy.

How can technology enhance finance management?

Technology enhances finance management by automating processes, providing real-time data analysis, and improving accuracy in financial reporting and decision-making.

What role do ethics play in finance management?

Ethics in finance management is vital to maintain trust, ensure compliance with regulations, and promote responsible financial practices that benefit all stakeholders.

How do global trends affect finance management?

Global trends impact finance management by influencing economic conditions, shaping regulatory environments, and altering the ways businesses approach financing and investment decisions.

What are key performance indicators (KPIs) in finance management?

Key performance indicators in finance management include metrics such as return on investment (ROI), net profit margin, and liquidity ratios, which help evaluate financial health and performance.

What challenges do finance management professionals face?

Challenges include navigating regulatory changes, adapting to technological advancements, and managing financial risks in increasingly volatile markets.